Successfully Purchasing A Home Despite Student Loan Debt

Table of Contents

Assessing Your Financial Situation & Creating a Realistic Budget

Before you even start browsing houses, a thorough assessment of your financial situation is crucial. This involves understanding your debt-to-income ratio and creating a realistic budget that accommodates both your student loan payments and the costs of homeownership.

Understanding Your Debt-to-Income Ratio (DTI)

Your Debt-to-Income Ratio (DTI) is a crucial factor lenders consider when evaluating your mortgage application. It represents the percentage of your gross monthly income that goes towards debt repayment. A lower DTI generally improves your chances of mortgage approval and securing a favorable interest rate.

-

Calculating your DTI: Add up all your monthly debt payments (student loans, credit cards, car loans, etc.). Divide this total by your gross monthly income (before taxes). Multiply the result by 100 to get your DTI percentage.

-

Example: Monthly debt payments: $1,500; Gross monthly income: $5,000; DTI: ($1,500 / $5,000) * 100 = 30%

-

Improving your DTI: Strategies to lower your DTI include paying down high-interest debt, increasing your income, or finding ways to reduce your monthly expenses.

-

Steps to Calculate DTI:

- List all monthly debt payments.

- Determine your gross monthly income.

- Divide total debt payments by gross monthly income.

- Multiply by 100 to express as a percentage.

-

Resources for DTI Calculators: Many online lenders and financial websites offer free DTI calculators.

Creating a Realistic Homeownership Budget

Owning a home involves more than just the mortgage payment. You need to account for:

- Property Taxes: These vary widely by location and are a significant expense.

- Homeowners Insurance: Essential for protecting your investment.

- HOA Fees (if applicable): Cover maintenance and amenities in homeowner associations.

- Home Maintenance and Repairs: Budget for unexpected repairs – a leaky roof, faulty appliance, etc., can be costly.

It's also crucial to establish an emergency fund specifically for home repairs. Aim for at least 3-6 months' worth of housing-related expenses in a separate savings account.

- Examples of Unexpected Home Expenses: Furnace repair, roof leak, plumbing issues, appliance malfunction.

- Budgeting App Recommendations: Mint, YNAB (You Need A Budget), Personal Capital.

Exploring Different Mortgage Options

Several mortgage options cater to different financial situations. Understanding the pros and cons of each is essential, particularly when dealing with student loan debt.

- Conventional Loans: Require a higher credit score and often a larger down payment.

- FHA Loans: Backed by the Federal Housing Administration, requiring lower down payments and credit scores, making them more accessible to borrowers with student loan debt.

- VA Loans: Offered to eligible veterans and military members, often with no down payment requirement.

- USDA Loans: For rural properties, often with low down payment requirements.

Shopping around for the best interest rates is crucial. Different lenders offer varying rates and terms.

- List of Mortgage Lenders: Check with local banks, credit unions, and online lenders.

- Resources for Comparing Mortgage Rates: Bankrate, NerdWallet, LendingTree.

Strategies for Managing Student Loan Debt While Saving for a Down Payment

Juggling student loan repayments and saving for a down payment requires discipline and strategic planning.

Prioritizing Debt Repayment

Consider these strategies to manage your student loans effectively:

- Snowball Method: Pay off your smallest debt first, regardless of interest rate, for psychological motivation.

- Avalanche Method: Focus on paying off the debt with the highest interest rate first to save money long-term.

Making on-time payments is critical for maintaining a good credit score, which is essential for mortgage approval. Explore loan refinancing options to potentially lower your interest rates.

- Advantages and Disadvantages of Snowball vs. Avalanche Method: Snowball provides psychological wins, while avalanche saves more money over time.

- Resources for Student Loan Refinancing: Credible, LendKey, Earnest.

Building Savings for a Down Payment

Saving for a down payment requires commitment. Strategies include:

- Create a Dedicated Savings Account: Automate regular transfers from your checking account.

- Cut Expenses: Identify areas where you can reduce spending (e.g., dining out, entertainment).

- Gifts or Grants: Explore the possibility of receiving financial assistance from family or grants.

A larger down payment reduces your monthly mortgage payments and may qualify you for better interest rates.

- Savings Goal Examples: Aim for 5-20% of the home's purchase price for a down payment.

- Tips for Reducing Monthly Expenses: Track your spending, meal prep, use coupons, negotiate bills.

Working with Lenders and Navigating the Mortgage Application Process

Choosing the right lender and preparing for the application process are crucial steps.

Finding a Lender Who Understands Student Loan Debt

Finding a lender experienced with borrowers who have student loans is essential. They can better understand your financial situation and offer tailored advice.

- Questions to Ask Potential Lenders: What is your experience with borrowers who have student loan debt? What types of mortgages do you offer? What are your current interest rates?

- Resources for Finding Lenders: Online lender marketplaces, referrals from friends and family, local banks and credit unions.

Preparing for the Mortgage Application

Gather all necessary documentation beforehand to expedite the process:

- Pay stubs: Demonstrate consistent income.

- Tax returns: Verify your income and expenses.

- Credit report: Shows your credit history and score.

A strong credit score significantly impacts your mortgage approval and interest rate. Address any negative marks on your credit report before applying.

- Checklist of Documents Needed for Mortgage Application: Pay stubs, tax returns, W-2s, bank statements, credit report, employment verification.

- Tips for Improving Credit Score: Pay bills on time, keep credit utilization low, monitor your credit report regularly.

Conclusion

Successfully purchasing a home despite student loan debt is achievable with careful financial planning, strategic debt management, and a proactive approach to the mortgage application process. By understanding your financial situation, exploring various mortgage options, and working with a knowledgeable lender, you can overcome the challenges of student loan debt and realize your dream of homeownership. Start planning your journey towards successfully purchasing a home today – your dream home awaits!

Featured Posts

-

Controversial Non Call Decides Knicks Pistons Game Officials Admission

May 17, 2025

Controversial Non Call Decides Knicks Pistons Game Officials Admission

May 17, 2025 -

Best Online Casinos In Canada 2025 A Players Guide Featuring 7 Bit Casino

May 17, 2025

Best Online Casinos In Canada 2025 A Players Guide Featuring 7 Bit Casino

May 17, 2025 -

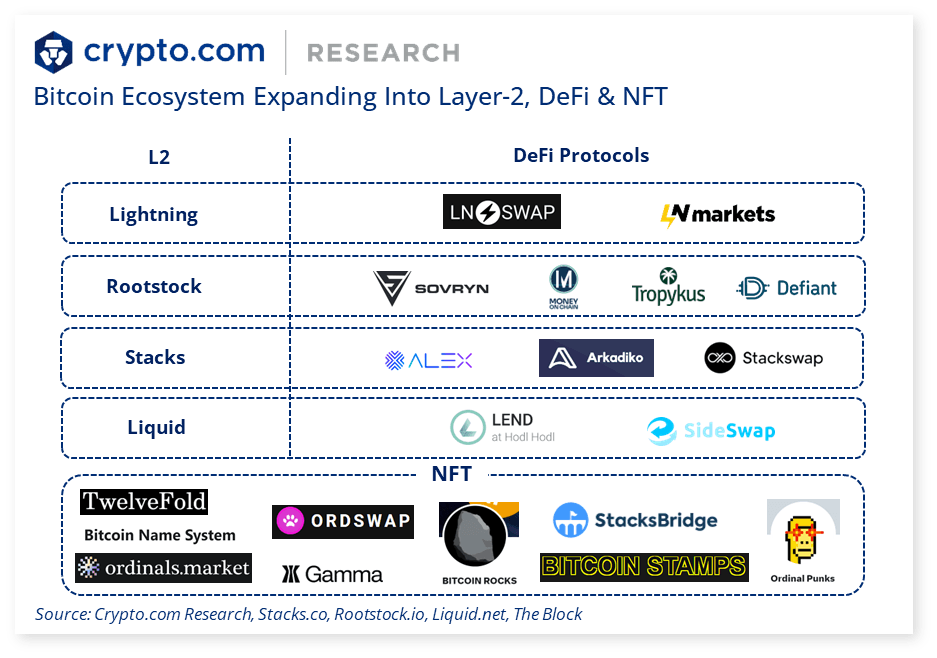

Finding The Best Bitcoin And Crypto Casinos A 2025 Selection

May 17, 2025

Finding The Best Bitcoin And Crypto Casinos A 2025 Selection

May 17, 2025 -

Elaekeyhtioeiden Osakesijoitusten Heikko Alkuvuosi 2024

May 17, 2025

Elaekeyhtioeiden Osakesijoitusten Heikko Alkuvuosi 2024

May 17, 2025 -

Tjrbt Mmyzt Aljzayr Tkrm Almkhrj Allyby Sbry Abwshealt

May 17, 2025

Tjrbt Mmyzt Aljzayr Tkrm Almkhrj Allyby Sbry Abwshealt

May 17, 2025