Should You Buy Palantir (PLTR) Stock Before May 5th? The Analyst Consensus

Table of Contents

The upcoming May 5th earnings report has investors questioning whether now is the right time to buy Palantir (PLTR) stock. This article analyzes the analyst consensus and provides insights to help you decide whether to invest in PLTR before this crucial date. We'll explore the current market sentiment, recent performance, and future growth projections to help you make an informed investment decision regarding Palantir stock. Remember, this is not financial advice; always conduct your own thorough research.

Palantir's Recent Performance and Financial Health

Q4 2023 Earnings and Revenue Growth

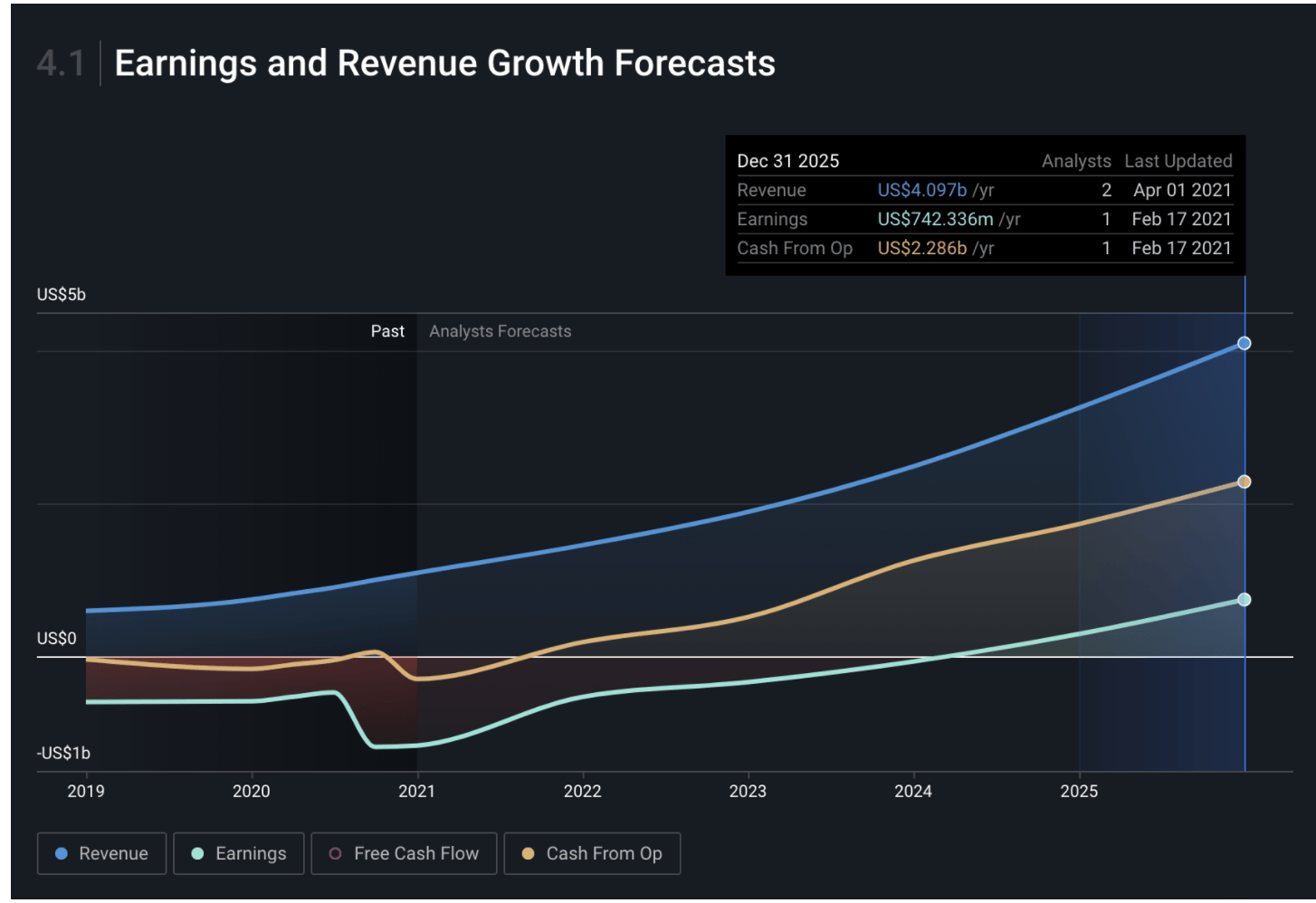

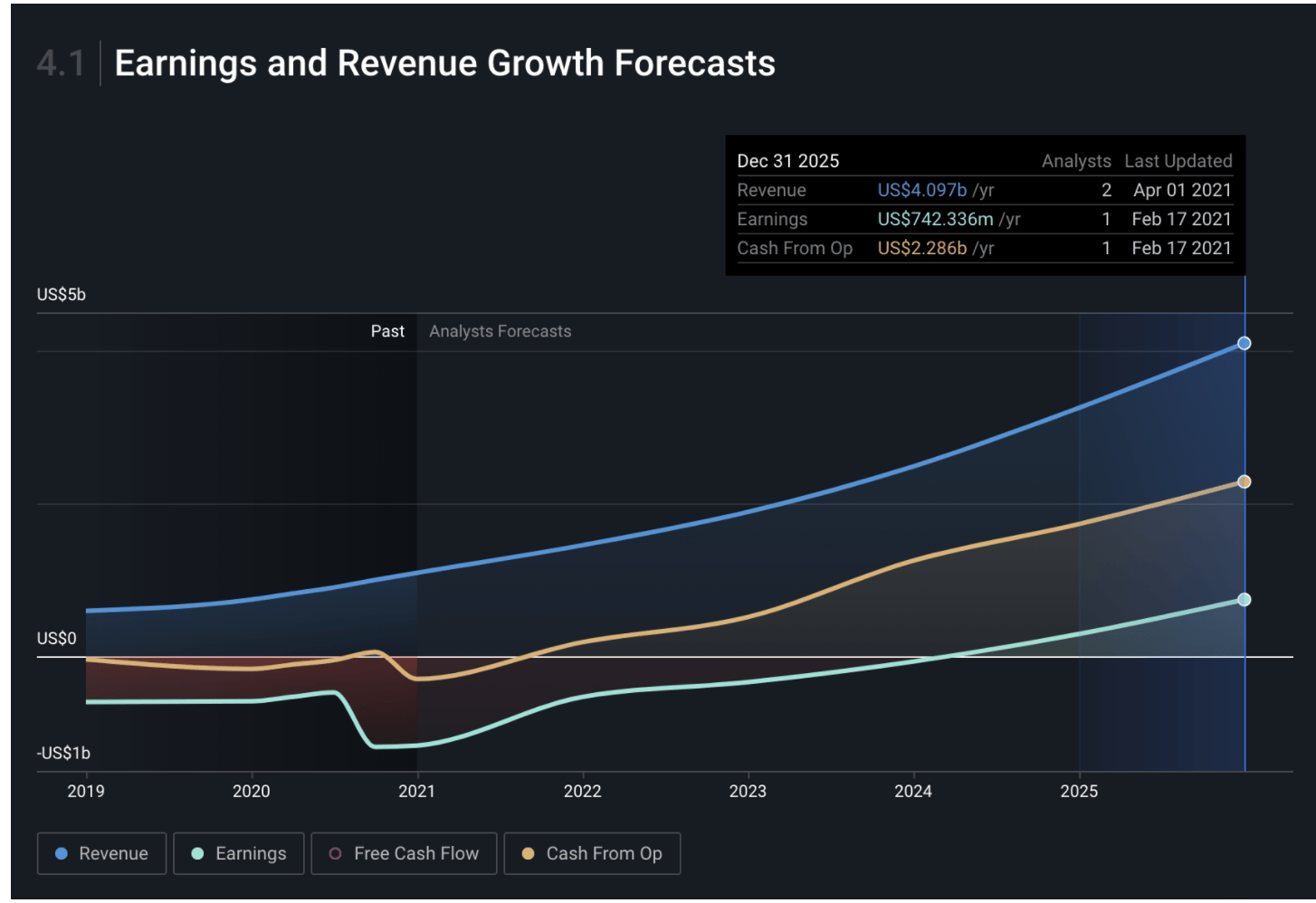

Palantir's recent financial performance will be a key factor influencing investor decisions. The Q4 2023 earnings report will reveal crucial metrics like revenue growth, net income, and operating margins. Investors will be closely watching for any surprises or significant deviations from analyst expectations. A strong performance, exceeding projections, could significantly boost PLTR stock.

- Revenue Growth: Analysts are anticipating [Insert Analyst Consensus Revenue Growth Percentage] for Q4 2023. A higher-than-expected growth rate would be a positive sign for Palantir's future prospects. (Source: [cite financial news source])

- Net Income: Profitability remains a key focus for investors. Any improvement in net income compared to previous quarters would be viewed favorably. (Source: [cite financial news source])

- Operating Margins: Investors will analyze operating margins to assess Palantir's efficiency and cost management. Expanding margins indicate a healthy and growing business. (Source: [cite financial news source])

Key Business Developments and Contracts

Beyond financial figures, significant business developments influence Palantir stock. New contracts, particularly large government contracts or strategic partnerships, can drive substantial growth.

- Government Contracts: Palantir's reliance on government contracts makes securing new deals crucial. Any significant contract wins in Q4 2023 will likely impact investor sentiment. (Source: [cite Palantir press releases or financial news])

- Commercial Partnerships: Expanding into the commercial sector is vital for Palantir's long-term growth. New partnerships with major corporations could signal increased market adoption. (Source: [cite Palantir press releases or financial news])

- Product Launches: New product releases or significant updates to existing platforms could enhance Palantir's offerings and attract new clients. (Source: [cite Palantir press releases or financial news])

Debt Levels and Cash Flow

Assessing Palantir's financial stability requires examining debt levels and cash flow. A healthy cash position and manageable debt are essential for sustaining growth and navigating economic uncertainty.

- Debt-to-Equity Ratio: Investors will scrutinize Palantir's debt-to-equity ratio to evaluate its financial leverage. A lower ratio indicates lower risk. (Source: [cite Palantir financial statements])

- Free Cash Flow: Positive free cash flow demonstrates Palantir's ability to generate cash from operations, supporting future investments and potentially returning value to shareholders. (Source: [cite Palantir financial statements])

- Credit Ratings: Credit rating agencies' assessments of Palantir's creditworthiness provide another perspective on its financial health. (Source: [cite relevant credit rating agency reports])

Analyst Ratings and Price Targets for PLTR Stock

Consensus Price Target and Range

Before making any investment decisions on PLTR stock, it's essential to review analyst price targets. These provide a range of potential future stock prices based on analysts' forecasts.

- Average Price Target: The average price target from reputable analysts for PLTR stock is currently [Insert Average Price Target]. (Source: [cite sources like Bloomberg, Yahoo Finance, etc.])

- Price Target Range: The range of price targets varies from [Insert Low Price Target] to [Insert High Price Target], reflecting the diversity of analyst opinions. (Source: [cite sources])

- Analyst Sentiment: Overall analyst sentiment towards PLTR stock can be categorized as [bullish/bearish/neutral], based on the proportion of buy, hold, and sell recommendations. (Source: [cite sources])

Factors Influencing Analyst Ratings

Various factors drive analyst ratings and price targets. Understanding these factors helps to interpret the consensus more accurately.

- Competition: The competitive landscape, including rivals like [mention key competitors], influences analysts' assessments of Palantir's market share and future growth.

- Regulatory Hurdles: Potential regulatory changes or compliance issues could impact Palantir's operations and profitability, influencing analyst views.

- Market Demand: The overall demand for big data analytics solutions and Palantir's ability to meet that demand play a crucial role in analyst forecasts.

- Technological Advancements: Palantir's ability to innovate and maintain a technological edge is a significant factor in analyst evaluations.

Risks and Opportunities Associated with Investing in Palantir Stock

Market Volatility and Economic Uncertainty

External factors significantly influence Palantir stock. Broader market trends and economic conditions can impact investor sentiment and the stock price.

- Market Correlation: PLTR stock price often correlates with the performance of the broader technology sector and the overall market. During market downturns, PLTR may experience heightened volatility.

- Economic Factors: Economic factors like interest rate changes, inflation, and recessionary risks can significantly impact investor confidence and affect PLTR's valuation.

Competition and Market Share

Palantir operates in a competitive market. Analyzing the competitive landscape and Palantir's market share is vital for assessing its long-term prospects.

- Key Competitors: Companies like [mention key competitors] pose significant competition to Palantir in the big data and analytics space.

- Competitive Advantages: Palantir's unique platform, strong government relationships, and technological advancements represent potential competitive advantages.

- Market Share: Maintaining and expanding market share will be critical for Palantir's future success.

Conclusion

The analyst consensus on Palantir (PLTR) stock before May 5th is mixed, reflecting both the potential for significant growth and inherent risks. While the Q4 2023 earnings report and ongoing business developments will significantly influence the stock price, investors should carefully consider the company's financial health, competitive landscape, and external economic factors. This information is for educational purposes only and does not constitute financial advice. Before making any investment decisions regarding Palantir stock (PLTR), conduct thorough research and consider consulting a financial advisor. Remember to assess your personal risk tolerance and investment goals before buying Palantir stock.

Featured Posts

-

Measles Outbreak Prompts School Quarantine In North Dakota Unvaccinated Children Affected

May 10, 2025

Measles Outbreak Prompts School Quarantine In North Dakota Unvaccinated Children Affected

May 10, 2025 -

Mstwa Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 10, 2025

Mstwa Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 10, 2025 -

Easter Weekend In Lake Charles Live Music Events And Entertainment

May 10, 2025

Easter Weekend In Lake Charles Live Music Events And Entertainment

May 10, 2025 -

Apples Ai Current Status And Future Predictions

May 10, 2025

Apples Ai Current Status And Future Predictions

May 10, 2025 -

New Uk Visa Regulations Targeting Visa Misuse And Abuse

May 10, 2025

New Uk Visa Regulations Targeting Visa Misuse And Abuse

May 10, 2025