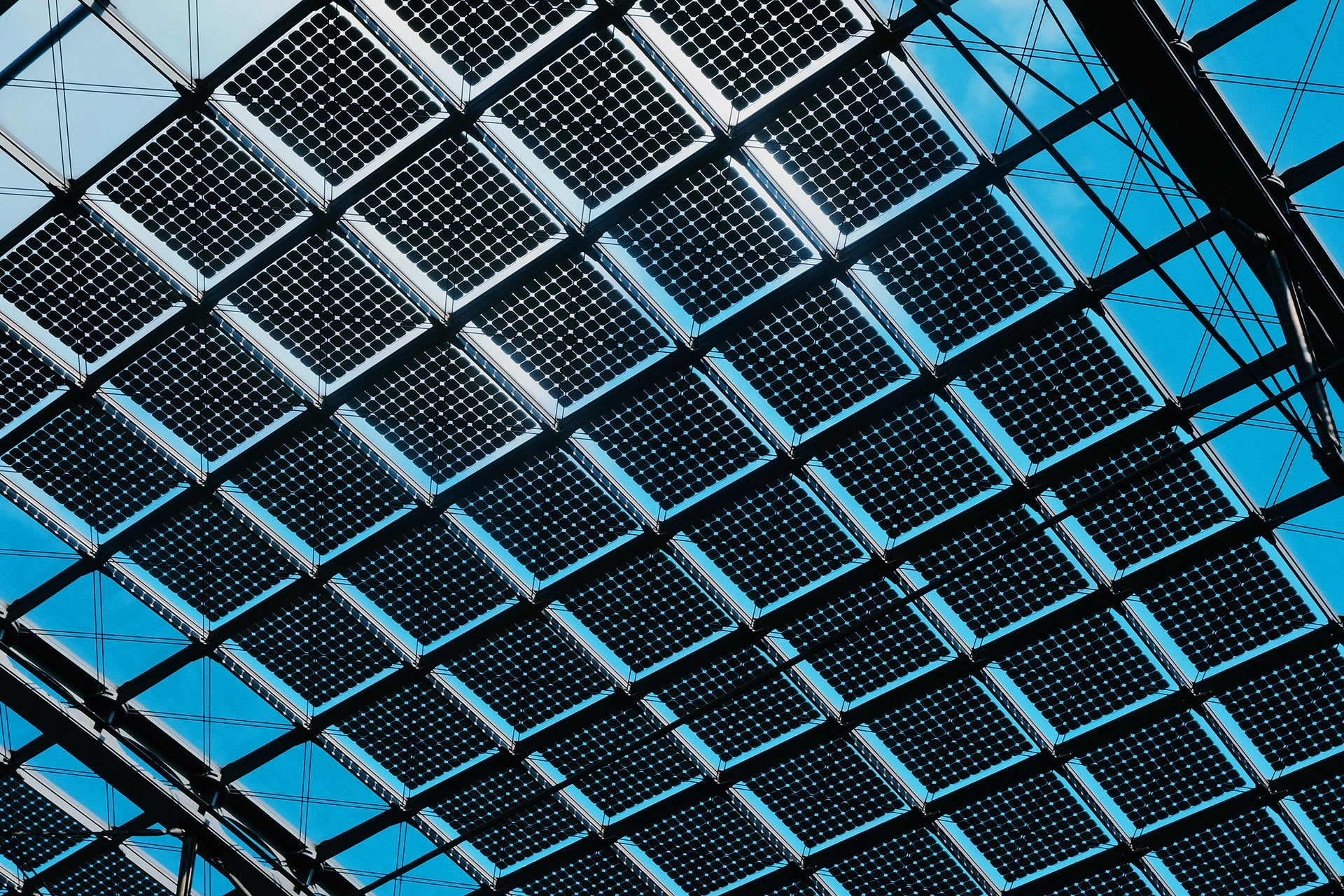

Southeast Asian Solar Imports Face Steep US Tariffs: A 3,521% Duty Explained

Table of Contents

Understanding the 3,521% Tariff on Southeast Asian Solar Imports

The Department of Commerce imposed this exorbitant tariff following an investigation into allegations of circumvention of previous anti-dumping and countervailing duties on solar panels from China. The investigation centered on the claim that manufacturers in Southeast Asian countries were evading earlier tariffs by shifting production or utilizing components from China, effectively circumventing the existing trade restrictions.

Circumvention, in this context, means avoiding the intent of the original tariffs by using indirect methods. While Southeast Asian manufacturers are distinct legal entities from their Chinese counterparts, the investigation focused on whether they were acting as fronts or significantly relying on Chinese components and processes to produce solar panels for export to the US. This distinction between independent Southeast Asian production and Chinese involvement is crucial in understanding the complexity of this situation.

The tariff directly impacts several Southeast Asian nations, including:

- Vietnam

- Cambodia

- Malaysia

- Thailand

- Indonesia

- Others are also potentially affected depending on the specifics of their production and sourcing.

Impact on the US Solar Industry and Consumers

The 3,521% tariff on Southeast Asian solar imports will undoubtedly lead to substantial price increases for solar panels in the US market. Analysts predict a potential price surge of anywhere from 20% to 40%, depending on the specific product and market segment. This increase will severely impact the affordability of solar energy for residential consumers and commercial businesses.

This price hike will inevitably cause significant project delays. Developers of large-scale solar farms and homeowners considering residential solar installations will face extended timelines as they navigate the dramatically altered economic landscape. This slowdown in project development directly translates into delayed deployment of renewable energy infrastructure, hindering the progress towards national climate goals.

The consequences extend beyond mere cost increases; the tariff threatens job losses within the US solar installation sector. Higher prices could dampen demand, leading to reduced project volumes and subsequent layoffs among installers, technicians, and other workers.

The overall negative impacts can be summarized as:

- Substantially increased costs for consumers and businesses.

- A significant slowdown in the adoption of solar energy across the US.

- Potential job losses throughout the US solar industry supply chain.

- Reduced competitiveness of US solar companies relative to global counterparts.

Potential Legal Challenges and Future Implications

The 3,521% tariff is likely to face legal challenges. Several industry groups and affected businesses are expected to contest the tariff's imposition, arguing that it's unfairly punitive and damaging to the US economy. The outcome of these legal battles remains uncertain, potentially leading to modifications or even a complete reversal of the tariff.

The political ramifications are also significant. The tariff may strain US relations with Southeast Asian nations, creating trade tensions and potentially harming diplomatic ties. Domestically, the tariff faces criticism from those who argue it undermines US efforts to transition to cleaner energy sources and achieve climate goals. The long-term effects on the renewable energy sector depend heavily on the resolution of the legal challenges and the political responses to the economic consequences.

The uncertainties surrounding this situation include:

- The outcome of pending and future legal challenges to the tariff.

- The possibility of the tariff being modified or overturned.

- The long-term implications for renewable energy investment and US climate goals.

Conclusion: Navigating the Complexities of Southeast Asian Solar Imports and US Tariffs

The 3,521% tariff on Southeast Asian solar imports represents a significant hurdle for the US solar industry. This steep increase in duties will lead to higher prices, project delays, and potential job losses, hindering the progress towards renewable energy adoption and impacting both consumers and businesses. Understanding the complexities of these US tariffs and their impact on Southeast Asian solar imports is crucial for navigating this challenging period. Stay informed about updates on these Southeast Asian solar imports and the US tariffs to make informed decisions about your solar energy investments and to advocate for policies that support the growth of the renewable energy sector. Consult reliable news sources and industry publications for the latest developments.

Featured Posts

-

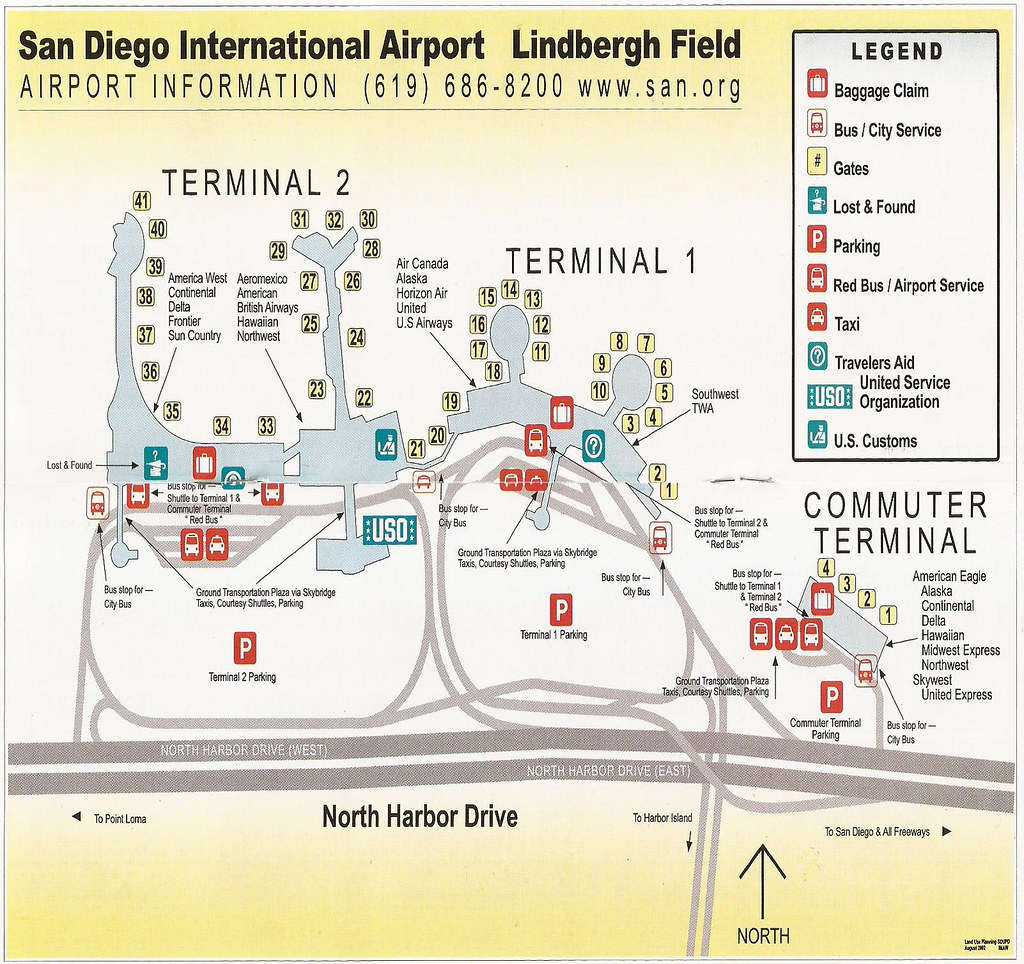

San Diego Airport Ground Stop Understanding The Implications

May 30, 2025

San Diego Airport Ground Stop Understanding The Implications

May 30, 2025 -

Odra Po Trzech Latach Analiza Ryzyka Kolejnej Katastrofy

May 30, 2025

Odra Po Trzech Latach Analiza Ryzyka Kolejnej Katastrofy

May 30, 2025 -

Tennis Governance Under Fire Djokovics Union Initiates Legal Action

May 30, 2025

Tennis Governance Under Fire Djokovics Union Initiates Legal Action

May 30, 2025 -

Pop Up Store Bts Fechas Ubicacion Y Como Llegar A La Experiencia Army

May 30, 2025

Pop Up Store Bts Fechas Ubicacion Y Como Llegar A La Experiencia Army

May 30, 2025 -

Unmade Pacific Rim Sequel A Look At Potential Storylines And Characters

May 30, 2025

Unmade Pacific Rim Sequel A Look At Potential Storylines And Characters

May 30, 2025