Student Loan Debt And Homeownership: A Practical Guide

Table of Contents

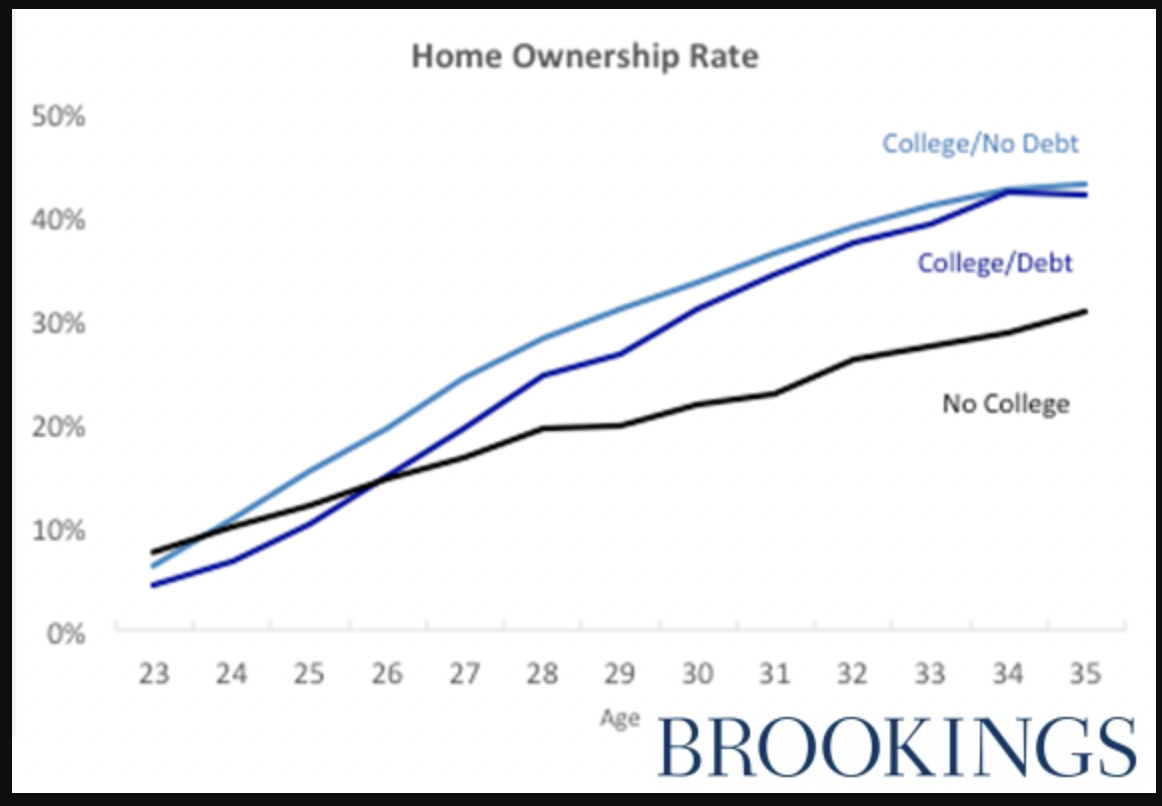

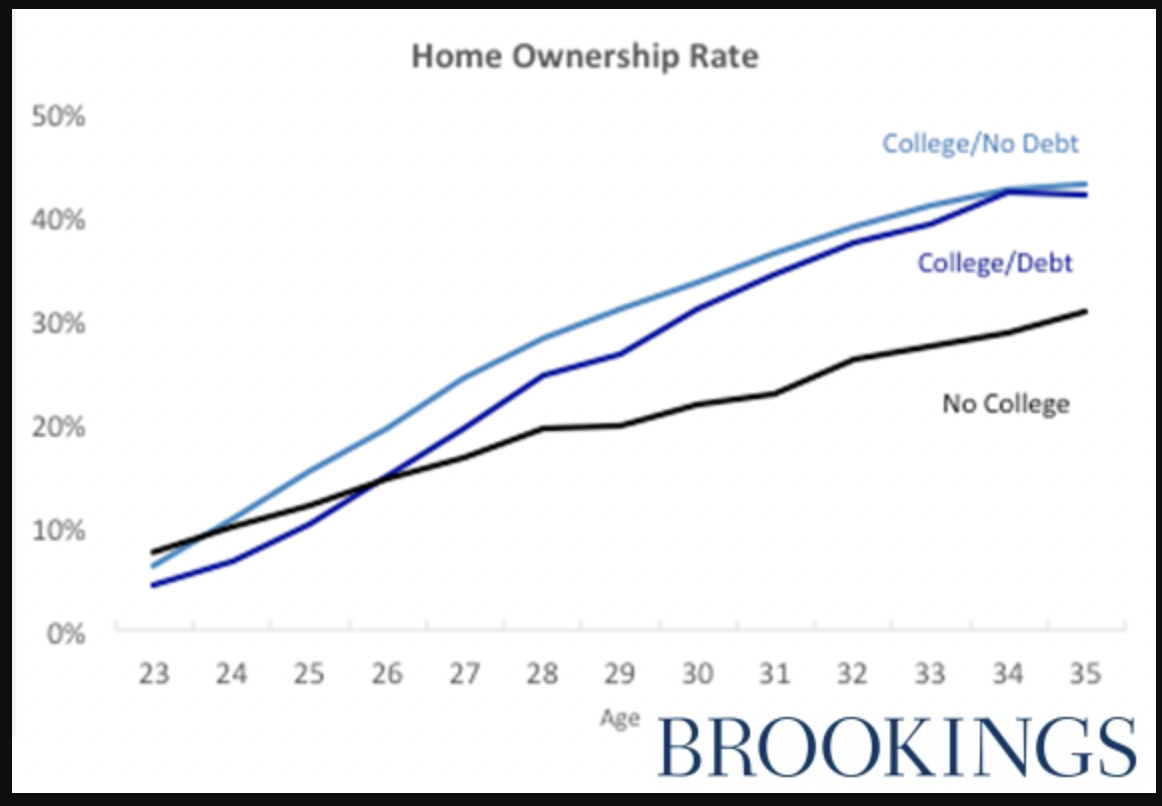

Understanding the Impact of Student Loan Debt on Homeownership

Student loan payments significantly impact your ability to buy a home, primarily by affecting your debt-to-income ratio (DTI). Your DTI is a crucial factor lenders consider when assessing your mortgage application. It represents the percentage of your gross monthly income that goes towards debt repayment, including student loans, credit cards, and car payments.

A high DTI reduces your chances of mortgage approval, as lenders perceive you as a higher-risk borrower. The higher your DTI, the less likely you are to qualify for a favorable interest rate or loan amount.

Different types of student loans also play a role. Federal student loans often offer more flexible repayment options, such as income-driven repayment plans, which can temporarily lower your monthly payments and improve your DTI. Private student loans, however, may have stricter repayment terms, potentially hindering your home buying prospects.

- Higher DTI = Lower mortgage approval chances. Lenders prefer a DTI below 43%, but ideally below 36%.

- Federal student loans vs. private student loans: Federal loans often provide income-driven repayment plans, making them more manageable for homebuyers. Private loans typically lack such flexibility.

- Importance of checking your credit report before applying for a mortgage: A good credit score is essential for securing a favorable mortgage rate. Check your report for errors and work on improving your score before applying.

Strategies for Managing Student Loan Debt While Saving for a Down Payment

Successfully navigating student loan debt and saving for a down payment requires a strategic approach. Effective strategies include exploring different repayment options for your student loans, implementing a strict budget, and building good credit.

Income-driven repayment plans can significantly reduce your monthly student loan payments, freeing up more funds for savings. Careful budgeting is crucial to allocate funds for both loan repayments and down payment savings. Consider using budgeting apps and tracking your expenses meticulously. Building a strong credit history is paramount, as it directly influences your mortgage interest rates.

- Creating a realistic budget: Allocate funds for essential expenses, loan repayments, and savings. Track your spending habits to identify areas for improvement.

- Exploring high-yield savings accounts and investment options: Maximize your savings growth through high-yield savings accounts or low-risk investments.

- The role of credit score in securing a favorable mortgage interest rate: A higher credit score translates to lower interest rates and more favorable mortgage terms.

Exploring Mortgage Options for Borrowers with Student Loan Debt

Several mortgage options cater to borrowers with student loan debt. FHA loans, for instance, typically have less stringent credit score requirements and lower down payment needs compared to conventional loans. However, they often come with mortgage insurance premiums. Conventional loans may require a higher credit score and a larger down payment but may offer better long-term rates.

- FHA loans vs. conventional loans: FHA loans are more accessible for borrowers with student loan debt due to their lower credit score requirements. Conventional loans may offer better rates but demand higher credit scores and down payments.

- Importance of comparing mortgage offers from multiple lenders: Shop around for the best interest rates and terms before committing to a mortgage.

- The benefits of working with a mortgage broker: A mortgage broker can help you navigate the complex mortgage landscape and find the best loan options tailored to your situation.

Long-Term Financial Planning: Balancing Homeownership and Debt Repayment

A comprehensive long-term financial plan is crucial for managing both homeownership and student loan repayment effectively. This plan should incorporate your mortgage payments, property taxes, insurance, student loan repayments, and other expenses. Regularly review and adjust your plan based on your changing financial circumstances.

- Developing a realistic long-term budget: Account for all expenses, including unexpected costs like home repairs.

- Regularly reviewing and adjusting the financial plan: Life circumstances change; your financial plan should adapt accordingly.

- Seeking professional financial advice when needed: A financial advisor can help you create and manage a comprehensive financial plan tailored to your specific needs.

Achieving Homeownership Despite Student Loan Debt

Successfully navigating student loan debt and achieving homeownership requires careful planning, responsible financial management, and a strategic approach. By understanding the impact of your DTI, employing effective debt management strategies, and exploring suitable mortgage options, you can overcome the challenges and realize your dream of homeownership.

Start planning your path to homeownership today, even with student loan debt. Use the strategies outlined in this guide to navigate the challenges and achieve your dream!

Featured Posts

-

Djokovic Miami Acik Finalini Kazandi Mi

May 17, 2025

Djokovic Miami Acik Finalini Kazandi Mi

May 17, 2025 -

Reddit Down Page Not Found Errors Affecting Us Users

May 17, 2025

Reddit Down Page Not Found Errors Affecting Us Users

May 17, 2025 -

Rfk Jr S Hhs To Halt Routine Covid Vaccine Recommendations For Children And Pregnant Women

May 17, 2025

Rfk Jr S Hhs To Halt Routine Covid Vaccine Recommendations For Children And Pregnant Women

May 17, 2025 -

Microsoft Surface Simplification Another Device Cut

May 17, 2025

Microsoft Surface Simplification Another Device Cut

May 17, 2025 -

Us Tariffs On Honda Boosting Canadian Exports

May 17, 2025

Us Tariffs On Honda Boosting Canadian Exports

May 17, 2025