Success In Private Credit: 5 Do's And Don'ts To Land Your Next Role

Table of Contents

Do: Network Strategically in the Private Credit Industry

The private credit industry thrives on relationships. Building a strong network is paramount to landing your next role.

Leverage LinkedIn:

Actively engage with industry professionals on LinkedIn. This professional networking platform is your gateway to connecting with potential employers and learning about new opportunities.

- Customize your LinkedIn profile: Highlight your private credit experience, skills (e.g., financial modeling, credit analysis, deal structuring), and accomplishments using relevant keywords like "private debt," "direct lending," "leveraged lending," and "credit underwriting."

- Follow key players and firms: Stay informed about industry news and developments by following influential figures and leading private credit firms. Engage with their content and participate in relevant discussions.

- Join relevant groups: Participate actively in LinkedIn groups focused on private credit, finance, and investment management. Share insightful comments and contribute to conversations to establish yourself as a knowledgeable professional.

Attend Industry Events:

Networking events, conferences (like the PEI's Private Debt Investor Forum), and workshops offer invaluable opportunities to meet potential employers and learn about industry trends.

- Prepare talking points: Develop concise and impactful talking points that highlight your expertise in private credit and your career goals. Quantify your achievements whenever possible.

- Follow up with meaningful connections: After each event, send personalized follow-up emails or LinkedIn messages to strengthen your connections and reiterate your interest.

Informational Interviews:

Reaching out to professionals for informational interviews is a powerful networking tool. It allows you to gain insights into their career paths, learn about different firms, and build valuable relationships.

- Prepare thoughtful questions: Research the individual and their firm beforehand. Prepare questions demonstrating genuine interest in private credit and their specific experiences.

- Express gratitude and maintain contact: Always express your appreciation for their time. Follow up with a thank-you note and maintain contact to nurture the relationship.

Don't: Neglect Your Online Presence

Your online presence reflects your professionalism and brand. A strong online profile is crucial for securing a private credit role.

Update Your Resume/CV:

Your resume is your first impression. Ensure it's tailored to each private credit role you apply for, showcasing relevant skills and accomplishments.

- Quantify your accomplishments: Use numbers and data to demonstrate the impact of your work. For example, instead of "Improved team efficiency," say "Improved team efficiency by 15%, resulting in a 10% reduction in processing time."

- Use relevant keywords: Incorporate keywords relevant to private credit jobs, such as "portfolio management," "due diligence," "syndicated loans," and "asset-based lending."

Overlook Your Digital Footprint:

Employers often check social media profiles. Maintain a clean and professional online presence across all platforms.

- Review your social media profiles: Remove any inappropriate content or posts that could negatively impact your application.

- Consider creating a professional website or portfolio: Showcase your work and expertise through a professional website or online portfolio, particularly if you have significant accomplishments to highlight.

Do: Tailor Your Application to Each Private Credit Role

Generic applications rarely succeed in the competitive private credit market. Each application should be meticulously tailored to the specific firm and role.

Research the Firm:

Thoroughly research each firm's investment strategy, portfolio companies, recent transactions, and team before submitting your application. This demonstrates genuine interest and initiative.

- Understand their investment strategy: Identify their target sectors, deal sizes, and investment approaches (e.g., senior secured, mezzanine, distressed debt).

- Align your skills and experience: Highlight the aspects of your experience that directly align with the firm's investment strategy and the specific requirements of the role.

Craft a Compelling Cover Letter:

Your cover letter should personalize your application and explain why you're an ideal fit for the specific role and firm.

- Show, don't tell: Use concrete examples to demonstrate your skills and experience. Instead of stating you're a strong team player, describe a situation where you successfully collaborated with a team to achieve a specific goal.

- Proofread carefully: Ensure your cover letter is free of grammatical errors and typos.

Don't: Underestimate the Importance of Technical Skills

Private credit roles demand a strong foundation in financial analysis and credit assessment.

Financial Modeling:

Mastering financial modeling is crucial. You'll need to build and analyze complex financial models to evaluate potential investments.

- Practice building complex models: Develop proficiency in building various financial models, including discounted cash flow (DCF) models, leveraged buyout (LBO) models, and debt capacity models.

- Demonstrate proficiency in relevant software: Excel is essential, but familiarity with other financial modeling software (e.g., Argus, Bloomberg Terminal) is highly advantageous.

Credit Analysis:

Strong credit analysis skills are essential for assessing the creditworthiness of borrowers and mitigating risk.

- Understand credit risk: Develop a thorough understanding of different types of credit risk (e.g., default risk, interest rate risk, liquidity risk).

- Showcase your understanding: Clearly demonstrate your knowledge of credit analysis techniques in your resume, cover letter, and interviews.

Do: Prepare for Behavioral and Technical Interviews

Thorough preparation is key to succeeding in private credit interviews.

Practice Your Answers:

Prepare answers to common interview questions using the STAR method (Situation, Task, Action, Result). This structured approach ensures your answers are concise, impactful, and highlight your accomplishments.

- Practice with a friend or mentor: Practice your answers with a friend or mentor to improve your delivery and confidence.

- Anticipate technical questions: Prepare for detailed questions related to financial modeling, credit analysis, and the private credit market.

Ask Thoughtful Questions:

Asking insightful questions demonstrates your genuine interest and engagement.

- Prepare questions beforehand: Research the firm thoroughly and prepare questions about their investment strategy, culture, and future plans.

- Avoid asking questions easily answered through research: Focus on questions that require the interviewer's unique perspective and insights.

Conclusion

Securing a role in private credit requires a strategic approach that combines diligent networking, robust skill development, a polished online presence, and meticulous interview preparation. By following these five do's and don'ts, you can significantly increase your chances of landing your next role in private credit. Remember to network strategically, master your technical skills, tailor your applications, cultivate a professional online presence, and prepare thoroughly for interviews. Start actively applying these strategies today and accelerate your success in private credit!

Featured Posts

-

Uusi Britannian Kruununperimysjaerjestys Yksityiskohtainen Katsaus

May 10, 2025

Uusi Britannian Kruununperimysjaerjestys Yksityiskohtainen Katsaus

May 10, 2025 -

Dakota Johnsons Shifting Roles Exploring The Dynamics With Chris Martin

May 10, 2025

Dakota Johnsons Shifting Roles Exploring The Dynamics With Chris Martin

May 10, 2025 -

The Controversy Surrounding James Comers Epstein Files And Pam Bondis Reaction

May 10, 2025

The Controversy Surrounding James Comers Epstein Files And Pam Bondis Reaction

May 10, 2025 -

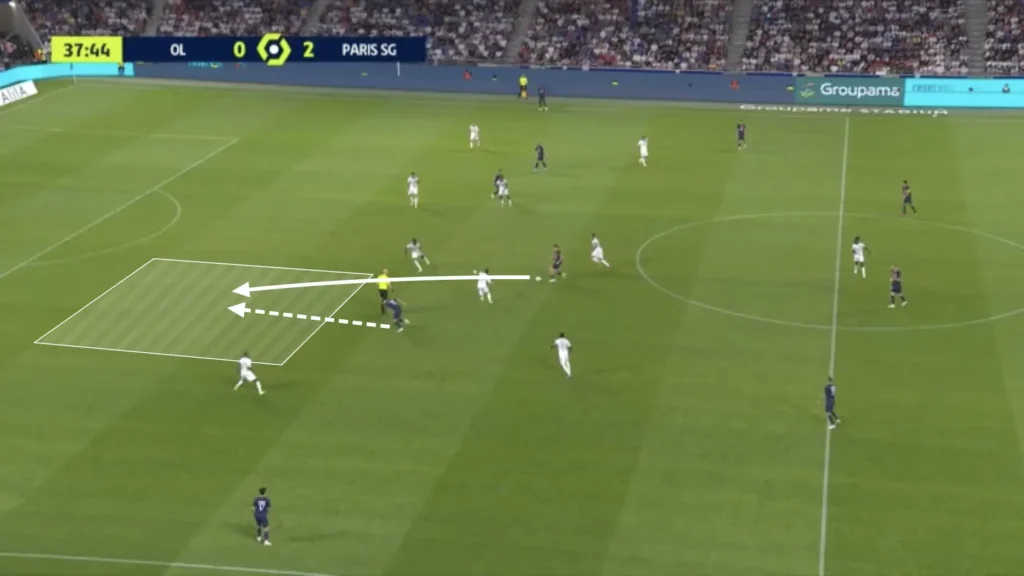

Psgs Winning Formula Luis Enriques Tactical Masterclass

May 10, 2025

Psgs Winning Formula Luis Enriques Tactical Masterclass

May 10, 2025 -

How Much Wealth Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025

How Much Wealth Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025