Tariff Wars Top Threat To Ryanair's Growth, Buyback Program Announced

Table of Contents

Tariff Wars: A Direct Threat to Ryanair's Operating Costs

The imposition of tariffs significantly impacts Ryanair's bottom line, affecting its operational costs in several key areas.

Fuel Prices and Hedging Strategies

Increased tariffs on aviation fuel directly translate to higher operational expenditure for Ryanair. Understanding the airline's fuel hedging strategies and their effectiveness in mitigating this risk is crucial.

- Ryanair's Fuel Hedging Policy: Ryanair, like many airlines, employs hedging strategies to protect itself against volatile fuel prices. This typically involves purchasing fuel futures contracts, locking in prices for a future period. However, the effectiveness of these hedges depends on the accuracy of price predictions and the duration of the tariff impact.

- Impact of Tariff Increases on Fuel Costs: Tariffs imposed on imported fuel directly increase the cost per unit, squeezing profit margins. The magnitude of this impact depends on the size and duration of the tariffs, as well as Ryanair's ability to pass on these increased costs to consumers through ticket prices.

- Alternative Fuel Sources and Their Feasibility: The airline industry is actively exploring alternative sustainable aviation fuels (SAFs) to reduce its carbon footprint and dependence on fossil fuels. However, the widespread adoption of SAFs is still some years away, and their current cost remains significantly higher than traditional jet fuel.

- Effectiveness of Current Hedging Strategies: While hedging can partially mitigate the impact of volatile fuel prices, it's not a foolproof solution. Unexpected tariff increases can still significantly affect Ryanair's profitability, especially if the hedging strategies are not perfectly aligned with market realities.

Impact on Aircraft Manufacturing and Maintenance

Tariffs on aircraft parts and maintenance services represent another significant cost pressure for Ryanair. This impacts its fleet management and overall operational efficiency.

- Cost of Imported Aircraft Parts: A large portion of aircraft parts are manufactured internationally, making Ryanair vulnerable to tariffs imposed on imported goods. This directly impacts maintenance costs and potential upgrades.

- Potential Supply Chain Disruptions: Tariffs can disrupt established supply chains, leading to delays in receiving essential parts and impacting maintenance schedules. This disruption can lead to increased downtime and reduced operational efficiency.

- Alternative Sourcing Strategies: Ryanair might explore alternative sourcing strategies, potentially shifting its reliance on suppliers in countries not subject to the same tariffs. However, this requires time, investment, and may not always be feasible.

- Impact on Maintenance Schedules: Delays in acquiring parts due to tariffs can lead to disruptions in maintenance schedules, potentially affecting the airline's operational safety and punctuality.

Ryanair's Buyback Program: A Strategic Response to Uncertainty?

Ryanair's announcement of a significant share buyback program amidst the uncertainty caused by tariff wars requires careful analysis.

Buyback as a Confidence Booster

The buyback can be seen as a signal of confidence from Ryanair's management, suggesting that they believe the company is undervalued in the current market despite external challenges.

- Details of the Buyback Program: The specifics of the buyback—the number of shares, the timeframe, and the total investment—should be clearly detailed and analyzed for its impact.

- Potential Impact on Shareholder Value: A buyback program can increase earnings per share, potentially boosting shareholder value in the short term. However, it also depends on the company's overall financial health and future prospects.

- Implications for Future Investment: The capital allocated to the buyback could have been used for other strategic investments, such as fleet expansion or technological upgrades. This trade-off needs careful consideration.

- Messaging to Investors and the Market: The buyback program's messaging to the market is crucial. It signals management's confidence and outlook, affecting investor sentiment and the company's stock price.

Alternative Uses of Capital

The decision to undertake a buyback program implies the forgoing of other potential investments.

- Opportunity Costs of the Buyback: The capital used for the buyback could have been invested in fleet modernization, technological improvements, or expansion into new markets, which might offer higher long-term returns.

- Return on Investment Comparison: A thorough comparison of the potential return on investment (ROI) of the buyback versus other potential strategic investments is necessary to assess the long-term impact of this capital allocation decision.

- Long-Term Implications of Capital Allocation Strategy: The buyback's long-term impact needs to be assessed within the context of Ryanair's overall strategic goals and the prevailing economic environment.

The Broader Economic Impact and Future Outlook for Ryanair

The impact of tariff wars extends beyond Ryanair's direct costs, influencing the broader economic landscape and affecting passenger demand.

Passenger Demand and Economic Slowdown

Tariff wars can trigger an economic slowdown, impacting consumer spending and potentially reducing air travel demand.

- Correlation Between Economic Growth and Air Travel: Air travel is often considered a discretionary expense, meaning that demand is sensitive to economic fluctuations. A slowdown reduces passenger numbers.

- Potential for Decreased Passenger Demand: An economic slowdown triggered by tariff wars can lead to lower demand for air travel, impacting Ryanair's revenue.

- Impact on Ryanair’s Pricing Strategies: Ryanair might need to adjust its pricing strategies to maintain occupancy rates in the face of reduced demand.

Navigating Uncertainty

Ryanair’s ability to navigate the challenges posed by tariff wars and broader economic uncertainty will shape its future.

- Ryanair’s Historical Performance During Economic Downturns: Analyzing Ryanair's performance during previous economic downturns can offer valuable insights into its resilience and adaptability.

- Potential Diversification Strategies: Exploring opportunities for diversification—such as expanding into different market segments or geographic areas—could help mitigate risks associated with tariff wars and economic uncertainty.

- Long-Term Prospects for the Company: The long-term prospects of Ryanair depend on its ability to effectively manage costs, adapt to evolving market conditions, and maintain its competitive edge.

Conclusion

The escalating tariff wars present a significant challenge to Ryanair's ambitious growth trajectory. While the buyback program signals a degree of confidence, the airline faces considerable headwinds related to increased fuel costs and potential supply chain disruptions. Investors and industry analysts should carefully monitor the impact of these global trade disputes on Ryanair's future performance. Understanding the interplay between tariff wars, operating costs, and strategic decisions like buyback programs is crucial for assessing Ryanair's long-term prospects. Continue to follow our analysis for further updates on how Ryanair is navigating the complexities of the ongoing tariff wars and their impact on its growth strategy.

Featured Posts

-

Colombian Models Murder And Mexican Influencers Killing A Wave Of Condemnation Against Femicide

May 21, 2025

Colombian Models Murder And Mexican Influencers Killing A Wave Of Condemnation Against Femicide

May 21, 2025 -

Hellfest 2024 Decouvrez La Brasserie Hell City A Clisson

May 21, 2025

Hellfest 2024 Decouvrez La Brasserie Hell City A Clisson

May 21, 2025 -

Grocery Bargains 2000 Found And Doge Poll This Week In Gbr

May 21, 2025

Grocery Bargains 2000 Found And Doge Poll This Week In Gbr

May 21, 2025 -

Femicide Understanding The Rise In Violence Against Women

May 21, 2025

Femicide Understanding The Rise In Violence Against Women

May 21, 2025 -

Analyzing Liverpools Win Against Psg Luck Or Slots Tactical Brilliance

May 21, 2025

Analyzing Liverpools Win Against Psg Luck Or Slots Tactical Brilliance

May 21, 2025

Latest Posts

-

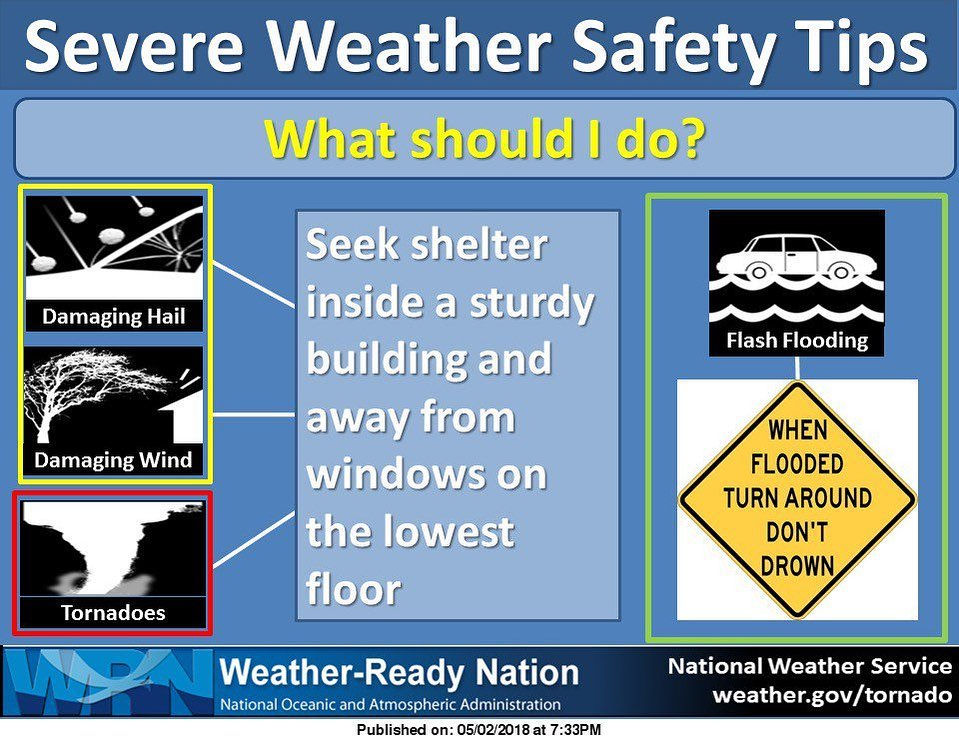

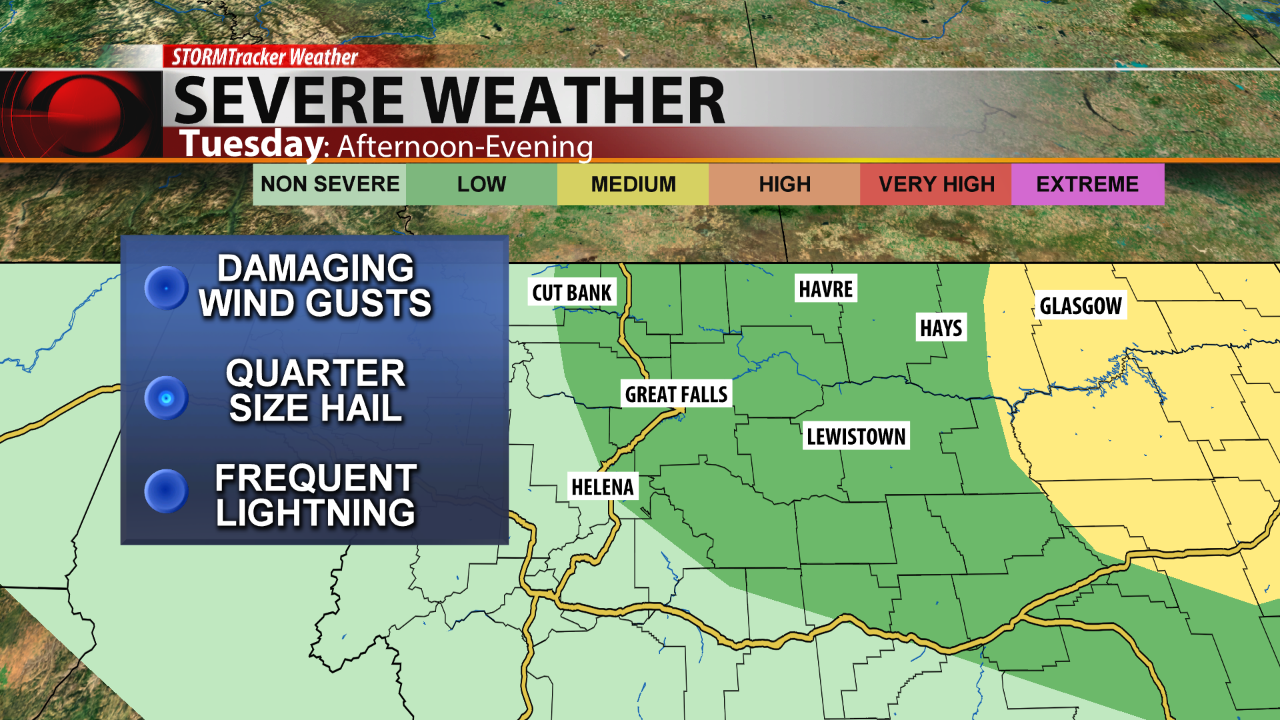

Increased Storm Chance Overnight Severe Weather Alert For Monday

May 21, 2025

Increased Storm Chance Overnight Severe Weather Alert For Monday

May 21, 2025 -

Enjoy Mild Temperatures And A Low Chance Of Rain This Week

May 21, 2025

Enjoy Mild Temperatures And A Low Chance Of Rain This Week

May 21, 2025 -

How To Dress For Breezy And Mild Conditions A Practical Guide

May 21, 2025

How To Dress For Breezy And Mild Conditions A Practical Guide

May 21, 2025 -

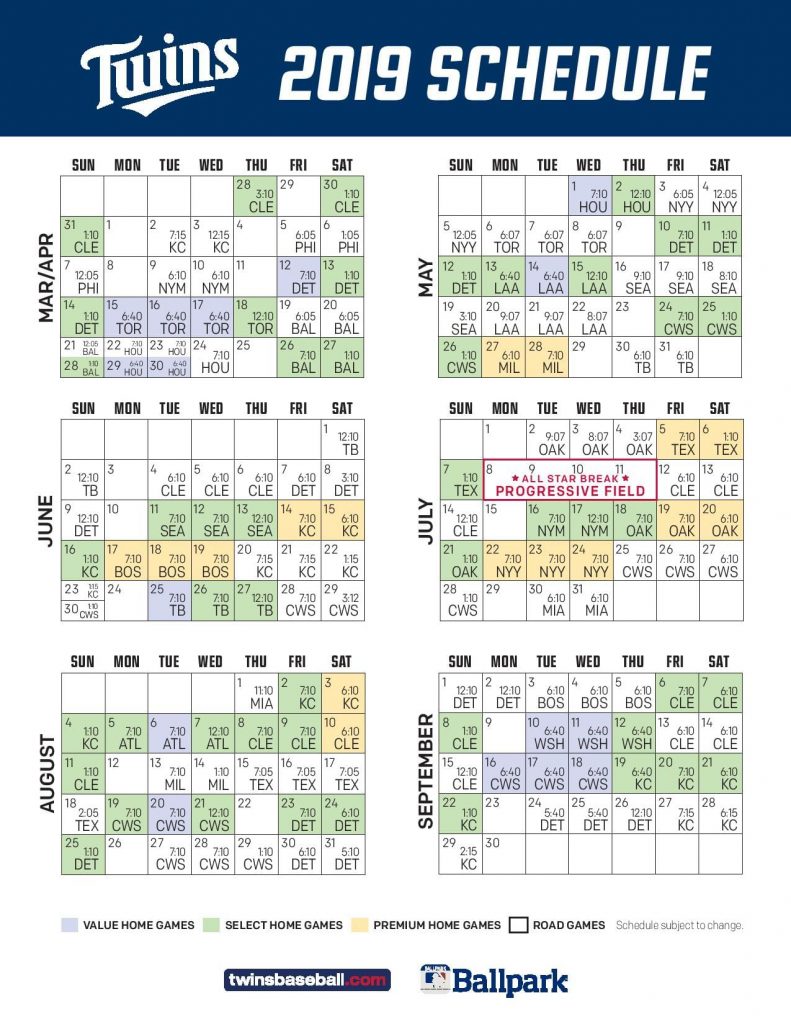

Minnesota Twins Baseball 10 Games On Kcrg Tv 9

May 21, 2025

Minnesota Twins Baseball 10 Games On Kcrg Tv 9

May 21, 2025 -

Severe Weather Possible Monday Overnight Storm Chances

May 21, 2025

Severe Weather Possible Monday Overnight Storm Chances

May 21, 2025