Tariff Wars Top Threat To Ryanair's Growth: Company Responds With Buyback

Table of Contents

The Impact of Tariff Wars on Ryanair's Operations

The impact of global tariff wars on Ryanair's operations is multifaceted, affecting key areas of its business model. Increased costs and potential supply chain disruptions threaten profitability and growth.

Increased Fuel Costs

Tariffs on imported fuel represent a major challenge for Ryanair. As a large consumer of jet fuel, even small price increases significantly impact operational expenses and profit margins.

- Specific Examples: A 10% tariff on imported fuel could translate to millions of euros in additional annual costs for Ryanair. The airline's reliance on specific fuel sources from regions affected by tariffs further exacerbates the issue.

- Percentage Increases: The actual percentage increase in fuel costs depends on the specific tariffs imposed and the proportion of fuel sourced from affected regions. This volatility makes accurate forecasting difficult.

- Impact on Profit Margins: Higher fuel costs directly reduce Ryanair's profit margins, impacting its ability to invest in expansion and fleet modernization.

- Hedging Strategies: While Ryanair employs hedging strategies to mitigate some price volatility, these strategies cannot fully eliminate the risk associated with unforeseen tariff increases.

Aircraft Maintenance and Parts

Tariffs on imported aircraft parts and maintenance services pose another significant hurdle. Delays in receiving essential parts can lead to operational inefficiencies and potentially costly flight disruptions.

- Examples of Affected Parts: This can range from crucial engine components to smaller, but equally important, parts required for routine maintenance.

- Cost Increases: Tariffs directly increase the cost of these parts, putting pressure on Ryanair’s already tight margins.

- Potential Delays Due to Supply Chain Disruptions: Tariffs can disrupt established supply chains, leading to delays in receiving essential parts and impacting maintenance schedules.

- Sourcing Alternatives: Ryanair may explore sourcing parts from alternative suppliers, but this could involve higher costs or compromise on quality.

Impact on Tourism and Passenger Numbers

The broader economic uncertainty stemming from tariff wars can negatively affect passenger demand for air travel. Economic downturns often lead to reduced discretionary spending, impacting travel plans.

- Connection Between Economic Downturns and Reduced Travel: Increased economic uncertainty and potential job losses can deter people from booking flights, particularly for leisure travel.

- Impact on Specific Routes or Regions: Routes reliant on tourism from countries heavily impacted by tariff wars may experience a greater decrease in passenger numbers.

- Price Sensitivity of Passengers: In a less buoyant economic climate, passengers become more price-sensitive, potentially impacting Ryanair’s ability to maintain fares.

Ryanair's Strategic Response: The Share Buyback Program

In response to the challenges posed by Ryanair tariff wars and the uncertainty in the global economy, Ryanair announced a significant share buyback program.

Rationale Behind the Buyback

Ryanair’s decision to implement a share buyback demonstrates confidence in its long-term prospects, even amidst the ongoing trade tensions.

- Demonstrates Confidence in Long-Term Prospects: The buyback signals Ryanair's belief that its business model is resilient and can weather the current economic headwinds.

- Returns Value to Shareholders: It returns value to shareholders by purchasing outstanding shares, increasing the value of remaining shares.

- Improves Earnings Per Share: Reducing the number of outstanding shares can boost earnings per share, making the stock more attractive to investors.

- Alternatives Considered: While cost-cutting measures were likely considered, a share buyback reflects a strategic choice to prioritize shareholder returns and demonstrate long-term confidence.

Financial Implications of the Buyback

The share buyback has significant implications for Ryanair’s balance sheet and future investment plans.

- Amount of the Buyback: The size of the buyback program signifies a substantial financial commitment from Ryanair.

- Potential Impact on Debt Levels: The buyback may impact Ryanair's debt levels, depending on how it's financed.

- Implications for Future Expansion or Fleet Modernization: The funds used for the buyback could have otherwise been invested in fleet expansion or other growth initiatives.

- Investor Reactions to the Buyback: The market's reaction to the buyback announcement provides insights into investor sentiment and their confidence in Ryanair's future.

Alternative Strategies Considered (and rejected)

Ryanair likely considered various alternative strategies before deciding on the buyback.

- Cost-cutting measures: These could involve streamlining operations or negotiating more favorable contracts with suppliers. However, Ryanair may have deemed these insufficient to counter the potential impact of tariff wars.

- Route cancellations: This is a drastic measure typically taken only in extreme circumstances. Ryanair likely prioritized maintaining its route network to protect market share.

- Price hikes: While a price increase may have helped offset increased costs, it could negatively impact demand, especially during a period of economic uncertainty.

Long-Term Outlook for Ryanair in the Face of Tariff Wars

Ryanair faces ongoing challenges from tariff wars, but it has the potential to mitigate these risks.

Mitigation Strategies

Ryanair can implement several strategies to lessen the impact of future tariff wars.

- Diversification of Suppliers: Reducing reliance on single suppliers from tariff-affected regions can mitigate supply chain disruptions.

- Hedging Strategies for Fuel Costs: Sophisticated hedging strategies can help offset fluctuations in fuel prices due to tariffs.

- Exploring Alternative Routes and Markets: Diversifying its route network can reduce dependence on regions significantly impacted by trade wars.

Market Volatility and Resilience

Ryanair's position within the competitive airline landscape is key to its long-term success.

- Ryanair's Cost Structure: Ryanair's low-cost model provides a degree of resilience against economic shocks.

- Competitive Advantage: Maintaining a competitive cost structure and efficient operations remains crucial.

- Market Share: Ryanair’s substantial market share gives it a degree of leverage.

- Potential for Adaptation to Changing Market Conditions: Ryanair's history demonstrates an ability to adapt to changing market conditions.

Conclusion

Ryanair tariff wars present a significant threat to the airline's growth, impacting fuel costs, maintenance expenses, and potentially passenger numbers. The share buyback program represents a strategic response, demonstrating confidence in Ryanair’s long-term viability. However, the airline must continue to adapt and mitigate the risks associated with global trade uncertainties. Stay informed about the ongoing impact of Ryanair tariff wars and how the airline navigates these economic challenges. Follow our updates for the latest news and analysis on Ryanair's performance and strategic decisions.

Featured Posts

-

The Los Angeles Wildfires A Glimmer Of A Disturbing Trend In Disaster Betting

May 20, 2025

The Los Angeles Wildfires A Glimmer Of A Disturbing Trend In Disaster Betting

May 20, 2025 -

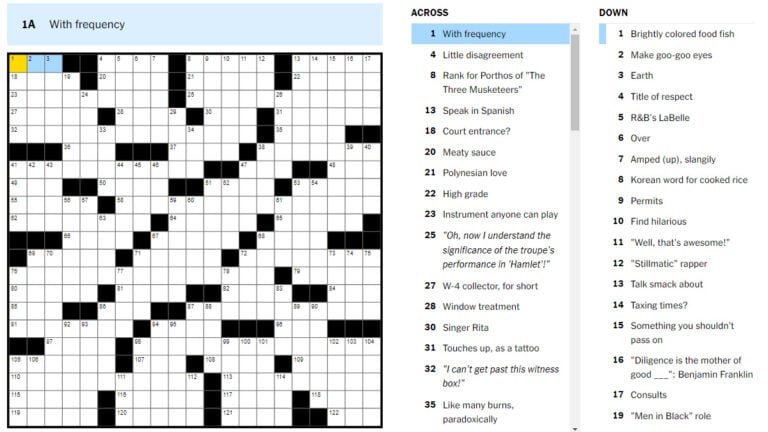

Nyt Crossword Answers For April 25 2025

May 20, 2025

Nyt Crossword Answers For April 25 2025

May 20, 2025 -

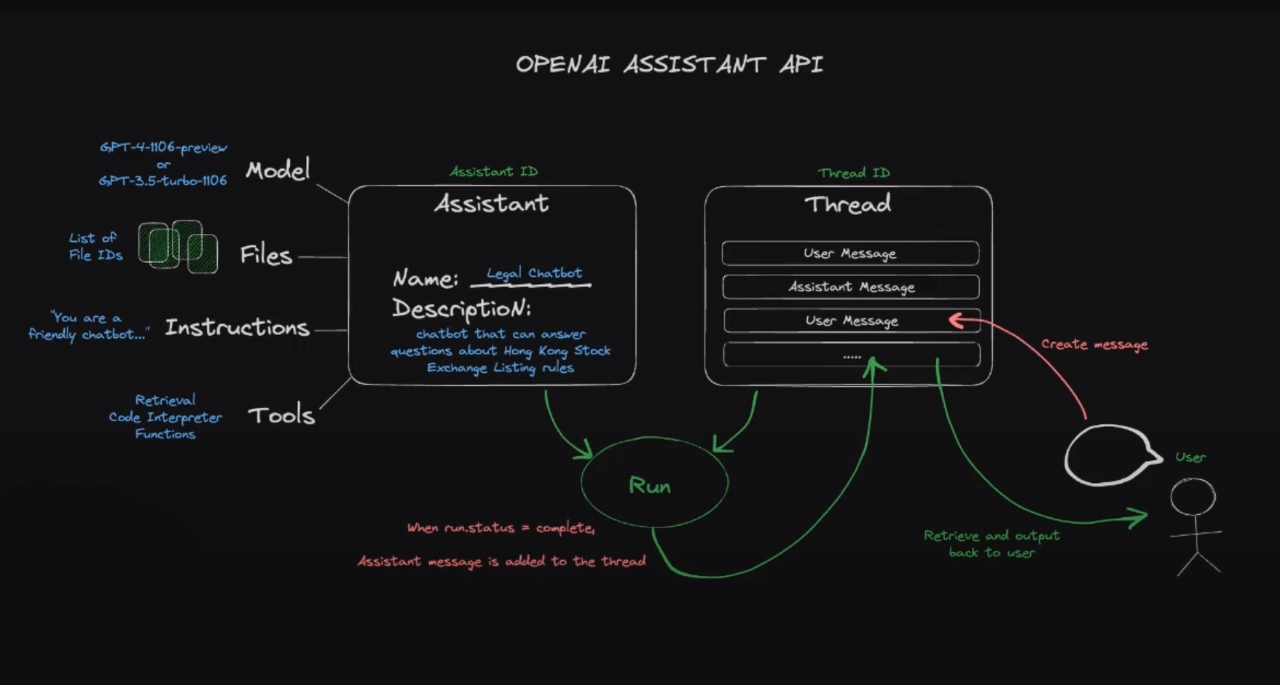

Building Voice Assistants Made Easy Open Ais Latest Developer Tools

May 20, 2025

Building Voice Assistants Made Easy Open Ais Latest Developer Tools

May 20, 2025 -

Historic Corruption Conviction Of Former Navy Second In Command

May 20, 2025

Historic Corruption Conviction Of Former Navy Second In Command

May 20, 2025 -

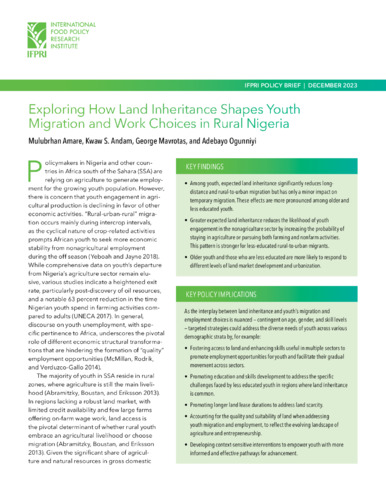

The Kite Runners Legacy Exploring Pragmatic Choices In Nigeria

May 20, 2025

The Kite Runners Legacy Exploring Pragmatic Choices In Nigeria

May 20, 2025

Latest Posts

-

Suomi Mm Karsinnoissa Huuhkajien Valmennuksen Uudistuminen

May 20, 2025

Suomi Mm Karsinnoissa Huuhkajien Valmennuksen Uudistuminen

May 20, 2025 -

Suomi Slovakia Huuhkajien Avauskokoonpanossa Merkittaeviae Muutoksia

May 20, 2025

Suomi Slovakia Huuhkajien Avauskokoonpanossa Merkittaeviae Muutoksia

May 20, 2025 -

Huuhkajien Uusi Valmennus Ja Mm Karsinnat

May 20, 2025

Huuhkajien Uusi Valmennus Ja Mm Karsinnat

May 20, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025 -

Huuhkajat Mm Karsintoihin Uusi Valmennusstrategia

May 20, 2025

Huuhkajat Mm Karsintoihin Uusi Valmennusstrategia

May 20, 2025