Spring Budget Update: Public Sentiment Turns Negative

Table of Contents

Tax Increases Spark Public Outrage

The Spring Budget Update unveiled a series of tax increases that have ignited public outrage. These tax hikes have disproportionately affected various income groups, leading to widespread feelings of unfairness and resentment. The impact of these fiscal policy changes is already being felt across the nation.

-

Increase in income tax rates: The increase in income tax rates for higher earners, while expected by some, has still been met with significant resistance, particularly given the current cost of living crisis. Analysis from the Institute for Fiscal Studies suggests this will impact [insert percentage or number] of households.

-

Changes to National Insurance contributions: The changes to National Insurance contributions, while presented as temporary, have been criticized for adding further strain on already struggling families and businesses. [Cite source – e.g., a news article detailing public reaction].

-

Impact on corporation tax: The increase in corporation tax, although impacting businesses rather than individuals directly, is feared to stifle economic growth and potentially lead to job losses. This is a major concern for those arguing that the government's fiscal strategy is short-sighted.

-

Public reaction to these increases: Public reaction has been overwhelmingly negative, with numerous protests and online campaigns expressing discontent. Social media is flooded with hashtags like #TaxHikes and #UnfairBudget, reflecting the widespread anger and frustration. [Cite source – e.g., a poll showing public disapproval]. The increased tax burden is leaving many feeling squeezed.

Spending Cuts Fuel Further Criticism

Adding to the public's anger, the Spring Budget included substantial spending cuts. These austerity measures have focused on several key public service areas, further exacerbating concerns about the government's priorities.

-

Cuts to public services (e.g., healthcare, education): The cuts to essential public services such as healthcare and education are particularly concerning, sparking fears of a decline in service quality and accessibility. [Cite source – e.g., a report detailing the impact of cuts on specific services].

-

Impact on vulnerable populations: These cuts are particularly damaging to vulnerable populations, who rely heavily on public services for support. This has raised serious questions about the fairness and equity of the government's budget allocation.

-

Public perception of fairness and efficiency of cuts: Public perception of the cuts is overwhelmingly negative, with many questioning the government's justification and the efficiency of its spending priorities. Concerns are being raised regarding the long-term societal impact of reduced public spending. [Cite source – e.g., public opinion poll results].

Lack of Support for Key Initiatives

Beyond the tax increases and spending cuts, the Spring Budget also introduced several new initiatives that have failed to garner widespread public support. This lack of enthusiasm reflects a disconnect between the government's priorities and the public's needs.

-

Public reaction to specific policy proposals: [Name specific policy proposals and cite sources detailing public reaction]. For example, the proposed [policy name] has been met with skepticism due to [reason for skepticism].

-

Analysis of public opinion polls and surveys: Various polls and surveys consistently reveal low approval ratings for several key policy proposals included in the Spring Budget. This indicates a significant lack of public confidence in the government's direction.

-

Media coverage and public discourse surrounding the initiatives: Media coverage and public discourse have largely been critical of the new initiatives, highlighting their perceived flaws and lack of public benefit.

The Impact on Consumer Confidence and the Economy

The overwhelmingly negative public sentiment towards the Spring Budget Update carries significant economic consequences. This widespread discontent threatens to negatively impact consumer confidence and investment.

-

Potential for decreased consumer spending: The increased tax burden and uncertainty about the economic outlook are likely to lead to decreased consumer spending, potentially slowing down economic growth.

-

Impact on economic growth: The combination of reduced consumer spending and potential business investment hesitation due to tax increases could lead to a significant slowdown in economic growth, potentially even a recession.

-

Expert opinions on the economic outlook: Many economic experts warn that the negative public reaction to the Spring Budget could have severe repercussions for the UK economy, potentially leading to higher inflation and further instability.

Conclusion: Understanding the Fallout from the Spring Budget Update

The negative public sentiment surrounding the Spring Budget Update stems from a combination of factors: substantial tax increases impacting various income groups, significant spending cuts in essential public services, and poorly received new initiatives. This widespread discontent poses significant challenges for the government and has the potential to severely impact consumer confidence and the overall economic outlook. The long-term consequences of this budget remain to be seen, but the immediate impact is clear: a significant erosion of public trust and widespread dissatisfaction. Stay informed about the evolving situation surrounding the Spring Budget Update and its implications by following [link to relevant news source or government website].

Featured Posts

-

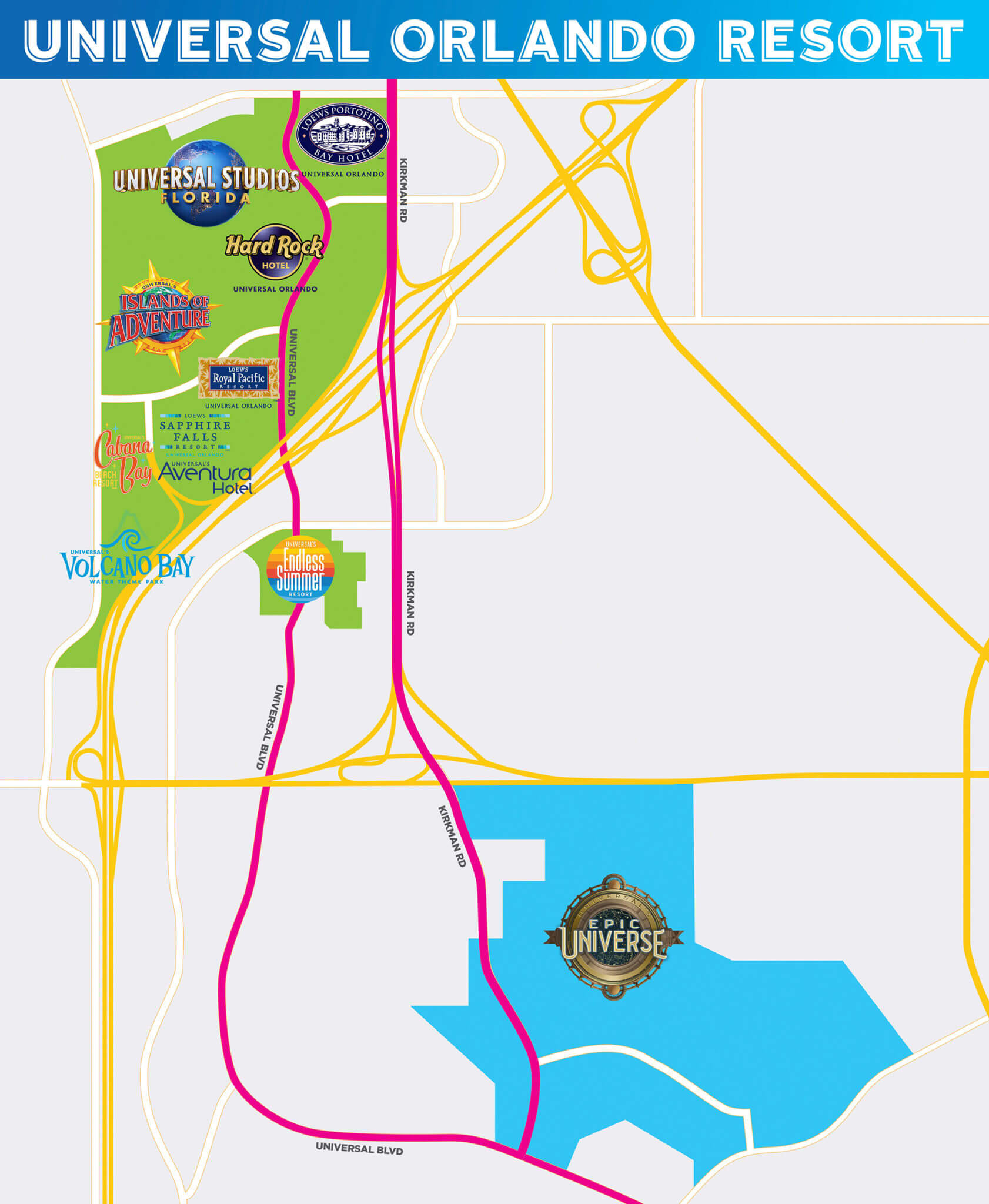

Reaching Universal Epic Universe Via Sun Rail And Brightline A Comprehensive Guide

May 19, 2025

Reaching Universal Epic Universe Via Sun Rail And Brightline A Comprehensive Guide

May 19, 2025 -

Eurovision 2025 Speculation Mounts Over Jamalas Participation

May 19, 2025

Eurovision 2025 Speculation Mounts Over Jamalas Participation

May 19, 2025 -

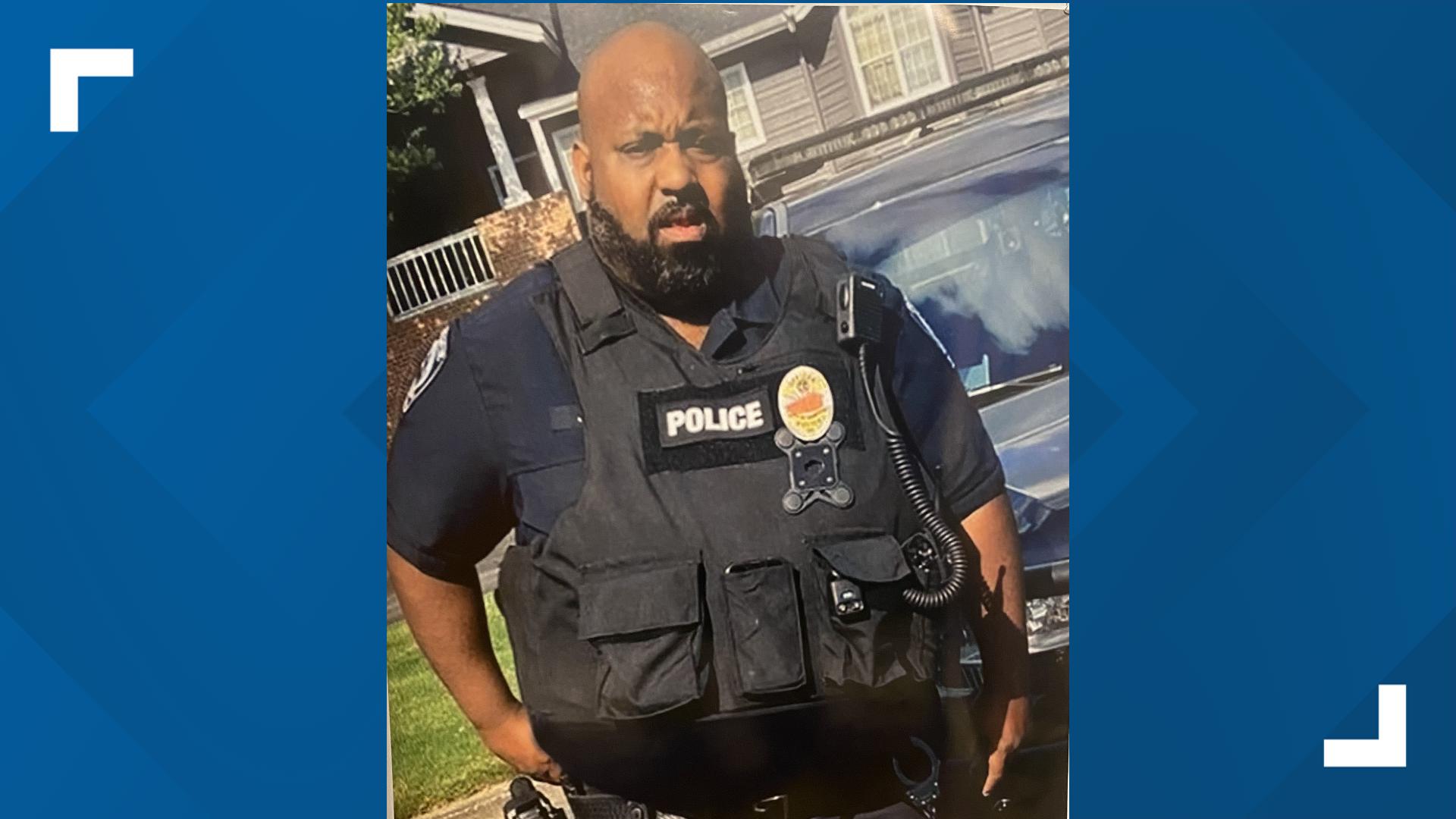

Southampton Police Charge East Hampton Officer Luis Morales With Driving While Intoxicated

May 19, 2025

Southampton Police Charge East Hampton Officer Luis Morales With Driving While Intoxicated

May 19, 2025 -

Justyna Steczkowska Niespodziewany Taniec W Reczniku Do Hitu Eurowizji

May 19, 2025

Justyna Steczkowska Niespodziewany Taniec W Reczniku Do Hitu Eurowizji

May 19, 2025 -

European Futures Surge Us Futures Dip Swissquote Bank Perspective

May 19, 2025

European Futures Surge Us Futures Dip Swissquote Bank Perspective

May 19, 2025

Latest Posts

-

Zheneva Stanet Ploschadkoy Dlya Neformalnykh Peregovorov Po Kipru Pod Rukovodstvom Genseka Oon

May 19, 2025

Zheneva Stanet Ploschadkoy Dlya Neformalnykh Peregovorov Po Kipru Pod Rukovodstvom Genseka Oon

May 19, 2025 -

Kiprskiy Konflikt Gensek Oon Sozyvaet Neformalnye Peregovory V Zheneve

May 19, 2025

Kiprskiy Konflikt Gensek Oon Sozyvaet Neformalnye Peregovory V Zheneve

May 19, 2025 -

Vstrecha V Zheneve Gensek Oon Obsudit Kiprskiy Vopros

May 19, 2025

Vstrecha V Zheneve Gensek Oon Obsudit Kiprskiy Vopros

May 19, 2025 -

To Kypriako I Protimisi Gia Ton Kateynasmo Kai Oi Enallaktikes

May 19, 2025

To Kypriako I Protimisi Gia Ton Kateynasmo Kai Oi Enallaktikes

May 19, 2025 -

To Kypriako Kateynasmos I Skliri Drasi Mia Kritiki

May 19, 2025

To Kypriako Kateynasmos I Skliri Drasi Mia Kritiki

May 19, 2025