Stock Market Valuations: BofA's Reassurance For Concerned Investors

Table of Contents

BofA's Assessment of Current Stock Market Valuations

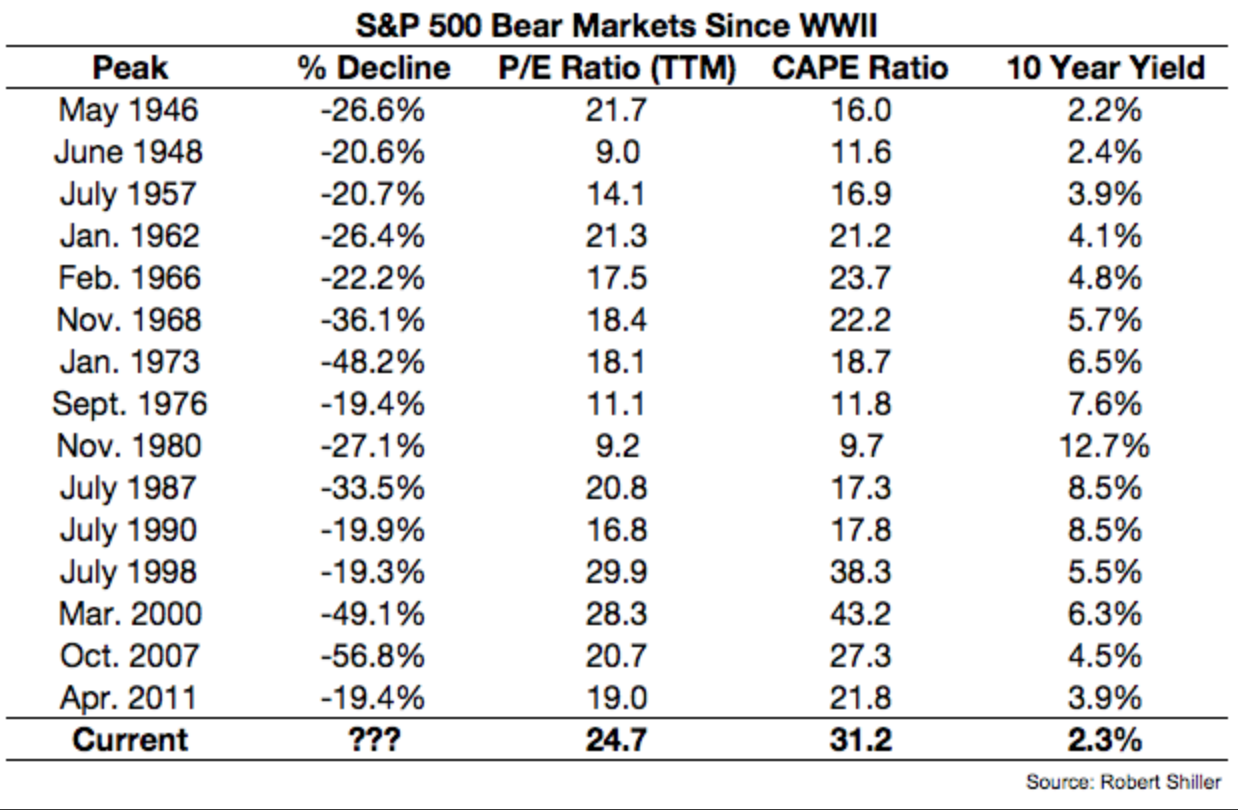

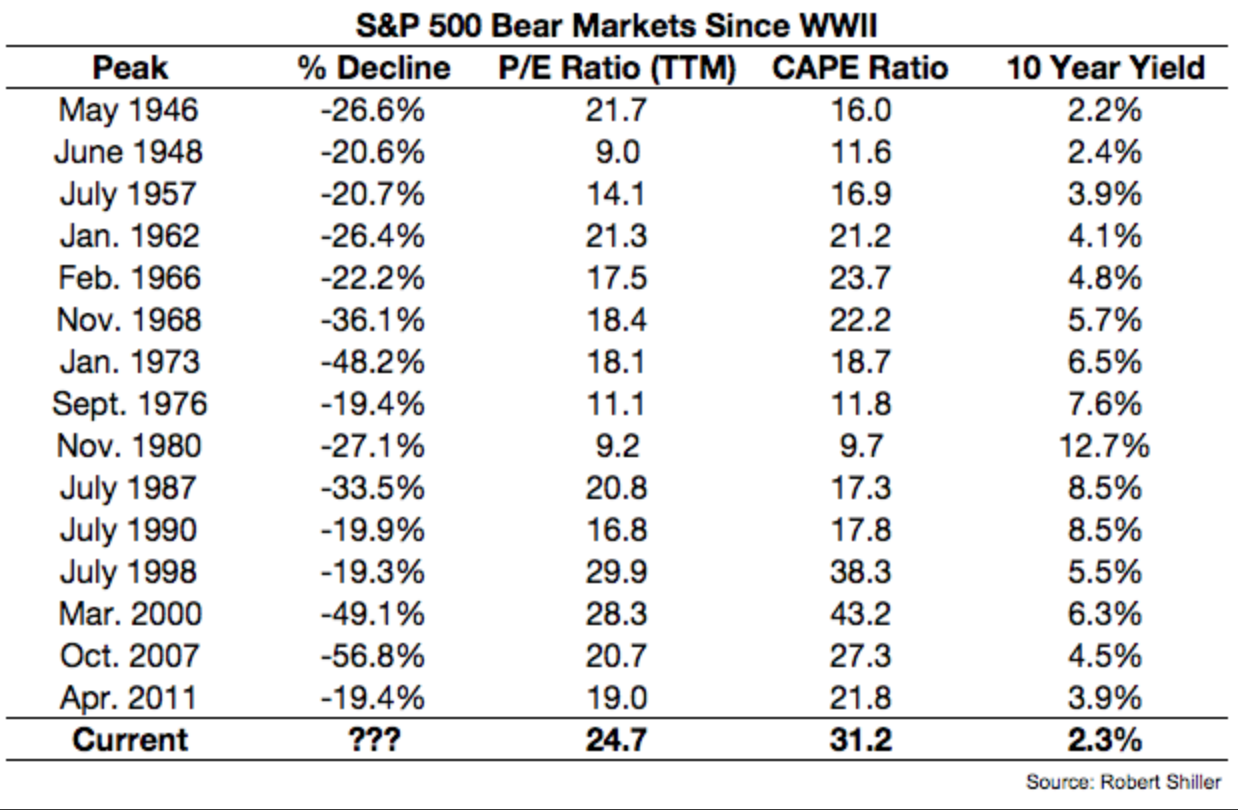

BofA employs a multifaceted approach to evaluating stock market valuations, utilizing several key metrics. Their analysis incorporates a range of valuation tools, including price-to-earnings ratios (P/E), price-to-book ratios (P/B), and dividend yields. By comparing these metrics to historical averages and considering various macroeconomic factors, they arrive at a comprehensive assessment.

BofA's key findings suggest that while valuations are not historically low, they are not excessively high either. Their analysis points towards a relatively fair valuation in the current market, considering the prevailing economic conditions.

- Specific valuation metrics used by BofA: P/E ratios, P/B ratios, dividend yields, cyclically adjusted price-to-earnings ratio (CAPE ratio).

- Comparison to historical valuations: BofA’s analysis compares current valuations to long-term averages, adjusting for factors like inflation and economic growth. They might find that while certain sectors appear relatively expensive, others are trading at historically attractive levels.

- Specific sectors or indices highlighted in BofA's analysis: The report may identify specific sectors, such as technology or energy, where valuations appear more or less attractive based on their analysis. They might also provide insights into regional differences in valuations across various stock market indices.

Factors Influencing BofA's Positive Outlook

BofA's relatively positive outlook on stock market valuations is underpinned by several macroeconomic factors. These factors contribute to a more optimistic view of future corporate earnings and overall market performance.

- Economic growth projections: BofA’s analysis likely incorporates projections for continued, albeit possibly slower, economic growth, suggesting that corporate profits are expected to remain robust, supporting current valuations.

- Interest rate expectations: The bank's assessment probably considers the trajectory of interest rates, anticipating their impact on corporate borrowing costs and investor behavior. Lower interest rates generally support higher valuations.

- Inflationary pressures and their impact on valuations: BofA's analysis likely acknowledges inflationary pressures and their potential to impact corporate profitability and investor sentiment. However, their positive outlook suggests that these pressures are manageable.

- Geopolitical factors and their influence: Geopolitical events and uncertainties are considered, with BofA likely assessing their potential impact on market valuations. The bank will attempt to quantify these risks and incorporate them into their overall assessment.

Strategies for Investors Based on BofA's Analysis

BofA's analysis can inform several investment strategies. Investors should consider their individual risk tolerance and investment goals.

- Specific investment recommendations (if any): While BofA may not offer specific stock picks, their analysis could highlight sectors or asset classes that appear undervalued.

- Strategies for mitigating risk: Investors may choose to diversify their portfolios across asset classes to mitigate risks associated with individual stocks or sectors.

- Importance of diversification: Diversification remains a crucial strategy for managing risk, regardless of the overall market outlook. Spreading investments across various asset classes can help cushion against losses in any single area.

- Long-term vs. short-term investment perspectives: BofA's assessment should primarily guide long-term investment decisions. Short-term market fluctuations are less influenced by fundamental valuations.

Alternative Perspectives and Potential Risks

It's crucial to acknowledge that different analysts hold varying viewpoints on stock market valuations. While BofA offers a relatively optimistic assessment, other analysts may express more cautious opinions.

- Potential downsides of the current market conditions: Higher interest rates, a potential economic slowdown, or unexpected geopolitical events could negatively affect stock market valuations.

- Risks related to specific sectors or industries: Certain sectors may be more vulnerable to specific economic or regulatory changes, leading to greater volatility in their valuations.

- Unforeseeable events that could impact valuations: Black swan events – unexpected and highly impactful occurrences – remain a constant risk that can significantly affect stock market valuations.

Conclusion: Understanding Stock Market Valuations and Investing Wisely

BofA's analysis suggests that while current stock market valuations aren't excessively high, they are not historically cheap either. Investors should carefully consider the macroeconomic factors influencing the market and diversify their portfolios to manage risk. Remember that informed decision-making is key to successful investing. Conduct your own thorough research, and consult with a qualified financial advisor before making any investment decisions. Learn more about effectively managing your investments and understanding current stock market valuations. Consider seeking professional advice on navigating the complexities of stock market valuations.

Featured Posts

-

Significant Changes To Carneys Cabinet Focus On Energy Housing And Ai

May 16, 2025

Significant Changes To Carneys Cabinet Focus On Energy Housing And Ai

May 16, 2025 -

West Broad Street Foot Locker Man Dies After Altercation Crime Insider Details

May 16, 2025

West Broad Street Foot Locker Man Dies After Altercation Crime Insider Details

May 16, 2025 -

Bombay Hc Rejects Plea Challenging Dial 108 Ambulance Contract

May 16, 2025

Bombay Hc Rejects Plea Challenging Dial 108 Ambulance Contract

May 16, 2025 -

Penarol Vs Olimpia Resultado Final 0 2 Resumen Y Analisis Del Juego

May 16, 2025

Penarol Vs Olimpia Resultado Final 0 2 Resumen Y Analisis Del Juego

May 16, 2025 -

Is There Really Tension Between Jill Biden And Kamala Harris A Detailed Look

May 16, 2025

Is There Really Tension Between Jill Biden And Kamala Harris A Detailed Look

May 16, 2025