Solid Corporate Earnings Now, But For How Long? Analyzing The Sustainability Of Profits

Table of Contents

Macroeconomic Factors Impacting Profit Sustainability

Several macroeconomic factors significantly impact the sustainability of profits. Understanding these influences is crucial for accurate financial forecasting and strategic planning.

Inflation and Interest Rates

Rising inflation and interest rate hikes create a complex challenge for businesses. Inflationary pressures increase production costs, forcing companies to adjust pricing strategies. This can lead to decreased consumer demand as purchasing power erodes. Simultaneously, increased interest rates raise borrowing costs, impacting businesses' ability to invest and potentially increasing debt servicing costs.

- Impact on pricing strategies: Businesses face a difficult choice between absorbing increased costs and passing them on to consumers, risking reduced sales.

- Decreased consumer demand: Higher prices and reduced disposable income lead to lower consumer spending, impacting sales volumes and profit margins.

- Increased debt servicing costs: Higher interest rates increase the cost of servicing existing debt, reducing profitability and potentially hindering future investment.

- Keyword integration: inflationary pressures, interest rate hikes, economic uncertainty, profit margins

Geopolitical Risks and Supply Chain Disruptions

Geopolitical instability and global supply chain disruptions significantly impact profitability. Unpredictable events, such as wars or trade disputes, can severely disrupt production and distribution networks, increasing input costs and reducing output.

- Examples of geopolitical risks: The ongoing conflict in Ukraine, trade tensions between major economies, and political instability in key regions all contribute to supply chain uncertainty.

- Effects on production and distribution: Supply chain bottlenecks lead to delays, shortages, and increased transportation costs, directly impacting profit margins.

- Increased input costs: Disruptions can lead to shortages of raw materials and components, driving up prices and squeezing profit margins.

- Keyword integration: global supply chain, geopolitical instability, risk management, supply chain resilience

Government Regulations and Policies

The regulatory environment plays a significant role in shaping corporate earnings. New government regulations, whether environmental, labor-related, or focused on other aspects of business operations, can increase compliance costs and potentially limit profitability. Changes in tax policies can also have a substantial impact.

- Examples of regulations affecting various sectors: Environmental regulations impacting manufacturing, labor laws affecting wages and working conditions, and financial regulations impacting banking and investment firms.

- Compliance costs: Meeting regulatory requirements often involves substantial investment in new technologies, processes, and personnel.

- Potential for increased taxes: Changes in tax laws can directly impact corporate tax burdens, reducing after-tax profits.

- Keyword integration: regulatory environment, compliance costs, government policies, tax implications

Analyzing Corporate-Specific Factors

While macroeconomic conditions are important, the sustainability of profits also depends on factors specific to individual corporations.

Debt Levels and Financial Leverage

High levels of corporate debt can significantly impact the sustainability of profits. Excessive leverage increases vulnerability to interest rate fluctuations and can restrict a company's ability to invest in growth and innovation.

- Risks associated with high debt: Increased risk of default, reduced financial flexibility, and potential for credit rating downgrades.

- Interest rate sensitivity: Higher interest rates increase debt servicing costs, potentially squeezing profit margins.

- Impact on investment capacity: High debt levels can limit a company's ability to invest in research and development, new technologies, and expansion opportunities.

- Keyword integration: corporate debt, financial leverage, credit risk, debt servicing

Innovation and Competitive Landscape

In today's dynamic market, continuous innovation and adaptation are critical for maintaining long-term profits. Companies must be able to adapt to disruptive technologies and compete effectively against new entrants.

- Examples of companies adapting to disruptive technologies: Companies leveraging artificial intelligence, cloud computing, and other technological advancements to improve efficiency and offer new products and services.

- Competition from new entrants: The emergence of new competitors, particularly in rapidly evolving industries, can put pressure on existing players' market share and profitability.

- The importance of R&D: Investing in research and development is crucial for creating innovative products and services that maintain a competitive advantage.

- Keyword integration: competitive advantage, innovation, disruptive technologies, market share

ESG (Environmental, Social, and Governance) Factors

ESG considerations are increasingly impacting corporate profitability and reputation. Investors and consumers are placing greater emphasis on sustainability, social responsibility, and ethical business practices.

- Examples of ESG-related risks and opportunities: Risks include environmental damage, social injustices, and poor governance leading to reputational damage and financial penalties. Opportunities include developing sustainable products, improving employee relations, and attracting socially conscious investors.

- Investor pressure for sustainability: Investors are increasingly demanding transparency and accountability regarding ESG performance.

- Potential for long-term cost savings: Investing in sustainable practices can lead to long-term cost savings through reduced energy consumption, waste reduction, and improved efficiency.

- Keyword integration: ESG investing, corporate social responsibility, sustainable business practices, environmental sustainability

Conclusion: Assessing the Sustainability of Corporate Profits – A Long-Term View

The sustainability of corporate profits is a complex issue influenced by a multitude of interconnected factors. While current earnings may be strong, it's crucial to consider the potential impact of macroeconomic headwinds, corporate-specific vulnerabilities, and the growing importance of ESG factors. By carefully considering inflation, interest rates, geopolitical risks, government regulations, corporate debt, innovation, and ESG performance, a more accurate assessment of long-term profitability can be achieved. By carefully analyzing the sustainability of profits within specific sectors and companies, investors and business leaders can make more informed decisions for long-term success. The unpredictable nature of future economic conditions necessitates constant adaptability and foresight in maintaining long-term profitability.

Featured Posts

-

25 Mal For Dolberg Et Chokskifte Og Dets Konsekvenser

May 30, 2025

25 Mal For Dolberg Et Chokskifte Og Dets Konsekvenser

May 30, 2025 -

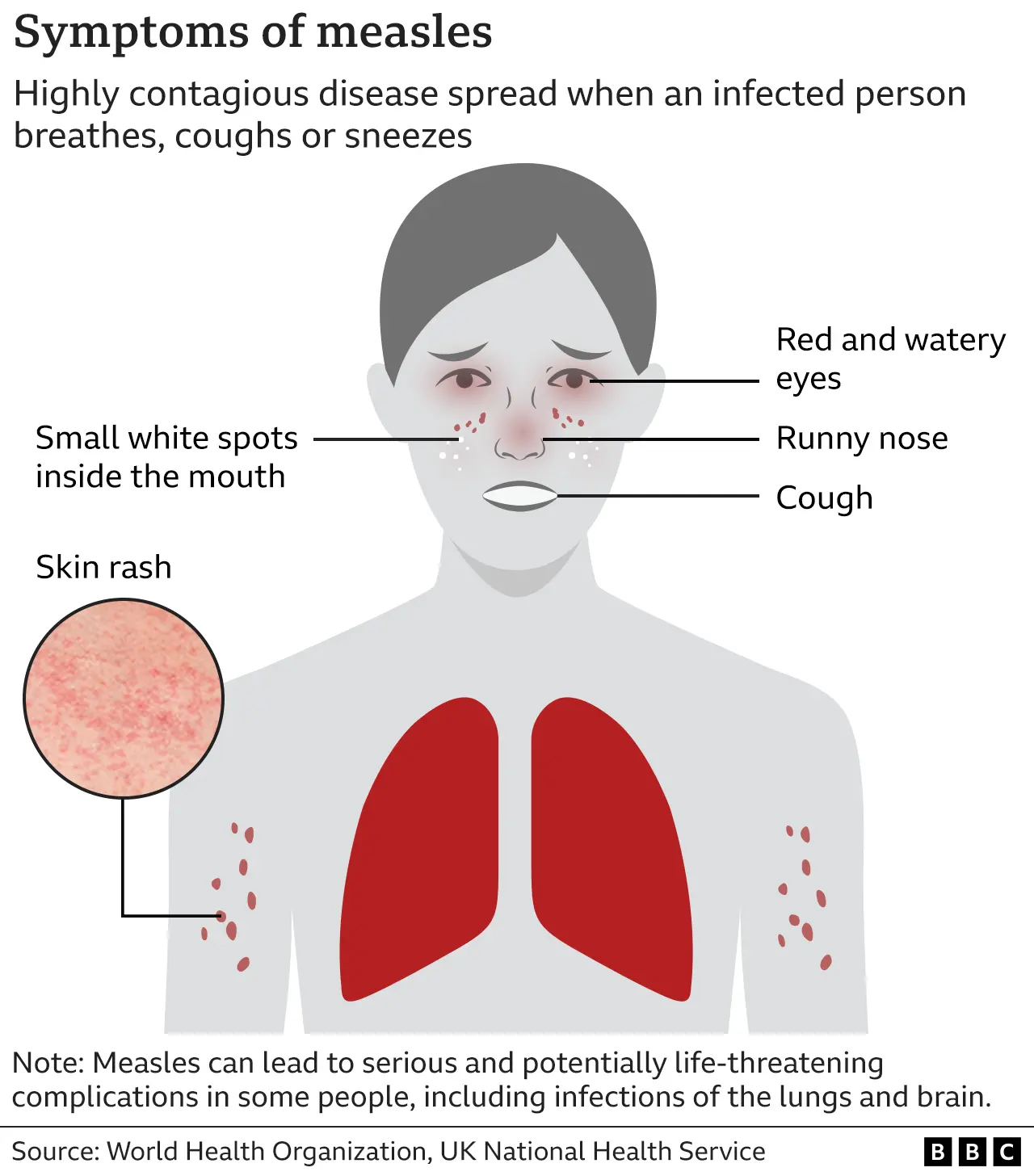

Texas Measles Cases Rise Increase Unrelated To Main Outbreak

May 30, 2025

Texas Measles Cases Rise Increase Unrelated To Main Outbreak

May 30, 2025 -

Sud Ouest L Etat Depose Un Recours Contre L Annulation De L A69

May 30, 2025

Sud Ouest L Etat Depose Un Recours Contre L Annulation De L A69

May 30, 2025 -

Rajinikanth Salutes Ilaiyaraajas Triumphant London Symphony Concert

May 30, 2025

Rajinikanth Salutes Ilaiyaraajas Triumphant London Symphony Concert

May 30, 2025 -

Subventions Regionales Pour Le Concert De Medine En Grand Est Le Rassemblement National Proteste

May 30, 2025

Subventions Regionales Pour Le Concert De Medine En Grand Est Le Rassemblement National Proteste

May 30, 2025