Should You Buy Palantir Stock After Its 30% Fall?

Table of Contents

Palantir Technologies (PLTR) stock recently experienced a significant 30% drop. This dramatic fall has left many investors wondering: is now the time to buy Palantir stock? This article will delve into the factors contributing to the decline and analyze whether this presents a buying opportunity or a warning sign. We'll examine Palantir's financial performance, future prospects, and market position to help you make an informed decision about PLTR stock.

Understanding Palantir's Recent Stock Price Decline

Factors Contributing to the Fall:

The recent PLTR stock price decline is a multifaceted issue stemming from several interconnected factors:

-

Market-wide correction impacting growth stocks: The broader stock market correction, particularly impacting high-growth technology companies, played a significant role. Investors often rotate out of riskier assets during periods of economic uncertainty, impacting companies like Palantir, which are still establishing their profitability.

-

Concerns regarding profitability and revenue growth: Palantir's path to profitability has been a key concern for investors. While revenue is growing, the company's operating expenses have also been significant, leading to ongoing losses. This has raised questions about the sustainability of its growth trajectory.

-

Increased competition in the data analytics market: The data analytics market is increasingly competitive, with established tech giants and emerging startups vying for market share. This heightened competition puts pressure on Palantir to maintain its innovation edge and secure new clients.

-

Potential impact of geopolitical instability: Global geopolitical events can create uncertainty in the market, impacting investor sentiment towards technology stocks, especially those with significant government contracts like Palantir.

-

Specific news and events: Negative news cycles, analyst downgrades, or missed earnings expectations can trigger significant sell-offs. For example, [cite specific news events or announcements if available, linking to reputable sources].

Analyzing the Drop's Severity:

To assess the severity of the PLTR stock price drop, several comparisons are necessary:

-

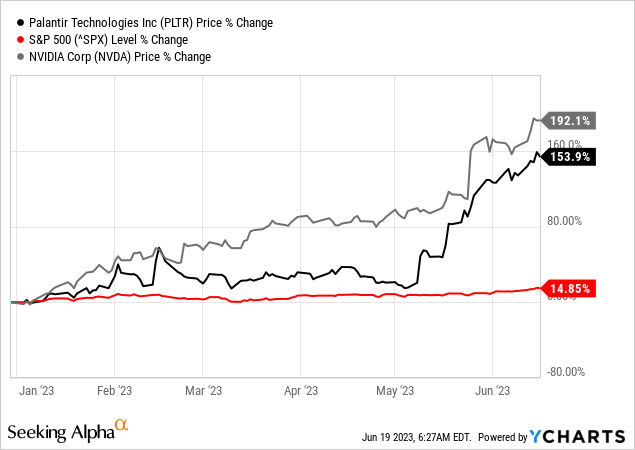

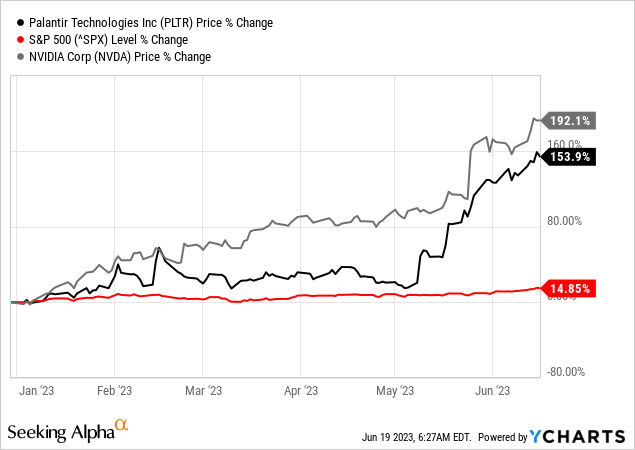

Historical stock performance: Comparing the recent 30% drop to Palantir's historical volatility provides context. Was this an unusually large drop, or does it fall within the typical range of fluctuations for PLTR stock?

-

Competitor performance: Analyzing how competitors in the data analytics space performed during the same period helps determine if the drop was specific to Palantir or a broader market trend.

-

Market overreaction: It's crucial to assess whether the market overreacted to negative news. Sometimes, a stock price decline may be disproportionate to the actual underlying fundamentals of the company.

Palantir's Strengths and Growth Potential

Government Contracts and Government Revenue:

Palantir has a strong foundation in government contracts, providing crucial data analytics services to various government agencies.

-

Reliance on government contracts: While a significant portion of Palantir's revenue stems from government contracts, it's important to analyze the diversity of its clients and the potential for contract renewal.

-

Future government contracts: The potential for securing new government contracts, especially in areas like national security and defense, represents a key driver of future revenue growth.

-

Contract stability: The long-term nature of many government contracts provides a degree of revenue predictability, offering a level of stability compared to purely commercial contracts.

Commercial Market Expansion:

Palantir's push into the commercial market is vital for long-term growth and diversification.

-

Commercial client base: Assessing the progress Palantir is making in expanding its commercial client base is critical. Success here is key to reducing reliance on government contracts.

-

Successful partnerships: Highlighting specific successful commercial partnerships and case studies demonstrating the value Palantir brings to commercial clients strengthens the argument for future growth.

-

Commercial market potential: The size and potential growth of the commercial data analytics market present a significant opportunity for Palantir to expand its revenue streams.

Technological Innovation and Competitive Advantage:

Palantir's unique data analytics platform and capabilities are key differentiators.

-

Data analytics capabilities: Examining Palantir's proprietary technology and its ability to integrate and analyze massive datasets is crucial to understanding its competitive advantage.

-

Technological advantages: Analyzing how Palantir's technology surpasses that of its competitors in terms of speed, accuracy, and scalability.

-

Innovation pipeline: Palantir's commitment to research and development and its innovation pipeline are critical for maintaining its competitive edge in a rapidly evolving market.

Risks and Challenges Facing Palantir

Profitability Concerns:

Profitability remains a key challenge for Palantir.

-

Current profitability: Analyzing Palantir's current financial statements and its path to profitability is crucial.

-

Challenges to profitability: Identifying the main hurdles preventing Palantir from achieving consistent profitability, such as high operating expenses or pricing pressure.

-

Competitor comparison: Comparing Palantir's profitability metrics (margins, operating income) to those of competitors provides valuable context.

Competition in the Data Analytics Space:

The data analytics market is fiercely competitive.

-

Key competitors: Identifying major competitors, such as Microsoft, Amazon, Google, and smaller specialized firms, is vital.

-

Market share: Understanding Palantir's current market share and its ability to maintain or grow its share in the face of intense competition.

-

Competitive impact: Assessing the potential for increased competition to erode Palantir's revenue and market position.

Dependence on a Few Large Clients:

Palantir's reliance on a relatively small number of large clients presents a risk.

-

Concentrated client base: Evaluating the potential vulnerabilities created by this concentration of clients.

-

Impact of losing a major client: Analyzing the financial consequences of losing one or more key clients.

-

Mitigation strategies: Discussing the strategies Palantir is employing to diversify its client base and mitigate this risk.

Conclusion

This analysis of Palantir Technologies (PLTR) and its recent stock price decline weighs the potential risks and rewards of investing in PLTR stock. The significant drop presents both opportunities and challenges. While concerns about profitability and competition exist, Palantir's unique technology and potential for growth in the government and commercial sectors remain compelling.

Call to Action: Ultimately, the decision of whether to buy Palantir stock after its 30% fall is a personal one, dependent on your individual risk tolerance and investment goals. However, a thorough understanding of the factors discussed above is crucial. Conduct further due diligence, consult a financial advisor, and consider your own risk profile before making any investment decisions regarding Palantir stock (PLTR). Remember to carefully assess the Palantir investment opportunity based on your own financial situation.

Featured Posts

-

Nicolas Cages Ex Wifes Lawsuit Dismissed But Son Weston Remains A Defendant

May 10, 2025

Nicolas Cages Ex Wifes Lawsuit Dismissed But Son Weston Remains A Defendant

May 10, 2025 -

Sensex And Nifty Today Market Rally Key Highlights And Analysis

May 10, 2025

Sensex And Nifty Today Market Rally Key Highlights And Analysis

May 10, 2025 -

Reactions To James Comers Epstein Files Pam Bondis Response Included

May 10, 2025

Reactions To James Comers Epstein Files Pam Bondis Response Included

May 10, 2025 -

Stricter Uk Visa Requirements Curbing Immigration And Visa Fraud

May 10, 2025

Stricter Uk Visa Requirements Curbing Immigration And Visa Fraud

May 10, 2025 -

Understanding Stock Market Valuations Bof As Take For Investors

May 10, 2025

Understanding Stock Market Valuations Bof As Take For Investors

May 10, 2025