Suncor's Record Production: Inventory Build Impacts Sales Volumes

Table of Contents

Record Production at Suncor: A Closer Look

Suncor's record oil production is a significant event, but understanding the contributing factors is crucial.

Factors Contributing to Record Production:

- Increased operational efficiency: Streamlined processes and improved resource allocation have boosted production output.

- New project commissioning: The successful launch of new projects, including expansions of existing facilities and entirely new oil sands operations, has added significantly to overall production capacity.

- Favorable market conditions: Higher oil prices throughout much of the past year provided strong economic incentives for increased production.

- Technological advancements in oil extraction: Suncor's investment in advanced technologies has improved extraction rates and reduced operational costs, contributing to higher production volumes.

Analyzing Production Data:

While precise figures require referencing Suncor's official financial reports, the increase in oil production has been substantial. For example, [Insert hypothetical data: e.g., "Production at Suncor's Fort Hills operation increased by 15% compared to the previous year, while production at its Base Mine saw a 10% rise"]. This data would be best represented visually with charts and graphs showcasing production increases across various oil sands operations, illustrating the magnitude of the achievement. (Note: Insert actual data and visuals here if available).

Geographical Breakdown:

The record production wasn't confined to a single facility. [Insert hypothetical data: e.g., "The Base Mine contributed 40% to the total increase, while Fort Hills and other oil sands operations contributed 30% and 30% respectively"]. Analyzing the contribution of each facility highlights the widespread success of Suncor's production initiatives. (Note: Insert actual data here if available).

The Inventory Build-Up: Causes and Consequences

Despite the record production, Suncor faces a significant challenge: a substantial inventory build-up.

Reasons for Increased Inventory:

- Weak global demand for oil: A slowdown in global economic growth has dampened demand, leading to an oversupply in the market.

- Logistical challenges in transportation and distribution: Bottlenecks in transportation infrastructure and difficulties in efficient distribution have contributed to inventory accumulation.

- Market saturation and pricing pressures: The increased supply has put downward pressure on oil prices, reducing the incentive for immediate sales.

- Unexpected refinery maintenance impacting throughput: Scheduled and unscheduled refinery maintenance has further limited the capacity to process and sell the produced oil, adding to the inventory build-up.

The Impact of High Inventories:

- Increased storage costs: Maintaining large oil inventories incurs substantial storage and maintenance expenses.

- Potential for price discounts due to surplus supply: To clear the excess inventory, Suncor might need to offer price discounts, reducing profit margins.

- Risk of asset write-downs if prices fall further: If oil prices continue to decline, Suncor may need to write down the value of its oil inventory, impacting its financial statements.

- Strain on cash flow: The combination of increased storage costs and potential price discounts can strain Suncor's cash flow.

Comparison to Industry Trends:

Comparing Suncor's inventory levels to other major oil producers provides context. [Insert comparative data if available and relevant, potentially using a table to highlight the differences]. This comparison helps assess whether Suncor's situation is unique or reflects broader industry trends.

Impact on Suncor's Sales Volumes

The inventory build-up has directly impacted Suncor's sales volumes.

Decline in Sales Figures:

[Insert data on decreased sales volumes, comparing current figures with previous periods. Use charts and graphs to visualize the trend. Example: "Sales volume in Q3 2023 decreased by X% compared to Q3 2022"].

The Relationship Between Production and Sales:

The record production and the drop in sales are directly correlated. The inability to sell the increased production has led to the inventory build-up and the subsequent decline in sales figures. This highlights a critical imbalance between supply and demand.

Strategic Implications for Suncor's Pricing and Marketing:

Suncor may need to implement new pricing strategies to stimulate demand and reduce inventory levels. This could involve offering discounts or exploring new markets.

Suncor's Response and Future Outlook

Suncor is likely to take several steps to address this challenge.

Suncor's Strategies for Inventory Management:

Suncor's response will likely involve a multi-pronged approach: potentially adjusting production levels to better align with demand, enhancing its sales and marketing efforts to increase sales volumes, exploring new markets, and improving logistics to reduce transportation bottlenecks.

Potential for Long-Term Growth:

Despite the current challenges, Suncor's long-term growth prospects remain dependent on factors such as global oil demand, successful implementation of its inventory management strategies and continuing technological advancements in the oil and gas sector.

Investor Sentiment and Stock Performance:

The market reaction to Suncor's record production and decreased sales has likely been mixed, impacting the company's stock performance. [Insert relevant data if available on stock performance].

Conclusion: Understanding Suncor's Production and Sales Imbalance

Suncor's record oil production, while impressive, has been overshadowed by a significant inventory build-up, directly impacting sales volumes. Several factors, including weak global demand and logistical challenges, have contributed to this imbalance. The resulting high inventories pose risks to Suncor's profitability and financial stability. Suncor's response to this challenge will be crucial in determining its future performance and ability to balance production with sales. Stay tuned for further updates on Suncor's strategies to manage its inventory and improve sales volumes. Follow our analysis for continued insights into Suncor Energy's performance.

Featured Posts

-

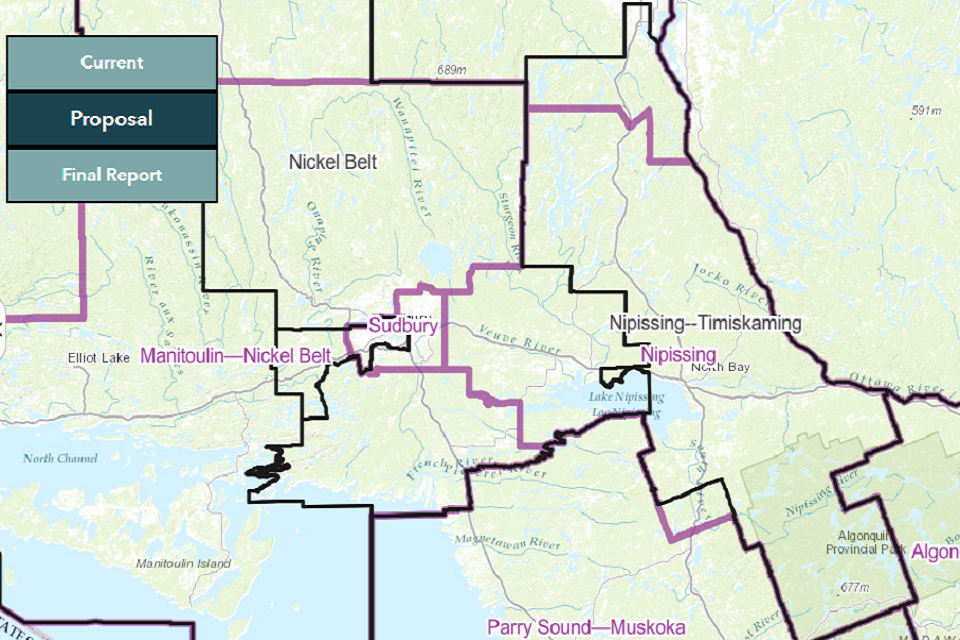

Greater Edmonton Federal Riding Changes Impacts On Voters

May 09, 2025

Greater Edmonton Federal Riding Changes Impacts On Voters

May 09, 2025 -

3 Year Stock Prediction Identifying Two Potential Palantir Outperformers

May 09, 2025

3 Year Stock Prediction Identifying Two Potential Palantir Outperformers

May 09, 2025 -

Bondis Alleged Hiding Of Epstein Records Investigation By Senate Democrats

May 09, 2025

Bondis Alleged Hiding Of Epstein Records Investigation By Senate Democrats

May 09, 2025 -

Caso Madeleine Mc Cann Prisao De Mulher Que Se Identifica Como A Desaparecida

May 09, 2025

Caso Madeleine Mc Cann Prisao De Mulher Que Se Identifica Como A Desaparecida

May 09, 2025 -

Laebwa Krt Alqdm Almdkhnwn Asmae Wathr Altdkhyn Ela Msyrthm

May 09, 2025

Laebwa Krt Alqdm Almdkhnwn Asmae Wathr Altdkhyn Ela Msyrthm

May 09, 2025