Should You Invest In Palantir Before May 5th? Risks And Rewards

Table of Contents

Palantir's Current Financial Performance and Future Projections

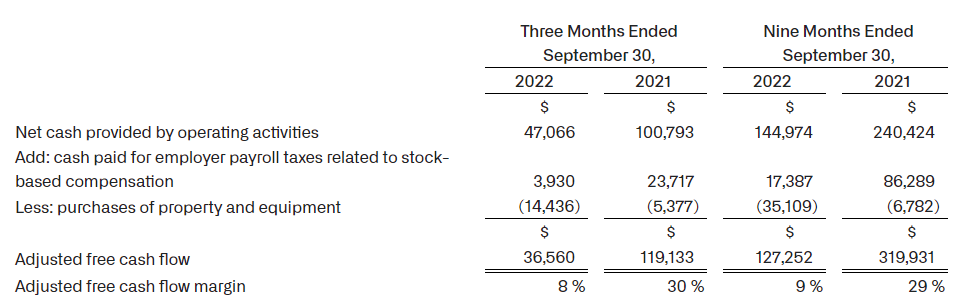

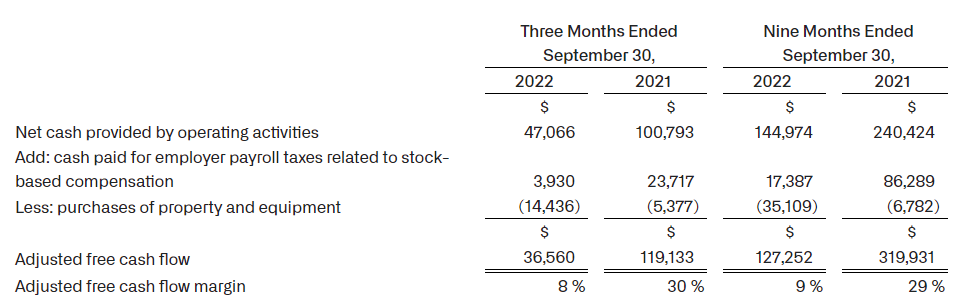

Palantir's financial performance and future projections are crucial factors in determining whether to invest before May 5th. Analyzing these aspects provides a clearer picture of the company's potential for growth and profitability.

Revenue Growth and Profitability

Palantir's recent quarterly earnings reports show a mixed bag. While revenue growth has been consistent, profitability remains a key area of focus. Analyzing year-over-year growth is critical.

- Year-over-Year Growth: [Insert data from recent quarterly reports, citing source]. Highlight periods of significant growth and any periods of slowdown.

- Key Revenue Drivers: Government contracts remain a significant revenue driver for Palantir, but the company is increasingly focusing on expanding its commercial partnerships. [Provide examples of large government contracts and significant commercial partnerships, citing sources].

- Path to Profitability: Palantir's path to profitability involves a delicate balance between scaling operations and managing costs. [Analyze their profitability margins and their stated plans for achieving profitability. Cite company statements and financial reports.]

Key Partnerships and Contracts

Palantir's success hinges significantly on its ability to secure and maintain key partnerships and contracts. These relationships directly impact revenue streams and future growth potential.

- Strategic Partnerships: [Provide examples of key partnerships with large government agencies (e.g., CIA, Department of Defense) and Fortune 500 companies. Highlight the specific value each partnership brings to Palantir.] Analyzing these partnerships is crucial to assess the stability and potential growth of Palantir's revenue streams.

- Contract Renewals: The consistent renewal of existing contracts is a positive indicator of Palantir's performance and client satisfaction. [Discuss the track record of contract renewals and their contribution to long-term revenue predictability.]

- Future Contract Wins: The potential for securing new, large-scale contracts will significantly impact Palantir's future financial performance. [Mention any upcoming bids or anticipated contract awards, citing reliable news sources if available.]

Market Analysis and Competitive Landscape

Understanding the market dynamics and Palantir's competitive position is crucial for any potential investor. This analysis considers industry trends and Palantir's standing against its competitors.

Industry Trends and Growth Potential

The big data analytics and artificial intelligence markets are experiencing significant growth. This presents both opportunities and challenges for Palantir.

- Market Size and Growth: The global market for big data analytics and AI is projected to reach [insert market size projections from reputable sources, such as Gartner or IDC]. This substantial growth provides a favorable backdrop for Palantir's expansion.

- Palantir's Market Positioning: Palantir differentiates itself through its focus on complex data integration and its specialized offerings for government and enterprise clients. [Discuss their unique selling points, highlighting what sets them apart from the competition.]

Competition and Market Share

Palantir faces fierce competition from established tech giants such as Amazon Web Services (AWS), Google Cloud, and Microsoft Azure.

- Competitive Analysis: While Palantir's technology is sophisticated, the competition from these larger companies with broader resources is a significant consideration. [Compare Palantir's offerings, market share, and strengths/weaknesses against key competitors. Cite market research reports if available.]

- Competitive Advantages: Palantir's focus on complex data analytics and its strong relationships with government agencies offer a degree of competitive advantage. [Highlight Palantir's niche and its ability to serve specific market segments effectively.]

Risks Associated with Investing in Palantir

Investing in Palantir carries inherent risks that potential investors should carefully consider before making any decisions regarding Palantir investment.

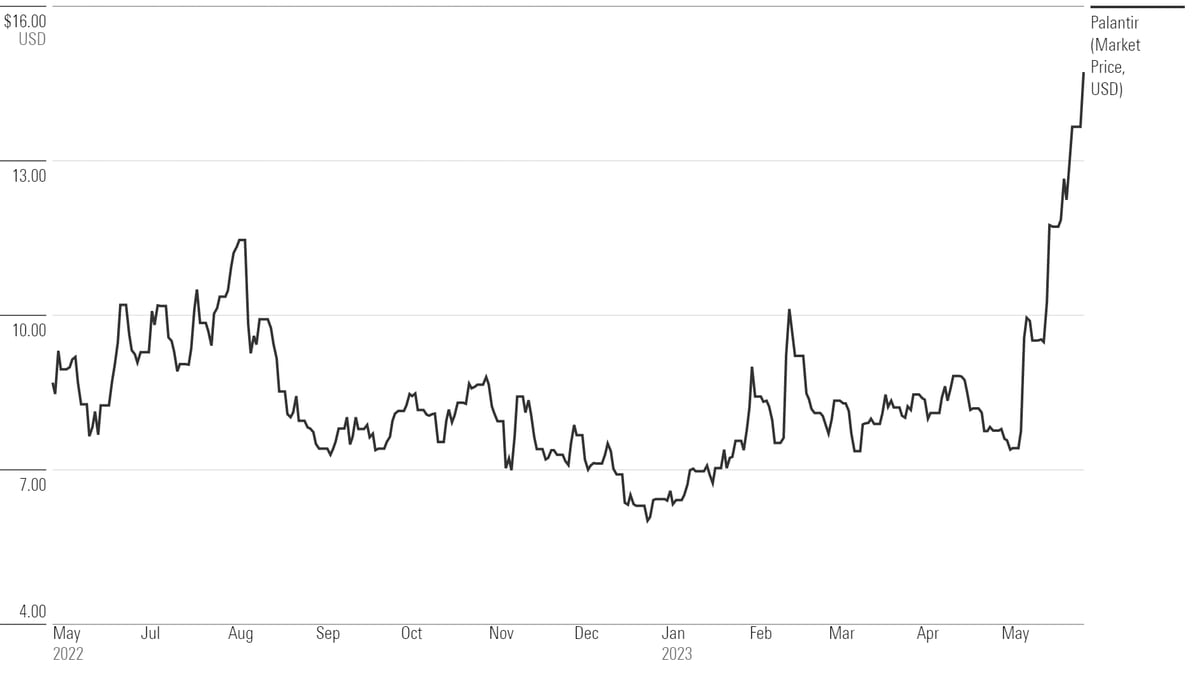

Valuation and Stock Price Volatility

Palantir's stock price has been known for its volatility. Understanding the factors influencing this volatility is crucial.

- Valuation Metrics: Analyzing Palantir's price-to-earnings ratio (P/E ratio) and other key valuation metrics provides insight into its current market valuation. [Provide data and context regarding their valuation compared to industry peers.]

- Market Sentiment and News Events: Market sentiment and news events (both positive and negative) can significantly impact Palantir's stock price. [Discuss how external factors can affect the volatility of PLTR stock.]

Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to the risks associated with government spending and policy changes.

- Government Spending Fluctuations: Changes in government budgets or shifts in political priorities could impact the demand for Palantir's services. [Discuss the potential impact of budget cuts or policy changes on Palantir's revenue stream.]

- Diversification Efforts: Palantir is actively trying to diversify its revenue streams by expanding into the commercial sector. [Discuss their efforts to reduce reliance on government contracts and build a more stable revenue base.]

Technological Disruption and Competition

The rapid pace of technological advancement presents a constant threat to Palantir's market position.

- Technological Obsolescence: New technologies or innovative approaches to data analytics could render Palantir's current offerings less competitive. [Discuss the potential for disruptive technologies and their impact on Palantir's long-term viability.]

- Competitive Pressure: The ongoing competition from established tech giants with significantly larger resources poses a continuous challenge. [Highlight the risks posed by competitors with greater market reach and financial resources.]

Conclusion

Deciding whether to invest in Palantir before May 5th requires a careful evaluation of its financial performance, market position, future growth prospects, and associated risks. While Palantir's innovative technology and strong government partnerships offer significant potential for growth, its reliance on government contracts and the intense competition in the big data analytics market present considerable challenges. The volatility of Palantir stock further adds to the investment risk.

Ultimately, the decision of whether to invest in Palantir before May 5th is a personal one, depending on your individual risk tolerance and investment strategy. Thoroughly research Palantir and conduct your due diligence before making any investment decisions concerning Palantir stock (PLTR). Consider consulting a financial advisor to determine if investing in Palantir aligns with your long-term financial goals. Remember to carefully analyze all aspects of Palantir before investing in Palantir stock.

Featured Posts

-

Ray Epps Vs Fox News A Defamation Case Examining January 6th Narratives

May 10, 2025

Ray Epps Vs Fox News A Defamation Case Examining January 6th Narratives

May 10, 2025 -

Should You Buy Palantir Stock Now A Detailed Investors Guide

May 10, 2025

Should You Buy Palantir Stock Now A Detailed Investors Guide

May 10, 2025 -

Don De Cheveux A Dijon Pour Une Bonne Cause

May 10, 2025

Don De Cheveux A Dijon Pour Une Bonne Cause

May 10, 2025 -

Beyonces Cowboy Carter A Tour Driven Streaming Success

May 10, 2025

Beyonces Cowboy Carter A Tour Driven Streaming Success

May 10, 2025 -

200 Million Economic Hit Perus Emergency Mining Ban And Gold Production

May 10, 2025

200 Million Economic Hit Perus Emergency Mining Ban And Gold Production

May 10, 2025