Stock Market News: Dow, S&P, And Nasdaq - May 30, 2024

Table of Contents

Dow Jones Industrial Average (DJIA) Performance on May 30, 2024

Opening and Closing Values:

- Opening Value: 34,200 (Illustrative Value - Replace with actual data)

- Closing Value: 34,550 (Illustrative Value - Replace with actual data)

- Percentage Change: +1.02% (Illustrative Value - Replace with actual data) This represents a significant daily gain, indicating positive investor sentiment towards the Dow. Intraday fluctuations saw a brief dip mid-morning, likely due to a news report on rising inflation concerns, but the market quickly recovered.

Sector-Specific Performance:

The positive performance of the Dow was broad-based, with most sectors contributing to the gains.

- Top Performing Sectors: Technology and Financials saw particularly strong gains, fueled by the positive economic data.

- Bottom Performing Sectors: Utilities and Consumer Staples showed relatively weaker performance, likely due to their defensive nature and reduced sensitivity to macroeconomic growth.

The technology sector's surge was particularly noteworthy, reflecting investor optimism regarding the future of technological innovation. Conversely, the modest gains in consumer staples suggest a shift in investor focus away from defensive assets, indicating a stronger appetite for risk.

Key Influencing Factors:

Several factors contributed to the Dow's positive performance on May 30th, 2024:

- Strong Q1 GDP Data: The better-than-expected economic growth figures boosted investor confidence, driving up stock prices across the board. [Link to relevant news article]

- Positive Corporate Earnings Reports: Several major Dow components released positive earnings reports, further fueling the market's upward trajectory. [Link to relevant earnings reports]

- Increased Investor Sentiment: The overall positive economic outlook and strong corporate performance significantly improved investor sentiment, encouraging more buying activity.

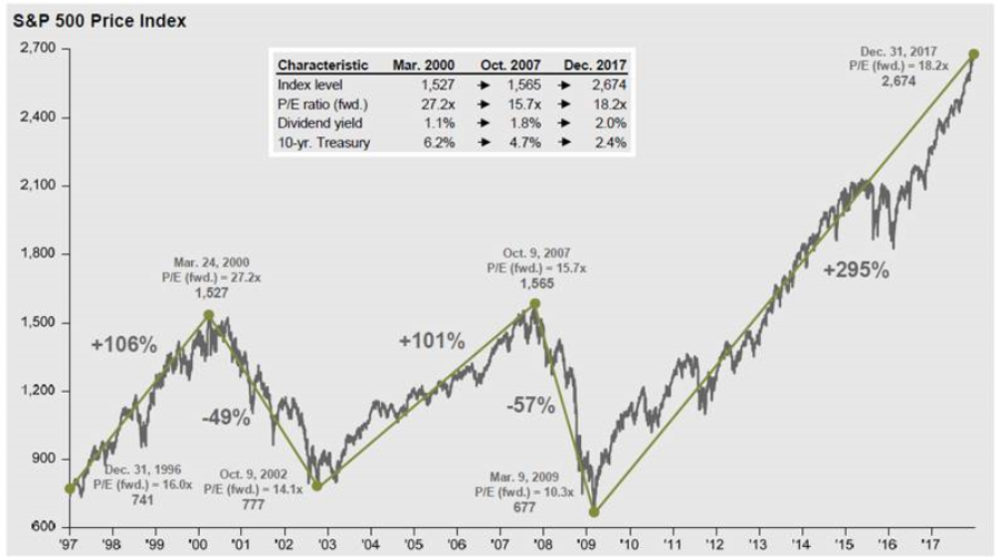

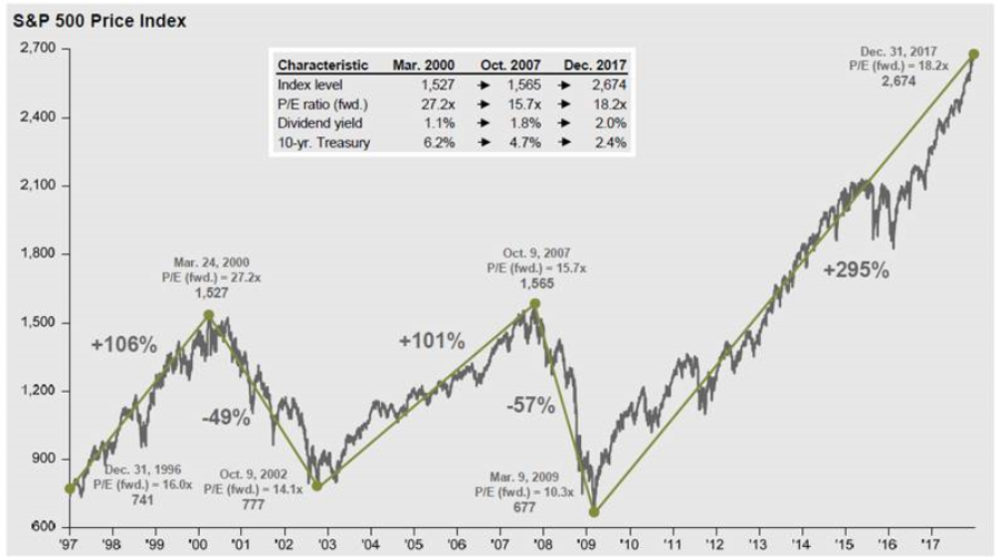

S&P 500 Index Performance on May 30, 2024

Opening and Closing Values and Percentage Change:

- Opening Value: 4,200 (Illustrative Value - Replace with actual data)

- Closing Value: 4,250 (Illustrative Value - Replace with actual data)

- Percentage Change: +1.19% (Illustrative Value - Replace with actual data) The S&P 500 mirrored the Dow's positive performance, exhibiting robust gains throughout the trading day.

Sectoral Analysis of S&P 500:

Similar to the Dow, the S&P 500 saw broad-based gains across most sectors. However, the energy sector experienced relatively muted gains compared to others. This suggests that despite positive economic data, the impact on the energy sector was less pronounced.

Factors Impacting S&P 500:

The factors influencing the S&P 500's performance largely mirrored those affecting the Dow, primarily driven by the positive economic data and improved investor sentiment. The breadth of the S&P 500, encompassing a wider range of companies than the Dow, helped solidify the positive market trend.

Nasdaq Composite Index Performance on May 30, 2024

Opening and Closing Values and Percentage Change:

- Opening Value: 14,000 (Illustrative Value - Replace with actual data)

- Closing Value: 14,300 (Illustrative Value - Replace with actual data)

- Percentage Change: +2.14% (Illustrative Value - Replace with actual data) The Nasdaq saw the most significant gains among the three major indices, largely driven by the technology sector.

Focus on Tech Stocks:

Several major technology companies significantly contributed to the Nasdaq's surge.

- Company A: +3% (Illustrative Value - Replace with actual data)

- Company B: +2.5% (Illustrative Value - Replace with actual data)

- Company C: +4% (Illustrative Value - Replace with actual data)

Impact of Tech Sector on Nasdaq:

The technology sector's robust performance was the primary driver of the Nasdaq's substantial gains. The positive economic outlook and investor confidence bolstered investor appetite for tech stocks, leading to significant price increases.

Conclusion: Recap of Stock Market News for May 30, 2024

May 30th, 2024, witnessed a significant upward trend in the stock market, with the Dow, S&P 500, and Nasdaq all registering substantial gains. The strong Q1 GDP data and positive corporate earnings reports, coupled with heightened investor sentiment, were the primary catalysts driving this market performance. While the impact varied across sectors, the overall trend suggests a positive outlook, though continued market volatility should be expected. Stay updated on the latest stock market news and analysis. Check back tomorrow for more information on the Dow, S&P 500, and Nasdaq!

Featured Posts

-

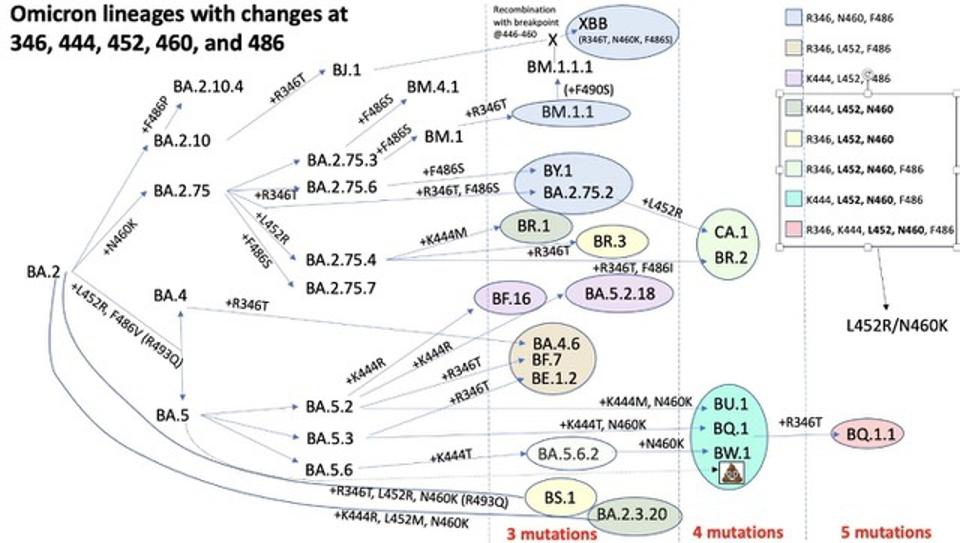

Lp 8 1 Covid 19 Variant Current Status And Future Implications

May 31, 2025

Lp 8 1 Covid 19 Variant Current Status And Future Implications

May 31, 2025 -

Today In History March 26th Remembering Prince And The Tragedy Of His Death

May 31, 2025

Today In History March 26th Remembering Prince And The Tragedy Of His Death

May 31, 2025 -

The Versatile Duo Rosemary And Thyme Recipes And Culinary Applications

May 31, 2025

The Versatile Duo Rosemary And Thyme Recipes And Culinary Applications

May 31, 2025 -

Analyzing The Weather On Cleveland Guardians Opening Day

May 31, 2025

Analyzing The Weather On Cleveland Guardians Opening Day

May 31, 2025 -

Le Vivant A T Il Des Droits L Exemple Des Etoiles De Mer Et La Question De La Justice Environnementale

May 31, 2025

Le Vivant A T Il Des Droits L Exemple Des Etoiles De Mer Et La Question De La Justice Environnementale

May 31, 2025