Soaring Down Payments: The Canadian Homeownership Challenge

Table of Contents

The Impact of Rising Home Prices on Down Payments

The significant increase in Canadian home prices in recent years is a primary driver of the down payment problem. This rapid appreciation, particularly in major urban centers, directly translates into a substantially higher required down payment amount. For example, a 5% down payment on a $500,000 home is $25,000, while a 5% down payment on a $1,000,000 home is $50,000 – a significant difference that places homeownership further out of reach for many. This trend is visible across the country, impacting the Canadian housing market's affordability dramatically.

- Average home price increases in major Canadian cities: Toronto, Vancouver, and Montreal have witnessed some of the most dramatic price increases, making even a modest home purchase a considerable financial stretch for many. Data from the Canadian Real Estate Association (CREA) clearly illustrates this upward trend.

- Correlation between home price growth and down payment requirements: The direct correlation is undeniable: the higher the home price, the larger the down payment required, exponentially increasing the financial burden on potential homebuyers. This creates a vicious cycle, pushing more potential buyers out of the market.

- Financial strain on potential homebuyers: This escalating cost of entry forces many Canadians to postpone or abandon their homeownership dreams, impacting personal financial well-being and long-term financial security. The dream of owning a home is becoming a distant prospect for a growing segment of the population.

Mortgage Rates and Their Influence on Affordability

Rising interest rates significantly impact affordability, adding another layer of complexity to the already challenging Canadian housing market. Higher interest rates increase the overall cost of borrowing, leading to substantially higher monthly mortgage payments. This makes it even more difficult for buyers to qualify for a mortgage, even with a substantial down payment. The stress test, implemented by the Office of the Superintendent of Financial Institutions (OSFI), further complicates matters by requiring borrowers to demonstrate their ability to handle higher interest rates.

- Comparison of current mortgage rates with historical rates: A comparison highlights the significant increase in borrowing costs in recent years, illustrating the substantial added financial burden on homebuyers.

- Impact of interest rate hikes on monthly mortgage payments: Even small interest rate increases can lead to hundreds of extra dollars in monthly mortgage payments, making budgeting and financial planning far more challenging.

- Implications of different mortgage types (fixed vs. variable): Understanding the risks and rewards associated with fixed and variable-rate mortgages is critical. While variable rates might offer lower initial payments, they carry significant risk if interest rates rise unexpectedly.

Government Policies and Their Role in the Housing Market

The Canadian government has implemented various policies aimed at addressing housing affordability. These include initiatives designed to support first-time homebuyers and stimulate the market. However, the effectiveness of these policies remains a subject of debate. Programs like the First-Time Home Buyers' Incentive, while helpful, often fail to address the core issue of escalating home prices and down payment requirements.

- Evaluation of the success and limitations of existing programs: An in-depth analysis is needed to determine the actual impact of these programs on improving access to homeownership. Many find that existing programs do not adequately address the challenges faced by those in the lower and middle income brackets.

- Exploration of potential future policy changes: Policymakers need to explore innovative solutions, such as addressing zoning regulations, increasing housing supply, and exploring alternative housing models, to make a meaningful impact on affordability.

- Discussion of the role of organizations like CMHC (Canada Mortgage and Housing Corporation): The CMHC plays a crucial role in insuring mortgages, but its influence on addressing the core issue of affordability needs further examination.

Saving Strategies for a Down Payment

Saving for a down payment requires a disciplined approach and careful financial planning. It's essential to develop a realistic savings plan tailored to your financial circumstances and goals. This involves budgeting, minimizing unnecessary expenses, and exploring various investment options.

- Realistic savings goals and timelines: Setting achievable targets, factoring in the current market conditions and your financial capacity, is crucial for success.

- Recommended investment options with different risk profiles: A diversified investment strategy can help accelerate savings growth. However, understanding the risks involved is crucial before committing funds.

- Importance of financial planning and budgeting: Professional financial advice can be invaluable in creating a personalized savings plan that aligns with your circumstances and risk tolerance.

Conclusion

The challenge of soaring down payments in the Canadian housing market is a multifaceted issue impacted by rising home prices, increasing interest rates, and the limitations of current government policies. This makes homeownership significantly more difficult for many Canadians, especially first-time buyers. The financial strain associated with accumulating a large down payment is a significant barrier.

Despite these challenges, homeownership remains a vital goal for many. By understanding the factors influencing affordability and implementing effective saving strategies, along with exploring available government programs and seeking personalized financial guidance, Canadians can increase their chances of achieving their homeownership dreams and overcoming the hurdle of soaring down payments. Start planning your financial future today and conquer the challenge of soaring down payments.

Featured Posts

-

Who Is Kimbal Musk Exploring The Life And Career Of Elons Brother

May 09, 2025

Who Is Kimbal Musk Exploring The Life And Career Of Elons Brother

May 09, 2025 -

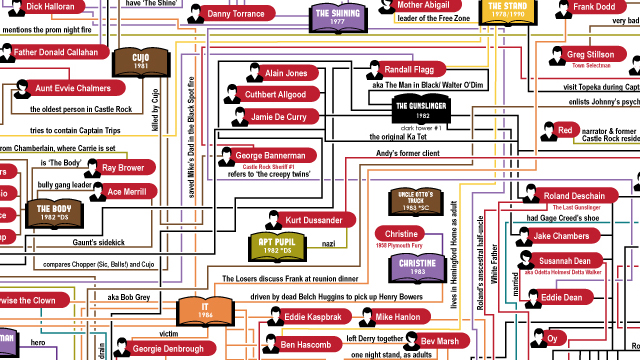

4 Randall Flagg Theories To Reshape Your Understanding Of Stephen Kings Universe

May 09, 2025

4 Randall Flagg Theories To Reshape Your Understanding Of Stephen Kings Universe

May 09, 2025 -

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 09, 2025

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 09, 2025 -

5 Must Read Stephen King Books For True Fans

May 09, 2025

5 Must Read Stephen King Books For True Fans

May 09, 2025 -

Dijon Agression Sauvage Au Lac Kir Trois Hommes Blesses

May 09, 2025

Dijon Agression Sauvage Au Lac Kir Trois Hommes Blesses

May 09, 2025