Stock Market Overview: Dow Futures Reaction To China's Economic Measures

Table of Contents

Understanding China's Recent Economic Measures

China's recent economic policies represent a significant shift in its approach to growth. These measures aim to stimulate the economy and address various challenges, but their global ramifications are far-reaching. Understanding the nuances of these "China Economic Policy" changes is key to interpreting their impact on Dow Futures.

- Interest Rate Cuts: The People's Bank of China (PBOC) has implemented several interest rate cuts to lower borrowing costs for businesses and consumers. This aims to boost investment and spending. The impact of these cuts on inflation and economic growth remains to be seen, however.

- Stimulus Packages: Targeted stimulus packages focused on infrastructure projects and technological advancements are designed to inject capital into the economy. The effectiveness of these packages will depend largely on their efficient implementation and absorption by the market.

- Regulatory Changes: Changes to regulations in various sectors, particularly technology and real estate, have created uncertainty and impacted investor sentiment. These "Monetary Policy China" changes can lead to both short-term volatility and long-term structural changes.

These "Chinese Stimulus" efforts are interwoven and their combined effects on the global economy, and consequently Dow Futures, are complex and require careful analysis. The success of these measures hinges on various factors including international cooperation and effective domestic policy implementation. Data from the PBOC and other relevant organizations will be crucial in tracking the impact of these policies.

Immediate Dow Futures Reaction

The announcement of China's economic measures immediately triggered a noticeable reaction in Dow Jones Futures. Initial responses were mixed, reflecting the uncertainty surrounding the long-term effects of the policies.

- Initial Dip: Many analysts observed an initial dip in Dow Jones Futures prices following the announcement, reflecting investor apprehension about potential negative consequences.

- Increased Volatility: "Market Volatility" increased significantly in the hours following the news, indicating uncertainty and heightened trading activity. This was reflected in a higher trading volume of Dow Jones Futures contracts.

- Gradual Recovery: In subsequent trading sessions, a gradual recovery was observed, suggesting that some investors viewed the measures as potentially positive in the long run.

(Insert chart/graph here visually depicting the Dow Futures movement immediately following the announcement of China’s economic measures.)

The immediate market reaction highlights the sensitivity of Dow Futures to news originating from the Chinese economy, underscoring the close relationship between the two. This volatility underscores the importance of "Futures Trading" strategies that account for such sudden shifts in the market.

Analyzing the Long-Term Implications for Dow Futures

The long-term impact of China's economic policies on Dow Jones Industrial Average and Dow Futures remains uncertain, with various potential scenarios unfolding.

- Positive Scenario: Successful implementation of the stimulus packages and regulatory reforms could lead to robust economic growth in China, boosting global demand and positively impacting US companies with significant exposure to the Chinese market. This could result in a sustained increase in Dow Futures.

- Negative Scenario: If the measures fail to stimulate the economy effectively or lead to unforeseen negative consequences, it could dampen global growth prospects, negatively impacting US companies and leading to a decline in Dow Futures. This scenario might involve increased "Market Volatility."

- Neutral Scenario: The policies might have a relatively neutral impact on the global economy, with marginal effects on Dow Futures. This scenario depends largely on how these "China Economic Policy" changes interact with other economic factors globally.

These scenarios highlight the need for careful long-term "Market Forecast" and diversified "Long-Term Investment" strategies. The probability of each scenario will depend on various factors including the effectiveness of China's policies, global economic conditions, and geopolitical stability.

Investor Sentiment and Market Behavior

Investor sentiment played a crucial role in shaping market behavior following the announcement of China's economic measures.

- Initial Uncertainty: Initial investor sentiment was largely characterized by uncertainty and apprehension, leading to cautious trading activity. This was reflected in decreased "Investor Confidence."

- Shifting Risk Appetite: As more information became available and analysts weighed the potential implications of the measures, "Risk Appetite" began to shift, with some investors becoming more optimistic about the long-term prospects.

- News Coverage and Expert Opinions: News coverage and expert opinions played a significant role in influencing investor sentiment. Positive news reports generally helped to boost confidence, while negative reports contributed to uncertainty and volatility.

Analyzing "Market Sentiment" is crucial in understanding the dynamics of Dow Futures trading. Monitoring news sources and expert opinions while remaining vigilant about potential market shifts is paramount for effective investment strategies.

Conclusion: Navigating the Dow Futures Landscape in Light of China's Actions

China's recent economic measures have had a demonstrable impact on Dow Futures, highlighting the interconnectedness of the global economy. The immediate reaction was marked by volatility, while the long-term implications remain uncertain, presenting both opportunities and risks for investors. Understanding "China's Economic Measures" and their influence on "Dow Futures" is crucial for informed decision-making. Stay informed about these critical developments and monitor them closely to navigate the evolving market landscape effectively. For more in-depth analysis, refer to resources like the Wall Street Journal and Bloomberg. Continuously monitor "Dow Futures" and "China's Economic Measures" for crucial insights into the future of the market.

Featured Posts

-

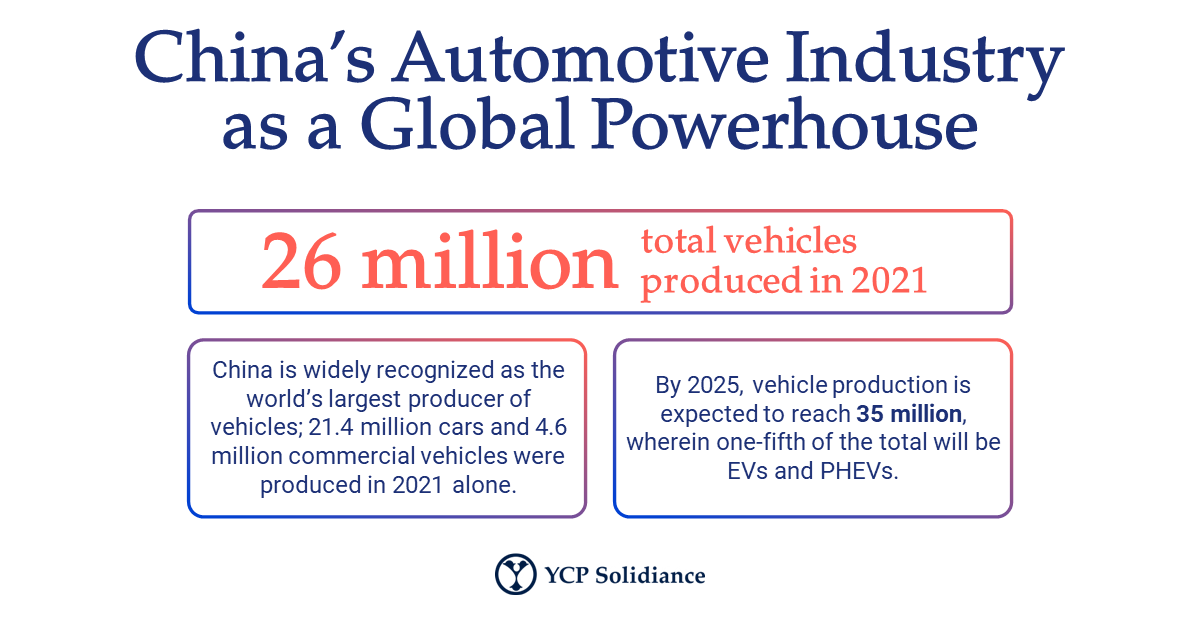

Are China Made Vehicles The Future Of The Auto Industry

Apr 26, 2025

Are China Made Vehicles The Future Of The Auto Industry

Apr 26, 2025 -

White House Cocaine Found Secret Service Concludes Investigation

Apr 26, 2025

White House Cocaine Found Secret Service Concludes Investigation

Apr 26, 2025 -

Ftc Probe Into Open Ai Implications For Ai Development And Regulation

Apr 26, 2025

Ftc Probe Into Open Ai Implications For Ai Development And Regulation

Apr 26, 2025 -

Ukraines Nato Prospects The Impact Of Trumps Opinion

Apr 26, 2025

Ukraines Nato Prospects The Impact Of Trumps Opinion

Apr 26, 2025 -

The Company That Laid You Off Wants You Back What To Say

Apr 26, 2025

The Company That Laid You Off Wants You Back What To Say

Apr 26, 2025