Student Loan Debt: Understanding The Government's Increased Enforcement

Table of Contents

Increased Wage Garnishment and Tax Refund Offset

The government employs several powerful tools to collect on outstanding federal student loans. Two of the most impactful are wage garnishment and tax refund offset. Wage garnishment allows the government to directly seize a portion of a borrower's wages to apply towards their student loan debt. The percentage of wages that can be garnished varies, but it's typically a significant portion of disposable income. The process of initiating wage garnishment usually begins with a default notice and can lead to legal action if the borrower fails to respond or make arrangements.

- Percentage of wages garnished: Up to 15% of disposable income can be garnished. This percentage can be higher in cases of willful default.

- Process of initiating wage garnishment: The Department of Education (DOE) typically works through the Treasury Department and the individual's employer to initiate wage garnishment.

- Tax refund offset: The IRS offsets tax refunds to repay student loan debt. This means the entire refund, or a portion of it, can be used to pay down the outstanding balance.

- State variations: While federal regulations govern the basics, individual states might have additional regulations or processes related to wage garnishment.

These actions, governed by the Federal Debt Collection Procedures Act and managed by the Department of Education and the IRS, significantly impact student loan repayment. Understanding these processes is crucial for borrowers facing federal student loans.

Aggressive Collection Practices by Private Collection Agencies

The government increasingly utilizes private collection agencies to pursue outstanding student loan debt. These agencies operate on behalf of the Department of Education, employing various strategies to collect payments. While private agencies can be effective in recovering debt, they also raise concerns about potential harassment or unfair practices.

- How private agencies operate: They contact borrowers by phone, mail, and sometimes in person, demanding payments. They may also negotiate repayment plans.

- Borrower legal rights: Borrowers retain specific legal rights when dealing with collection agencies, including the right to dispute inaccurate information and to be treated fairly under the Fair Debt Collection Practices Act (FDCPA).

- Potential for harassment: Borrowers should be aware of potential harassment or unfair practices. Unlawful actions include repeated calls at inconvenient times, threats, and false representations.

- Resources to address unfair practices: The Consumer Financial Protection Bureau (CFPB) and state attorney general offices provide resources and assistance to borrowers facing unfair debt collection practices.

Understanding your rights and reporting any unlawful actions are crucial steps to protect yourself when dealing with student loan collection.

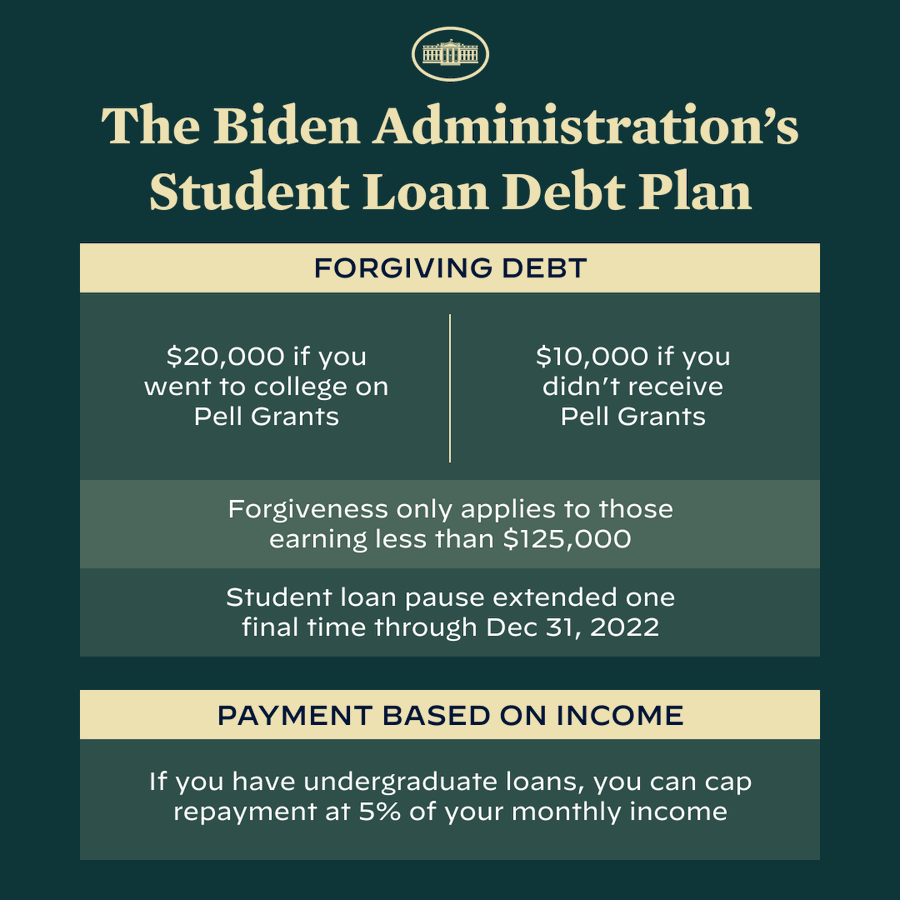

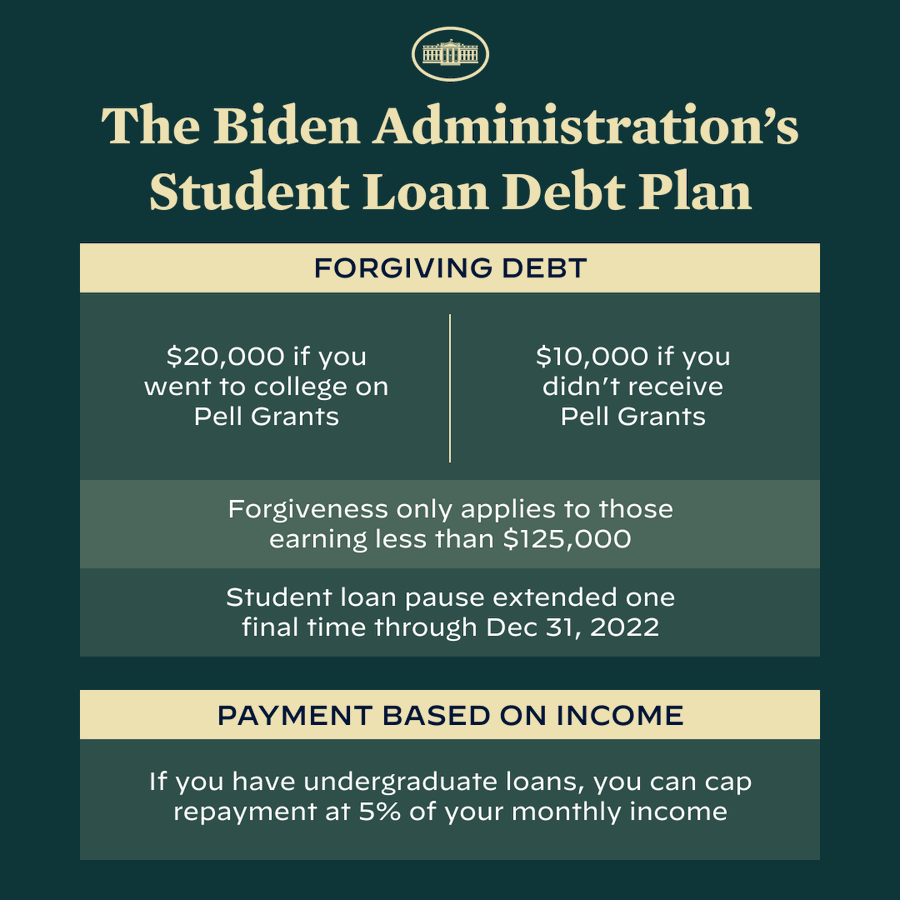

Changes in Loan Forgiveness and Repayment Plans

Recent changes to student loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program, and income-driven repayment (IDR) plans have made qualification more challenging. Increased scrutiny and stricter documentation requirements mean fewer borrowers qualify for relief.

- Increased scrutiny of eligibility: The DOE has implemented stricter guidelines and more rigorous reviews of applications for loan forgiveness programs.

- Stricter documentation: Borrowers now need to provide more extensive documentation to prove their eligibility for loan forgiveness or IDR plans.

- Changes to income thresholds: The income thresholds for qualifying for certain IDR plans have been adjusted, potentially excluding some borrowers.

- Impact on borrowers: These changes significantly impact borrowers' ability to access relief, increasing their long-term student loan debt burden.

The Impact on Borrowers with Disabilities or Other Hardships

Borrowers with disabilities or those facing financial hardship often face additional challenges in navigating the complexities of student loan repayment.

- Difficulty navigating appeals: Appealing denials of loan forgiveness or IDR plans can be a complex and time-consuming process.

- Limited access to resources: Finding resources and support specifically tailored to their circumstances can be difficult.

- Increased stress and financial strain: The added stress and financial strain from managing student loan debt can exacerbate existing challenges.

Understanding available resources and seeking professional assistance is crucial for borrowers facing these specific hurdles. Options like loan deferment or loan forbearance might provide temporary relief.

Conclusion: Navigating the Increased Enforcement of Student Loan Debt

The government's increased enforcement of student loan debt is a significant development for millions of borrowers. Increased wage garnishment, tax refund offset, aggressive private collection agency practices, and stricter eligibility requirements for repayment plans and forgiveness programs highlight the need for proactive management. Understanding your rights under the FDCPA, accessing available resources like the CFPB and state attorney general's offices, and exploring available repayment options are crucial steps. Don't let the increased government enforcement of student loan debt overwhelm you. Take control of your finances by understanding your rights and exploring available repayment options. Contact a student loan counselor today to learn more about managing your student loan debt effectively and developing effective student loan repayment strategies for a brighter financial future.

Featured Posts

-

Injury Report Mariners Vs Athletics Series March 27 30

May 17, 2025

Injury Report Mariners Vs Athletics Series March 27 30

May 17, 2025 -

Supercharged Seaweed Condo Cracks And Corporate Crisis Todays Top Stories

May 17, 2025

Supercharged Seaweed Condo Cracks And Corporate Crisis Todays Top Stories

May 17, 2025 -

Why Did Uber Stock Jump Over 10 In April A Detailed Analysis

May 17, 2025

Why Did Uber Stock Jump Over 10 In April A Detailed Analysis

May 17, 2025 -

Numero De Vitimas Em Acidente Com Onibus Universitario Aumenta

May 17, 2025

Numero De Vitimas Em Acidente Com Onibus Universitario Aumenta

May 17, 2025 -

Superyacht Disaster Investigation Focuses On Giant Mast In Bayesian Vessels Final Moments

May 17, 2025

Superyacht Disaster Investigation Focuses On Giant Mast In Bayesian Vessels Final Moments

May 17, 2025