Startups Stalling Before IPO: Exploring All Available Options

Table of Contents

Identifying the Reasons for Pre-IPO Delays

Startups stalling before their IPO often encounter a confluence of factors impacting their readiness. Understanding these obstacles is the first step toward finding effective solutions.

Market Conditions and Economic Uncertainty

The IPO market is notoriously sensitive to broader economic trends. Negative market sentiment can significantly impact a company's valuation and investor appetite.

- Negative market trends: Bear markets, economic downturns, and geopolitical instability create uncertainty and reduce investor willingness to take on risk.

- Increased interest rates: Higher interest rates make borrowing more expensive, impacting a company's profitability and potentially reducing its valuation.

- Decreased investor appetite for risk: In uncertain times, investors often favor safer, more established investments, making it harder for startups to secure funding or attract IPO investors.

These factors can significantly decrease investor confidence, leading to delayed or even cancelled IPOs. A thorough understanding of current market conditions is critical for successful IPO planning.

Company Performance and Financial Metrics

Strong financial performance is paramount for attracting investors. Companies struggling to meet certain key performance indicators (KPIs) are unlikely to receive a positive reception.

- Lack of consistent revenue: Investors look for consistent revenue growth and predictable future earnings. Fluctuating or declining revenue raises red flags.

- High burn rate: Excessive spending without corresponding revenue growth is a major concern. Investors need to see evidence of efficient capital management.

- Negative cash flow: Consistent negative cash flow indicates unsustainable operations and increases the risk of failure.

- Insufficient profitability: A lack of profitability raises questions about the long-term viability of the business and its ability to generate returns for investors.

Improving these KPIs is crucial for demonstrating IPO readiness and securing favorable valuation. Thorough financial planning and operational efficiency are key to addressing these challenges.

Regulatory Hurdles and Compliance Issues

Navigating the regulatory landscape is a complex process requiring significant time and resources. Failure to meet regulatory standards can cause significant delays.

- SEC filings: Preparing accurate and compliant filings with the Securities and Exchange Commission (SEC) is a time-consuming and demanding process.

- Legal and financial audits: Rigorous audits are essential to ensure transparency and compliance, but can also cause delays if issues are discovered.

- Corporate governance issues: Weak corporate governance structures can raise concerns about accountability and transparency, potentially hindering the IPO process.

Addressing these regulatory aspects proactively and engaging experienced legal and financial professionals are critical for a smooth IPO process.

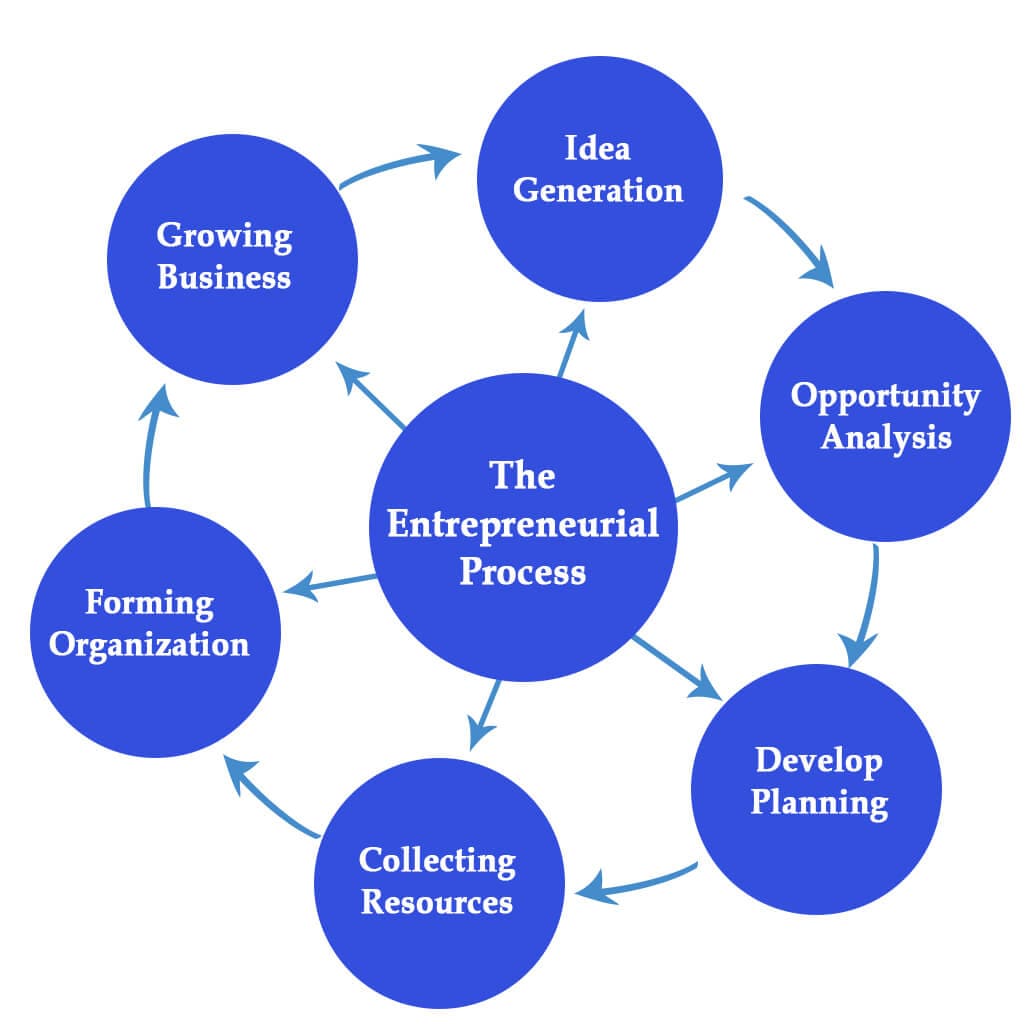

Strategies for Overcoming Pre-IPO Challenges

Addressing the challenges outlined above requires a proactive and multifaceted approach.

Restructuring and Operational Improvements

Streamlining operations and improving efficiency can significantly boost a company's financial health and attractiveness to investors.

- Layoffs: In some cases, reducing workforce size might be necessary to control costs and improve profitability.

- Process optimization: Identifying and eliminating inefficiencies can improve productivity and reduce operational expenses.

- Technology upgrades: Investing in technology can automate processes, increase efficiency, and enhance the overall business model.

- Cost-cutting measures: Implementing various cost-cutting measures is often necessary to improve margins and demonstrate financial discipline.

These actions demonstrate a commitment to fiscal responsibility and improve the company's overall financial health.

Seeking Additional Funding and Strategic Partnerships

Securing additional funding can provide the necessary capital to overcome short-term challenges and further enhance growth.

- Venture capital: Venture capitalists specialize in investing in high-growth companies and can offer both capital and valuable expertise.

- Private equity: Private equity firms can provide significant capital for expansion or restructuring.

- Strategic investors: Partnerships with strategic investors can provide not only funding but also access to new markets and resources.

- Mergers and acquisitions: Acquiring or merging with another company can expand market reach, enhance technological capabilities, or streamline operations.

Each funding option has its pros and cons; the best choice will depend on the company’s specific circumstances and goals.

Adjusting the IPO Strategy and Timeline

Sometimes, the best course of action is to adjust the IPO strategy or timeline.

- Repricing shares: Adjusting the share price can increase investor interest and facilitate a more successful IPO.

- Revising the prospectus: Updating the prospectus to reflect changes in market conditions or company performance can improve investor confidence.

- Changing IPO timing: Delaying the IPO to allow for improved financial performance or better market conditions is often a prudent strategy.

- Alternative listing venues: Considering alternative exchanges or listing options can increase chances of a successful offering.

Flexibility and adaptability are critical in navigating the dynamic IPO landscape.

Alternative Exit Strategies for Startups

While an IPO is a common goal, other viable exit strategies exist for startups.

Acquisition by a Larger Company

Being acquired by a larger, established company offers a swift and potentially lucrative exit.

- Negotiating terms: Negotiating a favorable acquisition price and terms is crucial for maximizing value.

- Due diligence: Both parties will conduct due diligence to assess the value and risks associated with the transaction.

- Integration process: The integration of the acquired company into the larger organization requires careful planning and execution.

An acquisition offers a clear and immediate exit, potentially providing a significant return for founders and investors.

Continued Private Growth and Funding Rounds

Some startups may opt to forgo an IPO and continue growing privately through further funding rounds.

- Series C, D, etc. funding: Securing additional funding rounds allows the company to further scale its operations and achieve long-term growth.

- Scaling operations: Continued private growth allows the company to focus on expanding its market share and strengthening its business model.

- Long-term growth: This strategy allows the company to pursue a longer-term growth trajectory without the immediate pressures of a public listing.

This approach offers more control and flexibility but requires consistent success in attracting private investment.

Conclusion: Navigating the Path to a Successful IPO

Startups facing pre-IPO delays encounter various hurdles, including challenging market conditions, performance issues, and regulatory complexities. However, by carefully identifying these challenges, implementing strategic solutions like operational improvements, securing additional funding, adjusting their IPO strategy, or exploring alternative exit strategies such as acquisition or continued private growth, these companies can significantly increase their chances of success. Remember, careful planning, proactive problem-solving, and adaptability are critical to navigating the path to a successful IPO or an appropriate alternative exit strategy. Don't let your startup stall before its IPO. Explore all available options and navigate the path to success.

Featured Posts

-

Diddys Business Ventures A Case Study In Entrepreneurial Risk And Reward

May 14, 2025

Diddys Business Ventures A Case Study In Entrepreneurial Risk And Reward

May 14, 2025 -

Analyzing Manchester Uniteds Chances In The Upcoming Transfer Window

May 14, 2025

Analyzing Manchester Uniteds Chances In The Upcoming Transfer Window

May 14, 2025 -

Fondation Seydoux Pathe Nuit Des Musees 2025 Une Soiree Cinema

May 14, 2025

Fondation Seydoux Pathe Nuit Des Musees 2025 Une Soiree Cinema

May 14, 2025 -

Svalbard In Final Reckoning A Featurette Analysis

May 14, 2025

Svalbard In Final Reckoning A Featurette Analysis

May 14, 2025 -

Suits La Episode 5 Reveals Harvey And Mikes Successors

May 14, 2025

Suits La Episode 5 Reveals Harvey And Mikes Successors

May 14, 2025