Student Loan Delinquency: Understanding The Credit Score Damage

Table of Contents

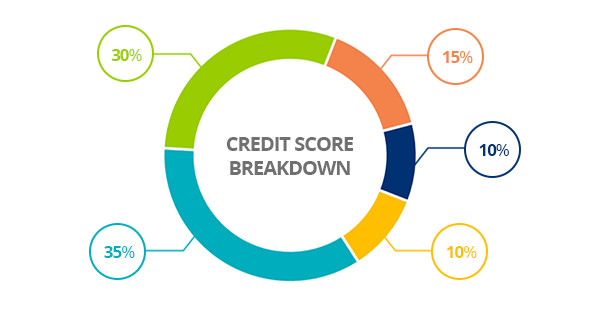

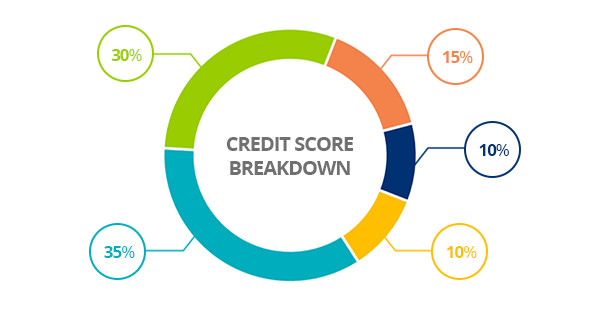

How Student Loan Delinquency Impacts Your Credit Score

Student loan delinquency, the failure to make timely payments on your student loans, significantly impacts your credit score. This section details the process and the severity of the damage.

The Reporting Process

When you miss a student loan payment, your loan servicer reports this delinquency to the three major credit bureaus: Equifax, Experian, and TransUnion. The timeline and impact vary depending on the length of the delinquency:

- 30 Days Late: A negative mark appears on your credit report. While this might not drastically affect your credit score initially, it's a warning sign.

- 60 Days Late: The negative impact on your credit score becomes more substantial. Your score will likely drop considerably.

- 90 Days Late: This is considered a serious delinquency and can lead to a significant drop in your credit score, potentially hundreds of points.

- 120+ Days Late: Your loan may be considered in default, leading to even more severe consequences, including collection agency involvement.

It's important to understand the difference between delinquency and default. Delinquency refers to being late on payments, while default occurs when you've missed payments for an extended period, typically 90 days or more, and the lender considers the loan uncollectible.

Credit Score Reduction

Student loan delinquency causes a significant reduction in your FICO score (Fair Isaac Corporation score), the most widely used credit scoring system. A drop of 100 points or more is entirely possible, depending on your credit history and the severity of the delinquency. This lower score makes it harder to:

- Secure loans (auto loans, mortgages, personal loans) at favorable interest rates. Even a small drop can translate into thousands of dollars in extra interest over the life of a loan. For example, a 50-point drop could increase your interest rate on a mortgage by 0.5%–1%, adding significant cost to your home purchase.

- Obtain credit cards with desirable terms and low interest rates.

- Rent an apartment, as many landlords conduct credit checks.

Long-Term Effects of Student Loan Delinquency

The effects of student loan delinquency extend far beyond a temporary dip in your credit score.

Difficulty Securing Future Loans

A history of student loan delinquency makes it significantly harder to qualify for future loans. Lenders view it as a high-risk factor, resulting in:

- Mortgage denials: Obtaining a mortgage, a major financial commitment, becomes significantly more challenging, potentially delaying or preventing homeownership.

- Higher interest rates: Even if you qualify, you’ll likely face much higher interest rates on any new loans, increasing the overall cost.

Impact on Employment Opportunities

Poor credit, a direct consequence of delinquency, can affect your job prospects, particularly in sectors requiring financial responsibility or background checks:

- Many employers conduct credit checks as part of the hiring process, particularly in finance, government, and some healthcare positions. A poor credit score can hurt your chances.

- Jobs requiring security clearances or access to sensitive information often have strict financial responsibility requirements, making a history of delinquency a significant obstacle.

Collection Agencies and Legal Action

If your student loans enter default, you'll likely deal with debt collection agencies. This can involve:

- Aggressive collection calls and letters.

- Damage to your credit report.

- Potential lawsuits and wage garnishment. The government can garnish your wages to recover the debt.

Strategies to Avoid Student Loan Delinquency

Proactive steps are crucial to avoid the damaging consequences of student loan delinquency.

Budgeting and Financial Planning

Effective financial management is key. Create a realistic budget:

- Track your income and expenses meticulously using budgeting apps or spreadsheets.

- Identify areas where you can cut expenses.

- Prioritize student loan payments.

Exploring Repayment Options

Several repayment options can help manage your student loan debt:

- Income-driven repayment (IDR) plans: Your monthly payments are based on your income and family size. Explore options like ICR, PAYE, REPAYE, and IBR.

- Deferment: Temporarily postpones your payments under specific circumstances.

- Forbearance: Reduces your payments temporarily, but interest usually still accrues.

Contact your loan servicer to discuss your options and apply for a suitable plan. Resources like StudentAid.gov offer valuable information and tools.

Seeking Professional Help

Don't hesitate to seek help if you're struggling:

- Credit counseling agencies like the National Foundation for Credit Counseling (NFCC) offer free or low-cost guidance.

- Non-profit organizations provide financial literacy programs and support.

Conclusion

Student loan delinquency severely impacts your credit score and has long-term financial consequences, including difficulty securing future loans, potential employment challenges, and legal repercussions. Take control of your student loan debt by creating a budget, exploring available repayment options, and seeking professional help when needed. Avoid the damaging effects of student loan delinquency and protect your credit score. Responsible financial management and proactive action are crucial for navigating the complexities of student loan repayment and building a strong financial future.

Featured Posts

-

Palmeiras Vs Bolivar Resumen Del Partido 2 0 Y Goles

May 17, 2025

Palmeiras Vs Bolivar Resumen Del Partido 2 0 Y Goles

May 17, 2025 -

Andor Season Finale Cast Provides Bts Look At Rogue One Connections

May 17, 2025

Andor Season Finale Cast Provides Bts Look At Rogue One Connections

May 17, 2025 -

Australian Crypto Casino Sites Your 2025 Review

May 17, 2025

Australian Crypto Casino Sites Your 2025 Review

May 17, 2025 -

Premiile Gopo 2025 Lista Completa A Nominalizarilor

May 17, 2025

Premiile Gopo 2025 Lista Completa A Nominalizarilor

May 17, 2025 -

Impact Of Canadas Tariff Exemptions On Us Canada Trade

May 17, 2025

Impact Of Canadas Tariff Exemptions On Us Canada Trade

May 17, 2025