Should Investors Buy Palantir Stock Before May 5th? A Wall Street Perspective

Table of Contents

Palantir's Recent Performance and Future Projections

Analyzing Palantir's recent performance is crucial to understanding its potential future trajectory. Let's delve into the key aspects affecting Palantir stock before May 5th.

Analyzing Q4 2023 Earnings and Guidance: Palantir's Q4 2023 earnings report (replace with actual quarter and year if different) will be a critical factor influencing investor decisions. We need to analyze key metrics:

- Revenue Growth: (Insert actual data here, e.g., "Revenue growth was X%, exceeding analysts' expectations of Y%.") A strong revenue growth rate will signal positive momentum.

- Profitability: (Insert actual data here, e.g., "The company reported a net income of Z, compared to a loss in the previous quarter.") Improved profitability demonstrates operational efficiency.

- Cash Flow: (Insert actual data here, e.g., "Positive free cash flow of A was reported, strengthening Palantir's financial position.") Strong cash flow is a crucial indicator of financial health.

- Guidance: (Insert actual data here, e.g., "Palantir provided guidance for the upcoming year, projecting revenue growth of B%.") Positive guidance indicates confidence in future performance. Compare this to analyst expectations.

Government Contracts and Commercial Growth: Palantir's revenue streams are split between government and commercial sectors. Understanding the growth in each is essential:

- Government: (Insert data here, e.g., "Government contracts accounted for X% of total revenue, showing a Y% increase year-over-year.") Government contracts provide stability but may be less dynamic than commercial ventures.

- Commercial: (Insert data here, e.g., "Commercial revenue grew by Z%, driven by strong partnerships with companies in the [mention industries] sectors.") The commercial sector offers higher growth potential.

- Future Projections: Consider future growth potential within each sector. What are Palantir's plans for expansion?

Technological Innovations and Competitive Landscape: Palantir's position in the big data and AI market is a significant factor affecting its stock price.

- Key Technologies: (List Palantir's key technologies, e.g., Foundry, AIP, etc., and explain their advantages.)

- Competitive Advantages: (Highlight Palantir's strengths compared to competitors like Databricks, Snowflake, etc.)

- Disruptive Technologies: (Discuss any potential threats from emerging technologies.)

Wall Street Analyst Opinions and Price Targets

Understanding the Wall Street consensus on Palantir stock before May 5th is crucial.

Consensus Ratings and Price Targets:

- Buy/Hold/Sell Ratings: (Summarize the ratings from major analyst firms, citing specific firms and their ratings.)

- Price Targets: (Present a range of price targets from different analysts and explain their reasoning.) A wide range of price targets indicates uncertainty.

Potential Catalysts and Risks:

- Positive Catalysts: (List potential positive events, such as new large contracts, successful product launches, strategic partnerships, etc.)

- Negative Catalysts: (List potential negative events, such as increased competition, economic slowdown, regulatory hurdles, etc.)

Factors to Consider Before Investing in Palantir Stock Before May 5th

Before making a decision about Palantir stock, individual circumstances should be carefully evaluated.

Risk Tolerance and Investment Goals:

- Risk Assessment: Investing in Palantir involves substantial risk. It is a high-growth, technology-focused stock, susceptible to market volatility.

- Portfolio Diversification: Palantir should be part of a well-diversified portfolio, not your sole investment.

- Long-term vs. Short-term: Are you looking for long-term growth or short-term gains?

Market Conditions and Economic Outlook:

- Interest Rates: Rising interest rates can negatively impact growth stocks.

- Inflation: Inflation can affect Palantir's costs and consumer spending.

- Economic Growth: A slowing economy could reduce demand for Palantir's services.

- Geopolitical Factors: Global events can impact the stock market and technology sector.

Conclusion: Should You Buy Palantir Stock Before May 5th?

The decision of whether to buy Palantir stock before May 5th is complex. While Palantir possesses strong technology and potential for growth, it also carries significant risk. The upcoming earnings release and other potential events before May 5th will significantly influence investor sentiment. Weigh the risks and rewards of investing in Palantir stock before May 5th carefully, considering your own risk tolerance, investment goals, and a thorough analysis of market conditions. Remember to conduct your own thorough research and consider consulting with a financial advisor before making any investment decisions. Make an informed decision on whether to buy Palantir stock before May 5th based on your own research and risk assessment.

Featured Posts

-

Investing Made Easy Jazz Cash And K Trade Revolutionize Stock Trading

May 10, 2025

Investing Made Easy Jazz Cash And K Trade Revolutionize Stock Trading

May 10, 2025 -

Childrens Hospital Activist Advocates For Uterus Transplants For Transgender Women

May 10, 2025

Childrens Hospital Activist Advocates For Uterus Transplants For Transgender Women

May 10, 2025 -

The Disturbing Trend Of Betting On The Los Angeles Wildfires

May 10, 2025

The Disturbing Trend Of Betting On The Los Angeles Wildfires

May 10, 2025 -

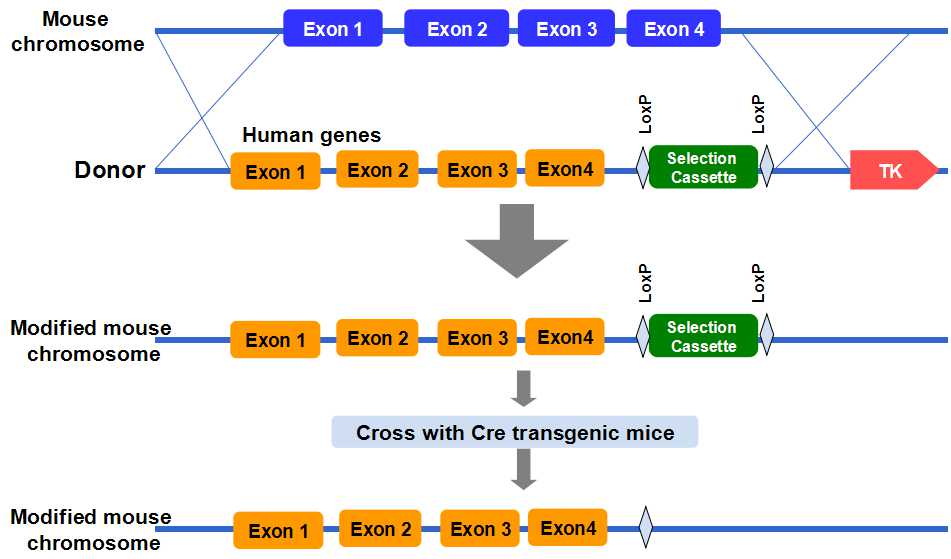

Is Us Taxpayer Money Funding Transgender Mouse Research

May 10, 2025

Is Us Taxpayer Money Funding Transgender Mouse Research

May 10, 2025 -

King Zvinuvachuye Maska Ta Trampa V Zradi Detali Zayavi Pismennika

May 10, 2025

King Zvinuvachuye Maska Ta Trampa V Zradi Detali Zayavi Pismennika

May 10, 2025