Stock Market Update: India's Sensex And Nifty 50 Remain Steady Despite Headwinds

Table of Contents

Sensex and Nifty 50 Performance Analysis

Recent Index Movements

The Sensex and Nifty 50 have shown a mixed performance in recent weeks. While experiencing some volatility, both indices have largely managed to hold their ground. For example, in the last month, the Sensex experienced a 2% increase, while the Nifty 50 saw a 1.8% rise. However, daily fluctuations are common, reflecting the dynamic nature of the Indian stock market. (Insert relevant chart or graph here showing the recent performance of both indices) This stability is particularly noteworthy given the considerable global uncertainty.

Sector-wise Performance

Analyzing sector-wise performance reveals a diverse picture.

- IT Sector: The IT sector, a significant contributor to the Nifty 50, has shown relatively strong performance, driven by consistent demand for IT services globally.

- Banking Sector: The banking sector exhibited moderate growth, influenced by factors like interest rate hikes and credit growth.

- FMCG Sector: The fast-moving consumer goods (FMCG) sector has shown resilience, indicating consistent consumer demand despite inflationary pressures.

- Pharma Sector: The pharmaceutical sector experienced mixed performance, with some companies outperforming others based on their individual strategies and product portfolios.

(Insert a table summarizing the performance of these and other key sectors with percentage changes) This diverse performance underscores the importance of diversified investment strategies within the Indian stock market.

Impact of Global Headwinds on Indian Markets

Global Inflation and Interest Rate Hikes

Rising inflation globally, coupled with aggressive interest rate hikes by major central banks, has created significant headwinds. These actions aim to curb inflation, but they also risk slowing economic growth, impacting investor sentiment and potentially leading to market corrections. The Indian stock market isn't immune to these global trends, although its resilience has been comparatively stronger than some other markets.

Geopolitical Uncertainty

Geopolitical tensions, such as the ongoing Russia-Ukraine conflict, introduce significant uncertainty into global markets. These conflicts disrupt supply chains, impact commodity prices (like crude oil), and generally increase investor risk aversion. This translates into volatility in the Indian stock market, although the impact has been somewhat muted due to strong domestic fundamentals.

Crude Oil Prices and Their Impact

Fluctuating crude oil prices significantly impact India's economy and its stock market. India is a net importer of crude oil, so high oil prices increase the country's import bill and fuel inflation. This, in turn, affects investor sentiment and can lead to market corrections. However, the recent relative stability in oil prices has provided some respite.

Factors Contributing to Market Stability

Strong Domestic Fundamentals

Despite global headwinds, India's strong domestic fundamentals have played a crucial role in maintaining market stability. Robust GDP growth, improving consumer spending, and government initiatives focused on infrastructure development and economic reforms contribute to a positive outlook.

Foreign Institutional Investor (FII) Activity

Foreign Institutional Investors (FIIs) have a significant influence on the Indian stock market. While FII investment flows can be volatile, recent trends show a relatively stable pattern, indicating continued confidence in the long-term growth prospects of the Indian economy.

Resilience of Domestic Investors

The increasing participation of domestic investors has also added to market stability. Domestic investors, often with a longer-term investment horizon, tend to be less susceptible to short-term market fluctuations caused by global events. This contributes to a more balanced and resilient market.

Outlook and Predictions for the Future

Analyst Forecasts

Leading market analysts offer a cautiously optimistic outlook for the Sensex and Nifty 50. While acknowledging the persistent global uncertainties, many predict continued growth, albeit at a potentially slower pace than previously anticipated. (Include specific forecasts from reputable sources, citing them appropriately)

Potential Risks and Opportunities

Potential risks include further escalation of global inflation, a potential global recession, and geopolitical instability. However, opportunities abound, including sustained domestic growth, government reforms, and the potential for increased FII investment.

Conclusion

India's Sensex and Nifty 50 indices have demonstrated notable resilience despite facing significant global headwinds. While global inflation, geopolitical risks, and fluctuating crude oil prices pose challenges, strong domestic fundamentals, consistent domestic investor participation, and a relatively stable FII flow have contributed to market stability. The outlook remains cautiously optimistic, with analysts forecasting continued growth, albeit with potential risks and opportunities. Stay informed about the Sensex and Nifty 50, monitor the Indian stock market update regularly, and track the Indian equity market for better investment strategies. For in-depth market analysis and investment advice, consult with a qualified financial advisor.

Featured Posts

-

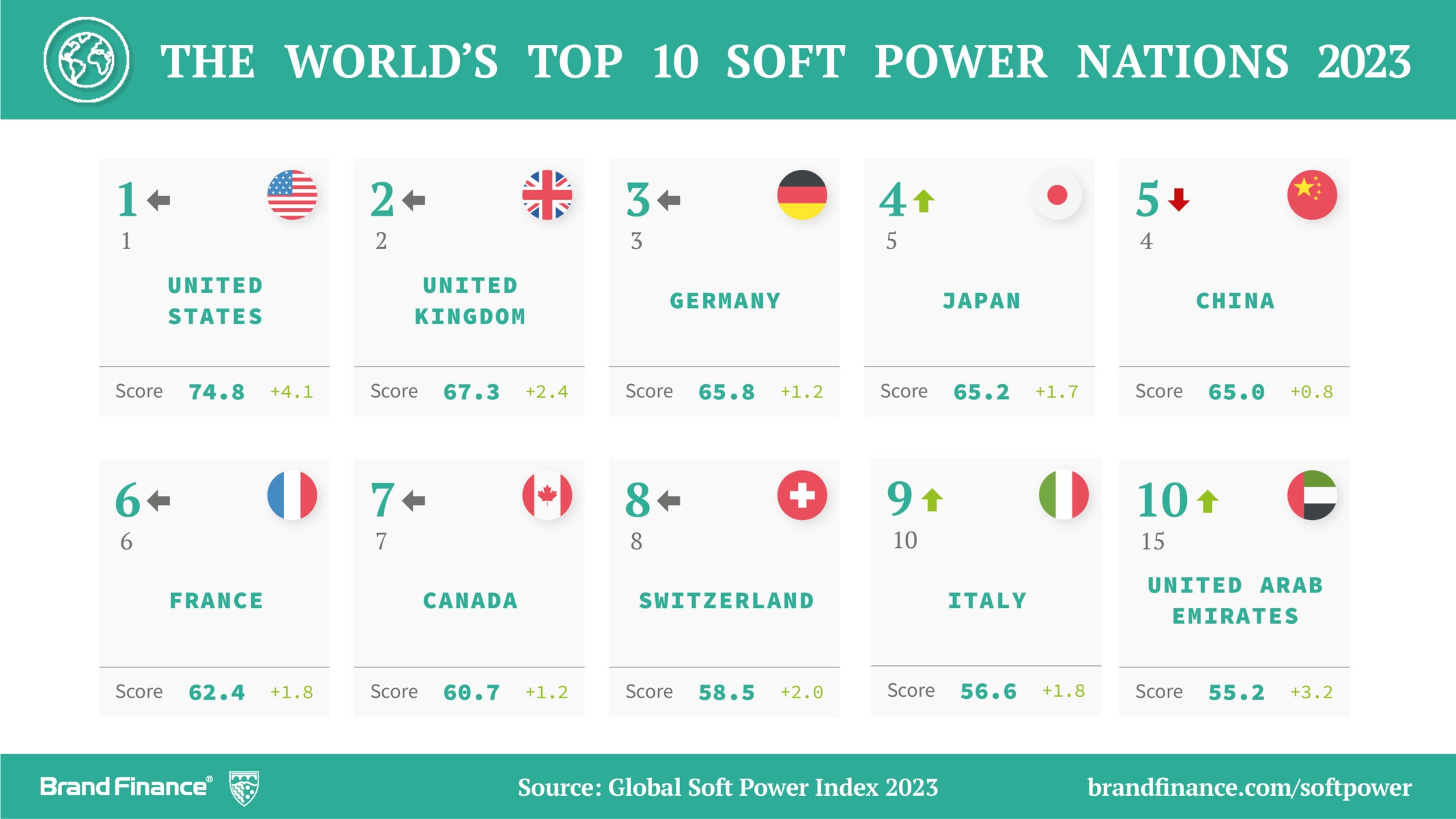

Indias Position In The New Global Power Rankings Analysis And Implications

May 09, 2025

Indias Position In The New Global Power Rankings Analysis And Implications

May 09, 2025 -

Snegopad V Permi Aeroport Vremenno Zakryt Informatsiya Dlya Passazhirov

May 09, 2025

Snegopad V Permi Aeroport Vremenno Zakryt Informatsiya Dlya Passazhirov

May 09, 2025 -

Municipales Dijon 2026 Un Programme Ecologiste Pour La Ville

May 09, 2025

Municipales Dijon 2026 Un Programme Ecologiste Pour La Ville

May 09, 2025 -

Palantir Stock Before May 5th Is Wall Streets Prediction Right

May 09, 2025

Palantir Stock Before May 5th Is Wall Streets Prediction Right

May 09, 2025 -

Phan Tich Loi Khai Bao Mau Bao Hanh Tre Em O Tien Giang

May 09, 2025

Phan Tich Loi Khai Bao Mau Bao Hanh Tre Em O Tien Giang

May 09, 2025