Stock Market Valuation Concerns: Why BofA Remains Optimistic

Table of Contents

BofA's Bullish Case: Analyzing the Current Market Landscape

BofA's bullish case rests on a careful analysis of various valuation metrics and a consideration of broader economic factors. They aren't dismissing the high valuations entirely; instead, they're offering a nuanced perspective that considers several mitigating factors.

-

Specific Metrics and Interpretation: BofA's analysis likely incorporates several key metrics, including the Price-to-Earnings ratio (P/E), the Shiller P/E (CAPE ratio), and other forward-looking indicators. While acknowledging that these metrics currently sit above historical averages, they emphasize the context within which these numbers should be interpreted.

-

Sector-Specific Optimism: BofA may be particularly bullish on certain sectors, such as technology or healthcare, citing strong growth prospects and innovative advancements within those areas as drivers of future earnings growth. This sector-specific analysis helps explain why their overall market outlook remains positive despite elevated valuations across the board.

-

Mitigating Factors: BofA likely points to several factors that mitigate the risks associated with high valuations:

- Strong Corporate Earnings: Consistent and robust corporate earnings growth can justify higher valuations if companies continue to outperform expectations.

- Low Interest Rates: Low interest rates make equities relatively more attractive compared to fixed-income investments, potentially supporting higher valuations.

- Technological Innovation: Groundbreaking technological advancements can drive substantial long-term growth, warranting premium valuations for companies at the forefront of these innovations.

Addressing the Concerns: Why High Valuations Aren't Necessarily a Red Flag

The most common concern surrounding high stock valuations is the potential for a market correction. BofA counters this concern by arguing that current valuations are not necessarily unsustainable.

-

Earnings Growth Outpacing Valuation Increases: BofA's optimistic outlook hinges on the belief that continued earnings growth will outpace any further increases in valuations. This would mean that even with higher prices, the underlying value of companies remains strong, thus mitigating valuation risks.

-

The Low Interest Rate Environment: The prolonged period of low interest rates has influenced asset pricing across the board. BofA likely argues that this artificially low cost of capital contributes to higher valuations, and that a gradual increase in interest rates would be manageable.

-

Technological Disruption and Innovation: Rapid technological advancement creates new markets and opportunities for growth. BofA likely identifies specific technological trends that justify higher valuations for companies successfully leveraging these innovations.

-

Acknowledging Potential Risks: While optimistic, BofA likely acknowledges potential risks, such as rising inflation or geopolitical instability. However, their analysis likely incorporates strategies to mitigate these risks, emphasizing the importance of diversification and risk management.

BofA's Investment Strategies and Recommendations

Based on their optimistic outlook, BofA is likely to recommend specific investment strategies and portfolio allocations.

-

Portfolio Allocation: They might advise a balanced portfolio approach, perhaps suggesting an allocation tilted towards sectors they deem to be high-growth and resilient.

-

Specific Investment Recommendations: While specific investment recommendations may vary depending on individual investor profiles and risk tolerance, BofA may highlight certain sectors or asset classes that align with their positive market outlook.

-

Risk Management Strategies: BofA will likely emphasize the importance of risk management, suggesting strategies like diversification across asset classes and geographies to mitigate potential downsides.

Long-Term Growth Projections and Supporting Factors

BofA's long-term market projections are crucial to understanding their optimistic stance.

-

Projected Economic Growth Rates: Their positive outlook relies on projected economic growth rates that are consistent with their valuation assessments.

-

Impact of Government Policies and Global Events: BofA's analysis likely considers the impact of government policies (fiscal and monetary) and global events, assessing potential risks and opportunities.

-

Technological Advancements: Continuous technological innovation remains a cornerstone of BofA's long-term growth projections, driving productivity gains and creating new avenues for investment.

Conclusion: Navigating Stock Market Valuation Concerns with BofA's Perspective

BofA's optimism regarding current stock market valuations stems from a comprehensive analysis that considers both valuation metrics and broader economic factors. Their bullish stance emphasizes the potential for continued earnings growth to outpace valuation increases, supported by low interest rates and ongoing technological innovation. While acknowledging potential risks, BofA's approach suggests a nuanced perspective, advising investors to consider diversification and risk management strategies. Understand the nuances of current stock market valuations and learn how BofA's optimistic outlook can inform your investment decisions. Explore BofA's research and resources to gain a more comprehensive perspective on navigating stock market valuation concerns.

Featured Posts

-

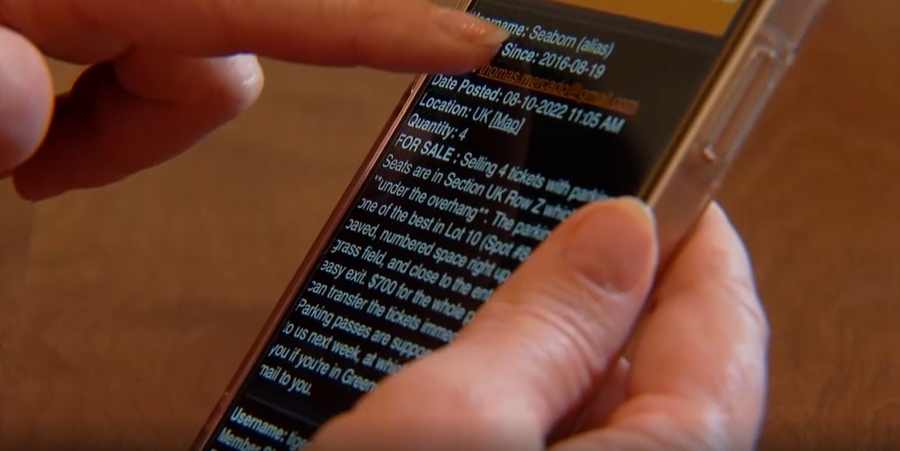

Fake Ticket Sellers Target Ticketmaster Customers Urgent Warning Issued

May 30, 2025

Fake Ticket Sellers Target Ticketmaster Customers Urgent Warning Issued

May 30, 2025 -

Injured Musetti Falls To Alcaraz In Monte Carlo Masters Final

May 30, 2025

Injured Musetti Falls To Alcaraz In Monte Carlo Masters Final

May 30, 2025 -

Bts 2025 Dates Des Examens Et Annonce Des Resultats

May 30, 2025

Bts 2025 Dates Des Examens Et Annonce Des Resultats

May 30, 2025 -

Alcarazs Monte Carlo Masters Win Overcoming Musettis Injury

May 30, 2025

Alcarazs Monte Carlo Masters Win Overcoming Musettis Injury

May 30, 2025 -

Amorims Worrying Claim About Manchester United Star Trust Issues

May 30, 2025

Amorims Worrying Claim About Manchester United Star Trust Issues

May 30, 2025

Latest Posts

-

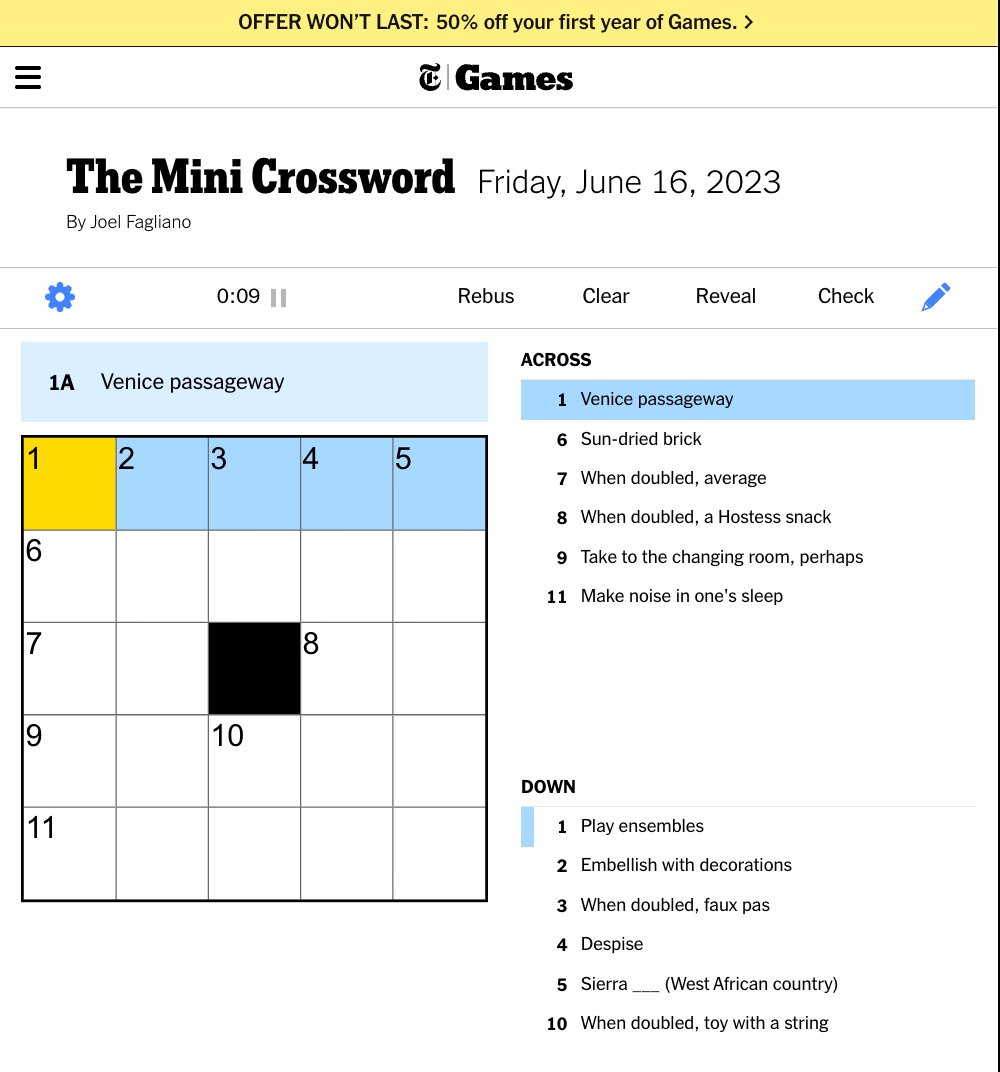

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025 -

April 19th Nyt Mini Crossword All The Clues And Answers You Need

May 31, 2025

April 19th Nyt Mini Crossword All The Clues And Answers You Need

May 31, 2025 -

Nyt Mini Crossword Saturday April 19th Complete Solutions And Clues

May 31, 2025

Nyt Mini Crossword Saturday April 19th Complete Solutions And Clues

May 31, 2025 -

March 31 2025 Nyt Mini Crossword Complete Solution Guide

May 31, 2025

March 31 2025 Nyt Mini Crossword Complete Solution Guide

May 31, 2025 -

Nyt Mini Crossword Answers For March 31 2025

May 31, 2025

Nyt Mini Crossword Answers For March 31 2025

May 31, 2025