Tariff Shock: Bond Market Repercussions

Table of Contents

Inflationary Pressures and Bond Yields

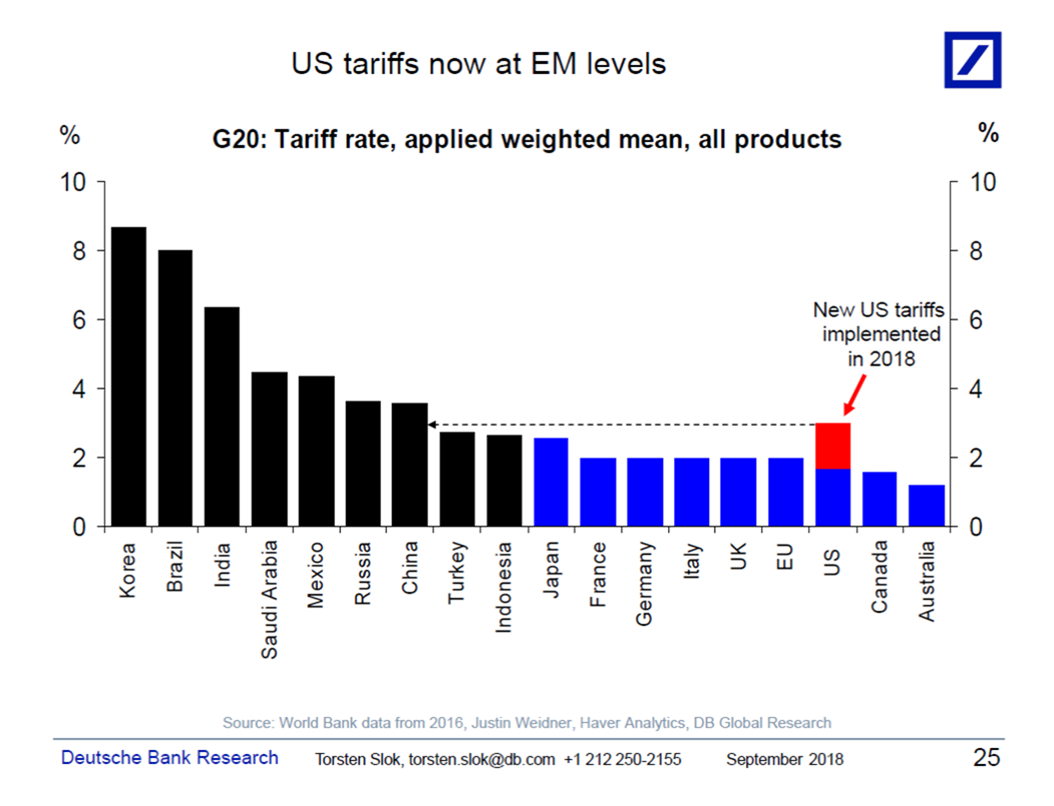

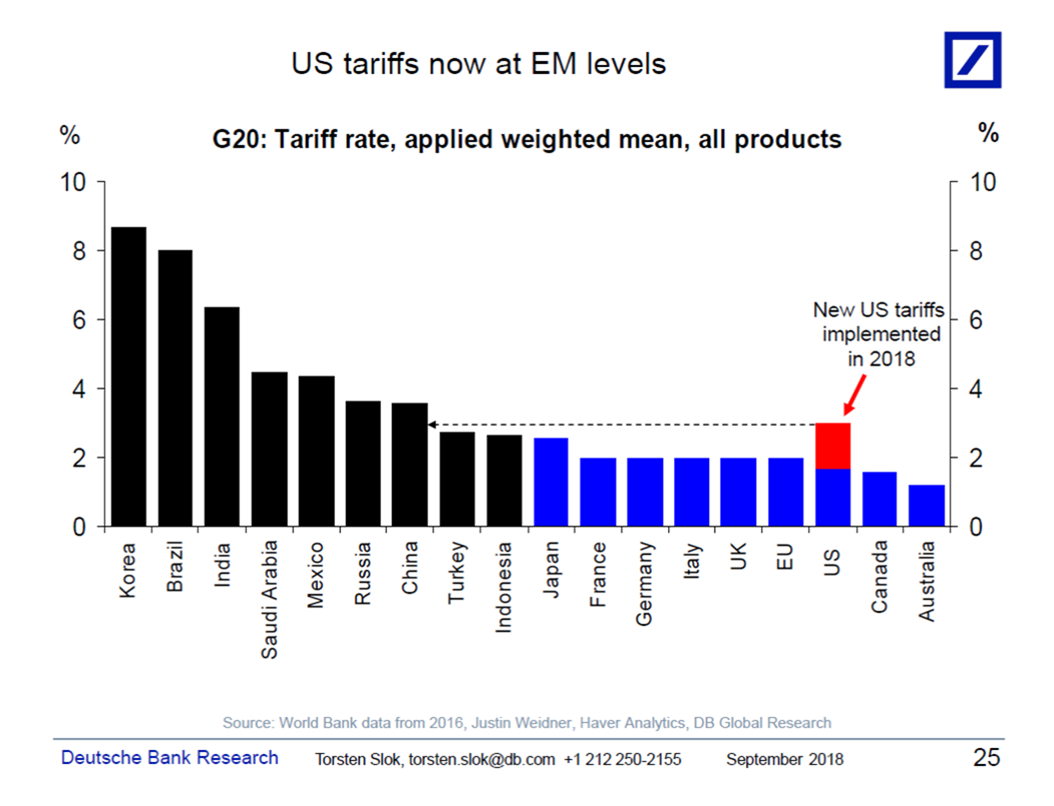

Tariffs, essentially taxes on imported goods, directly contribute to inflationary pressures. Increased import costs translate to higher prices for consumers, reducing their purchasing power. This inflationary pressure is a key driver of changes in the bond market. The relationship between inflation and bond yields is inverse: as inflation rises, bond yields typically rise as well to compensate investors for the diminished purchasing power of their fixed-income returns.

- Increased import costs: Tariffs directly increase the price of imported goods, leading to higher production costs for businesses and ultimately, higher consumer prices.

- Reduced consumer purchasing power: Higher prices erode consumer spending, potentially leading to slower economic growth.

- Impact on bond prices: Rising inflation erodes the real value of fixed-income securities, causing bond prices to fall.

- Bond yield curve steepening: As inflation expectations rise, the yield curve (the difference in yields between short-term and long-term bonds) often steepens, reflecting anticipated future interest rate increases.

Understanding the interplay between inflationary pressure and the bond yield curve is crucial for managing interest rate risk. Investors need to carefully consider how these dynamics will affect their bond portfolio returns.

Impact on Interest Rates and Monetary Policy

Central banks play a critical role in responding to inflation. When inflation rises due to tariff-induced shocks, central banks often react by increasing interest rates. This monetary policy response aims to cool down the economy and curb inflation. However, interest rate hikes have a direct impact on bond prices. As interest rates rise, the value of existing bonds with lower coupon rates decreases, making them less attractive compared to newly issued bonds with higher yields.

- Central bank response to inflation: Central banks typically raise interest rates to combat inflation. The Federal Reserve (Fed), the European Central Bank (ECB), and other central banks monitor inflationary pressures closely and adjust monetary policy accordingly.

- Consequences of interest rate hikes: Higher interest rates lead to lower bond prices and potentially reduced demand for bonds.

- Uncertainty in monetary policy: Unpredictable tariff policies create uncertainty for central banks, making it challenging to formulate effective monetary policy decisions. This uncertainty further contributes to bond market volatility.

Shifting Investor Sentiment and Flight to Safety

The uncertainty created by unpredictable tariff policies significantly affects investor sentiment. Investors become more risk-averse, seeking safer investment havens. This often leads to a "flight to safety," where investors shift their portfolios towards less risky assets, such as government bonds. This increased demand for government bonds can drive down their yields and increase their prices.

- Investor confidence and risk aversion: Tariffs introduce uncertainty into the market, making investors more cautious and leading to a decrease in risk appetite.

- Flight to safety: Investors often move into government bonds, considered low-risk assets, during periods of economic uncertainty.

- Impact on bond market liquidity: The increased demand for government bonds can temporarily reduce the liquidity of other segments of the bond market.

Specific Examples of Tariff Shock Impact

Historical examples, such as the Smoot-Hawley Tariff Act of 1930, illustrate the potential negative consequences of protectionist trade policies on economic growth and market stability. Analyzing these case studies reveals the significant impact that tariff shocks can have on various asset classes, including the bond market, highlighting the importance of proactive risk management strategies. Further research into these historical instances offers valuable insights into mitigating future risks.

Conclusion: Mitigating the Tariff Shock on Your Bond Portfolio

Tariffs can significantly impact the bond market by influencing inflation, interest rates, and investor sentiment. Understanding this intricate relationship is crucial for investors seeking to protect their bond portfolios. The unpredictable nature of tariff shocks necessitates careful consideration of diversification and risk management strategies. Investors should consider diversifying their bond portfolios across different sectors, maturities, and credit ratings to reduce their exposure to any single source of risk. Robust risk management, including stress testing and scenario analysis, is essential for navigating uncertain market conditions.

To effectively manage your bond portfolio in the face of potential Tariff Shock events, further research into bond market analysis and risk mitigation strategies is vital. Explore resources that provide in-depth analysis of macroeconomic trends, interest rate forecasts, and bond market valuations. By proactively adapting your investment strategy and staying informed about evolving global trade dynamics, you can better mitigate the impact of future Tariff Shock events on your fixed-income investments.

Featured Posts

-

Lily Collins Sizzling New Calvin Klein Campaign Photo 5133602

May 12, 2025

Lily Collins Sizzling New Calvin Klein Campaign Photo 5133602

May 12, 2025 -

Weekend Usmnt Recap Dest And Pulisic Headline The News

May 12, 2025

Weekend Usmnt Recap Dest And Pulisic Headline The News

May 12, 2025 -

The Unexpected Pairing Why The Stallone Parton Musical Comedy Failed

May 12, 2025

The Unexpected Pairing Why The Stallone Parton Musical Comedy Failed

May 12, 2025 -

40 Point Games For Two Celtics Players An Unexpected Outcome

May 12, 2025

40 Point Games For Two Celtics Players An Unexpected Outcome

May 12, 2025 -

Neal Mc Clellands Ill House U Featuring Andrea Love A Dancefloor Anthem

May 12, 2025

Neal Mc Clellands Ill House U Featuring Andrea Love A Dancefloor Anthem

May 12, 2025