Significant Drop In Amsterdam Stock Exchange: AEX Index Down Over 4%

Table of Contents

Causes Behind the AEX Index's Sharp Decline

The sudden and substantial fall in the AEX index wasn't an isolated event but rather a consequence of several interconnected factors. Understanding these contributing elements is crucial for navigating the current market volatility and making informed investment decisions.

Global Economic Factors

The global economic landscape is currently fraught with challenges, significantly influencing the AEX index's performance. Persistent high inflation, coupled with aggressive interest rate hikes by central banks like the European Central Bank (ECB), has created a climate of uncertainty and fear.

- Rising Inflation and Interest Rates: Inflation rates remain stubbornly high across Europe, forcing the ECB to continue raising interest rates to combat rising prices. These higher rates increase borrowing costs for businesses, impacting investment and potentially slowing economic growth. For instance, a recent inflation rate of X% in the Eurozone further exacerbated pressure on the AEX.

- Geopolitical Instability: The ongoing war in Ukraine continues to disrupt global supply chains, fuel energy price volatility, and increase uncertainty about the future economic outlook. This instability significantly affects sectors like energy and technology, heavily represented in the AEX.

- Recessionary Fears: Concerns about a potential recession in major economies are also weighing heavily on investor sentiment. The possibility of a global economic slowdown significantly reduces risk appetite, leading to sell-offs in stock markets worldwide, including the AEX.

Performance of Specific AEX Companies

The decline in the AEX index wasn't uniform across all companies. Several large-cap stocks experienced particularly sharp drops, contributing significantly to the overall market downturn.

- Company X: Company X, a major player in the [sector], saw its share price fall by Y% due to [reason for decline, e.g., disappointing earnings report, regulatory issues].

- Company Y: Similarly, Company Y, a leading [sector] company, experienced a Z% drop following [reason for decline, e.g., negative news impacting consumer confidence].

- Company Z: [Another example of a company with a significant drop and the reason why]. These individual company performances underscore the sector-specific challenges contributing to the broader AEX decline.

Investor Sentiment and Market Volatility

The sharp drop in the AEX index reflects a significant shift in investor sentiment. Fear and uncertainty have driven widespread selling, amplifying market volatility.

- Increased Trading Volume: The increased trading volume during the downturn indicates a significant shift in investor behavior, with many selling off their holdings to mitigate potential losses.

- Technical Indicators: Technical analysis indicators, such as [mention specific indicators like RSI or MACD], further pointed towards a potential market correction or downturn before the sharp decline.

- Panic Selling: As the market fell, panic selling exacerbated the decline, creating a feedback loop where further price drops triggered more selling.

Impact of the AEX Decline on the Dutch Economy

The significant drop in the AEX index has broad implications for the Dutch economy, affecting businesses, pensions, and potentially requiring government intervention.

Effect on Dutch Businesses

The decline in the AEX impacts Dutch businesses in several ways:

- Reduced Investment: A lower stock market valuation makes it more difficult for companies to raise capital through equity offerings, hindering investment and expansion plans.

- Decreased Consumer Confidence: A falling stock market can negatively impact consumer confidence, leading to reduced spending and potentially slowing economic growth.

- Job Creation Challenges: Reduced investment and lower consumer confidence can lead to job losses or slower job creation in the future.

Implications for Pensions and Savings

A large proportion of Dutch citizens' retirement savings are tied to the AEX index. The recent decline has direct consequences:

- Loss of Retirement Savings: The sharp drop translates to significant losses for individuals relying on their investments for retirement income. This necessitates a review of retirement planning strategies.

- Reduced Purchasing Power: The reduced value of pension funds and savings directly impacts the purchasing power of Dutch citizens, potentially affecting living standards.

Government Response and Potential Measures

The Dutch government might need to intervene to mitigate the negative economic consequences:

- Economic Stimulus Packages: The government may consider fiscal stimulus measures to boost economic activity and restore investor confidence.

- Regulatory Changes: Potential regulatory changes could aim to stabilize the market and protect investors from excessive risk.

- Support for Affected Businesses: The government may offer support to businesses struggling due to the stock market downturn.

Analyzing the Future of the AEX Index

Predicting the future of the AEX index requires careful consideration of various factors, both short-term and long-term.

Short-Term Outlook

The short-term outlook for the AEX remains uncertain:

- Potential for Further Decline: Depending on the evolution of global economic conditions and investor sentiment, the AEX could experience further declines in the short term.

- Potential for Recovery: However, if global economic concerns ease, investor sentiment improves, and specific companies report positive news, the AEX could experience a recovery.

Long-Term Prospects

The long-term prospects for the AEX are tied to the underlying strength of the Dutch economy:

- Innovation and Technological Advancements: The Netherlands' strong focus on innovation and technological advancements positions it well for long-term growth.

- Sustainable Economic Policies: Sustainable economic policies focusing on a green transition can drive long-term growth and attract investment.

Conclusion

The significant drop in the AEX index is a consequence of a confluence of global economic headwinds, specific company performance issues, and a shift in investor sentiment. This decline has significant implications for the Dutch economy, impacting businesses, pensions, and requiring potential government intervention. While the short-term outlook remains uncertain, the long-term prospects for the AEX are tied to the strength of the Dutch economy and its ability to adapt to global challenges. Stay updated on AEX index movements, monitor the AEX for potential recovery signals, and learn more about mitigating risks in volatile markets. Understanding the AEX index and its fluctuations is vital for investors and anyone interested in the health of the Dutch economy.

Featured Posts

-

Plan Your Memorial Day Trip 2025 Flight Booking Guide

May 25, 2025

Plan Your Memorial Day Trip 2025 Flight Booking Guide

May 25, 2025 -

Darwin Shop Owner Killed Teenager In Custody Following Nightcliff Incident

May 25, 2025

Darwin Shop Owner Killed Teenager In Custody Following Nightcliff Incident

May 25, 2025 -

Memorial Day 2025 Flights Minimize Travel Hassles

May 25, 2025

Memorial Day 2025 Flights Minimize Travel Hassles

May 25, 2025 -

Severe M56 Traffic Delays Near Cheshire Deeside Border Due To Collision

May 25, 2025

Severe M56 Traffic Delays Near Cheshire Deeside Border Due To Collision

May 25, 2025 -

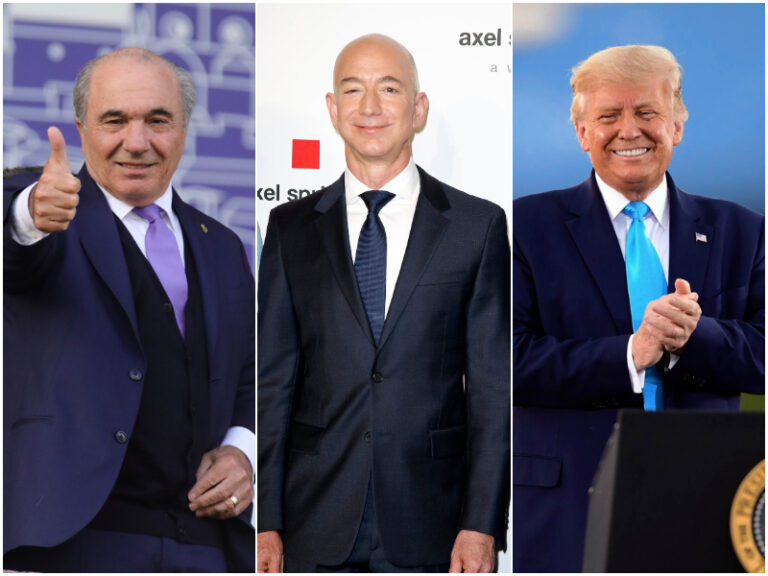

Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo Analisi Della Classifica

May 25, 2025

Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo Analisi Della Classifica

May 25, 2025

Latest Posts

-

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 25, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Mia Farrow Demands Trumps Imprisonment For Venezuelan Gang Member Deportations

May 25, 2025

Mia Farrow Demands Trumps Imprisonment For Venezuelan Gang Member Deportations

May 25, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025