Student Loan Reliance: A Shift In Parental College Funding Concerns

Table of Contents

The Rising Cost of Higher Education and its Impact on Parental Savings

The escalating cost of higher education is the primary driver of increased student loan reliance. Tuition, fees, room, and board have skyrocketed over the past decade, leaving many families struggling to cover even a fraction of the total cost.

Increased Tuition and Fees

- Average tuition increases: College tuition has increased at a rate far exceeding inflation for years. Many institutions have seen double-digit percentage increases in tuition and fees over the last ten years.

- Expensive universities: The cost of attending prestigious private universities can easily exceed $70,000 per year, including tuition, fees, room, and board. Even public universities are experiencing significant cost increases.

- Rising cost of materials: The cost of textbooks, technology, and other educational materials adds significantly to the overall expense of higher education, often totaling thousands of dollars annually.

Diminishing Parental Savings and Retirement Funds

The soaring cost of college is forcing many parents to make difficult choices between saving for their children's education and securing their own retirement.

- Statistics on parental savings: A significant portion of parents are finding it increasingly difficult to save enough for their children's college education.

- Impact of economic downturns: Economic recessions and unexpected job losses further exacerbate the challenges of saving for college, depleting already limited resources.

- Retirement savings vs. college funding: The trade-off between prioritizing retirement savings and funding a child's college education is a major source of stress for many families.

The Growing Gap Between Expected and Actual College Costs

Families often underestimate the true cost of college, leading to a significant gap between their expectations and the actual expenses incurred.

- Unexpected expenses: Unforeseen medical bills, unexpected increases in room and board, and the need for additional tutoring or academic support can quickly inflate college costs.

- Impact of scholarships and grants: While scholarships and grants can significantly reduce the overall cost, they often fail to cover the full expense, leaving a substantial gap to be filled.

Student Loans as the Primary Funding Source

The increasing accessibility and availability of student loans have made them a seemingly convenient solution for families facing the high cost of college, contributing significantly to student loan reliance.

Increased Availability and Accessibility of Student Loans

Students can easily access various types of student loans, both federal and private, through streamlined online applications and simplified processes.

- Types of student loans: Federal subsidized and unsubsidized loans, PLUS loans, and private student loans offer various options with differing interest rates and repayment terms.

- Online application processes: The ease of applying for student loans online further contributes to their growing popularity and contributes to student loan reliance.

- Role of student loan servicers: Student loan servicers play a crucial role in facilitating the loan process, but their involvement can sometimes add to the complexity of managing student loan debt.

The Psychology of Loan Reliance

Several psychological factors contribute to families' increasing reliance on student loans, even when aware of the long-term financial implications.

- Pressure to attend prestigious universities: The pressure to attend highly ranked and expensive universities can outweigh the concerns about accumulating significant student loan debt.

- Fear of falling behind peers: Families may feel compelled to borrow heavily to ensure their children have access to the same educational opportunities as their peers.

- Lack of financial literacy: A lack of understanding of the long-term financial implications of student loan debt can lead to poor decision-making.

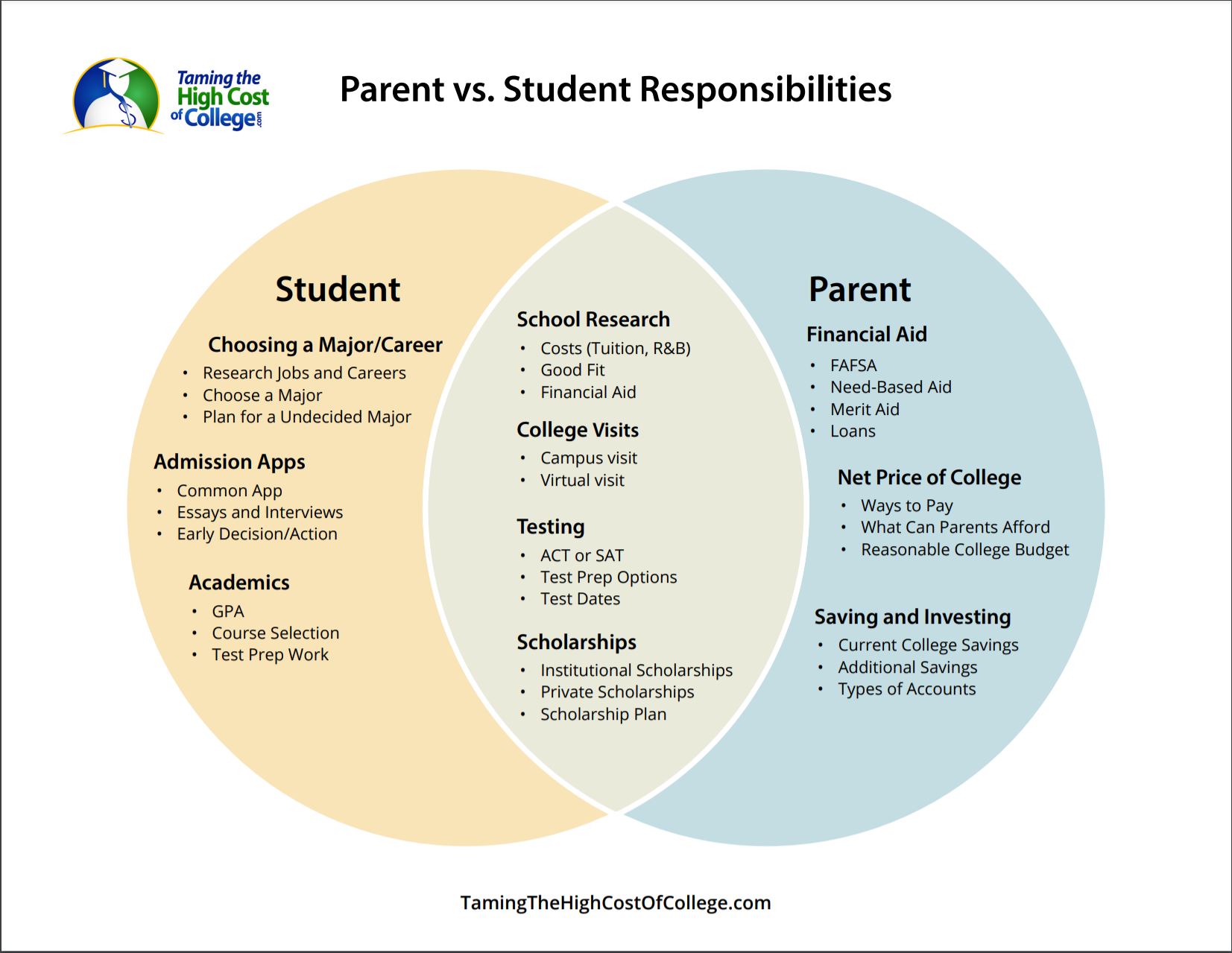

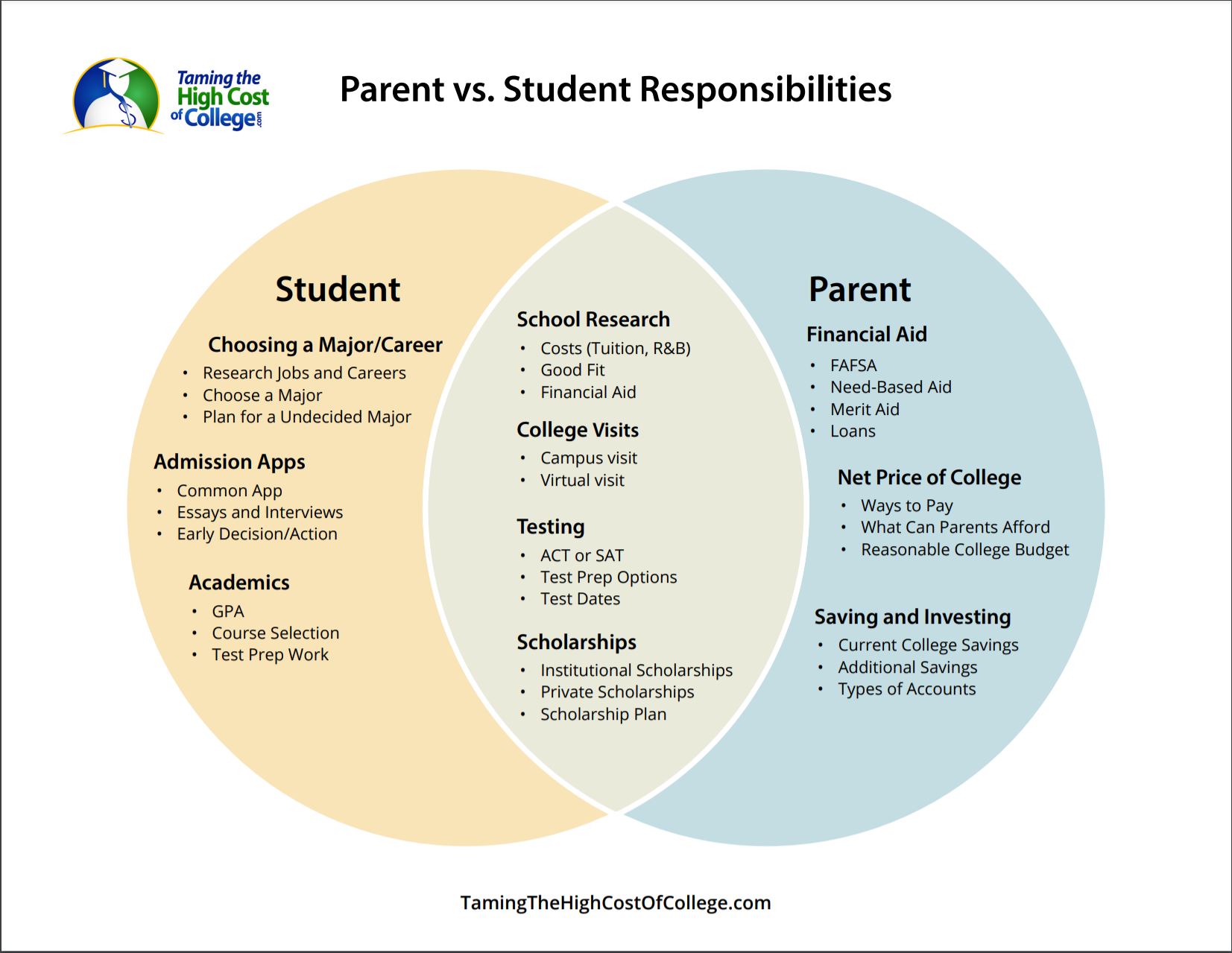

The Role of Financial Aid and Scholarships in Mitigating Loan Burden

Financial aid and scholarships play a crucial role in reducing student loan debt, but their effectiveness varies depending on individual circumstances.

- FAFSA completion rates: Completing the Free Application for Federal Student Aid (FAFSA) is essential for accessing federal financial aid, but many families fail to complete it, leaving potential funds untapped.

- Effectiveness of scholarships: Scholarships can significantly reduce the need for loans, but securing them requires considerable effort and research.

- Resources for finding scholarships and financial aid: Numerous resources are available to help students and families locate scholarships and financial aid opportunities.

Long-Term Consequences of Student Loan Reliance

The long-term consequences of relying heavily on student loans can be substantial, affecting graduates' financial well-being and overall quality of life.

The Burden of Student Loan Debt on Graduates

Significant student loan debt can severely burden graduates, hindering their ability to achieve major financial milestones.

- Average student loan debt upon graduation: The average student loan debt upon graduation is substantial and continues to grow.

- Impact on credit scores: High student loan debt can negatively impact credit scores, making it more challenging to secure loans for homes, cars, and other significant purchases.

- Difficulty securing mortgages and loans: The burden of student loan debt can make it difficult to qualify for mortgages and other loans, delaying major life events like homeownership and starting a family.

The Mental Health Impact of Student Loan Debt

The stress of managing significant student loan debt can significantly impact graduates' mental health and overall well-being.

- Anxiety and depression related to student loan debt: The weight of student loan debt is a significant source of anxiety and depression for many graduates.

- Impact on overall well-being: The financial strain of student loans can negatively impact various aspects of life, from relationships to career choices.

Potential Solutions and Strategies for Reducing Student Loan Reliance

Several strategies can mitigate the reliance on student loans and reduce the burden of student loan debt.

- 529 plans: 529 plans offer tax-advantaged savings options for college expenses.

- Community colleges: Attending community colleges for the first two years can significantly reduce overall college costs.

- Vocational schools: Vocational schools provide training for specific careers and often offer more affordable tuition than traditional four-year colleges.

- Financial literacy programs: Improving financial literacy can help families make informed decisions about college funding and reduce student loan reliance.

Conclusion

The increasing cost of higher education and the resulting surge in student loan reliance represent a significant shift in how families approach college funding. This reliance has profound and far-reaching implications, impacting not only graduates' finances but also their mental health and overall well-being. The strategies discussed above—from saving early and exploring affordable options to improving financial literacy—are crucial for minimizing student loan reliance and ensuring a brighter financial future for students and families. Take proactive steps to reduce your student loan reliance; your future self will thank you. Begin planning today by researching scholarships, creating a realistic college budget, and seeking professional financial advice. Minimize your student loan reliance and secure a more financially stable future.

Featured Posts

-

Former Lynx Player Signs With Golden State Valkyries

May 17, 2025

Former Lynx Player Signs With Golden State Valkyries

May 17, 2025 -

Kupovina Stanova Preko Granice Popularnost Medu Srbima

May 17, 2025

Kupovina Stanova Preko Granice Popularnost Medu Srbima

May 17, 2025 -

Uluslararasi Yatirim Pozisyonu Verileri Tuerkiye Subat 2024 Raporu

May 17, 2025

Uluslararasi Yatirim Pozisyonu Verileri Tuerkiye Subat 2024 Raporu

May 17, 2025 -

Epic Games And Fortnite A New Lawsuit Over In Game Purchases

May 17, 2025

Epic Games And Fortnite A New Lawsuit Over In Game Purchases

May 17, 2025 -

West Valley City To Get New University Of Utah Hospital And Medical Center

May 17, 2025

West Valley City To Get New University Of Utah Hospital And Medical Center

May 17, 2025