Taiwan's Reduced Exposure To US Bond ETFs

Table of Contents

Factors Contributing to Reduced Taiwanese Investment in US Bond ETFs

Several interconnected factors have contributed to Taiwan's reduced investment in US bond ETFs. These can be broadly categorized into shifts in the global economic landscape, regulatory changes, and the performance of the US bond ETFs themselves.

Shifting Global Economic Landscape

The current global economic climate presents challenges to investment strategies worldwide.

- Rising Interest Rates and Inflation: The Federal Reserve's aggressive interest rate hikes to combat inflation have made domestic investments in Taiwan comparatively more attractive, reducing the incentive to invest in US bonds.

- Geopolitical Uncertainty: The ongoing geopolitical tensions and uncertainties globally have increased risk aversion among investors, leading to a reassessment of portfolio diversification strategies.

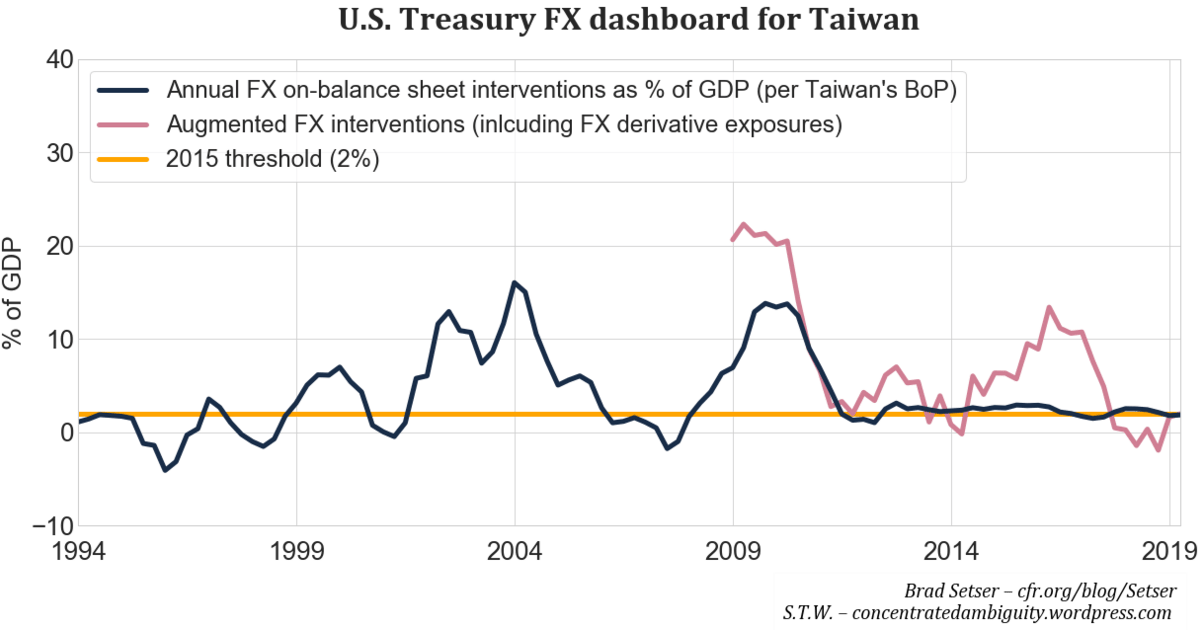

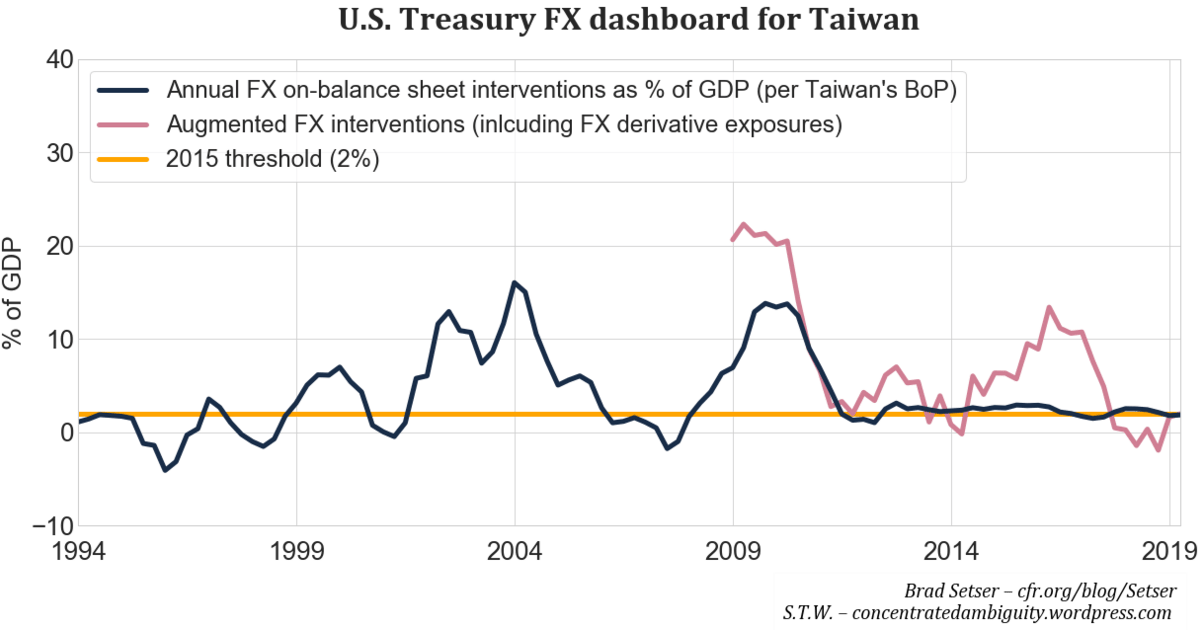

- US Dollar Volatility: Fluctuations in the US dollar's value introduce currency risk for Taiwanese investors, potentially impacting returns on US bond ETF investments. This risk is exacerbated by the strength of the Taiwanese dollar in certain periods.

- Diversification: Many Taiwanese investors are actively diversifying their portfolios away from heavy reliance on US assets, exploring opportunities in other regions and asset classes. This includes increased interest in Asian markets and emerging economies.

Regulatory Changes and Tax Implications

Changes in Taiwanese regulations and tax policies have also influenced investment decisions.

- New Tax Treaties: Any adjustments to tax treaties between Taiwan and the US could alter the tax burden on returns from US bond ETFs, affecting their relative attractiveness.

- Capital Gains Tax: Modifications to capital gains tax rates in Taiwan could impact the profitability of selling US bond ETFs, influencing investment decisions.

- Increased Regulatory Scrutiny: Greater oversight of overseas investments by Taiwanese authorities may have increased the compliance burden and reduced the appeal of US bond ETFs for some investors.

Performance of US Bond ETFs

The performance of US bond ETFs themselves has played a role in shaping Taiwanese investor sentiment.

- Bond Yield Fluctuations: Changes in US bond yields, influenced by factors like inflation and monetary policy, directly impact the value of bond ETFs, affecting returns.

- Credit Rating Downgrades: Potential downgrades to the credit ratings of US bonds could increase perceived risk and deter investment.

- Impact of Inflation on Bond Prices: High inflation erodes the purchasing power of fixed-income investments like bonds, impacting the attractiveness of US bond ETFs.

Implications of Reduced Taiwanese Holdings on the US Bond Market

The decrease in Taiwanese investment in US bond ETFs has potential implications for the US bond market.

Impact on Bond Yields

Reduced demand from Taiwanese investors could put upward pressure on US Treasury yields, potentially increasing borrowing costs for the US government and corporations.

- Increased Yields Due to Reduced Demand: A smaller pool of buyers for US bonds can lead to higher yields as the supply remains relatively constant.

- Potential for Increased Volatility: Reduced foreign investment can contribute to increased volatility in the US bond market, making it more susceptible to external shocks.

- Impact on Other Foreign Investors: The actions of Taiwanese investors could influence the behavior of other foreign investors, potentially creating a ripple effect across the global bond market.

Implications for US Monetary Policy

The reduced inflow of capital from Taiwan may influence the Federal Reserve's decisions on monetary policy.

- Potential for Altered Monetary Policy Responses: The Fed may need to adjust its monetary policy to account for decreased foreign investment, potentially affecting interest rate decisions.

- Impact on Inflation Targets: Changes in foreign investment can indirectly affect inflation, potentially influencing the Fed's inflation targets and policy responses.

- Influence on the US Dollar's Value: Decreased demand for US bonds could indirectly impact the value of the US dollar in the foreign exchange markets.

Future Outlook and Potential Rebalancing by Taiwan

The future of Taiwanese investment in US bond ETFs depends on several factors.

Potential for Future Investment

Several conditions could lead to a resurgence of Taiwanese interest in US bond ETFs.

- Economic Recovery: A robust global economic recovery could increase investor confidence and lead to renewed interest in US bond ETFs.

- Changes in Interest Rate Environment: A shift towards lower interest rates in the US could make US bond ETFs more attractive compared to domestic investments.

- Improved Geopolitical Stability: Reduced global uncertainty could encourage investors to allocate more capital to US assets.

Diversification Strategies for Taiwan

Taiwan may diversify its investment portfolio in several ways.

- Increased Investment in Asian Markets: Taiwan might increase its investments in other Asian markets to capitalize on regional growth opportunities.

- Exploration of Alternative Asset Classes: Taiwan could allocate capital to alternative asset classes like private equity, real estate, or infrastructure projects.

- Domestic Infrastructure Development: Focus could shift towards investing in domestic infrastructure projects to support economic growth within Taiwan.

Conclusion

Taiwan's reduced exposure to US bond ETFs is a complex issue influenced by global economic conditions, regulatory changes, and the performance of US bond ETFs. This shift has potential implications for both Taiwan's economic strategy and the US bond market's stability. While a complete withdrawal from US bond ETFs is unlikely, Taiwan's future investment strategy will likely involve diversification and a closer examination of risk-adjusted returns across a broader range of asset classes. Staying informed about the evolving situation surrounding Taiwan US Bond ETFs is crucial. We encourage readers to continue researching this important topic by subscribing to reputable financial news sources and consulting with financial advisors for personalized investment guidance tailored to your specific circumstances. Understanding the dynamics of Taiwan US Bond ETFs is essential for navigating the complexities of the global financial landscape.

Featured Posts

-

2025 Ptt Personel Alim Tarihleri Ve Basvuru Bilgileri

May 08, 2025

2025 Ptt Personel Alim Tarihleri Ve Basvuru Bilgileri

May 08, 2025 -

Winning Numbers Daily Lotto Thursday April 17 2025

May 08, 2025

Winning Numbers Daily Lotto Thursday April 17 2025

May 08, 2025 -

Postane Personel Alimlari 2025 Basvuru Tarihi Ve Detaylar

May 08, 2025

Postane Personel Alimlari 2025 Basvuru Tarihi Ve Detaylar

May 08, 2025 -

Understanding The Risks And Rewards Of Investing In Xrp Ripple

May 08, 2025

Understanding The Risks And Rewards Of Investing In Xrp Ripple

May 08, 2025 -

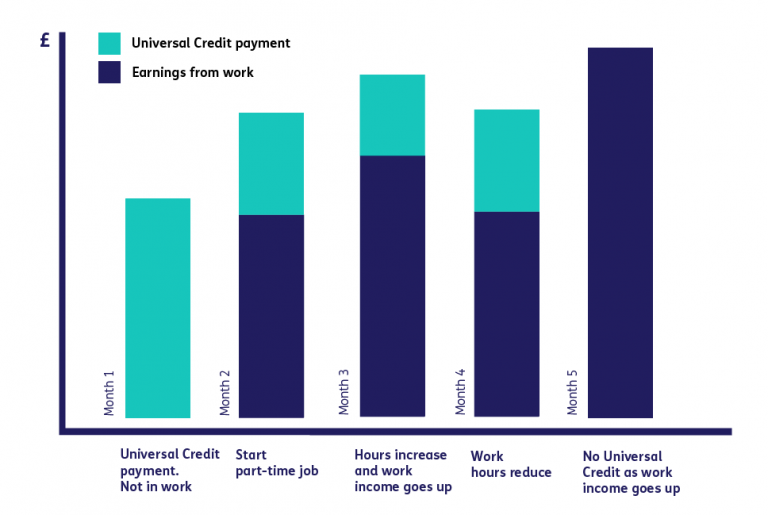

Historical Universal Credit Payments Are You Missing Out

May 08, 2025

Historical Universal Credit Payments Are You Missing Out

May 08, 2025