Stock Market Prediction: 2 Companies To Outpace Palantir Within 3 Years

Table of Contents

The tech sector is a thrilling landscape of innovation, brimming with potential for explosive growth. Identifying the next Palantir, however, is a significant challenge. This article presents a stock market prediction: we'll analyze two companies poised to outpace Palantir's growth within the next three years. By examining their competitive advantages, growth potential, and financial projections, we aim to illuminate promising investment opportunities in the rapidly evolving tech market.

2. Main Points:

2.1 Company #1: Snowflake (SNOW) - Disrupting Data Warehousing with Cloud-Based Solutions

H3: Competitive Advantage: Snowflake's cloud-based data warehouse stands apart through its scalability, cost-effectiveness, and ease of use. Its unique architecture allows for near-infinite scalability, handling massive datasets with unmatched efficiency. This eliminates the limitations of traditional on-premise data warehouses, offering a significant advantage in the rapidly expanding cloud computing market.

- Unique Selling Proposition (USP): Pay-as-you-go pricing model, eliminating upfront capital expenditure.

- Technological Innovation: Snowflake's data sharing capabilities and advanced analytics tools provide unparalleled flexibility and insights.

- Market Position: Snowflake is a leading player in the cloud data warehousing market, rapidly gaining market share from traditional vendors. Analysts project significant market penetration in the coming years.

H3: Growth Potential and Financial Projections: Snowflake demonstrates impressive revenue growth, consistently exceeding analyst expectations. Its strong customer acquisition rate and expansion within existing accounts fuel its growth trajectory.

- Projected Revenue Growth: Analysts predict a compound annual growth rate (CAGR) exceeding 30% over the next three years.

- Market Penetration Rates: Snowflake is expected to further penetrate key industries like finance, healthcare, and technology.

- Anticipated Profitability: While currently not highly profitable, Snowflake is expected to reach substantial profitability as it scales and benefits from economies of scale.

H3: Investment Rationale: Snowflake's innovative technology, strong market position, and significant growth potential make it a compelling alternative to Palantir. Its disruptive approach to data warehousing positions it for long-term success in the expanding cloud computing market.

- Key Reasons for Investment: First-mover advantage, strong network effects, and a rapidly expanding market.

- Expected Returns: High growth potential with the possibility of significant capital appreciation over the next three years.

2.2 Company #2: CrowdStrike (CRWD) - Leading the Charge in Cybersecurity with AI-Powered Endpoint Protection

H3: Competitive Advantage: CrowdStrike's cloud-native endpoint protection platform leverages artificial intelligence and machine learning to deliver superior threat detection and response capabilities. Its lightweight agent and robust cloud infrastructure provide unparalleled visibility and protection across endpoints.

- Unique Selling Proposition (USP): Single agent architecture that provides comprehensive endpoint protection, preventing costly security breaches.

- Technological Innovation: CrowdStrike's AI-powered threat intelligence continuously evolves, proactively identifying and neutralizing emerging threats.

- Market Position: CrowdStrike is a rapidly growing leader in the cloud-based cybersecurity market, gaining market share from traditional security vendors.

H3: Growth Potential and Financial Projections: CrowdStrike’s financial performance reflects its strong market position and rapid adoption of its platform. Subscription revenue is consistently growing, indicating strong customer retention and expansion.

- Projected Revenue Growth: Analysts project a strong CAGR exceeding 25% over the next three years.

- Market Penetration Rates: CrowdStrike is expected to expand its market share, particularly in large enterprise accounts.

- Anticipated Profitability: CrowdStrike is demonstrating improving profitability as it scales and achieves higher operating leverage.

H3: Investment Rationale: CrowdStrike's advanced threat detection capabilities, strong growth trajectory, and leadership position in the cloud-based cybersecurity market position it favorably against Palantir. Its focus on AI-powered solutions ensures it remains at the forefront of cybersecurity innovation.

- Key Reasons for Investment: Rapid innovation, strong customer retention, and the ever-growing demand for cybersecurity solutions.

- Expected Returns: High growth potential with substantial capital appreciation over the next three years.

2.3 Comparative Analysis: Palantir vs. Snowflake vs. CrowdStrike

| Company | Revenue Growth (Projected 3-Year CAGR) | Market Cap (Approximate) | Profit Margins (Projected) |

|---|---|---|---|

| Palantir | 20-25% | High | Moderate |

| Snowflake (SNOW) | >30% | High | Improving |

| CrowdStrike (CRWD) | >25% | High | Improving |

While Palantir holds a strong position, Snowflake and CrowdStrike exhibit faster projected revenue growth and improving profitability, suggesting potential for outperformance. Their focus on high-growth cloud-based markets and innovative technologies contributes to this optimistic outlook.

3. Conclusion: Investing in the Future of Tech: Beyond Palantir

Our analysis suggests that Snowflake and CrowdStrike, with their innovative technologies and strong growth trajectories, are well-positioned to outpace Palantir's growth within the next three years. Both companies benefit from strong market positions in high-growth sectors and demonstrate compelling investment rationales. Their unique strengths – Snowflake's cloud-based data warehousing solutions and CrowdStrike's AI-powered cybersecurity platform – are driving exceptional growth.

Begin your research into these promising alternatives to Palantir and consider adding them to your stock market portfolio. Remember, this is not financial advice, and thorough due diligence is crucial before making any investment decisions. Conduct your own research and consult with a financial advisor before investing.

Featured Posts

-

Offres D Emploi A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025

Offres D Emploi A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025 -

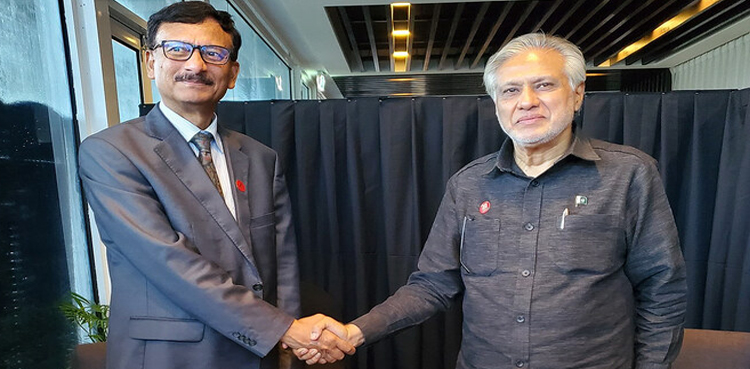

Pakistan Sri Lanka And Bangladesh To Strengthen Capital Market Ties

May 10, 2025

Pakistan Sri Lanka And Bangladesh To Strengthen Capital Market Ties

May 10, 2025 -

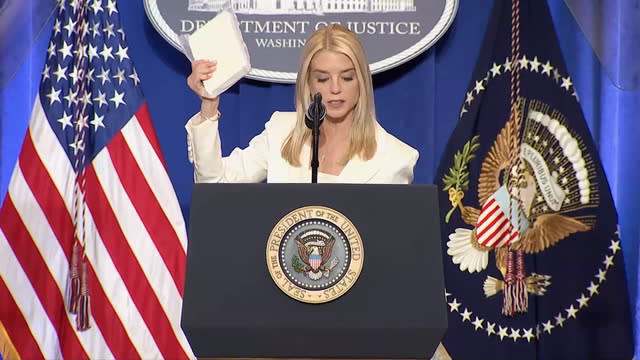

Press Conference Controversy Attorney General And The Fentanyl Block

May 10, 2025

Press Conference Controversy Attorney General And The Fentanyl Block

May 10, 2025 -

Update Pam Bondi To Publicly Release Documents Related To Epstein Diddy Jfk And Mlk

May 10, 2025

Update Pam Bondi To Publicly Release Documents Related To Epstein Diddy Jfk And Mlk

May 10, 2025 -

Cheveux Faire Un Don A Dijon

May 10, 2025

Cheveux Faire Un Don A Dijon

May 10, 2025