Should You Buy Apple Stock At $200? Analyst Sees $254 Potential

Table of Contents

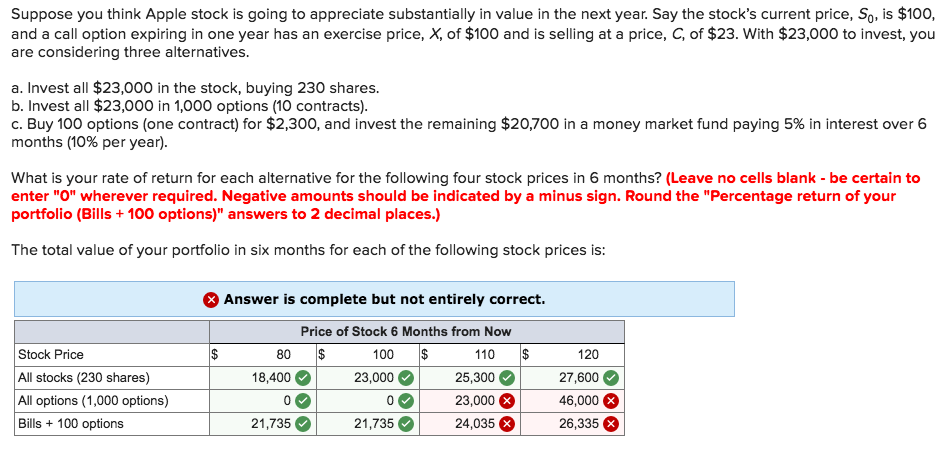

Apple's Current Financial Performance and Future Prospects

Strong Financials

Apple consistently delivers impressive financial performance. Recent earnings reports showcase robust revenue streams across its diverse product portfolio. The iPhone remains a significant revenue driver, but Apple's services segment, encompassing Apple Music, iCloud, and the App Store, is experiencing phenomenal growth, demonstrating the company's diversification and resilience. Profitability remains high, showcasing Apple's strong brand recognition and pricing power.

- Key Financial Metrics: Apple consistently shows strong Earnings Per Share (EPS) growth, high revenue growth year-over-year, and impressive profit margins, exceeding many industry benchmarks.

- Year-over-Year Comparisons: Compare the latest quarterly earnings reports to previous years to observe the trends in Apple earnings, Apple revenue, and Apple profitability. Look for sustained growth patterns.

- Analyst Ratings: Many leading financial analysts give Apple a strong "buy" rating, reflecting their positive outlook on the company's financial performance.

Future Growth Drivers

Several factors suggest continued growth for Apple. The highly anticipated iPhone 15 launch, along with the potential release of a new AR/VR headset, are expected to drive significant demand. Expansion into new markets and the continued growth of its services segment present further avenues for revenue generation. Apple's powerful brand loyalty and ecosystem lock-in provide a significant competitive advantage.

- New Products and Services: The upcoming iPhone 15, with its anticipated technological advancements, and the potential for a groundbreaking AR/VR headset are major catalysts for future growth.

- Market Penetration Strategies: Apple continues to expand into emerging markets, capitalizing on growing smartphone adoption rates globally.

- Competitive Advantages: Apple's strong brand, seamless ecosystem, and focus on premium products create high barriers to entry for competitors.

Analyst Predictions and Market Sentiment

The $254 Target

A recent prediction from a reputable investment bank suggests Apple stock could reach $254. This forecast is based on several key factors, including anticipated strong demand for upcoming products, continued market share gains, and a reasonable valuation multiple relative to projected earnings. The specific rationale behind the $254 Apple stock forecast should be carefully examined.

- Factors Influencing Prediction: Demand for the iPhone 15, expansion in services revenue, and overall market growth in consumer electronics all contribute to this bullish Apple stock forecast.

- Source of Prediction: It's crucial to identify the source of the prediction to assess its credibility and understand the underlying assumptions. Reputable investment banks and financial news outlets are generally reliable sources for Apple price target information.

Market Consensus and Risk Assessment

While the overall market sentiment towards Apple stock is generally bullish, it's essential to acknowledge potential risks. A global economic downturn, increased competition, or supply chain disruptions could negatively impact Apple's performance. However, Apple's diversified revenue streams and strong financial position offer a degree of resilience.

- Potential Risks: Economic uncertainty, intensified competition from Android manufacturers, and potential geopolitical issues influencing supply chains are all potential risks that need consideration before investing in Apple stock.

- Risk Mitigation Strategies: Diversifying your investment portfolio to reduce reliance on any single stock is a crucial risk mitigation strategy.

Comparing Apple Stock to Alternatives

Competitor Analysis

While Apple dominates the premium smartphone market, competition exists. Comparing Apple's financial performance, growth prospects, and valuation to competitors like Samsung, Google (Alphabet), and Microsoft is vital. This analysis helps determine if Apple offers superior investment potential compared to other tech stocks.

- Key Differences: Analyzing key performance indicators, future growth potential based on product portfolios and market positioning, and relative valuation multiples compared to competitors allows for a more informed investment decision.

Diversification Considerations

A well-diversified investment portfolio is crucial for managing risk. While Apple is a strong company, it shouldn't constitute the entirety of your investment portfolio. Diversification across different sectors and asset classes minimizes risk and maximizes potential returns.

- Concentrated vs. Diversified Holdings: Concentrated holdings in a single stock, even a seemingly strong one like Apple, expose your portfolio to significant risk. Diversification spreads this risk across different investments.

Conclusion: Should You Buy Apple Stock at $200?

The potential for Apple stock to reach $254, as suggested by some analysts, is certainly appealing. However, the decision to buy Apple stock at $200 (or its current price) hinges on your individual risk tolerance, investment goals, and overall portfolio diversification strategy. While Apple's financial health and future prospects are positive, potential risks must be considered. The information presented here is for analysis, not a recommendation.

Conduct thorough research, considering factors like current market conditions and your own investment objectives. Remember to only invest what you can afford to lose and never invest based solely on a single analyst's prediction. To make informed decisions about buying Apple stock at $200, consult reliable financial resources and seek personalized advice from a qualified financial advisor. Learn more about investing in Apple and other stocks by exploring reputable financial news sites and investment platforms.

Featured Posts

-

Dar Vienas Porsche Elektromobiliu Ikrovimo Centras Europoje Tvarumo Zenklas

May 25, 2025

Dar Vienas Porsche Elektromobiliu Ikrovimo Centras Europoje Tvarumo Zenklas

May 25, 2025 -

England Airpark And Alexandria International Airports Ae Xplore Your Gateway To Local And Global Adventures

May 25, 2025

England Airpark And Alexandria International Airports Ae Xplore Your Gateway To Local And Global Adventures

May 25, 2025 -

Brest Urban Trail Benevoles Artistes Et Partenaires

May 25, 2025

Brest Urban Trail Benevoles Artistes Et Partenaires

May 25, 2025 -

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025 -

New York Times Connections Puzzle 646 Hints And Solutions March 18 2025

May 25, 2025

New York Times Connections Puzzle 646 Hints And Solutions March 18 2025

May 25, 2025

Latest Posts

-

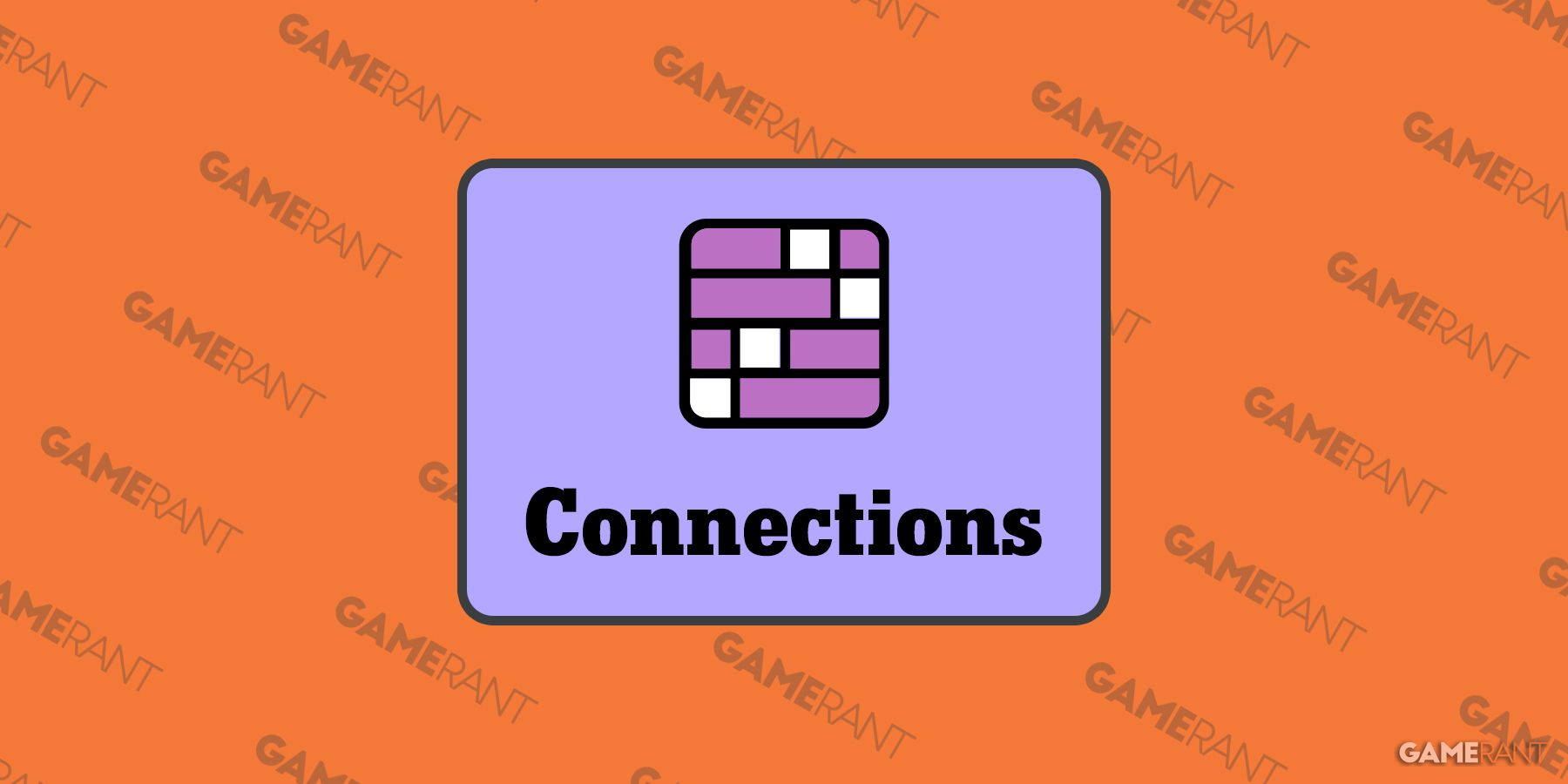

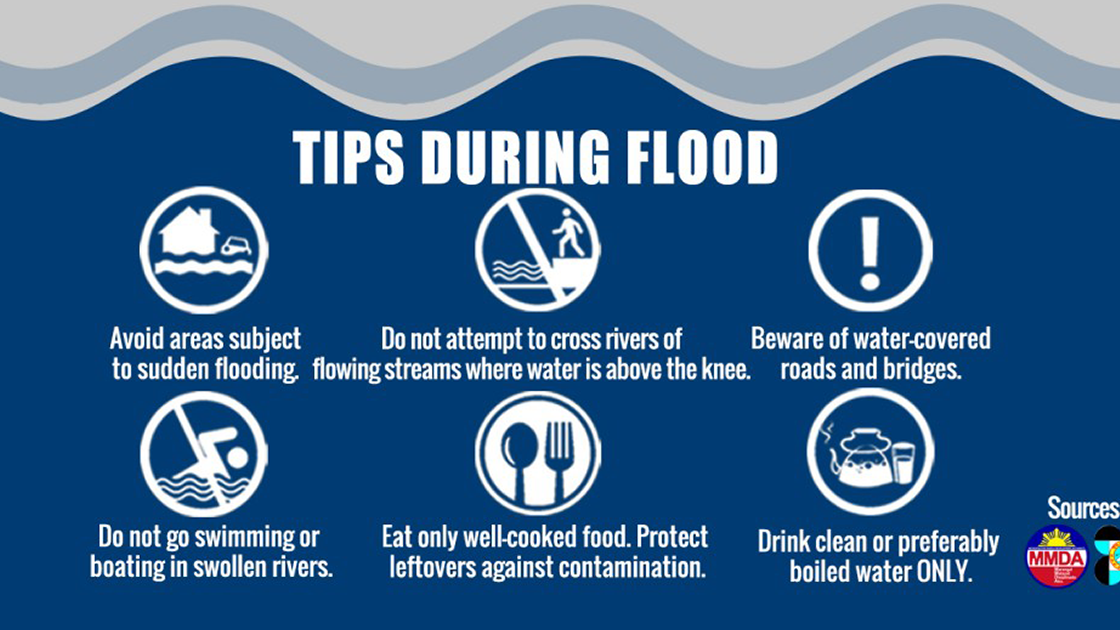

Flood Alerts Explained Understanding Flood Warnings And Staying Safe

May 25, 2025

Flood Alerts Explained Understanding Flood Warnings And Staying Safe

May 25, 2025 -

Flash Flood Emergency Recognizing The Signs And Taking Action

May 25, 2025

Flash Flood Emergency Recognizing The Signs And Taking Action

May 25, 2025 -

Heavy Rain Triggers Flash Flood Warning In South Florida What You Need To Know

May 25, 2025

Heavy Rain Triggers Flash Flood Warning In South Florida What You Need To Know

May 25, 2025 -

Are You Prepared For A Flash Flood Emergency A Checklist And Guide

May 25, 2025

Are You Prepared For A Flash Flood Emergency A Checklist And Guide

May 25, 2025 -

Flash Flood Emergency South Florida Residents Urged To Take Precautions Amid Heavy Downpour

May 25, 2025

Flash Flood Emergency South Florida Residents Urged To Take Precautions Amid Heavy Downpour

May 25, 2025