Six-Month Low Broken: Bitcoin Buying Outpaces Selling On Binance

Table of Contents

Binance Trading Volume Shows a Clear Shift in Sentiment

Binance's Bitcoin trading volume data reveals a compelling narrative. A detailed analysis shows a clear increase in buying orders significantly exceeding selling orders. This isn't just a minor fluctuation; the current buying volume surpasses that seen during the previous six-month low, indicating a notable shift in market sentiment.

- Increased Buy-Sell Ratio: The buy-sell ratio on Binance for Bitcoin has dramatically improved, suggesting a growing confidence among traders. This positive ratio is a key indicator of potential price increases.

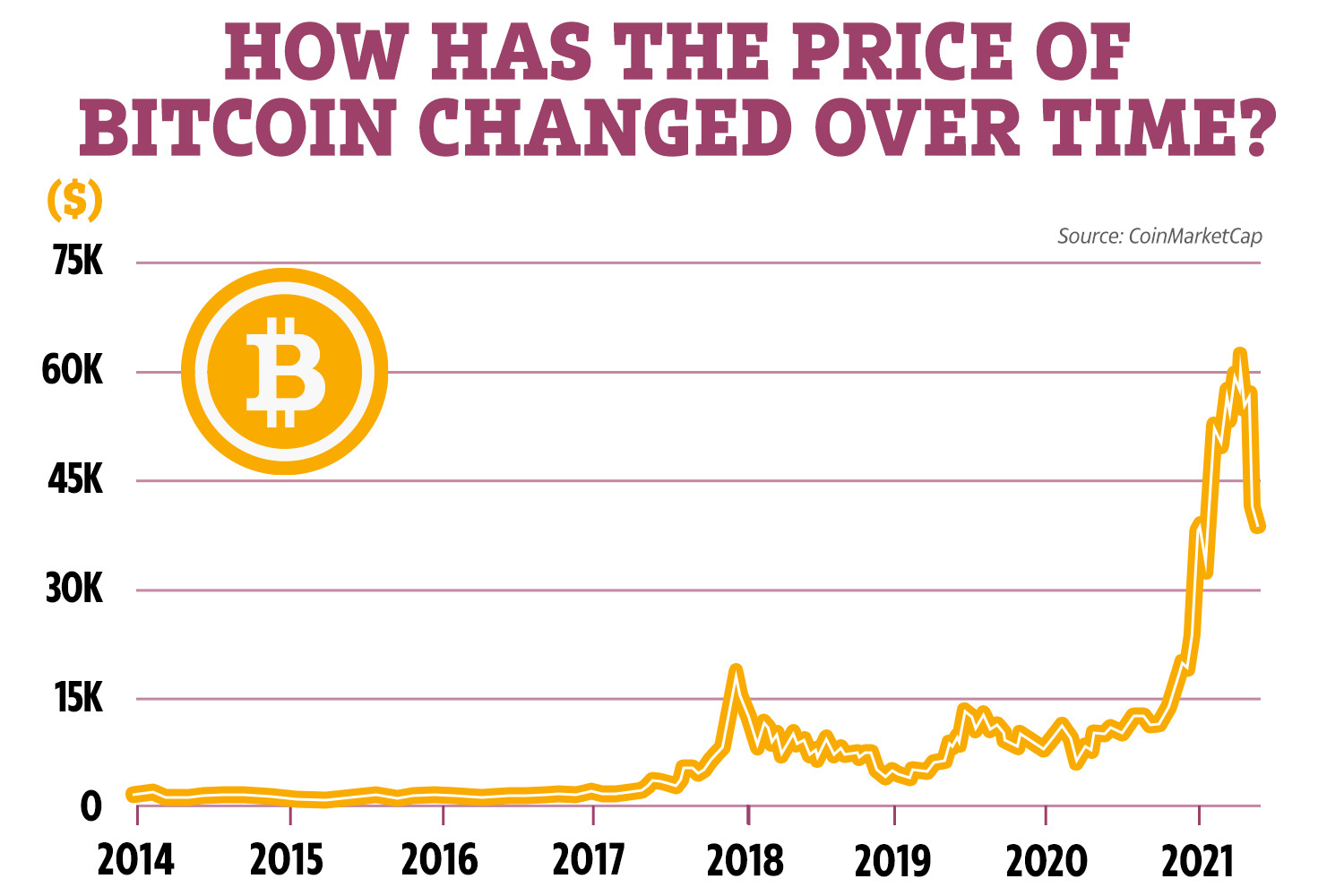

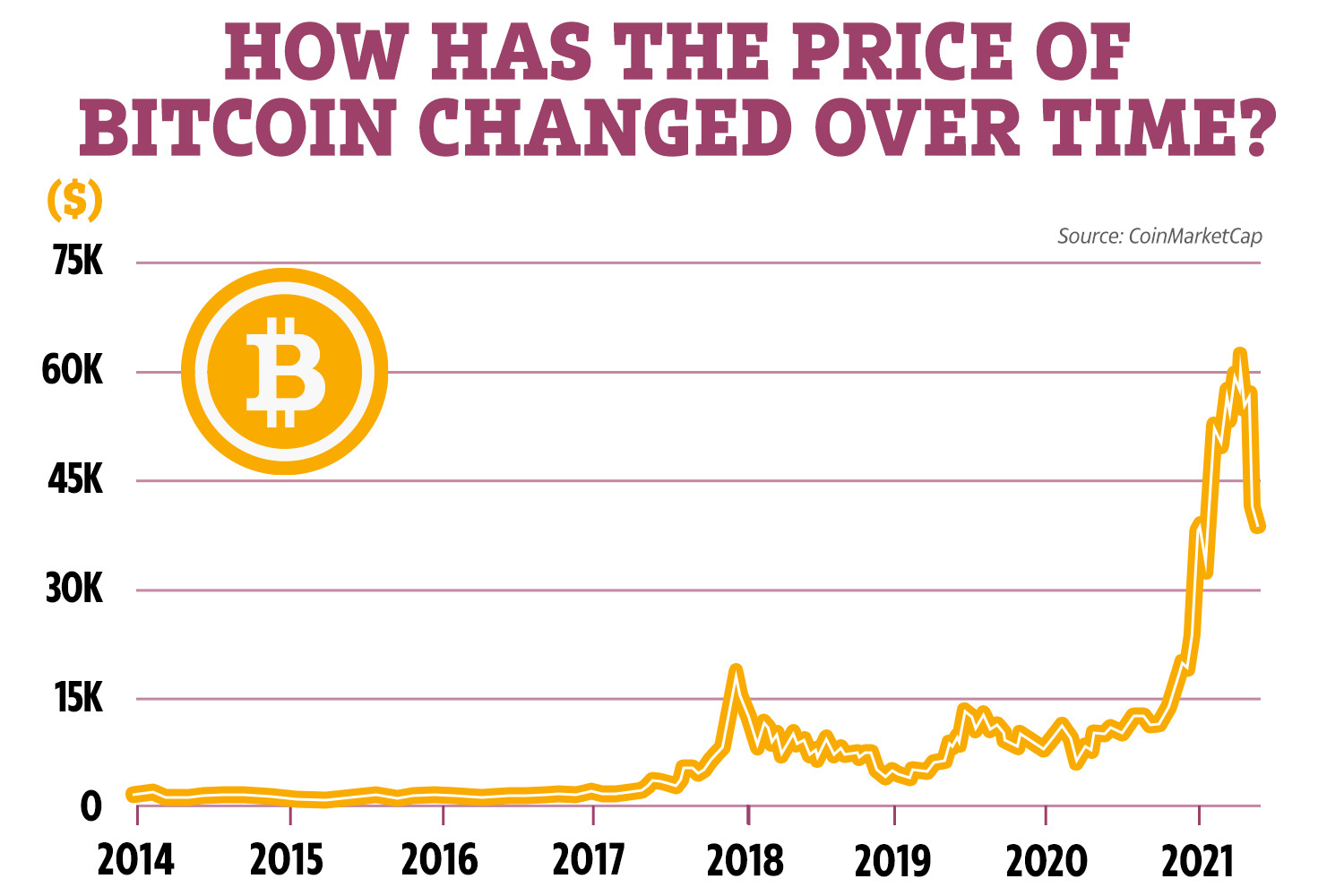

- Visual Representation: [Insert chart/graph here visually depicting the increase in buying volume on Binance compared to selling volume and the previous six-month low]. The graph clearly demonstrates the disparity between buying and selling pressure.

- Short-Term Implications: While not a guarantee, this significant increase in the buy-sell ratio strongly suggests positive short-term price movements for Bitcoin.

Potential Reasons Behind Increased Bitcoin Buying on Binance

Several factors could be contributing to this surge in Bitcoin buying on Binance. Understanding these factors provides a more comprehensive view of the situation.

- Institutional Investment: Large institutional investors may be accumulating Bitcoin, viewing the recent price dip as a buying opportunity. Their participation can significantly influence trading volume.

- Retail Investor FOMO: Positive news, successful Bitcoin price predictions, or simply a growing belief in Bitcoin's long-term potential could be driving increased retail investor participation – the Fear Of Missing Out (FOMO) effect.

- Short Squeeze Potential: A short squeeze, where investors who bet against Bitcoin's price are forced to buy to cover their positions, could be contributing to the increased buying pressure.

- Regulatory Changes: Recent regulatory changes, or the anticipation of future ones, could influence trading behavior. Positive regulatory developments can boost investor confidence.

- Technical Analysis: Technical indicators and chart patterns may have triggered buy signals for many traders, contributing to the increased buying activity. For example, a breakout from a significant resistance level could have triggered a wave of buying.

Impact on Bitcoin Price and the Broader Crypto Market

The surge in buying on Binance has already had a tangible impact.

- Immediate Price Increase: Bitcoin's price has seen a noticeable increase following the surge in buying volume on Binance, directly reflecting the increased demand.

- Altcoin Market Ripple Effect: This positive sentiment for Bitcoin often influences the broader altcoin market, potentially leading to increased trading volume and price appreciation in other cryptocurrencies.

- Market Capitalization Growth: The increased Bitcoin price contributes to the overall growth of the cryptocurrency market capitalization.

- Increased Volatility: It is important to note that while the increased buying is positive, short-term market volatility is likely to increase.

- Price Correlation: The movement of Bitcoin price often impacts other major cryptocurrencies, demonstrating a strong positive correlation.

Is This a Sustainable Trend or a Temporary Surge?

While the current increase in buying is encouraging, it's crucial to consider its sustainability.

- Long-Term Outlook: Whether this increased buying pressure translates into a sustained long-term trend remains to be seen. Several factors could reverse the trend.

- Potential Reversals: Negative news, regulatory setbacks, or a change in overall market sentiment could reverse the current trend.

- Risk Assessment: Investors should carefully assess the risks before making investment decisions based on short-term price movements.

- Balanced Perspective: It's vital to avoid making impulsive decisions based solely on short-term price fluctuations. A balanced approach considering both short-term and long-term factors is essential.

What This Means for Bitcoin Investors

For Bitcoin investors, this situation presents both opportunities and considerations.

- Investment Strategy: Investors should develop a well-defined investment strategy based on their risk tolerance and investment goals.

- Risk Management and Diversification: Diversification across different cryptocurrencies and asset classes is vital for mitigating risk.

- Trading Strategies: Investors can employ various trading strategies, such as dollar-cost averaging, to manage risk and potentially capitalize on price fluctuations.

- Thorough Research: Always conduct thorough research before making any investment decisions in the volatile cryptocurrency market.

Conclusion

The recent surge in Bitcoin buying volume on Binance, breaking the six-month low, presents a potentially significant development for the cryptocurrency market. While it's crucial to remain cautious and analyze the situation thoroughly, the increased buying pressure suggests a positive shift in market sentiment, which could lead to further Bitcoin price increase. However, it’s essential to approach this with a balanced perspective and acknowledge the inherent volatility of the market. Stay informed about the latest developments in the Bitcoin market and monitor Binance’s trading volume to stay ahead of potential trends. Understanding the nuances of Bitcoin trading and investing is key to making informed decisions. Learn more about Bitcoin price predictions and trading strategies today!

Featured Posts

-

A Geographic Analysis Of New Business Hotspots Investment Opportunities

May 08, 2025

A Geographic Analysis Of New Business Hotspots Investment Opportunities

May 08, 2025 -

Dojs Google Antitrust Action Will It Damage User Trust

May 08, 2025

Dojs Google Antitrust Action Will It Damage User Trust

May 08, 2025 -

Where To Start A Business Mapping The Countrys Hottest New Markets

May 08, 2025

Where To Start A Business Mapping The Countrys Hottest New Markets

May 08, 2025 -

New Superman Footage Highlights Kryptos Heroic Moments

May 08, 2025

New Superman Footage Highlights Kryptos Heroic Moments

May 08, 2025 -

Kripto Para Alim Satiminda Riskler Rusya Merkez Bankasi Ndan Aciklama

May 08, 2025

Kripto Para Alim Satiminda Riskler Rusya Merkez Bankasi Ndan Aciklama

May 08, 2025