Stock Market Today: Dow & S&P 500 Live Updates For May 26th

Table of Contents

Dow Jones Industrial Average (DJIA) Performance

Opening Prices and Initial Trends

The Dow Jones Industrial Average opened at 33,820.50 today, May 26th, showing a slight increase of 0.2% from yesterday's closing price. The initial market sentiment was cautiously optimistic, with a modest upward trend observed in the first hour of trading.

- Early gains were primarily driven by positive news regarding the tech sector.

- Companies like Apple and Microsoft saw early gains, contributing significantly to the Dow's positive opening.

- However, some energy stocks experienced slight dips, reflecting fluctuating oil prices.

Intraday Volatility and Key Turning Points

The morning session saw relatively stable trading, with the Dow fluctuating within a narrow range. However, around midday, the release of weaker-than-expected consumer confidence data triggered a noticeable dip.

- The Dow dropped approximately 150 points in response to the economic news.

- This volatility was short-lived, as investors quickly adjusted their positions.

- A subsequent surge in the afternoon, fueled by positive corporate earnings announcements from several Dow components, helped the index regain its losses. A chart illustrating these fluctuations can be found [link to chart, if applicable].

Closing Prices and Overall Assessment

The Dow Jones Industrial Average closed at 33,950.20, representing a 0.39% increase for the day. This positive close suggests resilience in the face of early morning economic headwinds.

- The day's trading highlights the importance of monitoring economic indicators and corporate news.

- Technical analysis shows the Dow successfully defended a key support level at 33,800.

- The 50-day moving average remains above the 200-day moving average, indicating a positive long-term trend.

S&P 500 Index Performance

Opening Prices and Initial Market Sentiment

The S&P 500 opened at 4,205.75, reflecting a similar positive, yet cautious, sentiment to the Dow. Initial gains were broad-based, with most sectors exhibiting positive performance.

- The technology sector saw strong opening performance, mirroring the Dow's early trends.

- Consumer discretionary stocks showed moderate gains, reflecting consumer confidence despite earlier reports.

- The financial sector experienced minor fluctuations early in the day.

Sector-Specific Performance

Throughout the day, sector performance diverged.

- Technology and communication services led the gains, fueled by strong corporate earnings and positive market forecasts.

- Energy stocks underperformed, impacted by concerns over global oil supply and demand.

- The healthcare sector showed modest gains. A detailed sector-by-sector analysis is available [link to detailed analysis, if applicable].

Closing Prices and Market Outlook

The S&P 500 closed at 4,220.10, representing a 0.34% increase for the day. This reflects broad market strength, despite sector-specific variations.

- The VIX (Volatility Index) closed slightly lower, indicating decreased market uncertainty.

- The S&P 500's continued upward trend suggests sustained investor confidence.

- However, the day's volatility underscores the ongoing need for careful portfolio management.

Factors Influencing the Stock Market Today

Economic News and Data

The release of weaker-than-expected consumer confidence data midday caused significant market fluctuations, underscoring the impact of economic indicators on investor sentiment. [Link to source of consumer confidence data]

- This data point highlights the ongoing economic uncertainty and market sensitivity.

- Further economic releases throughout the week will likely continue influencing market trends.

Geopolitical Events

Currently, there are no major geopolitical events significantly impacting the Stock Market Today. However, ongoing international tensions remain a factor to consider for long-term investment strategies.

- Increased global uncertainty can often lead to market volatility.

- Investors often seek safer investments during periods of geopolitical instability.

Corporate Earnings and Announcements

Positive corporate earnings announcements from several key technology companies boosted market sentiment in the afternoon, contributing to the positive closing prices.

- The impact of these announcements highlights the importance of company-specific news in shaping market trends.

- Future earnings reports are expected to further influence market movements.

Conclusion

This article provided live updates on the Stock Market Today, May 26th, analyzing the performance of the Dow Jones Industrial Average and the S&P 500. We examined key influencing factors and provided an overall assessment of market trends. Staying updated on daily stock market movements is crucial for informed investment decisions. For continued updates on the Stock Market Today and insightful analyses, bookmark this page and check back regularly for the latest information on Dow and S&P 500 performance. Remember to always conduct thorough research before making any investment decisions. Understanding the nuances of the stock market today is key to successful investing.

Featured Posts

-

How Canada And Mexico Can Boost Trade Despite Us Tariffs

May 27, 2025

How Canada And Mexico Can Boost Trade Despite Us Tariffs

May 27, 2025 -

Gerade Noch Bei Den Oscars Jetzt Im Stream Alle Oscar Gewinner Filme Sehen

May 27, 2025

Gerade Noch Bei Den Oscars Jetzt Im Stream Alle Oscar Gewinner Filme Sehen

May 27, 2025 -

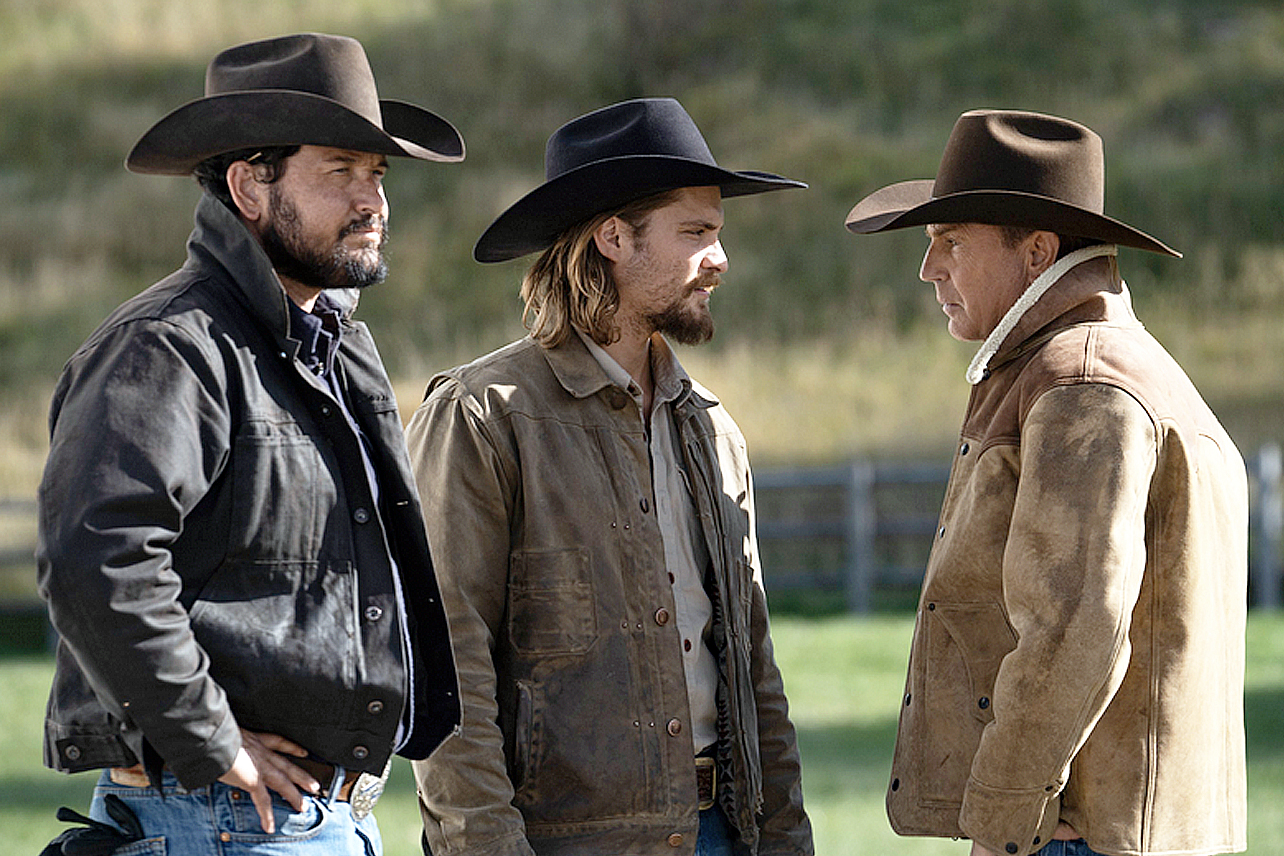

Exploring The Possibilities Yellowstone Season 6 Beth And Rip And A Kayce Series

May 27, 2025

Exploring The Possibilities Yellowstone Season 6 Beth And Rip And A Kayce Series

May 27, 2025 -

Ice Cube To Write And Star In New Last Friday Film

May 27, 2025

Ice Cube To Write And Star In New Last Friday Film

May 27, 2025 -

Victor Osimhen To Manchester United Transfer Update And Speculation

May 27, 2025

Victor Osimhen To Manchester United Transfer Update And Speculation

May 27, 2025

Latest Posts

-

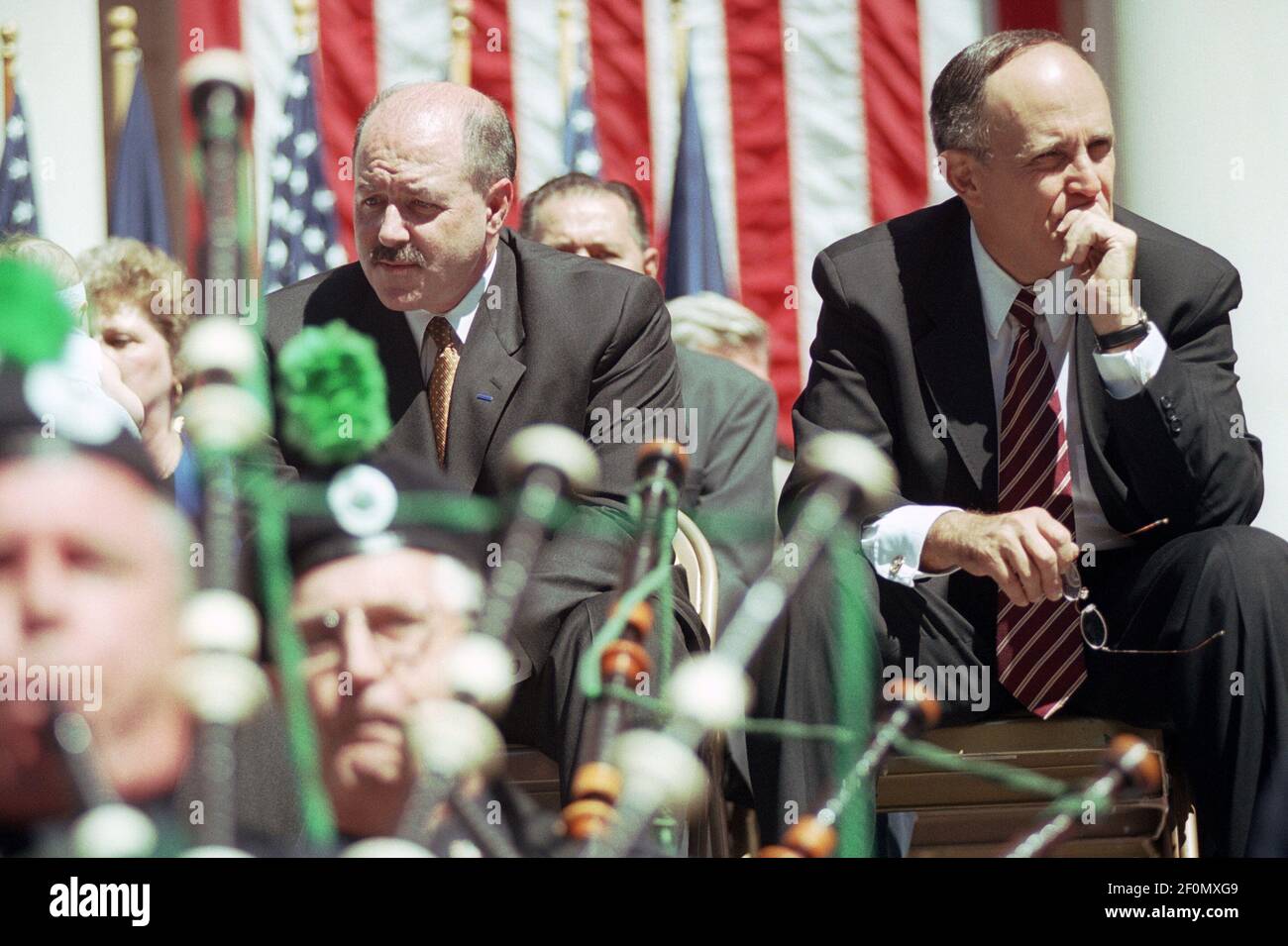

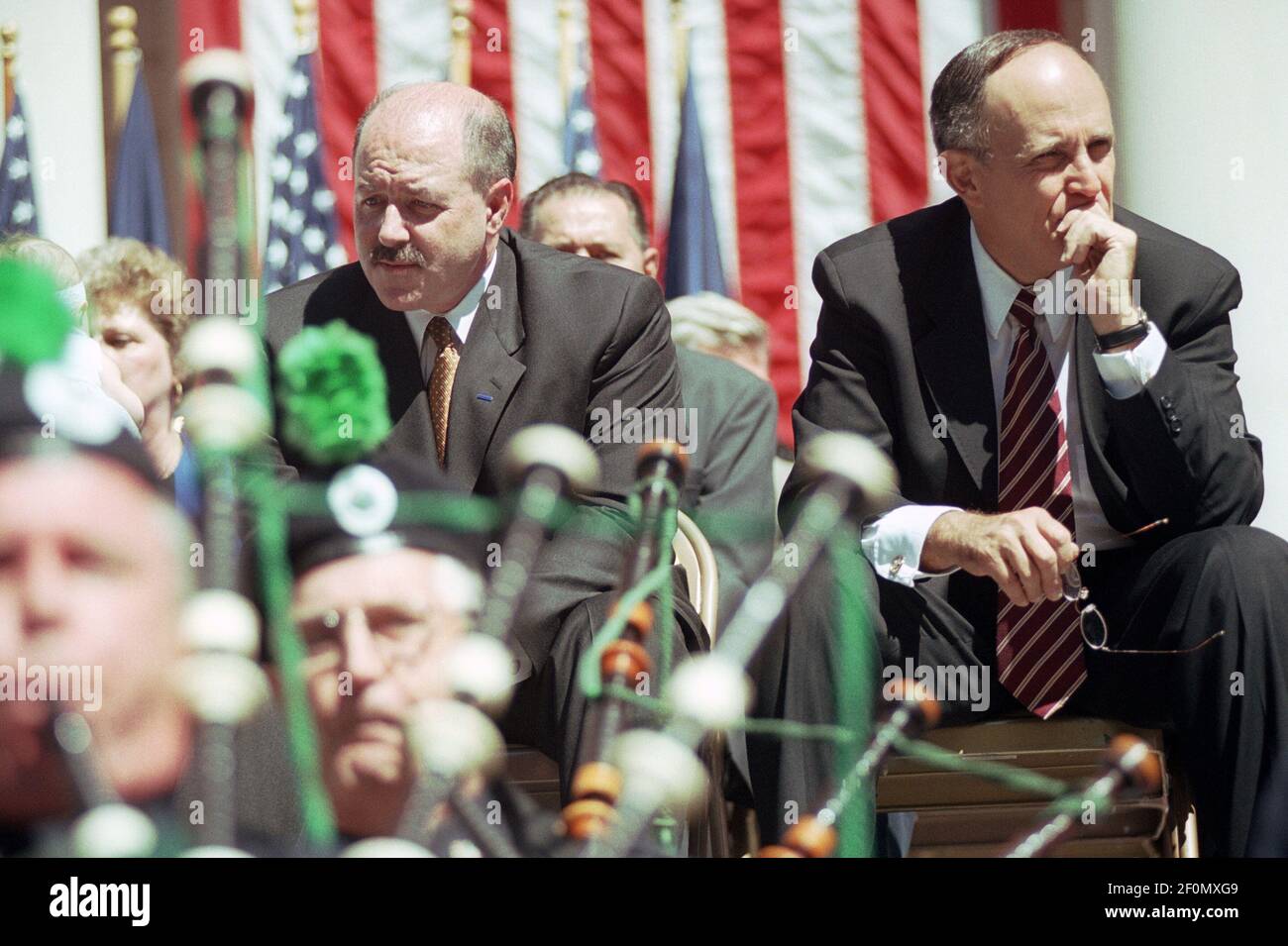

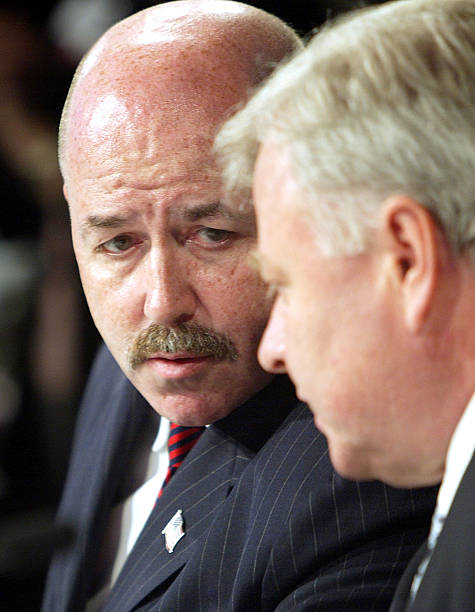

Death Of Bernard Kerik Remembering The 9 11 Nyc Police Commissioner

May 31, 2025

Death Of Bernard Kerik Remembering The 9 11 Nyc Police Commissioner

May 31, 2025 -

9 11 Era Nypd Commissioner Bernard Kerik Dies At Age 69

May 31, 2025

9 11 Era Nypd Commissioner Bernard Kerik Dies At Age 69

May 31, 2025 -

Bernard Kerik A Retrospective On His Career And Conviction

May 31, 2025

Bernard Kerik A Retrospective On His Career And Conviction

May 31, 2025 -

Death Of Bernard Kerik Remembering The 9 11 Era Nypd Commissioner

May 31, 2025

Death Of Bernard Kerik Remembering The 9 11 Era Nypd Commissioner

May 31, 2025 -

Bernard Kerik Nypd Commissioner During 9 11 Passes Away At 69

May 31, 2025

Bernard Kerik Nypd Commissioner During 9 11 Passes Away At 69

May 31, 2025