SSE Announces £3 Billion Reduction In Spending Amidst Growth Slowdown

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

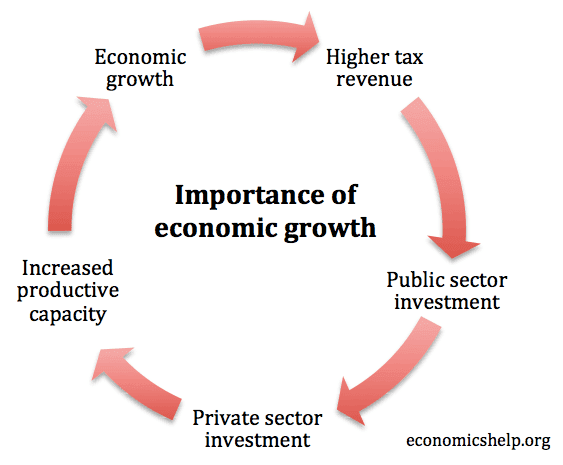

SSE's decision to slash £3 billion from its spending reflects a complex interplay of factors impacting the entire energy sector. The current economic climate, characterized by a growth slowdown and heightened uncertainty, is a primary driver.

-

Increased Inflationary Pressures: Soaring inflation has dramatically increased the cost of materials, labor, and logistics, making many energy projects significantly more expensive than initially projected. This inflationary spiral has squeezed profit margins and forced a reassessment of investment viability.

-

Slowing Energy Demand Growth: The economic slowdown has inevitably led to reduced energy demand. Lower demand directly impacts the return on investment for new energy infrastructure projects, making them less attractive in the short term.

-

Increased Regulatory Scrutiny: Energy companies are facing increasing regulatory scrutiny and pressure to demonstrate cost-effectiveness and responsible spending. This regulatory environment is influencing investment decisions and necessitates a more cautious approach to capital expenditure.

-

Focus on Debt Reduction and Financial Stability: In the face of economic uncertainty, prioritizing debt reduction and strengthening financial stability is a prudent move for SSE, ensuring the company's long-term viability. This often involves streamlining operations and reducing capital expenditure.

-

Shift in Investment Priorities towards Renewable Energy Projects: While reducing overall spending, SSE is likely shifting its investment focus towards renewable energy projects that offer long-term sustainability and align with the company's net-zero targets. This prioritization involves careful selection of projects with the highest potential for long-term returns.

Impact of Spending Cuts on SSE's Projects and Operations

The £3 billion spending reduction will inevitably impact SSE's operations and projects, both current and future. The consequences are far-reaching and could have significant implications for the energy transition.

-

Potential Delays or Cancellations of Planned Renewable Energy Projects: This is perhaps the most concerning consequence. Delays or cancellations of wind, solar, and other renewable energy projects could hinder the UK's progress towards its net-zero targets.

-

Reduced Investment in Grid Infrastructure Upgrades: Upgrading the grid infrastructure is crucial for integrating renewable energy sources effectively. Reduced investment in this area could create bottlenecks and hinder the smooth transition to a cleaner energy system.

-

Potential Job Losses or Hiring Freezes: Cost-cutting measures often lead to workforce reductions. While SSE hasn't explicitly stated job losses, hiring freezes or restructuring are possibilities.

-

Impact on SSE's Commitment to Net-Zero Targets: The spending cuts could potentially impact SSE's ability to meet its ambitious net-zero targets, necessitating a careful recalibration of its long-term strategy.

-

Review of Existing Projects for Cost Optimization Opportunities: SSE will likely undertake a thorough review of its existing projects to identify opportunities for cost optimization and efficiency improvements.

SSE's Response and Future Outlook

SSE's official statement acknowledges the challenging economic climate and highlights the need for a strategic response. The company's focus is shifting towards operational efficiency and cost-cutting measures to navigate these turbulent times.

-

SSE's Strategy for Navigating the Current Economic Challenges: The company is prioritizing projects with strong long-term returns and focusing on operational efficiencies to minimize costs.

-

Focus on Operational Efficiency and Cost-Cutting Measures: This will involve streamlining processes, optimizing existing assets, and potentially restructuring certain operations.

-

Long-Term Growth Plans and Commitment to Sustainable Energy: Despite the spending cuts, SSE remains committed to its long-term growth plans and its commitment to sustainable energy solutions.

-

Analyst Predictions and Market Reaction to the Spending Reduction Announcement: Analysts' reactions have been varied, with some expressing concerns about potential delays in renewable energy projects, while others see the move as a necessary step to ensure financial stability in the current economic climate.

-

Potential Impact on Investor Confidence and Share Price: The market's response to the announcement will likely depend on the perceived long-term viability of SSE's revised strategy and its impact on future profitability.

Comparison with Other Energy Companies

SSE's actions are not unique. Many major energy companies are facing similar pressures and implementing cost-cutting measures to navigate the current economic challenges.

-

Examples of Other Energy Companies Implementing Cost-Cutting Measures: Numerous energy companies globally are announcing similar cost-cutting measures, reflecting the industry-wide challenges.

-

Industry-Wide Trends Affecting Energy Company Spending and Investment: The energy sector is experiencing a period of significant adjustment, driven by economic uncertainties, regulatory changes, and the ongoing energy transition.

-

Analysis of Different Approaches to Navigating the Economic Slowdown: Different energy companies are adopting different strategies, ranging from aggressive cost-cutting to focusing on innovation and strategic acquisitions.

Analyzing SSE's £3 Billion Spending Reduction and its Implications

SSE's £3 billion spending reduction is a significant event with potentially far-reaching consequences for the company, its projects, and the broader energy sector. The decision is primarily driven by a combination of economic slowdown, increased inflationary pressures, regulatory scrutiny, and a need for improved financial stability. The potential impact includes delays or cancellations of renewable energy projects, reduced investment in grid infrastructure, and potential job losses. While SSE maintains its commitment to sustainable energy, the long-term effects of these cuts on its net-zero targets and the energy transition remain to be seen. The market's reaction and long-term consequences will be closely monitored.

What will the long-term impact of this SSE spending reduction be? Stay updated by subscribing to our newsletter, following SSE's news releases, and continuing to read further analysis on the energy sector and the impact of this significant £3 billion spending reduction.

Featured Posts

-

Astrologicheskie Prognozy Goroskopy I Predskazaniya Na Mesyats

May 24, 2025

Astrologicheskie Prognozy Goroskopy I Predskazaniya Na Mesyats

May 24, 2025 -

Frazier Teases Celtics Fan Dreyer With Championship Rings On Today Show

May 24, 2025

Frazier Teases Celtics Fan Dreyer With Championship Rings On Today Show

May 24, 2025 -

Bangladeshs Economic Growth The Importance Of European Partnerships

May 24, 2025

Bangladeshs Economic Growth The Importance Of European Partnerships

May 24, 2025 -

Broadways Bright Lights Mia Farrow Supports Sadie Sink

May 24, 2025

Broadways Bright Lights Mia Farrow Supports Sadie Sink

May 24, 2025 -

Ihanete Dayanikli Burclar Intikamlari Nasil Aliyorlar

May 24, 2025

Ihanete Dayanikli Burclar Intikamlari Nasil Aliyorlar

May 24, 2025

Latest Posts

-

Podderzhka Eleny Rybakinoy Buduschee Kazakhstanskogo Zhenskogo Tennisa

May 24, 2025

Podderzhka Eleny Rybakinoy Buduschee Kazakhstanskogo Zhenskogo Tennisa

May 24, 2025 -

Rybakinas Victory Propels Kazakhstan To Billie Jean King Cup Finals

May 24, 2025

Rybakinas Victory Propels Kazakhstan To Billie Jean King Cup Finals

May 24, 2025 -

Kazakhstans Billie Jean King Cup Finals Berth Rybakinas Crucial Role

May 24, 2025

Kazakhstans Billie Jean King Cup Finals Berth Rybakinas Crucial Role

May 24, 2025 -

Rybakina Pomogaet Yunym Tennisistkam Kazakhstana

May 24, 2025

Rybakina Pomogaet Yunym Tennisistkam Kazakhstana

May 24, 2025 -

Concerns Addressed Today Show Co Hosts Discuss Missing Anchor

May 24, 2025

Concerns Addressed Today Show Co Hosts Discuss Missing Anchor

May 24, 2025