Tariff Uncertainty? Why Microsoft Software Stock Stands Out

Table of Contents

Microsoft's Diversified Revenue Streams Mitigate Tariff Risks

One of the most significant advantages of Microsoft software stock is the company's impressively diversified revenue streams. This diversification significantly reduces its vulnerability to the risks associated with tariff uncertainty and global trade wars.

Reduced Dependence on Hardware

Microsoft's strategic shift towards cloud services (Azure) and software licensing has dramatically reduced its reliance on physical hardware manufacturing and distribution. This is crucial because hardware is particularly susceptible to import tariffs and supply chain disruptions.

- Azure's global reach diversifies revenue sources, reducing dependence on any single market and insulating it from regional economic downturns.

- Software licensing generates recurring revenue, providing a stable and predictable income stream, regardless of fluctuating hardware sales.

- Microsoft is far less susceptible to manufacturing delays and raw material price increases that often plague hardware companies, impacting both profitability and stock valuations.

Strong Global Presence, but Decentralized Operations

Microsoft boasts a vast global presence, which is generally a positive attribute. However, their operational strategy is crucial; it's decentralized. This minimizes reliance on any single region or geopolitical situation.

- Data centers strategically located across the globe minimize vulnerability to geopolitical tensions and regional disruptions.

- Distributed development teams mitigate risks associated with localized disruptions, ensuring business continuity even during regional crises.

- Revenue is generated from multiple geographic locations, safeguarding against market fluctuations in a single region or country. This international diversification is a key factor in the resilience of Microsoft software stock.

Microsoft's Software Dominance Ensures Consistent Demand

Microsoft's enduring success stems from its dominant market position in essential software. This dominance translates into consistent demand, regardless of broader economic fluctuations.

Essential Software Solutions

Microsoft's products, including Windows, Office 365, and other enterprise solutions, are deeply embedded in the workflows of businesses and individuals worldwide. This creates high switching costs, making them less vulnerable to economic downturns.

- High switching costs for businesses and consumers create a significant barrier to entry for competitors.

- Strong brand recognition and market loyalty ensure sustained demand even during economic uncertainty.

- Constant updates and improvements maintain market leadership, further solidifying their position.

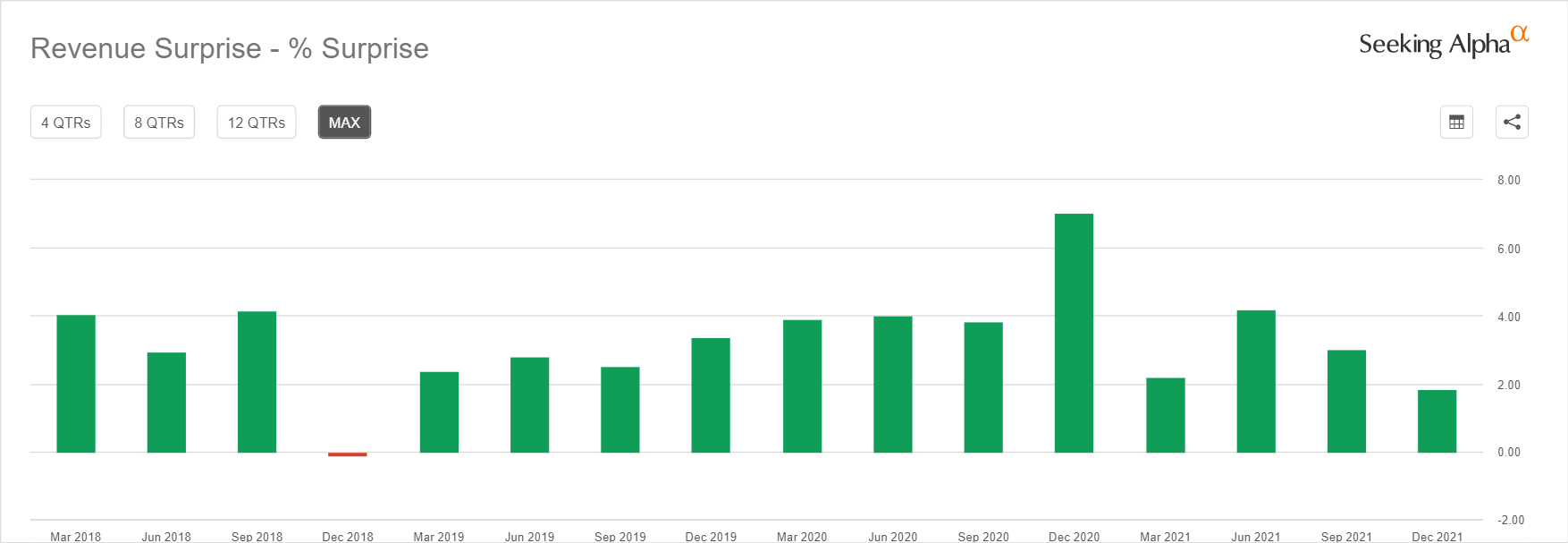

Cloud Computing Growth Fuels Steady Revenue

The explosive growth of Microsoft's cloud computing services, particularly Azure, is a major driver of consistent revenue streams. This sector is less susceptible to tariff impacts than traditional hardware.

- Azure competes directly with Amazon Web Services (AWS), showcasing its strength and market share in a rapidly expanding market.

- Growing adoption of cloud-based solutions across businesses of all sizes ensures continued growth and demand for Microsoft's cloud offerings.

- Cloud services typically offer higher profit margins compared to traditional software licensing, enhancing overall profitability and investor returns.

Microsoft's Financial Strength Provides a Safety Net

Beyond its diversified revenue streams and market dominance, Microsoft's robust financial position provides a critical safety net during periods of economic uncertainty and heightened tariff uncertainty.

Robust Balance Sheet

Microsoft possesses a remarkably strong balance sheet, enabling it to weather economic downturns and absorb potential tariff-related impacts far more effectively than many competitors.

- Significant cash reserves allow for strategic investments in research and development, acquisitions, and shareholder returns, demonstrating financial strength and stability.

- Stable cash flow provides crucial financial flexibility during challenging times, allowing for adaptation and strategic maneuvering.

- Low debt levels further enhance financial resilience, creating a buffer against potential economic headwinds.

Conclusion

While global tariff uncertainty presents challenges for many companies, Microsoft software stock emerges as a relatively safe haven. Its diversified revenue streams, market dominance in essential software, and robust financial health combine to create a compelling investment case, even during periods of economic instability. Considering its resilience to tariff impacts and consistent growth potential, investing in Microsoft software stock is a strategic move for investors seeking stability and long-term growth. Don’t hesitate to explore the potential of Microsoft Software Stock further – research the current market trends and consult with a financial advisor to make informed investment decisions.

Featured Posts

-

Viet Jet Payment Stay Denied Implications For The Airlines Finances

May 15, 2025

Viet Jet Payment Stay Denied Implications For The Airlines Finances

May 15, 2025 -

Hamer Bruins Moet Met Npo Toezichthouder Praten Over Leeflang

May 15, 2025

Hamer Bruins Moet Met Npo Toezichthouder Praten Over Leeflang

May 15, 2025 -

Padres Clinch Series Win Over Cubs

May 15, 2025

Padres Clinch Series Win Over Cubs

May 15, 2025 -

College Van Omroepen Hoe Vertrouwen Binnen De Npo Te Herstellen

May 15, 2025

College Van Omroepen Hoe Vertrouwen Binnen De Npo Te Herstellen

May 15, 2025 -

0 3

May 15, 2025

0 3

May 15, 2025

Latest Posts

-

Ohtanis Walk Off Blast Dodgers Suffer Historic 8 0 Defeat

May 15, 2025

Ohtanis Walk Off Blast Dodgers Suffer Historic 8 0 Defeat

May 15, 2025 -

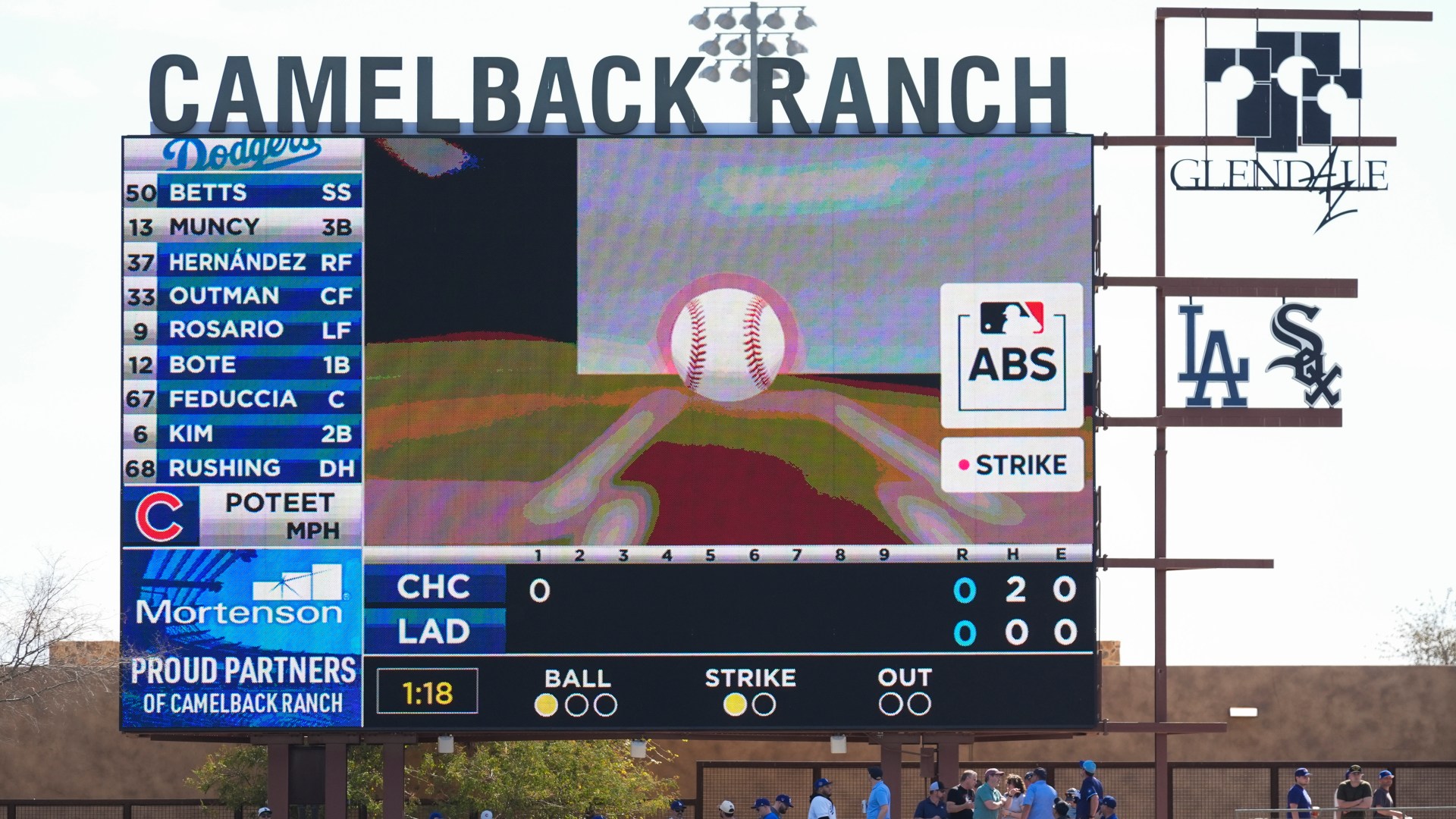

Cubs Poteet Triumphs In Spring Training Abs Challenge

May 15, 2025

Cubs Poteet Triumphs In Spring Training Abs Challenge

May 15, 2025 -

Oakland As News Muncy Makes Roster Starts At Second Base

May 15, 2025

Oakland As News Muncy Makes Roster Starts At Second Base

May 15, 2025 -

Cody Poteets First Abs Challenge Win Chicago Cubs Spring Training

May 15, 2025

Cody Poteets First Abs Challenge Win Chicago Cubs Spring Training

May 15, 2025 -

Dodgers Left Handers Performance Dip And Potential For Improvement

May 15, 2025

Dodgers Left Handers Performance Dip And Potential For Improvement

May 15, 2025