Should You Buy Palantir Stock Before May 5th? A Pre-Earnings Analysis

Table of Contents

Palantir's Recent Performance and Key Financials

Understanding Palantir's recent financial health is crucial before considering buying its stock. Analyzing key metrics from recent quarterly and annual reports offers insight into the company's trajectory. "Palantir financials" reveal a mixed bag, with some encouraging signs alongside persistent challenges.

-

Revenue Growth Trends (YoY and QoQ): Palantir has shown consistent year-over-year revenue growth, albeit at a fluctuating pace. Quarter-over-quarter growth has also been positive in recent periods, demonstrating a degree of stability. However, investors need to analyze the specific drivers of this growth to ascertain its sustainability.

-

Profitability (or lack thereof) and its trajectory: Palantir has yet to achieve consistent profitability, a key concern for many investors. While revenue is growing, operating expenses remain significant. The path to profitability and the company's strategies to achieve it are crucial factors to watch. Analyzing "PLTR revenue growth" alongside operating expenses is key to understanding the long-term outlook.

-

Key Contract Wins and their Significance: Palantir's success hinges on securing substantial contracts, particularly within the government sector. Recent contract wins should be examined for their size, duration, and potential impact on future revenue streams. Large, long-term contracts significantly influence "Palantir profitability."

-

Debt Levels and Cash Flow: Monitoring Palantir's debt levels and cash flow is vital for assessing its financial stability. High debt levels could pose risks, while strong cash flow indicates financial health. Investors should carefully review the "Palantir financials" to understand these aspects.

Analyst Expectations and Price Targets for May 5th Earnings

Analyst sentiment plays a significant role in shaping market expectations surrounding Palantir's earnings. The "Palantir earnings forecast" varies among analysts, reflecting differing perspectives on the company's future performance.

-

Average Analyst Price Target: The average price target set by analysts provides a benchmark for potential future stock valuation. This metric, however, should be taken with a grain of salt, as it is merely a consensus opinion.

-

High and Low Price Targets: The range between the highest and lowest price targets highlights the significant uncertainty surrounding Palantir's future performance. Understanding this range is vital for managing risk.

-

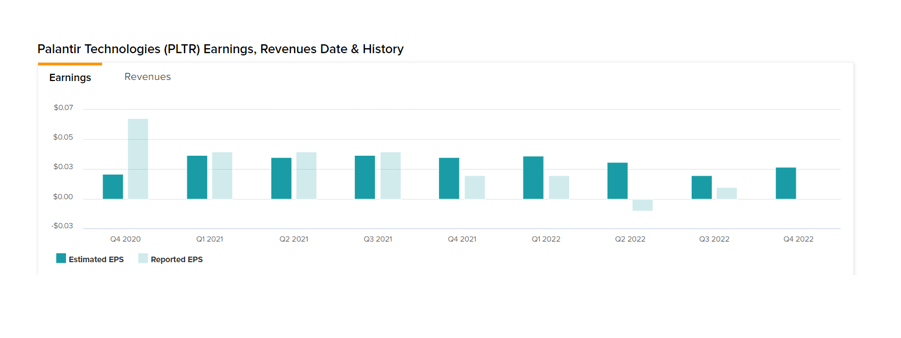

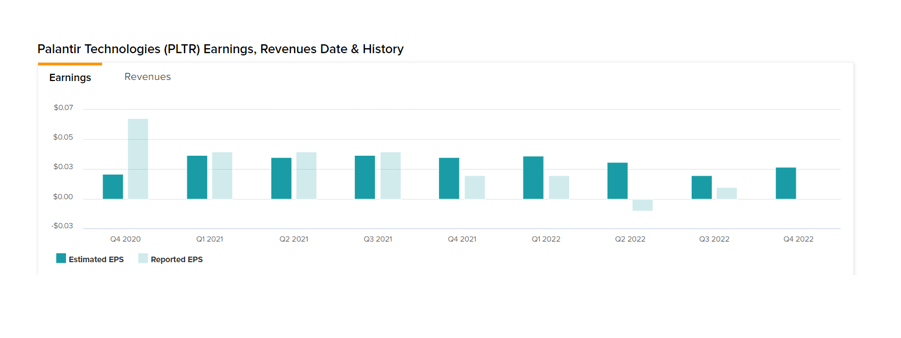

Consensus on Revenue and EPS Expectations: The consensus amongst analysts regarding expected revenue and earnings per share (EPS) is another critical factor to consider. Any significant deviation from these expectations can trigger substantial price movements.

-

Impact of Potential Surprises (Positive or Negative): Positive surprises, such as exceeding revenue expectations, typically lead to price increases. Conversely, negative surprises often cause stock prices to drop. Analyzing the "PLTR price target" range and the potential impact of surprises is crucial for risk management. Keywords like "analyst predictions Palantir" help in tracking market sentiment.

Factors Affecting Palantir Stock Price Beyond Earnings

Several factors beyond Palantir's immediate earnings report can significantly influence its stock price. Understanding these external factors is vital for a holistic "Palantir stock market" analysis.

-

Impact of Macroeconomic Factors: Broad market conditions, such as interest rate hikes, inflation, and overall economic growth, significantly impact the tech sector, including Palantir. A downturn in the overall economy can negatively affect investor sentiment and "PLTR market analysis."

-

Competition in the Big Data Analytics Market: Palantir faces intense competition from established players and emerging startups in the big data analytics market. Analyzing competitive dynamics is crucial for understanding Palantir's long-term prospects.

-

Regulatory Changes and their Potential Influence: Regulatory changes, particularly those affecting government contracts or data privacy, can significantly impact Palantir's operations and stock price. Staying abreast of relevant regulations is essential for "PLTR market analysis."

-

Recent News and Developments Affecting the Company: Recent news, including strategic partnerships, product launches, or legal challenges, can significantly affect investor sentiment and "Palantir stock market" performance. Staying informed about these developments is crucial.

Risks and Potential Rewards of Investing in Palantir

Investing in Palantir stock presents both significant risks and potential rewards. A thorough "Palantir risk assessment" is crucial before making any investment decision.

-

Potential Upside and Downside Scenarios: Consider the potential range of outcomes, from substantial gains to significant losses, based on various scenarios. Understanding "Palantir stock volatility" is critical.

-

Risk Tolerance Assessment for Investors: Assess your risk tolerance before investing in Palantir. Its high volatility makes it unsuitable for risk-averse investors.

-

Comparison to Competitors in the Industry: Compare Palantir's performance and prospects against its main competitors to gauge its competitive advantage and potential for future growth.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Our pre-earnings analysis reveals a mixed picture for Palantir. While revenue growth and key contract wins offer positive signals, concerns remain regarding profitability and the volatile nature of the tech sector. The "Palantir earnings forecast" offers a range of potential outcomes, highlighting the inherent uncertainty. Considering the macroeconomic factors, competition, and the inherent risks associated with "Palantir stock volatility," investing before the May 5th earnings release requires a high-risk tolerance.

Therefore, the decision of whether to buy Palantir stock before May 5th hinges on your individual risk tolerance and investment goals. While the potential rewards are significant, so are the risks. This analysis serves as a starting point; conduct your own thorough research before making any investment decisions. Remember, this is not financial advice; consider this a contribution to your own due diligence on Palantir stock.

Featured Posts

-

New Bot Governor Crucial As Thailand Battles Tariff Headwinds

May 10, 2025

New Bot Governor Crucial As Thailand Battles Tariff Headwinds

May 10, 2025 -

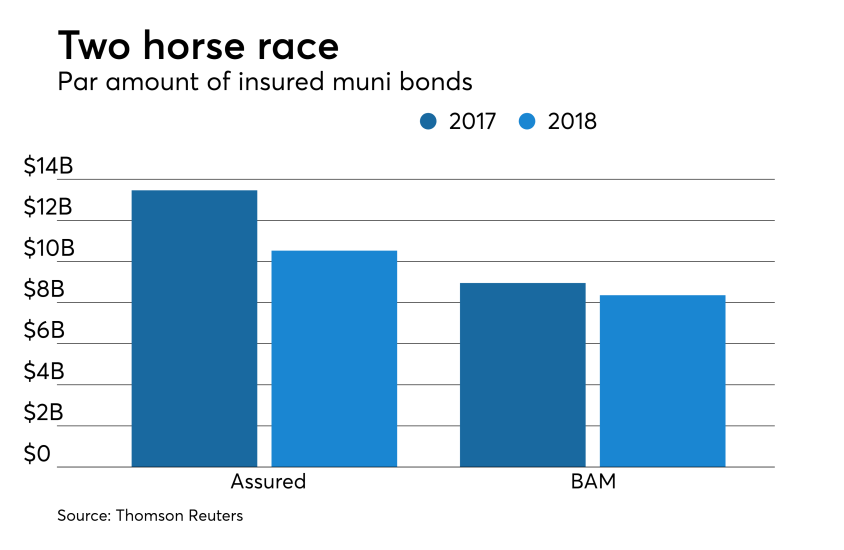

Proposed Changes Indian Insurers And The Bond Forward Market

May 10, 2025

Proposed Changes Indian Insurers And The Bond Forward Market

May 10, 2025 -

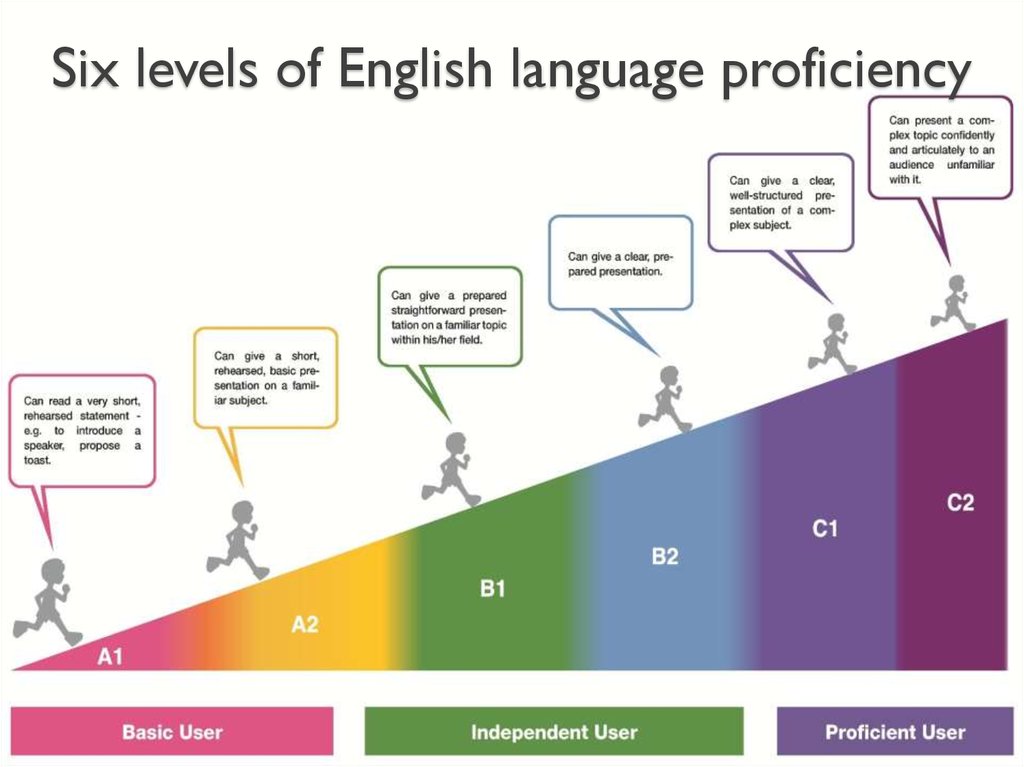

Tougher Uk Immigration Rules English Language Proficiency A Key Requirement

May 10, 2025

Tougher Uk Immigration Rules English Language Proficiency A Key Requirement

May 10, 2025 -

Ohio Train Derailment Investigation Into Lingering Toxic Chemicals In Structures

May 10, 2025

Ohio Train Derailment Investigation Into Lingering Toxic Chemicals In Structures

May 10, 2025 -

France Poland Friendship Treaty Macron Confirms Signing Next Month

May 10, 2025

France Poland Friendship Treaty Macron Confirms Signing Next Month

May 10, 2025