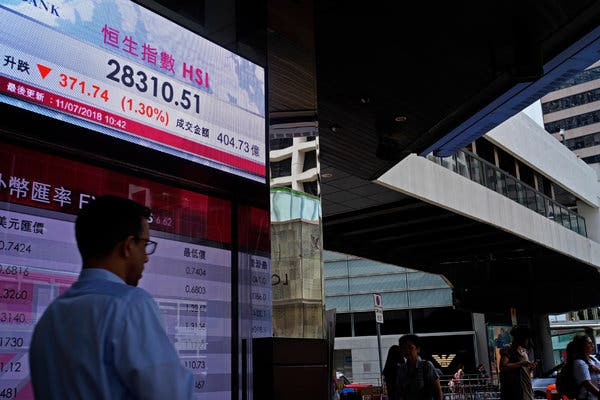

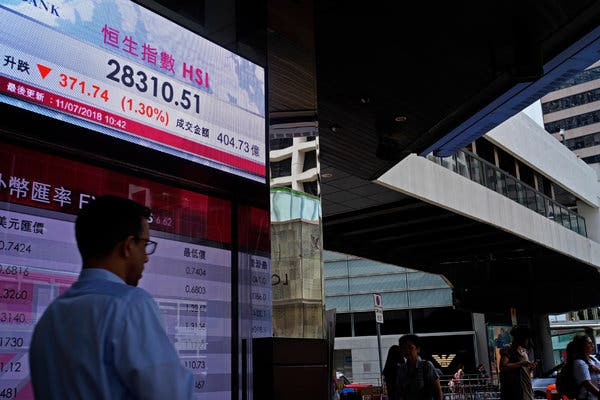

Stock Markets Surge On Renewed U.S.-China Trade Optimism

Table of Contents

Easing Trade Tensions: The Catalyst for Market Growth

Recent positive developments in U.S.-China trade negotiations have acted as a powerful catalyst for the current market growth. The palpable shift in sentiment is largely attributed to a series of significant events and statements signaling a potential de-escalation of the trade war.

-

Specific examples of de-escalation: Reports suggest a pause in planned tariff increases, a resumption of high-level bilateral talks, and a willingness from both sides to explore compromises on key sticking points. The tone of public statements from both governments has noticeably softened, indicating a potential shift towards cooperation.

-

Quotes from key officials or analysts highlighting positive sentiment: While specific quotes would require referencing current news sources, analysts are widely predicting a more positive trajectory for trade relations. Statements emphasizing the mutual benefits of cooperation and the economic costs of prolonged conflict are contributing to increased investor confidence.

-

Mention of any specific trade agreements or compromises reached: While no comprehensive agreement has been finalized, the mere indication of progress and willingness to negotiate has significantly boosted market sentiment. Any specific agreements reached would need to be referenced from current news reports to maintain accuracy.

Impact on Key Market Sectors

The improved trade outlook has had a disproportionate impact on various market sectors. Certain industries, particularly those directly affected by previous tariffs, have seen a significant rebound.

-

Analysis of stock performance in technology companies impacted by the trade war: Technology companies, previously heavily impacted by tariffs and trade restrictions, have shown significant gains. The easing of tensions has reduced uncertainty and allowed investors to regain confidence in the sector's long-term prospects.

-

Impact on agricultural exports and related companies: The agricultural sector, a major player in the U.S.-China trade relationship, has seen a positive response. Reduced trade barriers could lead to increased exports and improved profitability for agricultural businesses.

-

The effect on manufacturing and supply chains: Manufacturers, whose supply chains were disrupted by the trade war, are also experiencing a boost. The easing of tensions reduces uncertainty and allows for smoother operations and cost reductions.

Investor Sentiment and Market Volatility

The positive trade news has had a profound impact on investor sentiment and market volatility. The initial reaction has been overwhelmingly positive, yet caution remains.

-

Discuss changes in market indices (Dow Jones, S&P 500, Nasdaq): Major market indices like the Dow Jones, S&P 500, and Nasdaq have all experienced significant increases following the positive trade developments. These increases reflect the broad-based optimism sweeping through the market.

-

Mention investor behavior (increased buying, decreased risk aversion): Investors are showing increased risk appetite, with a shift towards buying stocks and other risk assets. This signals growing confidence in the market’s future performance.

-

Explain the potential for continued volatility or a sustained bull market: While the current trend is bullish, the possibility of future volatility remains. The long-term impact of the trade developments will depend on several factors, including the pace of negotiations and the ultimate outcome of any trade agreements.

Long-Term Implications for Global Trade

Improved U.S.-China trade relations hold significant long-term implications for the global economy. The positive effects could ripple across the globe, impacting various aspects of international trade.

-

Potential for increased global trade and economic growth: A resolution to the trade dispute could unleash a surge in global trade, stimulating economic growth worldwide. Reduced barriers to trade can lead to greater efficiency and specialization, benefiting businesses and consumers alike.

-

Impact on international supply chains and manufacturing: Improved relations could lead to more efficient and stable international supply chains, benefiting manufacturers and reducing production costs. This could further drive economic growth and enhance global competitiveness.

-

The role of international organizations in facilitating trade agreements: International organizations like the World Trade Organization (WTO) play a crucial role in facilitating trade agreements and resolving trade disputes. Their role in promoting cooperation and enforcing trade rules will be essential for maintaining a stable and predictable global trading environment.

Conclusion

The surge in stock markets is largely attributed to renewed optimism surrounding U.S.-China trade relations. The easing of trade tensions has had a positive impact across key market sectors, boosting investor confidence and reducing market volatility. While uncertainty remains, the potential for increased global trade and economic growth is significant.

The surge in stock markets driven by renewed U.S.-China trade optimism presents potential opportunities for investors. Stay informed about further developments in U.S.-China trade relations and consider diversifying your portfolio to capitalize on these positive trends. Learn more about how to navigate the complexities of the global stock market and make informed investment decisions based on evolving U.S.-China trade optimism. Understanding the nuances of U.S.-China trade and its impact on global markets is crucial for successful investment strategies.

Featured Posts

-

Sinner Vs Federer A Branding Analysis Why The Fox Logo Lacks Impact

May 14, 2025

Sinner Vs Federer A Branding Analysis Why The Fox Logo Lacks Impact

May 14, 2025 -

Iwi Asset Growth 8 2 Billion Value Revealed In New Report

May 14, 2025

Iwi Asset Growth 8 2 Billion Value Revealed In New Report

May 14, 2025 -

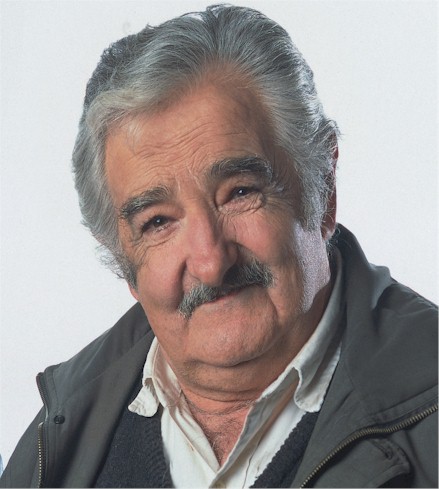

Fallece Jose Mujica Expresidente De Uruguay A Los 89 Anos

May 14, 2025

Fallece Jose Mujica Expresidente De Uruguay A Los 89 Anos

May 14, 2025 -

Suits La And Its Ghostly Residents A Paranormal Investigation

May 14, 2025

Suits La And Its Ghostly Residents A Paranormal Investigation

May 14, 2025 -

Eramet Production Miniere En 2025 Bilan Et Perspectives

May 14, 2025

Eramet Production Miniere En 2025 Bilan Et Perspectives

May 14, 2025