Suncor Hits Record Production, Inventory Levels Rise, Sales Dip

Table of Contents

Suncor's Record-Breaking Oil Sands Production

Suncor's upstream operations have delivered impressive results, achieving record-high oil sands production. This positive development reflects improvements in operational efficiency and technological advancements within Suncor's oil sands projects.

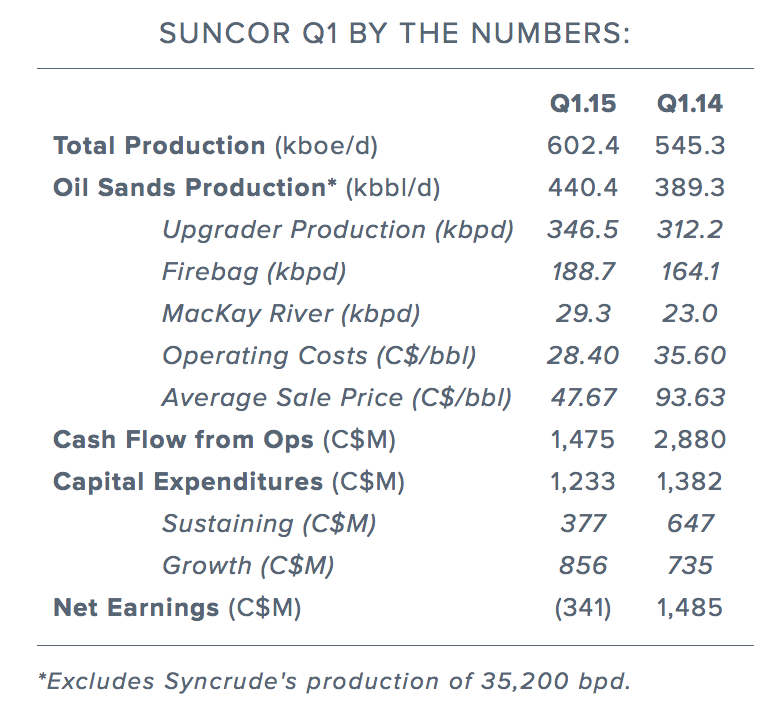

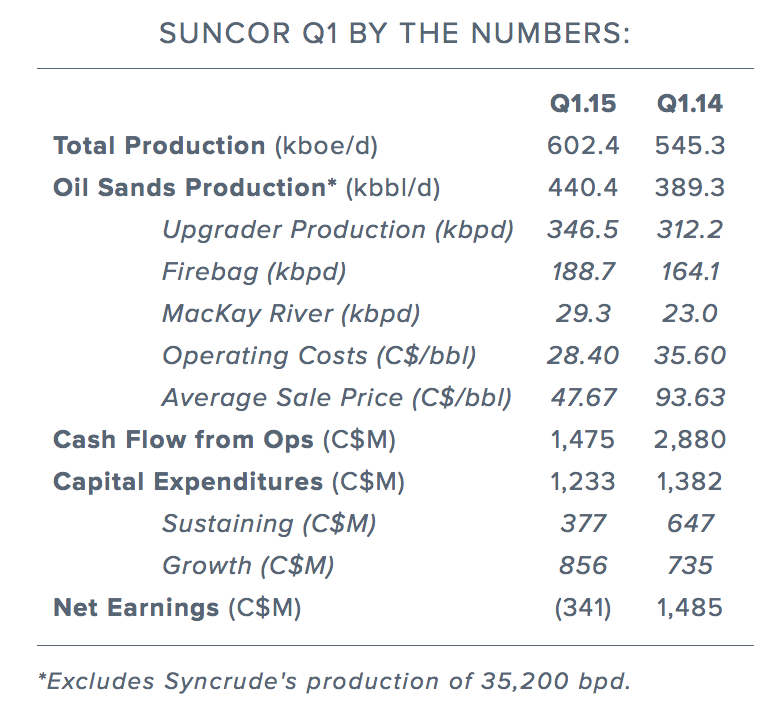

- Quantifiable Growth: Suncor's production figures show a significant year-over-year increase (insert specific percentage and barrel-per-day data here, citing the source). This substantial growth surpasses previous records and highlights the success of ongoing operational improvements.

- Key Contributing Projects: The increase is largely attributed to (mention specific oil sands projects, e.g., Fort Hills, Base Mine). These projects have benefited from increased operational efficiency and technological advancements leading to higher production rates and lower operational costs.

- Operational Efficiency and Cost Reduction: Suncor has implemented various strategies to enhance operational efficiency. These include (mention specific examples like automation, improved maintenance schedules, and streamlined processes). These efforts have resulted in lower production costs per barrel, improving overall profitability.

- Impact on Profitability: The increase in production, coupled with cost reductions, positively impacts Suncor's profitability (mention specific data or projections if available). This strong upstream performance is a key factor in Suncor's overall financial picture, although it's not the whole story.

Suncor's Inventory Surplus: A Cause for Concern?

Despite the record production, Suncor is experiencing a significant rise in its inventory levels. This surplus raises concerns about potential bottlenecks and financial implications.

- Reasons for Increased Inventory: The inventory buildup can be attributed to a combination of factors: slower-than-expected sales growth, increased production outpacing demand, and potentially, strategic inventory management decisions by Suncor.

- Financial Implications: Holding excess inventory comes with significant costs. These include storage expenses, the risk of oil price depreciation, and the potential for increased transportation and handling expenses. A large inventory also ties up capital that could be used for other investments or operations.

- Impact on Cash Flow: The increased inventory negatively affects Suncor's cash flow by tying up capital and increasing storage and related costs. This can impact the company's ability to invest in future projects and return value to shareholders.

- Inventory Reduction Strategies: Suncor may need to implement strategies to reduce inventory, such as adjusting production levels, increasing marketing efforts, or exploring alternative sales channels. These strategies will be crucial to mitigate the negative financial implications of the inventory surplus.

Suncor's Sales Dip: Market Dynamics at Play

The decrease in Suncor's sales presents a significant challenge, highlighting the impact of broader market dynamics on the company's performance.

- Market Conditions: The decline in sales is likely influenced by several external factors: fluctuating global oil prices, changes in global demand for oil products, and increased competition within the energy sector. Geopolitical events and economic uncertainties also play a role.

- Refining Margins: Refining margins, which represent the profit earned from refining crude oil into finished products, are highly influenced by market conditions and the price of refined products. Low refining margins can significantly impact Suncor's sales performance.

- Sales Boosting Strategies: To address the declining sales, Suncor might consider various strategies, including increased marketing and sales efforts, exploration of new markets, and diversification of its product portfolio. Strategic partnerships and technological advancements could also play a key role.

- Quantifiable Sales Decrease: (Insert specific percentage and sales figures here, citing the source). This decline requires careful attention and prompt action from Suncor to restore sales momentum.

Suncor's Financial Performance: A Balanced Perspective

Suncor's overall financial performance is a complex interplay of record production, rising inventory, and declining sales.

- Bottom-Line Impact: While record production contributes positively to the top line, the increased inventory levels and lower sales impact profitability and overall financial performance. A careful analysis of the interplay of these factors is crucial for understanding the complete picture.

- Financial Stability and Projections: Suncor's financial stability depends on its ability to manage its inventory, improve sales, and maintain its strong upstream operations. Analyst predictions and Suncor's own financial reports should be consulted for a deeper understanding of the company’s long-term financial outlook.

- Impact on Stock Price and Investor Sentiment: The mixed performance has likely affected Suncor's stock price and investor sentiment. Investors will be closely monitoring Suncor's strategies to address the challenges presented by rising inventories and declining sales.

Conclusion: Understanding Suncor's Complex Performance

Suncor Energy's recent performance highlights a paradox: record production coupled with increased inventory and lower sales. While the strong upstream performance is positive, the inventory buildup and sales decline pose challenges. Understanding these complexities is crucial for investors and analysts assessing Suncor's future prospects. The company needs to implement effective strategies to manage its inventory, boost sales, and maintain its strong production levels. To stay informed about Suncor Energy's ongoing performance and future developments, subscribe to our updates, review their financial reports, and continue researching Suncor Energy's financial performance.

Featured Posts

-

Reino Unido Depoimento De Mulher Que Afirma Ser Madeleine Mc Cann Leva A Prisao

May 09, 2025

Reino Unido Depoimento De Mulher Que Afirma Ser Madeleine Mc Cann Leva A Prisao

May 09, 2025 -

Understanding The Relationship Between Dangote Nnpc And Petrol Prices In Nigeria

May 09, 2025

Understanding The Relationship Between Dangote Nnpc And Petrol Prices In Nigeria

May 09, 2025 -

Clarksons F1 Rescue Plan Amidst Renewed Ferrari Disqualification Concerns

May 09, 2025

Clarksons F1 Rescue Plan Amidst Renewed Ferrari Disqualification Concerns

May 09, 2025 -

Changes To Uk Visa Policy Restrictions For Some Applicants

May 09, 2025

Changes To Uk Visa Policy Restrictions For Some Applicants

May 09, 2025 -

The Cost Of Inauguration Support Tech Billionaires 194 Billion In Losses

May 09, 2025

The Cost Of Inauguration Support Tech Billionaires 194 Billion In Losses

May 09, 2025