Succession Planning For The Ultra-High-Net-Worth: A Growing Trend

Table of Contents

The Unique Challenges of UHNW Succession Planning

Succession planning for ultra-high-net-worth individuals presents unique challenges that differ significantly from those faced by individuals with more modest wealth. The sheer scale and complexity of assets, intricate family dynamics, and ambitious philanthropic goals all require highly specialized expertise and careful planning.

Complexity of Assets

UHNW individuals often possess a diverse portfolio of complex assets, far exceeding the typical investment portfolio. This includes:

- Private equity investments: These illiquid assets require specialized valuation and transfer strategies.

- Extensive real estate portfolios: Managing properties across different jurisdictions necessitates intricate legal and tax planning.

- Significant art collections: Appraising and transferring valuable artwork involves specialist art advisors and insurance considerations.

- Intellectual property rights: Protecting and transferring intellectual property requires legal expertise in copyright, patent, and trademark law.

This complexity necessitates a multi-disciplinary team:

- Experienced estate planning lawyers specializing in international tax and asset protection.

- Skilled accountants proficient in complex tax structures and international tax laws.

- Financial advisors with expertise in managing diverse asset classes and sophisticated investment strategies.

- Family therapists or mediators to navigate potential family conflicts and facilitate open communication.

Family Dynamics and Governance

Family dynamics play a crucial role in the success of UHNW succession planning. Disagreements over asset distribution, control, and the family’s future can derail even the most meticulously crafted plan. Effective strategies include:

- Family constitutions: Formal documents outlining family values, governance structures, and dispute resolution mechanisms.

- Trust structures: Complex trust arrangements can facilitate asset protection, tax minimization, and distribution according to specific family needs and wishes.

- Mediation and conflict resolution strategies: Proactive conflict resolution processes can prevent disputes from escalating and ensure a harmonious transition.

- The role of family offices: Dedicated family offices provide centralized management of assets, tax planning, and philanthropic activities, contributing to smooth transitions.

Philanthropic Goals

Many UHNW individuals have significant philanthropic aspirations, which must be integrated into their succession plans. This often involves:

- Establishing family foundations: Dedicated foundations allow for structured charitable giving and long-term impact.

- Charitable giving strategies: Developing strategies to maximize the tax efficiency of charitable donations.

- Impact investing: Investing in ventures aligned with philanthropic goals, generating both financial returns and social impact.

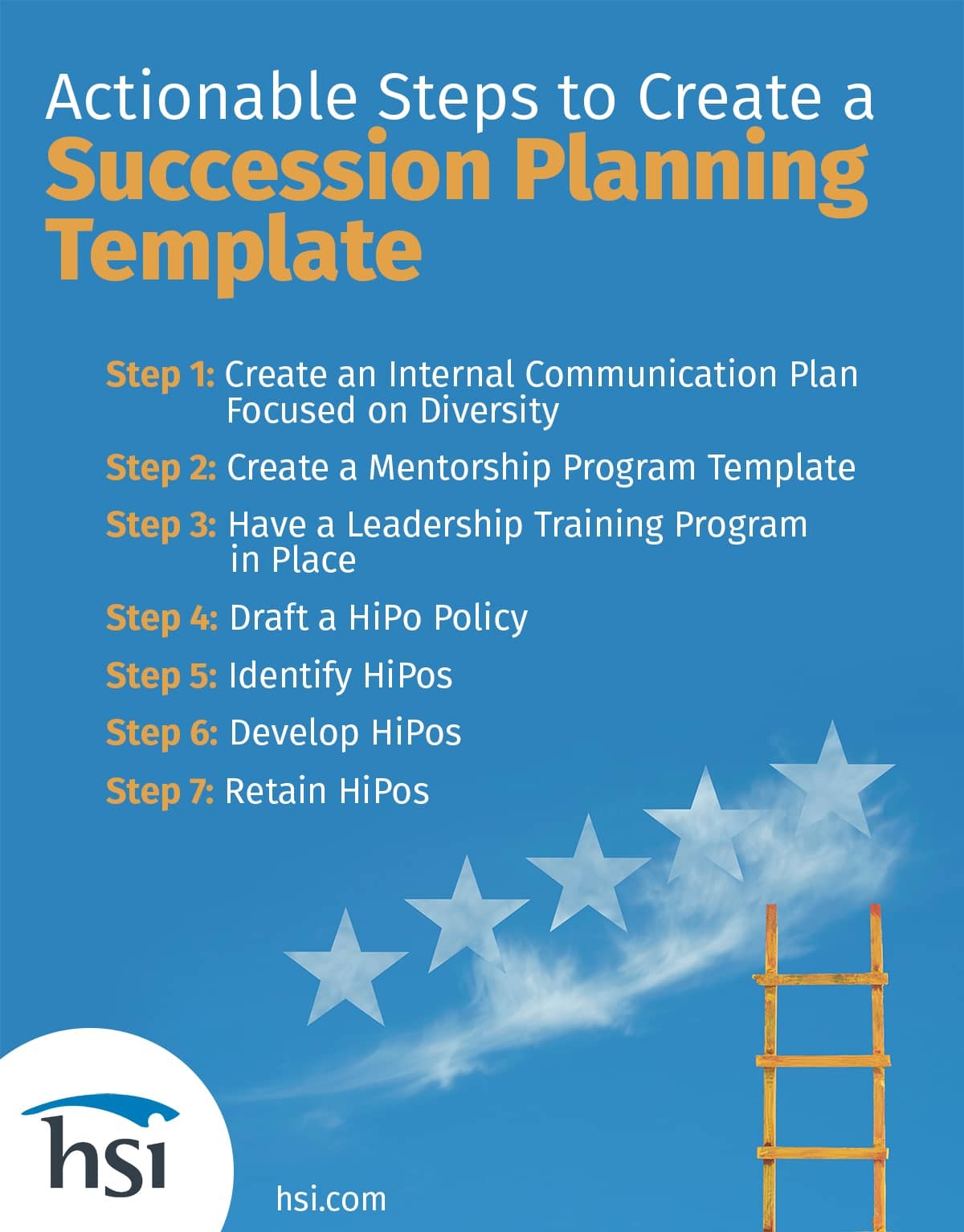

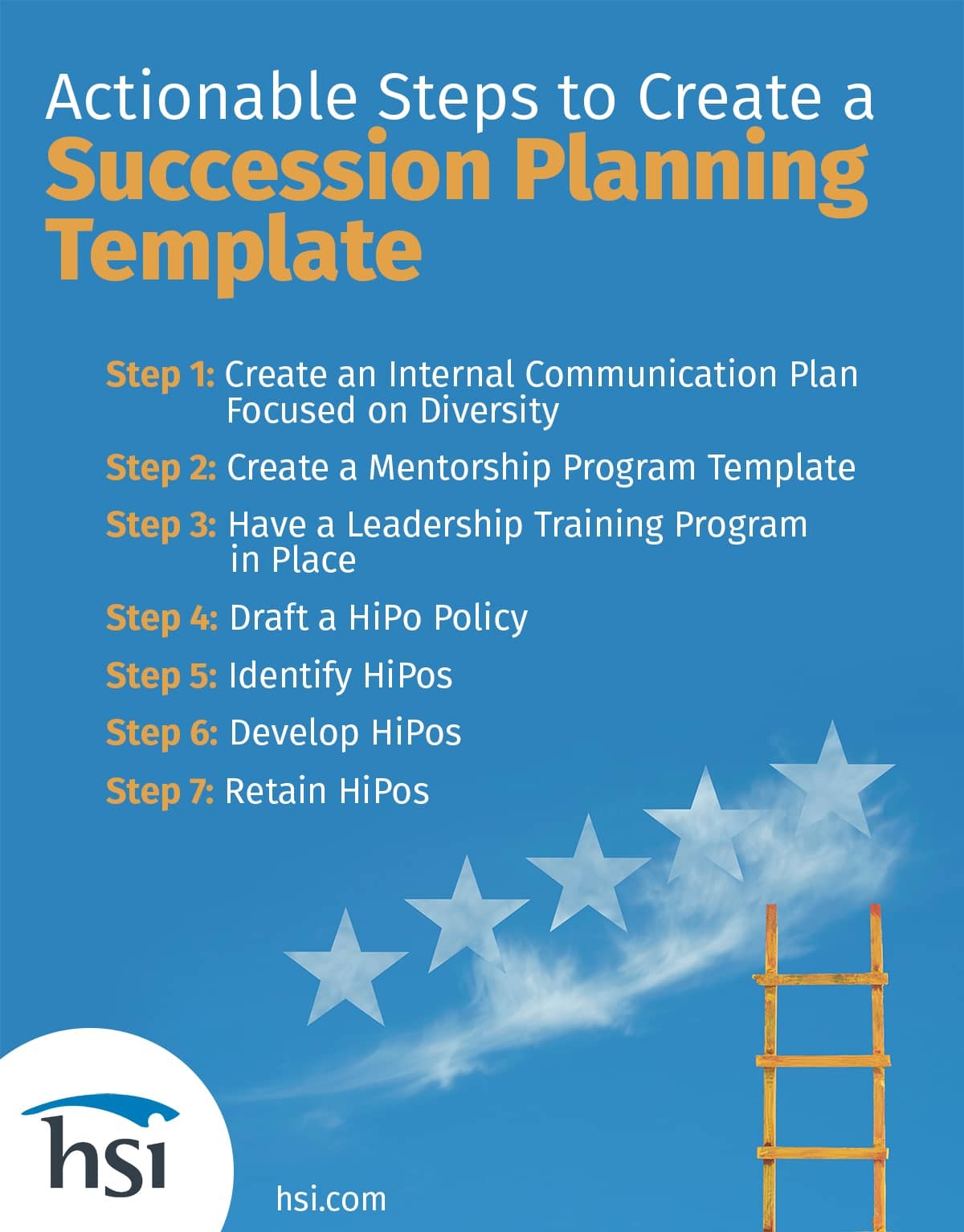

Key Strategies for Effective Succession Planning

Effective succession planning for ultra-high-net-worth individuals necessitates a proactive approach, open communication, and a comprehensive strategy addressing diverse aspects of wealth transfer.

Early Planning and Communication

Initiating the succession planning process well in advance is crucial. Open and honest communication within the family is paramount. Key steps include:

- Engaging in regular family meetings: These meetings allow for open discussions, address concerns, and foster understanding.

- Establishing clear goals and objectives: Defining family values, philanthropic aspirations, and desired outcomes guides the planning process.

- Utilizing professional advisors: Engaging a team of experienced advisors ensures the plan addresses all legal, tax, and financial considerations.

Tax Optimization Strategies

Minimizing tax liabilities is a major concern in UHNW succession planning. Strategies include:

- Understanding international tax laws: Navigating complex international tax regulations is critical for individuals with assets across multiple jurisdictions.

- Utilizing tax-efficient investment structures: Employing structures designed to minimize tax exposure on investment returns and asset transfers.

- Estate tax minimization: Employing legal strategies such as trusts and gifting to reduce estate taxes.

Business Continuity Planning

For families with significant business interests, ensuring business continuity is crucial. This involves:

- Succession planning for key personnel: Identifying and training successors for key roles within the family business.

- Mentorship programs: Establishing mentorship programs to transfer knowledge and skills to the next generation.

- Developing a robust operational plan: Creating a detailed plan that ensures the smooth functioning of the business post-transition.

The Role of Technology in UHNW Succession Planning

Technology plays an increasingly important role in succession planning for ultra-high-net-worth individuals, enhancing efficiency, security, and control.

Digital Asset Management

Managing digital assets is now a critical component of UHNW succession planning. This includes:

- Cryptocurrency management: Securely storing and transferring cryptocurrency holdings requires specialized expertise.

- Intellectual property management: Protecting and transferring digital intellectual property requires specialized legal and technological safeguards.

- Digital legacy planning: Creating a plan for managing and accessing digital accounts and data after death.

Data Security and Privacy

Protecting sensitive financial and personal information is crucial. This requires:

- Robust cybersecurity protocols: Implementing strong security measures to protect against cyber threats.

- Data encryption: Encrypting sensitive data to protect it from unauthorized access.

- Compliance with data protection regulations: Adhering to regulations such as GDPR and CCPA.

Technology-driven Wealth Management Tools

Advanced technology platforms enhance efficiency and control:

- Portfolio management software: Sophisticated software helps in tracking and managing diverse asset classes.

- Financial modeling tools: Tools that aid in forecasting and planning for long-term financial goals.

- Tax optimization software: Software that helps in minimizing tax liabilities through sophisticated planning.

Conclusion

Succession planning for ultra-high-net-worth individuals is a complex but vital undertaking. By acknowledging the unique challenges of significant wealth, implementing strategic planning, and leveraging technology, UHNW families can ensure a seamless transition, safeguard their legacies, and achieve their philanthropic ambitions. Proactive succession planning for ultra-high-net-worth individuals is not just about financial security; it's about securing the future of the family and its legacy. Don't delay; contact a specialist in succession planning for ultra-high-net-worth individuals today to begin building a secure and prosperous future.

Featured Posts

-

Conduite De L Alfa Romeo Junior 1 2 Turbo Speciale Le Matin Auto

May 22, 2025

Conduite De L Alfa Romeo Junior 1 2 Turbo Speciale Le Matin Auto

May 22, 2025 -

Will Trumps Tax Cuts Pass The Gops Divided Future

May 22, 2025

Will Trumps Tax Cuts Pass The Gops Divided Future

May 22, 2025 -

Bp Ceos Plan Double Valuation Remain On London Stock Exchange

May 22, 2025

Bp Ceos Plan Double Valuation Remain On London Stock Exchange

May 22, 2025 -

Google Ai Smart Glasses Prototype Our Experience

May 22, 2025

Google Ai Smart Glasses Prototype Our Experience

May 22, 2025 -

Unexplained Red Flashes In France Analysis Of A Recent Night Sky Event

May 22, 2025

Unexplained Red Flashes In France Analysis Of A Recent Night Sky Event

May 22, 2025

Latest Posts

-

Blake Lively Iced Out Sisters Rally Amidst A List Fallout

May 22, 2025

Blake Lively Iced Out Sisters Rally Amidst A List Fallout

May 22, 2025 -

Taylor Swift And Blake Livelys Feud New Allegations Of Blackmail And Leaked Personal Texts

May 22, 2025

Taylor Swift And Blake Livelys Feud New Allegations Of Blackmail And Leaked Personal Texts

May 22, 2025 -

Blake Lively And Taylor Swift Alleged Blackmail Over Leaked Texts And The Baldoni Feud

May 22, 2025

Blake Lively And Taylor Swift Alleged Blackmail Over Leaked Texts And The Baldoni Feud

May 22, 2025 -

Blake Lively Allegedly Involved News And Analysis From Bored Panda

May 22, 2025

Blake Lively Allegedly Involved News And Analysis From Bored Panda

May 22, 2025 -

Understanding The Blake Lively Alleged Controversy

May 22, 2025

Understanding The Blake Lively Alleged Controversy

May 22, 2025