Stock Market In Amsterdam Suffers 7% Drop: Trade War Uncertainty Creates Panic

Table of Contents

Trade War Uncertainty: The Primary Culprit

Current global trade tensions, particularly the ongoing trade disputes between major economic powers, are the primary culprits behind the Amsterdam Stock Market's dramatic fall. This uncertainty significantly impacts market sentiment, creating a climate of fear and prompting investors to sell off assets.

- Rising tariffs impacting Dutch exports: Increased tariffs on Dutch goods, particularly in sectors like agriculture and technology, directly reduce the profitability of Dutch companies, impacting their stock prices. Companies heavily reliant on international trade are particularly vulnerable.

- Uncertainty surrounding future trade agreements: The lack of clarity regarding future trade agreements creates significant risk for businesses planning long-term investments. This uncertainty discourages investment and fuels negative market sentiment.

- Reduced investor confidence due to geopolitical instability: Trade wars contribute to broader geopolitical instability, making investors hesitant to commit capital to risky assets like stocks. This "flight to safety" phenomenon is a key driver of market declines.

- Negative impact on consumer spending and business investment: Uncertainty about future costs and economic stability leads to decreased consumer spending and reduced business investment, creating a negative feedback loop that further dampens economic growth and stock market performance. This trade war impact is felt across various sectors.

Specific sectors within the Amsterdam Stock Market heavily impacted include technology companies reliant on global supply chains and agricultural businesses exporting to tariff-burdened markets. For example, [mention specific company examples if possible, e.g., "ASML Holding, a major semiconductor equipment manufacturer, saw a significant drop in its share price, reflecting the impact of trade war uncertainty on the tech sector"]. The impact of global trade tensions and tariff uncertainty is acutely felt across the Amsterdam Stock Exchange.

Impact on Key Amsterdam Stock Market Indices

The decline significantly affected major Amsterdam stock market indices.

- Percentage drop in AEX and other relevant indices: The AEX index, the leading benchmark for the Amsterdam Stock Exchange, experienced a substantial 7% drop, reflecting the widespread nature of the market downturn. Other relevant indices also suffered significant losses.

- Comparison to previous market downturns: This drop is comparable to [mention percentage and timeframe of a comparable past market downturn]. However, the underlying causes – primarily trade war uncertainty – differ from those of previous declines.

- Analysis of individual stock performance within the indices: While the AEX index provides an overall picture, individual stock performance varied. Some companies, particularly those less exposed to international trade, experienced less severe drops. Analyzing individual stock performance within the Amsterdam stock market indices provides a nuanced understanding of the impact.

This market volatility underscores the need for careful monitoring of Amsterdam stock market indices and individual stock performance to make informed investment decisions. The AEX index performance, in particular, acts as a crucial barometer for the overall health of the Amsterdam stock market.

Investor Reactions and Market Sentiment

The market drop triggered significant investor reactions.

- Increased selling pressure: Investors reacted with panic selling, driving the market decline even further. This increased selling pressure amplified the negative impact on Amsterdam stock market indices.

- Flight to safety (e.g., gold, government bonds): Many investors sought refuge in safer assets such as gold and government bonds, considered less susceptible to market volatility. This further reduced liquidity in the stock market.

- Reduction in trading volume: The uncertainty led to a reduction in trading volume, as investors adopted a wait-and-see approach. Lower trading volume exacerbates market instability.

- Analyst comments and predictions: Market analysts expressed concerns about the long-term implications of the trade war and issued cautious predictions about the Amsterdam Stock Market's near-term prospects. The prevailing investor sentiment reflects a high level of risk aversion. Market psychology indicates a significant shift towards caution.

Potential Long-Term Implications for the Amsterdam Stock Market

The consequences of this market decline could have long-term effects.

- Economic growth forecasts for the Netherlands: The downturn could negatively impact economic growth forecasts for the Netherlands, as reduced business investment and consumer spending ripple through the economy.

- Government response and potential policy interventions: The Dutch government may implement policy interventions to mitigate the negative economic impact and restore investor confidence in the Amsterdam stock market.

- Long-term investor confidence and recovery prospects: The speed and extent of the market's recovery will depend on factors like the resolution of trade disputes, government policies, and overall global economic stability. Long-term investment decisions require careful consideration of these factors.

- Opportunities for value investing amidst the downturn: The decline also creates opportunities for value investors to identify undervalued stocks with long-term growth potential.

The economic outlook for the Netherlands and the long-term recovery of the Amsterdam stock market depend on several interconnected factors. Careful analysis is crucial for navigating the challenges and identifying opportunities.

Conclusion

The 7% drop in the Amsterdam stock market highlights the significant impact of global trade war uncertainty. The decline reflects a broader market sentiment shift, impacting key indices and prompting significant investor reactions. While the short-term outlook remains uncertain, understanding the factors driving this downturn is crucial for navigating the Amsterdam stock market and making informed investment decisions. Stay informed about developments in the Amsterdam stock market and global trade relations to make strategic choices concerning your portfolio. Monitor the Amsterdam Stock Market closely for potential recovery signals and opportunities.

Featured Posts

-

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025 -

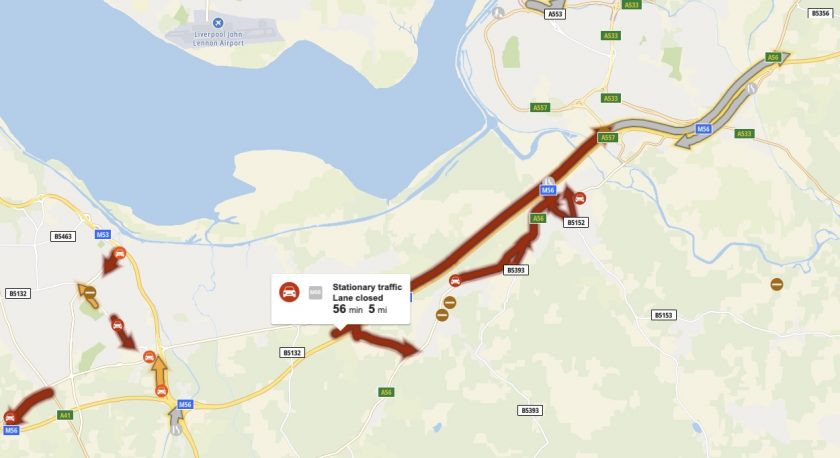

Cheshire Deeside M56 Road Closure Following Serious Accident

May 24, 2025

Cheshire Deeside M56 Road Closure Following Serious Accident

May 24, 2025 -

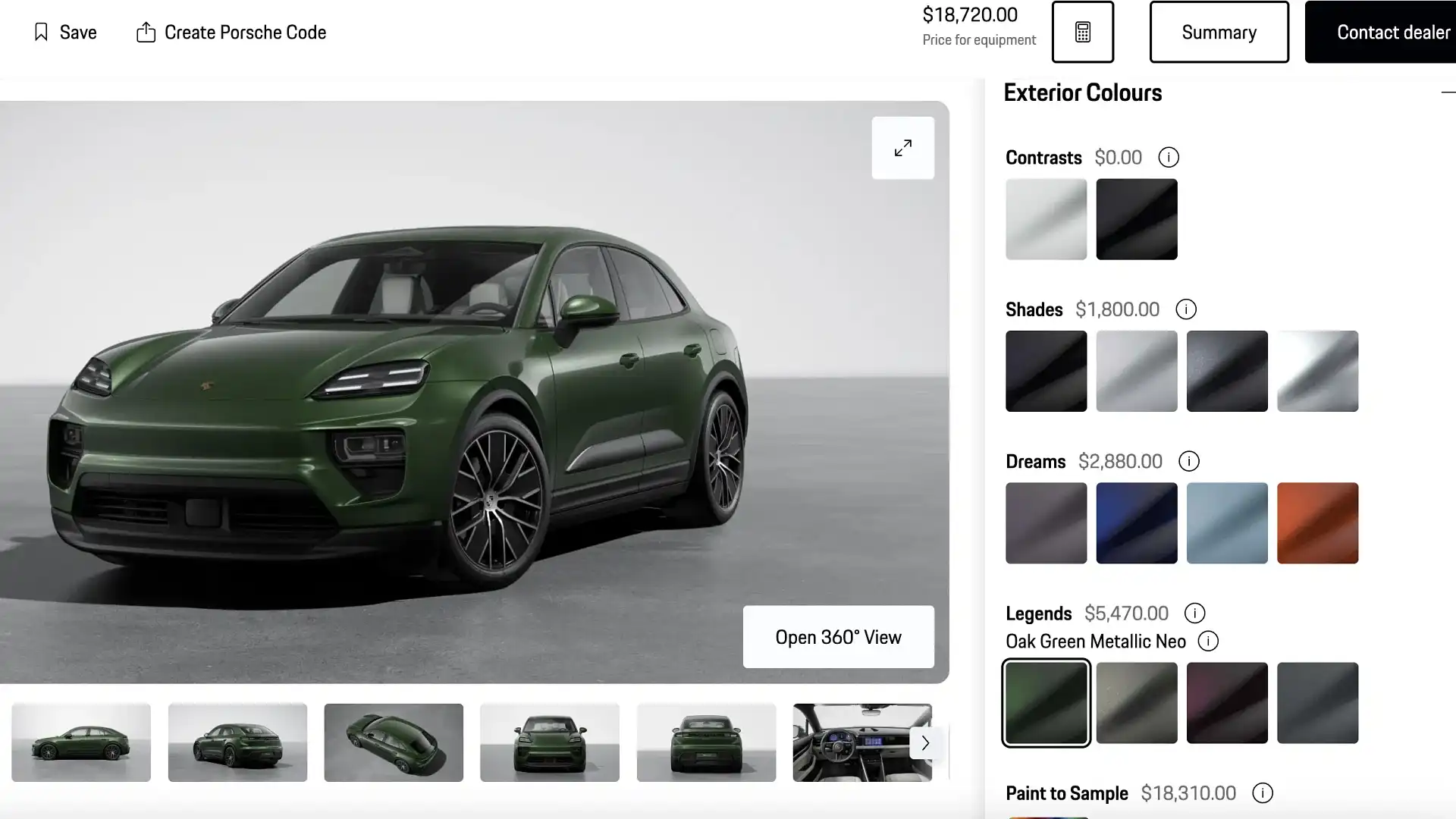

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025 -

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 24, 2025

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 24, 2025 -

90mph Police Chase How They Texted And Refueled

May 24, 2025

90mph Police Chase How They Texted And Refueled

May 24, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025 -

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025 -

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025