Should Investors Worry About Elevated Stock Market Valuations? BofA's View

Table of Contents

Keywords: Elevated stock market valuations, stock market valuation, BofA, Bank of America, investor concerns, market analysis, stock market outlook, investment strategy, portfolio management, risk assessment

The question on many investors' minds is: are current elevated stock market valuations a cause for concern? Bank of America (BofA), a major player in the financial world, offers valuable insights into this complex issue. Understanding BofA's perspective, along with the contributing factors and potential risks, is crucial for developing a sound investment strategy.

BofA's Current Assessment of Stock Market Valuations

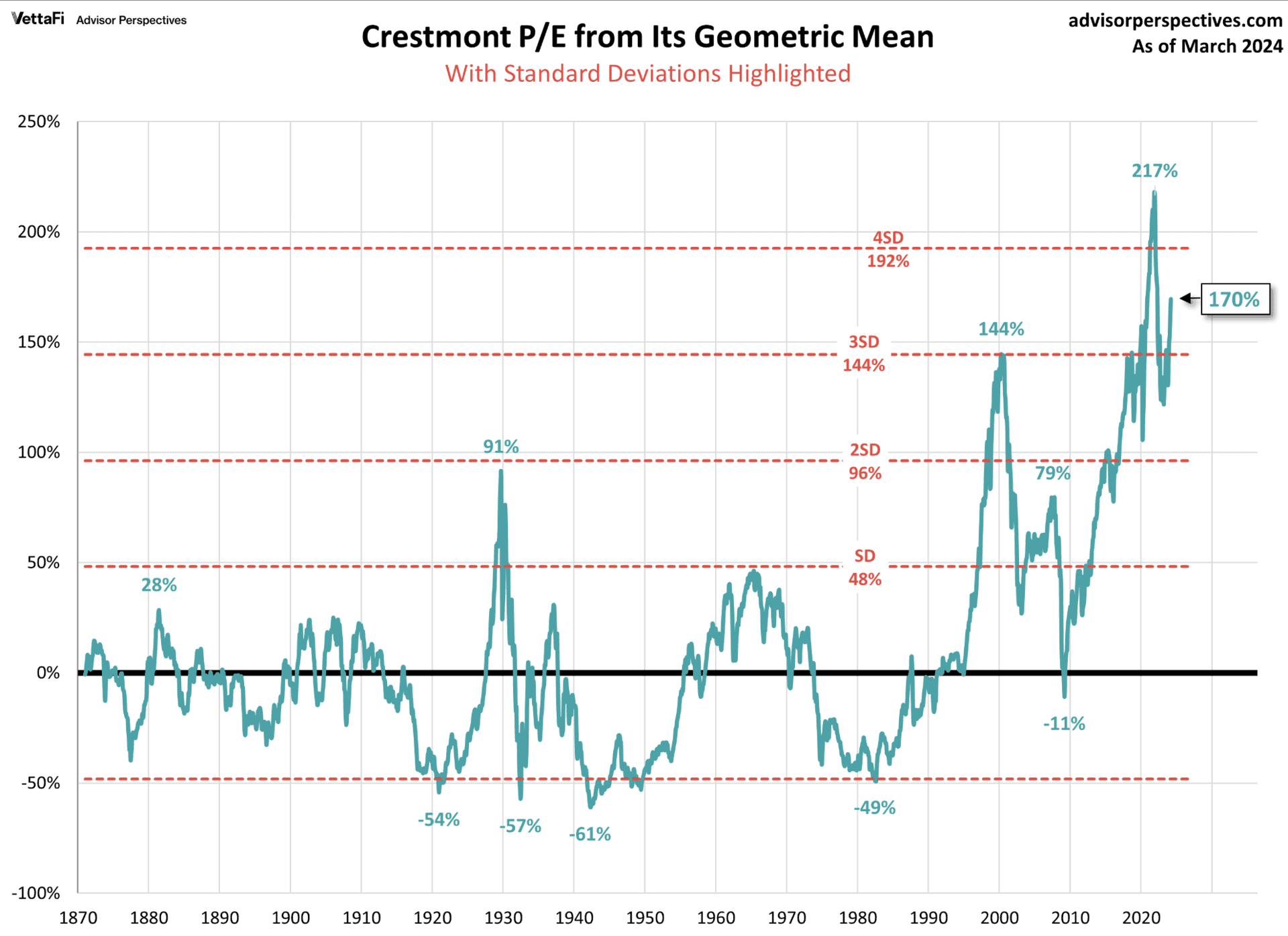

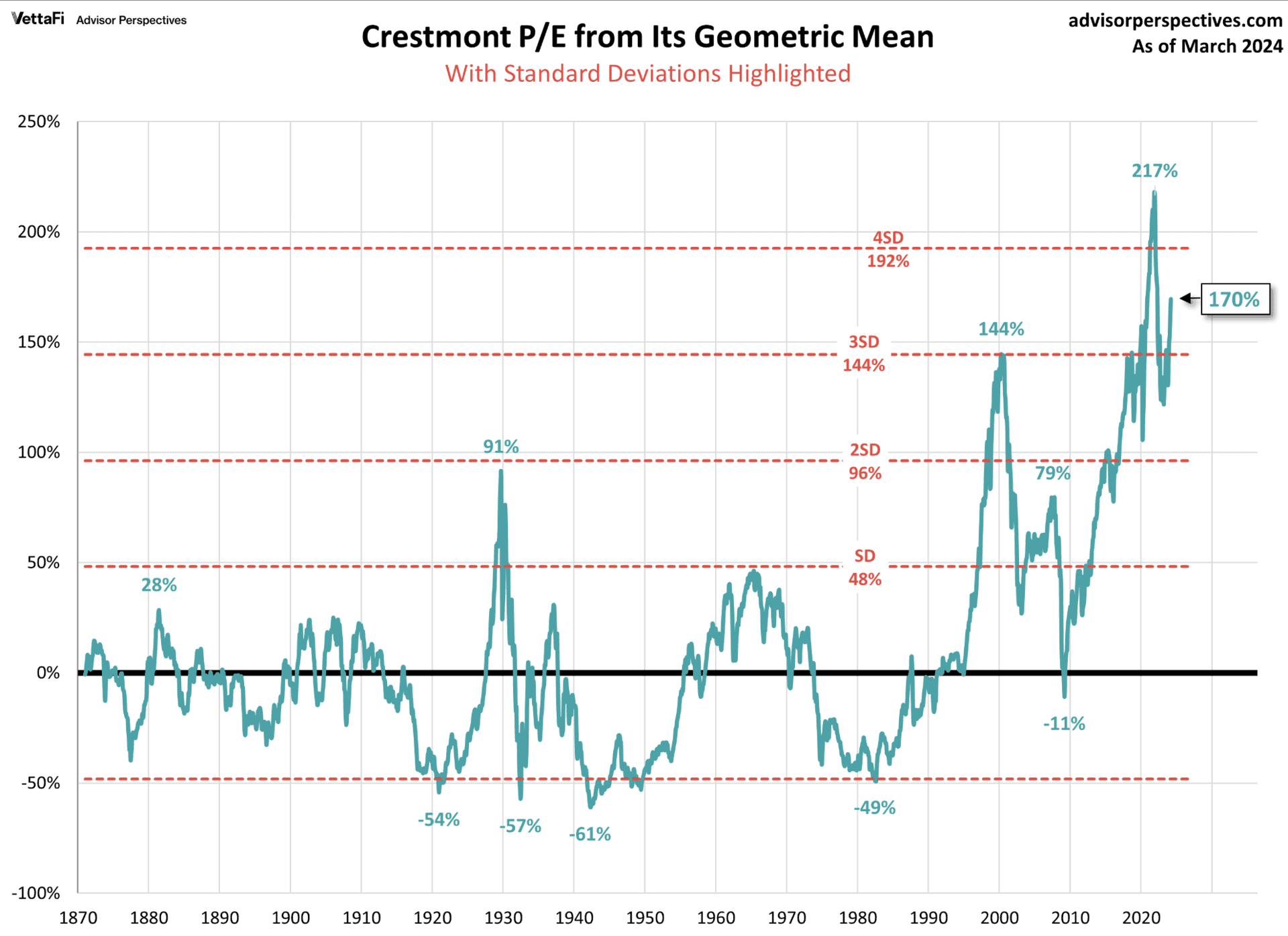

BofA regularly publishes reports analyzing market conditions, including assessments of stock market valuations. While specific data points fluctuate, BofA's recent analyses often incorporate key metrics like Price-to-Earnings (P/E) ratios and market capitalization relative to GDP to gauge market valuation levels. These reports provide insights into whether the market is overvalued, undervalued, or trading within a reasonable range.

-

BofA's Overall Stance: BofA's stance on market valuation varies over time, shifting from bullish to bearish or neutral depending on economic indicators and market performance. It's crucial to refer to their most recent reports for their up-to-date assessment. Their reports frequently cover major indices like the S&P 500 and the Nasdaq, providing a broad overview of market valuation.

-

Sector-Specific Analysis: BofA's reports often delve into individual sectors, highlighting those considered overvalued (e.g., potentially exhibiting a tech bubble) or undervalued, offering investors more granular insights for portfolio adjustments.

-

Accessing BofA Research: To access the most current data and analysis from BofA, it is recommended to visit their official website and look for their research publications and investment strategy reports. These typically contain detailed charts, graphs, and explanations supporting their conclusions.

Factors Contributing to Elevated Valuations

Several macroeconomic factors can contribute to elevated stock market valuations. Understanding these is critical for informed investing:

-

Low Interest Rates: Historically low interest rates make borrowing cheaper, encouraging businesses to invest and increasing corporate earnings, which in turn can boost stock prices. Lower rates also push investors towards higher-yielding assets, such as stocks.

-

Strong Corporate Earnings: Robust corporate earnings, fueled by economic growth or technological innovation, contribute positively to valuations by justifying higher stock prices. However, it's essential to look at the sustainability of these earnings.

-

Inflation's Impact: Inflation can influence stock valuations in several ways. Moderate inflation might signal a healthy economy, supporting higher valuations, while runaway inflation could trigger interest rate hikes, potentially causing a market correction.

-

Geopolitical Events: Global events, such as trade wars, political instability, or pandemics, can significantly impact investor sentiment and market valuations, leading to increased volatility.

-

Investor Sentiment and Speculation: Market psychology plays a critical role. Periods of high optimism and speculation can drive stock prices beyond what fundamental analysis might suggest, leading to overvaluation.

Potential Risks Associated with High Valuations

Elevated stock market valuations present several potential risks for investors:

-

Market Volatility and Corrections: Overvalued markets are inherently more susceptible to sharp corrections. A sudden shift in investor sentiment or an unexpected economic downturn can trigger significant price drops.

-

Market Bubble Risk: Extremely high valuations can indicate the formation of a market bubble, which can burst dramatically, resulting in substantial losses for investors.

-

Rising Interest Rates: As interest rates rise, the attractiveness of stocks relative to bonds diminishes, potentially leading to lower stock prices and reduced investment returns.

-

Lower Future Returns: High valuations generally imply lower future returns, as the potential for appreciation is diminished compared to buying at lower prices.

-

Sector-Specific Risks: Certain sectors, such as technology, may be more vulnerable to valuation corrections due to their inherent volatility and susceptibility to changing market trends.

Opportunities Despite High Valuations

Even in a market with elevated valuations, opportunities exist for savvy investors:

-

Undervalued Assets: Careful fundamental analysis can identify undervalued sectors or individual stocks that offer potential for growth despite the overall high market valuations.

-

Diversification: Diversifying across different asset classes and sectors helps mitigate risk associated with overvalued segments of the market.

-

Long-Term Growth Potential: Focusing on long-term investment horizons can help weather short-term market volatility and capitalize on the potential for long-term growth.

-

Strategic Approaches: Employing strategies like value investing or focusing on defensive stocks can help navigate a potentially volatile market.

-

Fundamental Analysis: Thorough fundamental analysis remains a cornerstone of sound investment decisions, helping to identify strong companies regardless of market sentiment.

BofA's Recommendations for Investors

BofA's advice to investors regarding elevated stock market valuations typically emphasizes prudence and a long-term perspective.

-

Asset Allocation Strategy: BofA likely recommends a well-diversified asset allocation strategy that aligns with each investor's risk tolerance and financial goals.

-

Risk Tolerance and Time Horizon: Understanding and managing risk tolerance and having a long-term investment horizon are key factors to consider when navigating a potentially volatile market.

-

Sector-Specific Recommendations: BofA may offer sector-specific advice, suggesting exposure to undervalued sectors or de-emphasizing exposure to overvalued ones.

-

Portfolio Adjustments: Regular portfolio reviews and adjustments based on evolving market conditions and BofA's ongoing analysis are essential for maintaining a well-balanced investment strategy.

Conclusion

BofA's perspective on elevated stock market valuations highlights the importance of careful analysis, risk management, and a long-term investment strategy. While high valuations present certain risks, such as increased volatility and potential corrections, opportunities still exist for investors who conduct thorough research and employ prudent investment strategies. Remember, understanding the factors influencing market valuations, assessing your own risk tolerance, and diversifying your portfolio are critical steps in successful investing.

Call to action: Stay informed about elevated stock market valuations and their potential impact on your portfolio. Consult with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals. Continue to monitor stock market valuation trends and BofA's ongoing analysis for informed decision-making.

Featured Posts

-

Portugal Relaxes Electricity Import Restrictions From Spain Following Blackout

May 19, 2025

Portugal Relaxes Electricity Import Restrictions From Spain Following Blackout

May 19, 2025 -

Segunda Vuelta Electoral Correismo Desafia La Prohibicion De Celulares

May 19, 2025

Segunda Vuelta Electoral Correismo Desafia La Prohibicion De Celulares

May 19, 2025 -

Royal Mails Investment In Sustainable Technology Solar Powered Smart Postboxes

May 19, 2025

Royal Mails Investment In Sustainable Technology Solar Powered Smart Postboxes

May 19, 2025 -

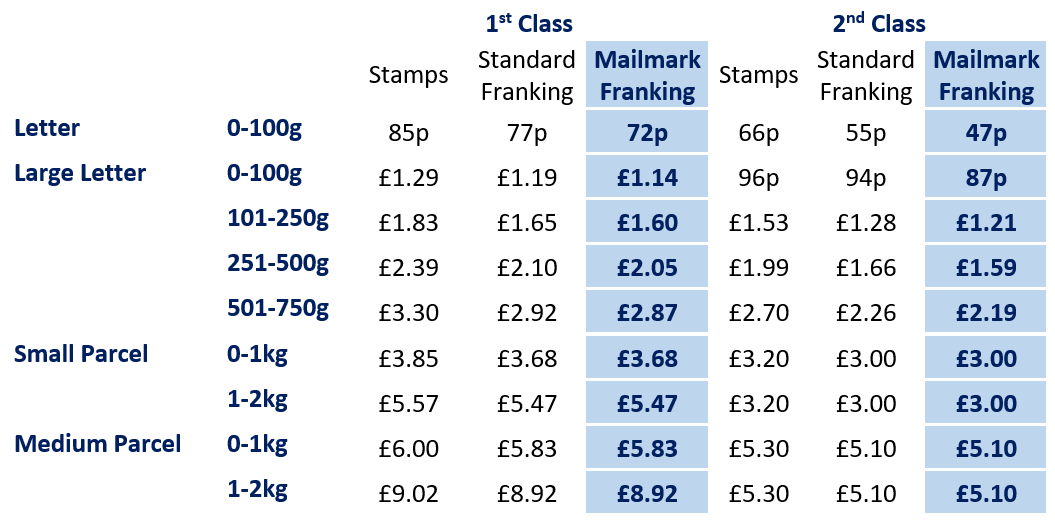

Royal Mail First Class Post Price Increases And Slower Delivery Times

May 19, 2025

Royal Mail First Class Post Price Increases And Slower Delivery Times

May 19, 2025 -

Eurovision 2025 Where And When Will The Contest Be Held

May 19, 2025

Eurovision 2025 Where And When Will The Contest Be Held

May 19, 2025