Stock Market Valuations: BofA's Case For Remaining Calm

Table of Contents

BofA's Valuation Metrics and Their Interpretation

BofA employs a multifaceted approach to analyzing stock market valuations, going beyond simple headline figures to provide a nuanced understanding of the current market landscape.

Analyzing Price-to-Earnings Ratios (P/E):

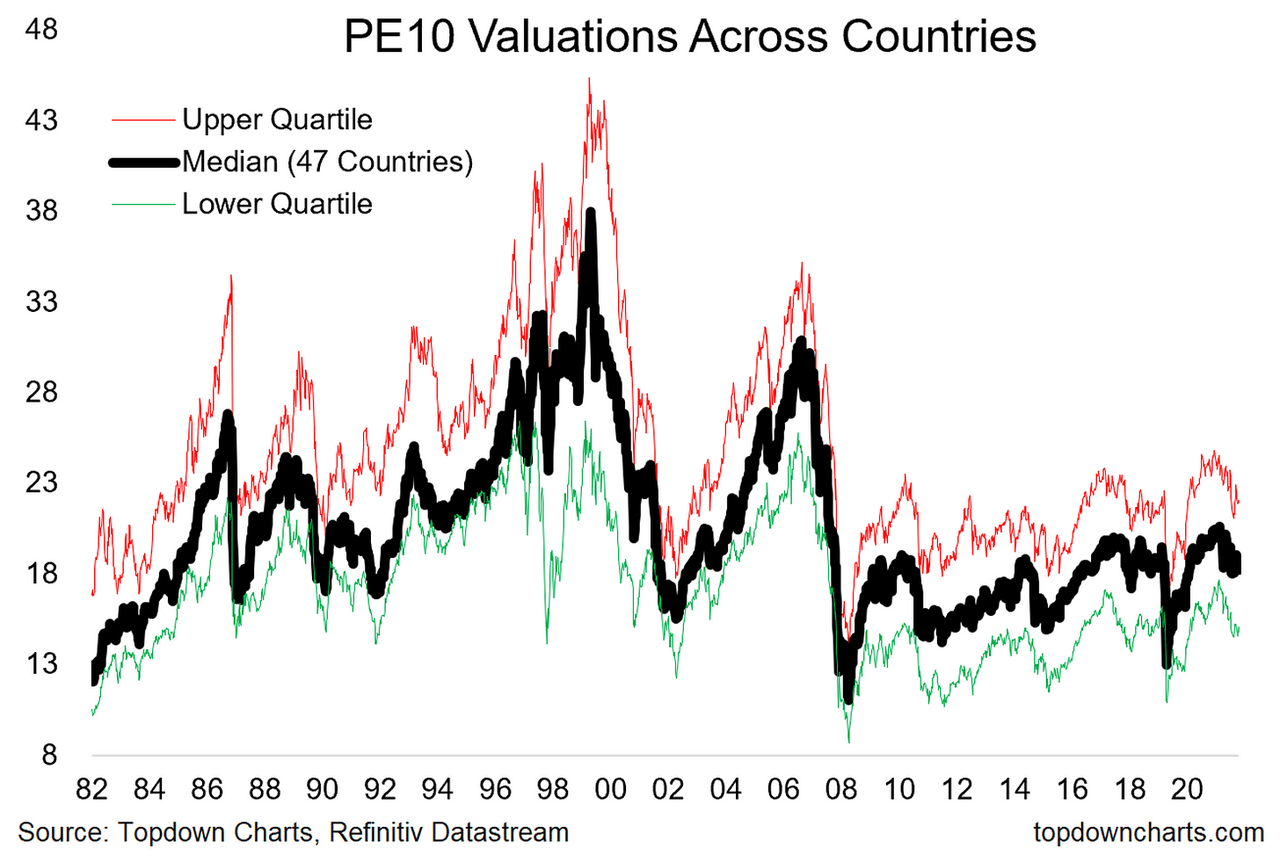

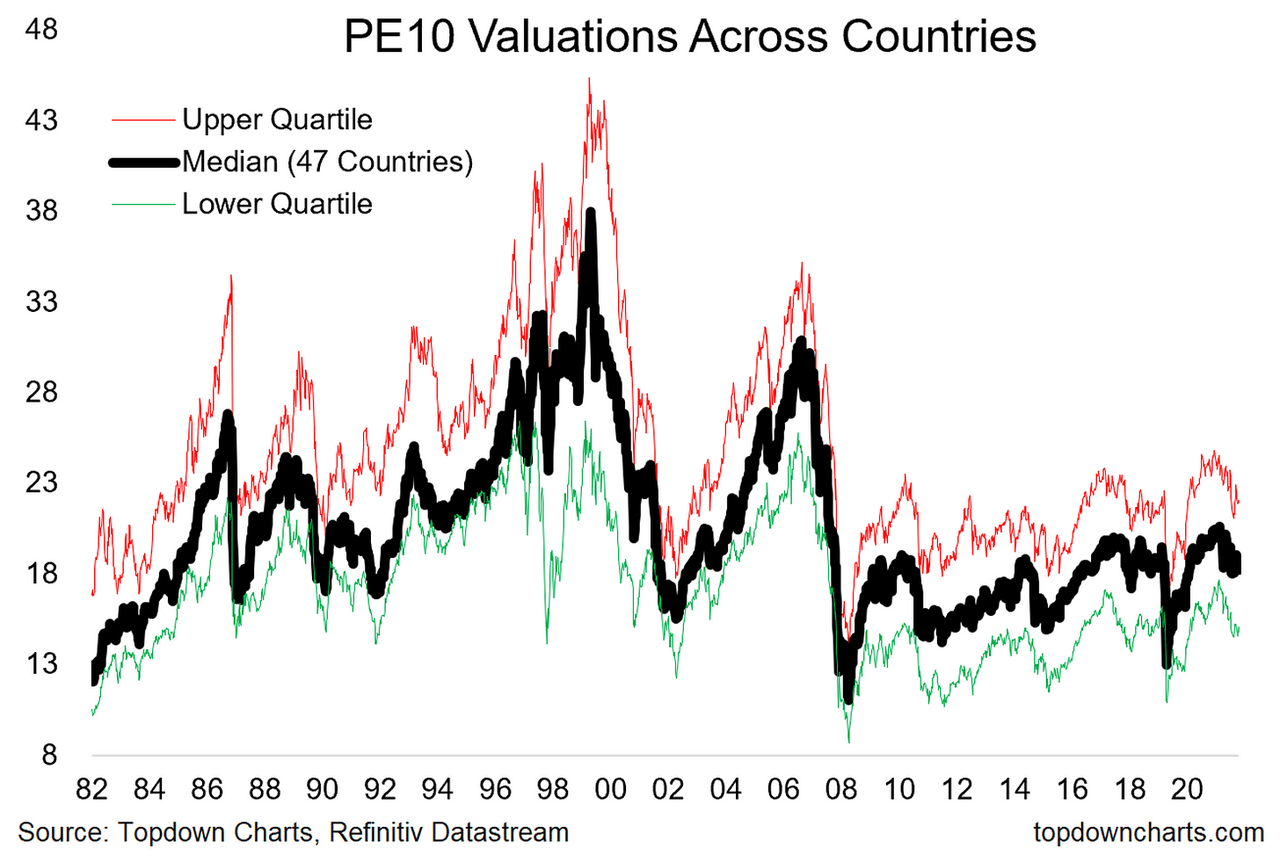

BofA's analysis of Price-to-Earnings (P/E) ratios is a cornerstone of their valuation strategy. P/E ratios, representing the price of a stock relative to its earnings per share, provide a crucial insight into market valuation. While some sectors might show elevated P/E ratios, indicating potentially overvalued stocks, others may present opportunities.

- Technology Sector: BofA notes that the tech sector's P/E ratios are currently higher than historical averages, reflecting investor optimism about future growth. However, they also highlight the sector's inherent volatility.

- Energy Sector: Conversely, the energy sector's P/E ratios may appear comparatively low, potentially suggesting undervaluation in certain segments. This is driven, in part, by fluctuating oil prices and increased regulatory scrutiny.

- Comparison to Historical Averages: BofA's analysis compares current P/E ratios against historical data spanning several decades, providing context for current valuations and identifying potential outliers. They emphasize that historical context is crucial in understanding the current market environment, considering factors like interest rates, inflation and economic growth.

- Methodology and Data Sources: BofA utilizes proprietary data models and widely accepted financial data sources to ensure the accuracy and robustness of their P/E ratio analysis. This transparency increases the credibility of their findings.

Considering Other Key Valuation Metrics:

BofA recognizes the limitations of relying solely on P/E ratios. They incorporate other key valuation metrics to provide a more comprehensive picture.

- Price-to-Sales (P/S) Ratio: This metric compares a company's market capitalization to its revenue, offering a useful alternative for companies with negative earnings. BofA's analysis reveals that P/S ratios vary significantly across sectors, offering another layer of understanding to overall valuation.

- Price-to-Book (P/B) Ratio: The P/B ratio compares a company's market value to its book value (assets minus liabilities). This metric is often used for value investing and provides further insight into potential undervaluation. BofA uses this metric to identify potentially undervalued companies in sectors beyond technology.

- Dividend Yield: For income-oriented investors, dividend yield is a key metric. BofA's analysis considers dividend yields in relation to overall market valuations and interest rates, offering additional perspective for portfolio construction.

The Impact of Interest Rates on Stock Market Valuations:

Interest rates significantly influence stock market valuations. BofA highlights the inverse relationship between interest rates and stock prices. Higher interest rates often lead to lower stock prices as investors shift towards fixed-income securities offering higher returns.

- Inverse Relationship: Higher interest rates increase the opportunity cost of holding stocks, as investors can earn higher returns with less risk in bonds or other fixed-income instruments.

- BofA's Interest Rate Predictions: BofA's economists provide forecasts for future interest rate movements, which are incorporated into their stock market valuation models. These forecasts are crucial in assessing the potential impact of monetary policy on market performance.

- Mitigating Factors: BofA acknowledges that other factors, such as economic growth and inflation, can mitigate the impact of interest rate changes on stock valuations.

Macroeconomic Factors and Their Influence

BofA's valuation assessment extends beyond company-specific metrics, incorporating a comprehensive analysis of macroeconomic factors.

Global Economic Growth and its Impact:

Global economic growth significantly impacts stock market valuations. Stronger global growth typically fuels higher corporate earnings and boosts investor confidence, leading to higher stock prices.

- Key Influencing Factors: BofA considers inflation, supply chain disruptions, geopolitical risks and consumer spending as key factors influencing global economic growth.

- BofA's Growth Forecast: BofA's economic forecasts provide insights into the potential trajectory of global growth, informing their valuation analysis and market outlook. These forecasts also consider the potential impact of government policies on economic activity.

Geopolitical Risks and Their Potential Effects:

Geopolitical risks, such as wars, trade disputes, and political instability, introduce uncertainty into the market and can significantly impact stock valuations.

- Specific Geopolitical Risks: BofA identifies specific geopolitical risks and assesses their potential impact on different sectors and market segments. They acknowledge the inherent uncertainty and volatility linked to such events.

- BofA's Risk Assessment: BofA's analysts assess the likelihood and potential severity of these risks, incorporating their findings into their overall valuation models. This assessment includes analyzing the potential ripple effects of geopolitical events on various economies and markets.

Inflation and its Role in Stock Market Valuations:

Inflation significantly influences stock valuations. High inflation erodes corporate profits and investor purchasing power, potentially leading to lower stock prices.

- Inflation and Stock Prices: BofA notes the negative correlation between high inflation and stock market performance, particularly during periods of sustained inflation.

- BofA's Inflation Predictions: BofA's inflation predictions influence their overall market outlook and inform their recommendations to investors. They carefully monitor inflation trends and their potential impact on market valuations and economic growth.

BofA's Recommendations for Investors

Based on their comprehensive analysis, BofA offers several recommendations for investors navigating the current market environment.

Maintaining a Long-Term Perspective:

BofA strongly advises investors to maintain a long-term perspective. Short-term market fluctuations are inevitable, and focusing on long-term growth is crucial for success.

- Riding Out Volatility: BofA emphasizes the importance of remaining invested and weathering short-term market volatility. Investors should resist panic selling during market downturns.

- Advantages of Long-Term Investing: BofA highlights the significant benefits of long-term investing strategies, including compounding returns and the ability to ride out market cycles.

Diversification Strategies:

Diversification is key to mitigating risk. BofA recommends diversifying across different asset classes, sectors, and geographies.

- Diversified Portfolio Examples: BofA provides examples of well-diversified portfolios, highlighting the importance of asset allocation based on individual risk profiles and investment goals.

- Importance of Asset Allocation: BofA emphasizes the importance of carefully allocating assets across different asset classes, such as stocks, bonds, real estate, and alternative investments, to optimize returns and minimize risk.

Considering Individual Risk Tolerance:

Investing should align with individual risk tolerance. BofA encourages investors to carefully assess their risk tolerance before making investment decisions.

- Assessing Risk Tolerance: BofA suggests various methods for assessing individual risk tolerance, considering factors such as age, financial goals, and investment time horizon.

- Matching Strategies to Risk Profiles: BofA emphasizes the importance of aligning investment strategies with individual risk profiles to ensure that investment decisions are consistent with an investor's comfort level and financial circumstances.

Conclusion: Understanding Stock Market Valuations and Maintaining Perspective

BofA's analysis suggests that while current stock market valuations may present some concerns in specific sectors, a long-term perspective is crucial. Their assessment, incorporating various valuation metrics and macroeconomic factors, indicates that panic selling is unwarranted. By understanding the nuances of stock market valuations and employing diversification strategies aligned with individual risk tolerance, investors can navigate market volatility and achieve their long-term financial goals. Don't let short-term market anxieties dictate your long-term investment strategy. Learn more about effective stock market valuation analysis and develop a plan that aligns with your goals. Consult with a financial advisor to create a personalized investment strategy informed by a thorough understanding of current stock market valuations.

Featured Posts

-

Access To Birth Control The Otc Revolution After Roe V Wade

May 19, 2025

Access To Birth Control The Otc Revolution After Roe V Wade

May 19, 2025 -

The Man Who Saved Jersey Battle Of Flowers

May 19, 2025

The Man Who Saved Jersey Battle Of Flowers

May 19, 2025 -

Ufc 313 Every Ko And Submission Finish

May 19, 2025

Ufc 313 Every Ko And Submission Finish

May 19, 2025 -

Juan Aguilera Mentor De Boris Becker Ha Fallecido

May 19, 2025

Juan Aguilera Mentor De Boris Becker Ha Fallecido

May 19, 2025 -

The Eus Tightening Grip A Rising Tide Of European Emigration

May 19, 2025

The Eus Tightening Grip A Rising Tide Of European Emigration

May 19, 2025