Should You Follow Wedbush's Bullish Apple Stock Prediction?

Table of Contents

Wedbush Securities is a well-respected financial services firm known for its equity research and investment banking capabilities. Their analysts often provide insightful commentary on the technology sector. This article aims to dissect their bullish outlook on Apple stock and provide you with the tools to assess whether it aligns with your investment strategy. We'll examine Apple's financials, current market trends, and potential risks associated with this prediction.

Wedbush's Apple Stock Price Target and Rationale

Wedbush recently set a price target of $230 for Apple stock (as of October 26, 2023 - Note: Always check for the most up-to-date information from reputable financial sources.). This represents a significant upside potential from its current trading price. Their bullish stance is primarily driven by several key factors:

- Strong iPhone Sales: Wedbush points to consistently strong iPhone sales, particularly in the higher-priced models, as a major driver of revenue growth. They expect this trend to continue, fueling Apple's overall financial performance.

- Growth in Services: Apple's services segment (including Apple Music, iCloud, and Apple TV+) continues to demonstrate impressive growth, contributing significantly to recurring revenue and high profit margins. This recurring revenue stream provides stability and predictability.

- Potential for New Product Categories: Wedbush anticipates Apple's continued innovation and expansion into new product categories (e.g., augmented reality/virtual reality headsets, electric vehicles), contributing to long-term growth.

- Market Share Dominance: Apple maintains a dominant market share in several key product categories, providing a strong foundation for future growth and resilience against competition.

Analyzing Apple's Current Financial Performance

Apple's recent financial reports reveal a mixed bag. While revenue growth remains robust, driven by strong iPhone sales and services revenue, profit margins have faced some pressure due to increased component costs and supply chain challenges.

- Key Performance Indicators (KPIs): Examining Apple's Earnings Per Share (EPS), revenue growth rate, and gross profit margin provides valuable insights into its financial health. Comparing these figures year-over-year and against industry benchmarks offers a comprehensive view.

- Strengths: Strong brand loyalty, a diverse product portfolio, and consistent innovation are key strengths underpinning Apple's financial performance. The Services segment acts as a significant buffer against economic downturns.

- Weaknesses: Dependence on iPhone sales, vulnerability to supply chain disruptions, and increasing competition in certain markets represent potential weaknesses.

Market Trends and External Factors

Macroeconomic factors significantly impact Apple's stock price. Currently, factors such as inflation, interest rate hikes, and potential recessions create uncertainty.

- Favorable Trends: The continued growth of the global smartphone market and the increasing adoption of cloud services and digital content present opportunities for Apple.

- Unfavorable Trends: Geopolitical instability, supply chain disruptions (particularly in Asia), and the escalating competition from Android manufacturers could negatively impact Apple's performance. Stronger-than-expected inflation could also hurt consumer spending.

Risks and Considerations Before Investing

While Wedbush's prediction is optimistic, it's crucial to acknowledge potential risks before investing in Apple stock based solely on this outlook:

- Economic Downturn: A significant economic recession could severely impact consumer spending, reducing demand for Apple products.

- Increased Competition: Intense competition from companies like Samsung, Google, and other tech giants constantly challenges Apple's market share.

- Negative News Cycles: Negative publicity or product recalls can significantly impact investor sentiment and stock prices.

- Market Volatility: The stock market is inherently volatile. Even with a positive long-term outlook, short-term price fluctuations are inevitable.

Alternative Investment Strategies

Instead of solely relying on Wedbush's prediction, consider diversifying your investment portfolio. Explore other investment options across various sectors and asset classes to mitigate risk. Dollar-cost averaging (investing a fixed amount regularly) can help reduce the impact of market volatility.

Conclusion

Wedbush's bullish Apple stock prediction presents a compelling case, supported by strong iPhone sales, growth in services, and the potential for new product categories. However, economic uncertainties, intense competition, and inherent market volatility necessitate caution. Before acting on Wedbush's Bullish Apple Stock Prediction, conduct thorough due diligence, carefully assess your risk tolerance, and consider diversifying your investments. Further research into Apple's financial statements, competitor analysis, and broader market trends is crucial for making a well-informed investment decision. Remember that this article is for informational purposes only and not financial advice. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025 -

Dramatic Highway Refueling During High Speed Police Chase

May 25, 2025

Dramatic Highway Refueling During High Speed Police Chase

May 25, 2025 -

Porsche 956 Muezede Tavan Sergisi Neden

May 25, 2025

Porsche 956 Muezede Tavan Sergisi Neden

May 25, 2025 -

Best New R And B Songs This Week Leon Thomas And Flo Lead The Pack

May 25, 2025

Best New R And B Songs This Week Leon Thomas And Flo Lead The Pack

May 25, 2025 -

Draper Claims First Atp Masters 1000 Title At Indian Wells

May 25, 2025

Draper Claims First Atp Masters 1000 Title At Indian Wells

May 25, 2025

Latest Posts

-

Car Dealerships Double Down On Opposition To Ev Mandates

May 25, 2025

Car Dealerships Double Down On Opposition To Ev Mandates

May 25, 2025 -

Dealerships Step Up Opposition To Mandatory Ev Sales

May 25, 2025

Dealerships Step Up Opposition To Mandatory Ev Sales

May 25, 2025 -

Toxic Chemicals From Ohio Train Derailment Months Long Persistence In Buildings

May 25, 2025

Toxic Chemicals From Ohio Train Derailment Months Long Persistence In Buildings

May 25, 2025 -

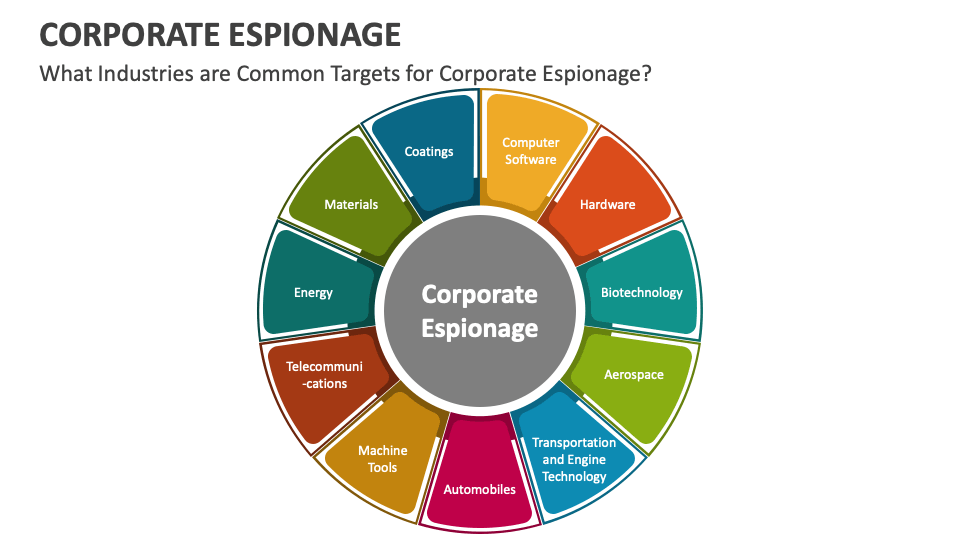

Corporate Espionage Office365 Breaches Net Millions For Hacker

May 25, 2025

Corporate Espionage Office365 Breaches Net Millions For Hacker

May 25, 2025 -

Federal Charges Millions Stolen Via Executive Office365 Hacks

May 25, 2025

Federal Charges Millions Stolen Via Executive Office365 Hacks

May 25, 2025