Stock Market Valuations: BofA's Argument For Investor Calm

Table of Contents

BofA's Valuation Metrics and Their Implications

BofA employs a multifaceted approach to assessing stock market valuations, utilizing a range of established metrics to paint a comprehensive picture. Their methodology goes beyond simple price-to-earnings ratios (P/E) to incorporate more nuanced indicators that provide a longer-term perspective.

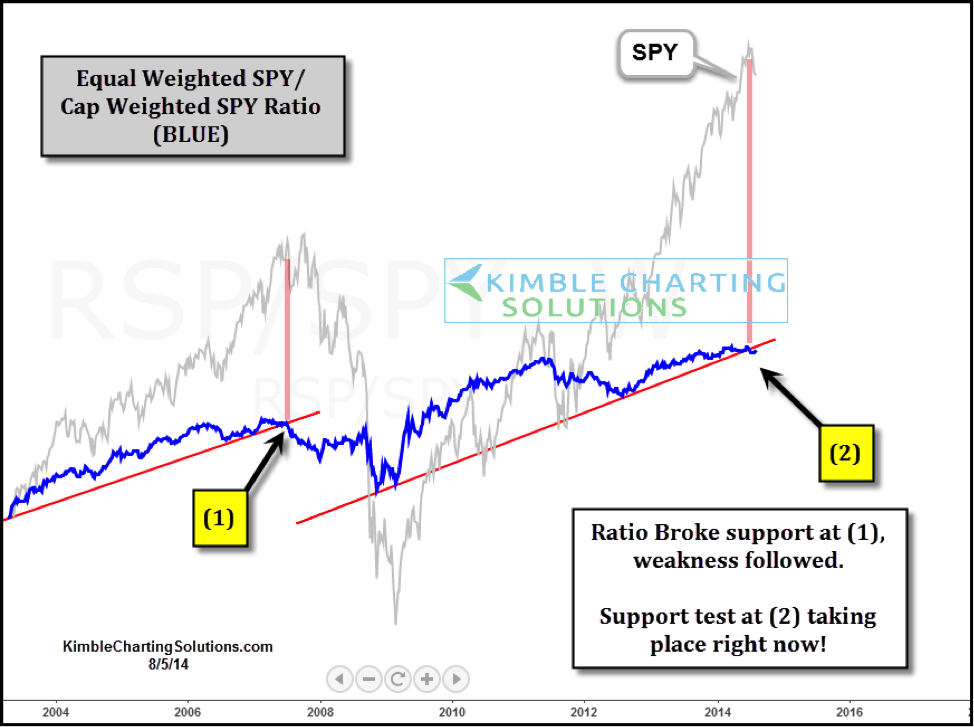

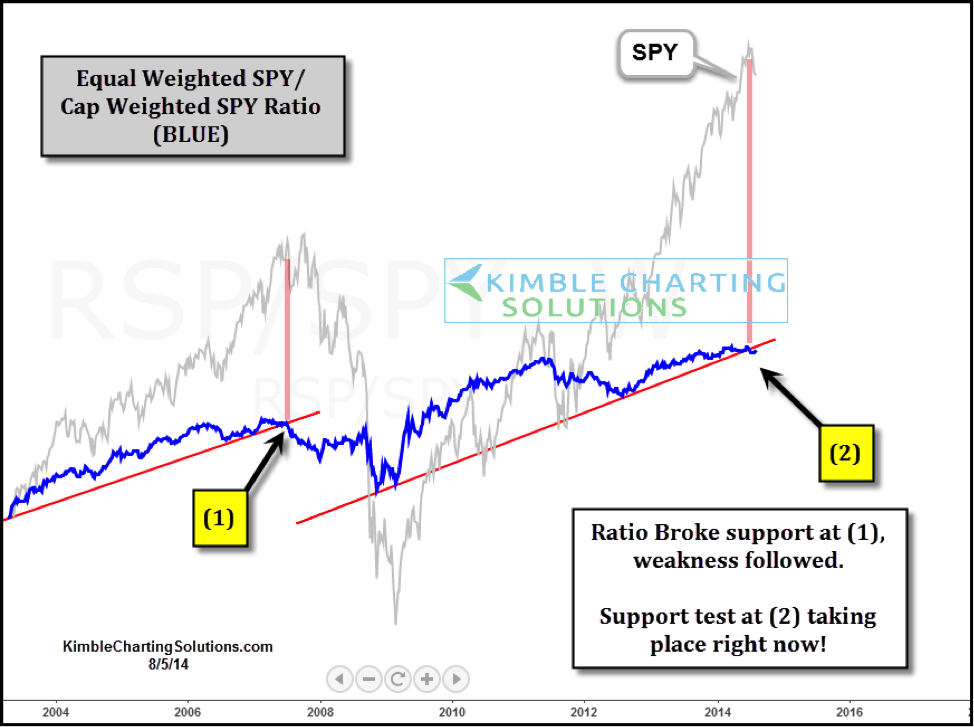

- Price-to-Earnings Ratio (P/E): BofA analyzes current P/E ratios across various sectors and the overall market, comparing them to historical averages and industry benchmarks. This helps gauge whether current prices reflect future earnings potential.

- Cyclically Adjusted Price-to-Earnings Ratio (CAPE): This metric, also known as the Shiller P/E ratio, smooths out earnings fluctuations over a longer period (typically 10 years), offering a more stable measure of valuation relative to long-term earnings trends. BofA likely uses CAPE to account for economic cycles and avoid short-term distortions.

- Other Valuation Metrics: BofA's analysis probably incorporates additional metrics like dividend yield, price-to-book ratio, and enterprise value-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) to provide a holistic view of market valuation.

Determining whether these metrics currently suggest overvaluation, undervaluation, or fair value requires careful interpretation and comparison to historical data. While specific numerical data is unavailable without access to BofA's proprietary research, it's crucial to understand that the interpretation of these metrics is context-dependent. Factors like interest rate changes and economic growth projections significantly influence the assessment. For long-term investors, BofA's findings likely highlight opportunities for strategic asset allocation, focusing on undervalued sectors or maintaining a diversified portfolio to mitigate risks associated with potential overvaluation in specific areas.

Addressing Macroeconomic Concerns and Their Impact on Valuations

BofA's valuation analysis doesn't exist in a vacuum. It's heavily influenced by macroeconomic factors that can significantly impact stock market valuations. These include:

- Inflation: High inflation erodes purchasing power and increases interest rates, potentially impacting corporate profitability and investor sentiment.

- Interest Rates: Rising interest rates increase borrowing costs for companies and can make bonds more attractive relative to stocks, potentially dampening equity valuations.

- Geopolitical Risks: Global events, such as wars or trade disputes, introduce uncertainty and volatility into the market, impacting investor confidence and valuations.

BofA likely incorporates these factors into their models through scenario analysis, assessing the potential impact of different macroeconomic outcomes on their valuation metrics. Their outlook on these factors influences their overall assessment of market risk and informs their recommendations for investors. For example, a pessimistic outlook on inflation might lead them to favor value stocks over growth stocks.

BofA's Sector-Specific Analyses and Investment Strategies

BofA's research likely extends beyond a broad market assessment, providing sector-specific analyses and investment strategies. This granular approach allows investors to make more informed decisions based on specific opportunities and risks within different sectors.

- Overvalued Sectors: BofA might identify sectors currently trading at high valuations relative to their earnings potential or future growth prospects. This could guide investors to reduce exposure in these areas.

- Undervalued Sectors: Conversely, BofA's analysis might point to sectors with attractive valuations, offering potential for higher returns, and warranting increased allocation.

- Investment Strategies: Based on their sector-specific valuations and macroeconomic outlook, BofA likely recommends specific investment strategies, ranging from active stock picking to passive index investing. They might suggest sector rotation, tactical asset allocation, or a combination of strategies to optimize risk and return.

The rationale behind these strategies hinges on BofA's assessment of risk and reward in different sectors. This may involve emphasizing diversification to mitigate risk, focusing on companies with strong balance sheets, and capitalizing on market inefficiencies.

Counterarguments and Potential Risks

While BofA's analysis provides a valuable perspective, it's crucial to acknowledge potential counterarguments and inherent risks:

- Unforeseen Economic Shocks: Unexpected events, such as a global pandemic or a major financial crisis, can significantly impact stock market valuations, regardless of existing models.

- Geopolitical Instability: Escalating geopolitical tensions can introduce extreme volatility and unpredictability into the market.

- Model Limitations: Valuation models are inherently based on assumptions and historical data, which may not accurately reflect future market behavior.

BofA's analysis likely addresses these risks by incorporating margin of safety principles, stress testing its models under various scenarios, and emphasizing the importance of diversification and long-term investment horizons.

Conclusion: Maintaining Perspective on Stock Market Valuations

BofA's approach to stock market valuations emphasizes a measured, nuanced perspective, acknowledging both the potential for growth and the presence of inherent risks. Their analysis, incorporating diverse metrics, macroeconomic considerations, and sector-specific insights, helps investors make more informed decisions. Key takeaways include the importance of using multiple valuation metrics for a complete picture, considering macroeconomic factors in investment strategies, and acknowledging potential risks and uncertainties. It's vital to remember that long-term investment horizons and effective risk management are crucial for navigating the inherent volatility of the market. We strongly encourage you to conduct your own thorough research on stock market valuations, consulting reputable sources and financial advisors before making any investment decisions. For further insights, consider exploring BofA's published research and reports on market analysis and investment strategies.

Featured Posts

-

Vanja Mijatovic Demantira Glasine O Razvodu Istina O Njenom Braku

May 21, 2025

Vanja Mijatovic Demantira Glasine O Razvodu Istina O Njenom Braku

May 21, 2025 -

Klopp Un Gelecegi Transfer Spekuelasyonlari Ve Son Gelismeler

May 21, 2025

Klopp Un Gelecegi Transfer Spekuelasyonlari Ve Son Gelismeler

May 21, 2025 -

Preparing For Drier Weather A Practical Guide

May 21, 2025

Preparing For Drier Weather A Practical Guide

May 21, 2025 -

Low Fi Rock Vapors Of Morphine Live In Northcote

May 21, 2025

Low Fi Rock Vapors Of Morphine Live In Northcote

May 21, 2025 -

The Goldbergs Exploring The Shows Humor And Heart

May 21, 2025

The Goldbergs Exploring The Shows Humor And Heart

May 21, 2025

Latest Posts

-

Germanys 5 4 Aggregate Victory Sends Them To Uefa Nations League Final Four

May 21, 2025

Germanys 5 4 Aggregate Victory Sends Them To Uefa Nations League Final Four

May 21, 2025 -

Borussia Dortmunds Victory Fueled By Beiers Double Against Mainz

May 21, 2025

Borussia Dortmunds Victory Fueled By Beiers Double Against Mainz

May 21, 2025 -

Schock Fuer Leipzig Kein Champions League Bochum Und Kiel Abgestiegen

May 21, 2025

Schock Fuer Leipzig Kein Champions League Bochum Und Kiel Abgestiegen

May 21, 2025 -

Saisonende Bundesliga Abstieg Bochum Kiel Leipzig Verpasst Champions League

May 21, 2025

Saisonende Bundesliga Abstieg Bochum Kiel Leipzig Verpasst Champions League

May 21, 2025 -

Goretzkas Nations League Call Up Nagelsmanns Germany Squad Announcement 03 13 2025

May 21, 2025

Goretzkas Nations League Call Up Nagelsmanns Germany Squad Announcement 03 13 2025

May 21, 2025