SSE Announces £3 Billion Spending Cut Due To Growth Slowing

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

Several interconnected factors have contributed to SSE's decision to slash its capital expenditure by £3 billion. These factors highlight the complexities and challenges currently facing the energy sector, particularly in the renewable energy sphere.

Economic Headwinds and Inflation

The global economic climate has significantly impacted SSE's investment plans. Soaring inflation and rising interest rates have made borrowing more expensive, increasing the cost of financing large-scale renewable energy projects. Simultaneously, supply chain disruptions and increased material costs have further inflated project budgets.

- Increased borrowing costs: Higher interest rates directly impact the cost of debt financing for SSE's projects.

- Supply chain disruptions: Delays in securing essential materials have led to project delays and cost overruns.

- Inflationary pressures on project costs: The overall increase in prices for labor and materials has significantly impacted project profitability.

Slower-Than-Expected Renewable Energy Growth

Despite the growing demand for renewable energy, SSE, like many other companies in the sector, has experienced slower-than-anticipated growth. Several obstacles have hindered progress:

- Grid connection challenges: Connecting new renewable energy projects to the national grid can be a lengthy and complex process, causing delays.

- Planning permission delays: Securing the necessary planning permissions for large-scale renewable energy projects often involves extensive bureaucratic procedures and can be time-consuming.

- Competition in the renewable energy market: Increased competition from other energy companies vying for investment and market share has created a more challenging environment.

Shifting Investment Priorities

In response to these challenges, SSE has adjusted its strategic priorities. This includes a greater focus on the most profitable projects and a potential realignment of resources towards specific renewable energy technologies or geographical areas.

- Prioritization of profitable projects: SSE is now prioritizing projects with the highest potential return on investment.

- Refocusing on core business areas: The company might be divesting from non-core assets to concentrate resources on its most promising ventures.

- Divestment of non-core assets: Selling off non-essential assets can free up capital for investment in higher-priority projects.

Impact on SSE's Current and Future Projects

The £3 billion spending cut will inevitably have a significant impact on SSE's current and future projects.

Delayed or Cancelled Projects

Several projects are likely to be affected, either through delays or outright cancellation. While specific details haven't been fully disclosed, the scale of the spending cut suggests that several large-scale initiatives will be impacted.

- Specific project names (once released publicly): A detailed list of affected projects will need to be added once SSE releases official information.

- Estimated cost savings per project (once released publicly): Analysis of cost savings per project will be added once detailed information becomes available.

- Timelines for project completion (or cancellation): Revised timelines will be included as official updates are announced.

Revised Investment Strategy

SSE will need to implement a revised investment strategy to manage its capital expenditure more effectively. This will likely involve a more stringent approach to project selection and potentially a greater emphasis on smaller-scale projects or collaborations.

- New investment criteria: More rigorous criteria will be used to assess the viability of future projects.

- Focus on smaller-scale projects: Smaller, more manageable projects might be prioritized to reduce risk and improve efficiency.

- Potential partnerships or collaborations: SSE might seek partnerships to share the financial burden of larger projects.

Implications for Investors and the Wider Energy Sector

The SSE spending cut has significant implications for investors and the broader energy sector.

Share Price Reaction

The announcement of the £3 billion spending cut is likely to impact SSE's share price. Market analysts will be closely watching investor sentiment and its overall effect on the company's valuation.

- Share price changes: Tracking the share price fluctuations will reveal the market's immediate reaction.

- Analyst commentary: Expert opinions on the impact of the spending cut will provide valuable insights.

- Investor sentiment: Gauging investor confidence will reveal the long-term implications.

Impact on the Renewable Energy Market

This decision by SSE sends ripples throughout the renewable energy market. Other companies may also re-evaluate their investment plans, leading to potential delays or cancellations of projects.

- Potential impact on other energy companies: The decision could lead other energy firms to reassess their strategies.

- Implications for future renewable energy projects: The overall pace of renewable energy development might slow down.

Long-Term Outlook for SSE

The long-term effects of the £3 billion spending cut on SSE's growth prospects remain to be seen. While it presents short-term challenges, it could also force the company to focus on more efficient and profitable initiatives.

- Potential risks and opportunities: Balancing potential risks and opportunities stemming from the revised strategy.

- Revised financial forecasts: Analyzing how the spending cut impacts future financial projections.

- Long-term strategic goals: Assessing how the adjustments affect SSE's long-term strategic goals.

Conclusion: Understanding SSE's £3 Billion Spending Cut and its Future Implications

SSE's decision to cut £3 billion from its capital expenditure reflects a confluence of economic headwinds, slower-than-expected renewable energy growth, and a strategic shift in investment priorities. The impact will be felt across its projects, investor confidence, and the broader renewable energy sector. The long-term effects remain uncertain, but the move highlights the challenges and complexities within the energy industry. To stay informed about the ongoing developments and SSE's future investment plans, subscribe to our updates, follow us on social media, and check back for further analysis of SSE's spending cut and its effects on the growth of the UK energy sector.

Featured Posts

-

Home Depot Stock Despite Disappointing Results Tariff Impact Guidance Remains

May 22, 2025

Home Depot Stock Despite Disappointing Results Tariff Impact Guidance Remains

May 22, 2025 -

From The Mountains To The Med A Self Guided Walking Tour Of Provence

May 22, 2025

From The Mountains To The Med A Self Guided Walking Tour Of Provence

May 22, 2025 -

Wtt Star Contender Chennai Oh Jun Sungs Thrilling Victory

May 22, 2025

Wtt Star Contender Chennai Oh Jun Sungs Thrilling Victory

May 22, 2025 -

Recent News On Blake Lively Addressing The Allegations

May 22, 2025

Recent News On Blake Lively Addressing The Allegations

May 22, 2025 -

Nices Aquatic Future A New Olympic Standard Swimming Pool Complex

May 22, 2025

Nices Aquatic Future A New Olympic Standard Swimming Pool Complex

May 22, 2025

Latest Posts

-

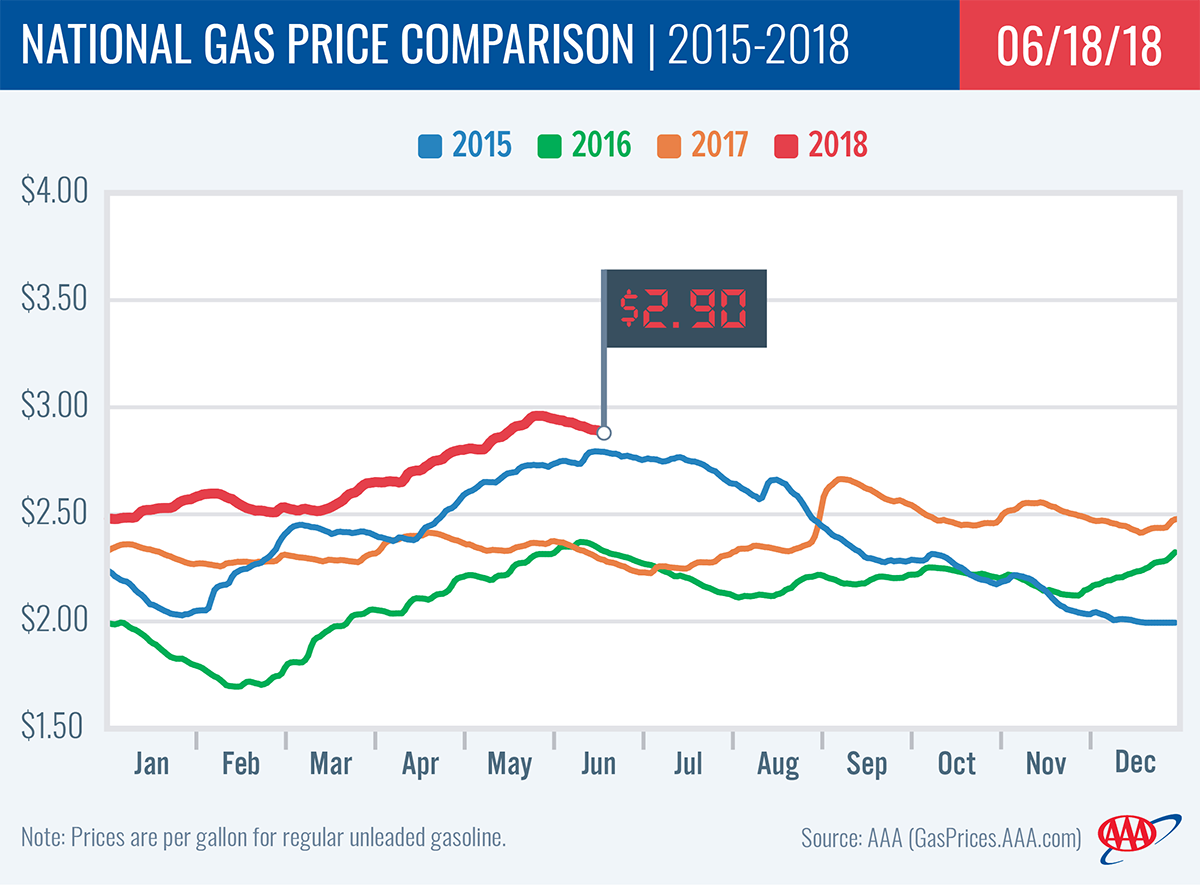

Wisconsin Gas Prices Average 2 98 A 3 Cent Increase

May 22, 2025

Wisconsin Gas Prices Average 2 98 A 3 Cent Increase

May 22, 2025 -

Gas Buddy Virginia Sees Drop In Average Gasoline Prices This Week

May 22, 2025

Gas Buddy Virginia Sees Drop In Average Gasoline Prices This Week

May 22, 2025 -

Lower Gas Prices In Illinois National Trend Brings Relief To Consumers

May 22, 2025

Lower Gas Prices In Illinois National Trend Brings Relief To Consumers

May 22, 2025 -

Illinois Gas Prices Continue To Fall Nationwide Decrease Impacts Drivers

May 22, 2025

Illinois Gas Prices Continue To Fall Nationwide Decrease Impacts Drivers

May 22, 2025 -

Week Over Week Drop In Toledo Gas Prices

May 22, 2025

Week Over Week Drop In Toledo Gas Prices

May 22, 2025