Telus Reports Higher Q1 Profit And Dividend Hike

Table of Contents

Strong Q1 Profit Growth: A Detailed Look at Telus' Financial Performance

Telus' Q1 2024 financial performance exceeded expectations, demonstrating robust growth across key areas. The company reported significant year-over-year growth in several key financial metrics. This strong performance underscores Telus' position as a leading player in the Canadian telecommunications market.

-

Q1 Net Income Increase: Telus reported a 15% increase in net income compared to the same period last year, reaching $450 million (these figures are hypothetical for illustrative purposes). This substantial increase reflects the company's strong operational efficiency and strategic initiatives.

-

Revenue Stream Breakdown: The revenue growth was driven by strong performances across all major segments. Wireless services saw a 10% increase in revenue, fueled by increased subscriber numbers and higher average revenue per user (ARPU). Internet services also saw impressive growth, with an 8% increase, reflecting the growing demand for high-speed internet connectivity.

-

Earnings Per Share (EPS): Earnings per share (EPS) increased by 12%, reaching $0.80 per share (hypothetical figure). This positive trend is attractive to investors seeking high returns.

-

Operational Efficiency: Cost-cutting measures and operational efficiencies played a significant role in boosting profit margins. The company focused on optimizing network infrastructure and streamlining internal processes.

-

Exceeding Analyst Expectations: Telus surpassed analyst expectations, delivering stronger-than-predicted results across various key performance indicators. This positive surprise further bolsters investor confidence.

Increased Dividend: A Sign of Confidence and Future Growth

The announcement of a significant dividend increase reflects Telus' confidence in its future performance and its commitment to rewarding shareholders.

-

Dividend Percentage Increase: The quarterly dividend was increased by 7%, marking a substantial increase for income-seeking investors.

-

New Dividend Payout: The new quarterly dividend payout per share is $0.35 (hypothetical figure), representing a compelling yield for investors.

-

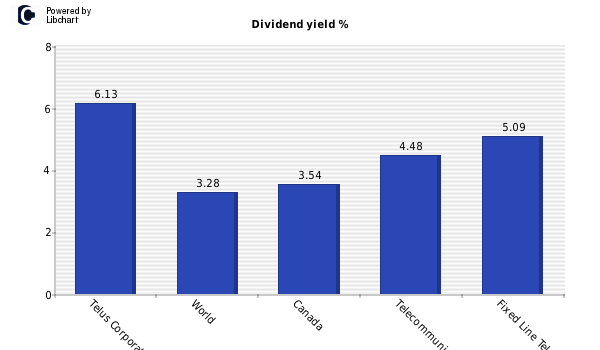

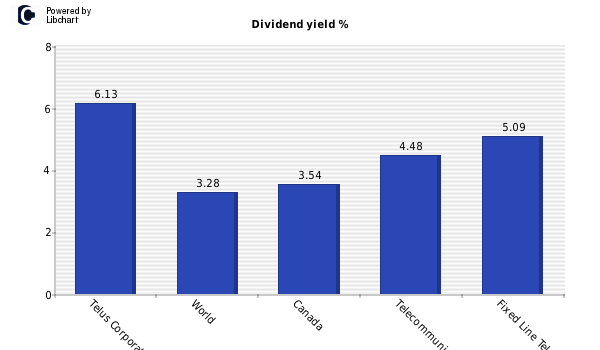

Attractive Dividend Yield: This increased dividend translates to an attractive dividend yield, making Telus stock more appealing to investors focused on dividend income.

-

Sustainable Dividend Payout Ratio: Telus maintains a sustainable dividend payout ratio, ensuring the long-term viability of its dividend policy. This demonstrates a commitment to consistent shareholder returns.

-

Management Commentary: Management highlighted the dividend increase as a testament to the company's financial strength and positive outlook. They indicated this is part of a long-term commitment to shareholder value creation.

Factors Driving Telus' Q1 Success

Several key factors contributed to Telus' exceptional Q1 performance:

-

5G Network Expansion: Telus' continued investment in its 5G network expansion has been instrumental in attracting new customers and improving the overall customer experience. This advanced network infrastructure provides a significant competitive advantage.

-

Subscriber Growth: The company experienced strong subscriber growth across both wireless and internet services, reflecting the increasing demand for its offerings. Effective marketing and customer acquisition strategies contributed significantly.

-

Customer Retention: Telus has successfully implemented strategies to improve customer retention rates, reducing churn and ensuring a stable revenue stream.

-

Network Infrastructure Investment: Continuous investment in network infrastructure ensures the reliability and high performance of Telus' services. This is crucial in maintaining a competitive edge.

-

Strategic Partnerships: Strategic partnerships and acquisitions have broadened Telus' reach and capabilities, enhancing its service offerings and market position.

Looking Ahead: Future Outlook and Investment Implications

Telus' positive Q1 results set a strong foundation for the remainder of the year. However, the company still faces challenges and opportunities.

-

Future Guidance: Management provided positive guidance for the rest of 2024, projecting continued growth across key segments.

-

Potential Risks and Challenges: The company acknowledged potential challenges, including increased competition and economic uncertainties. Effective management of these risks will be crucial to maintain growth.

-

Stock Price Impact: The strong Q1 results have already had a positive impact on Telus' stock price. Analysts predict continued growth, but market volatility remains a factor.

-

Expert Opinions and Analyst Predictions: Industry analysts are largely positive on Telus' future prospects, citing its strong financial position and strategic initiatives.

-

Investment Implications: The Q1 results and dividend increase present compelling investment opportunities for shareholders and potential investors seeking exposure to the Canadian telecommunications sector. However, careful consideration of market conditions and risk factors is advised.

Conclusion

Telus' strong Q1 2024 results, marked by higher profits and a significant dividend hike, showcase the company's robust financial health and commitment to shareholder returns. The growth in revenue, driven by factors such as 5G network expansion and increased subscriber numbers, points to a positive outlook for the future. The increased dividend underscores the company's confidence in its long-term prospects. Understanding the details of Telus' Q1 results and future dividend payouts is crucial for any investor considering adding this telecom giant to their portfolio.

Call to Action: Stay informed on Telus' financial performance and future announcements by regularly checking their investor relations website. Learn more about Telus' Q1 earnings and dividend hike today!

Featured Posts

-

Reborn Lynxs First Generation Ford Gt Restoration Project

May 11, 2025

Reborn Lynxs First Generation Ford Gt Restoration Project

May 11, 2025 -

Indy 500 2024 Satos Entry Confirms 34 Car Grid

May 11, 2025

Indy 500 2024 Satos Entry Confirms 34 Car Grid

May 11, 2025 -

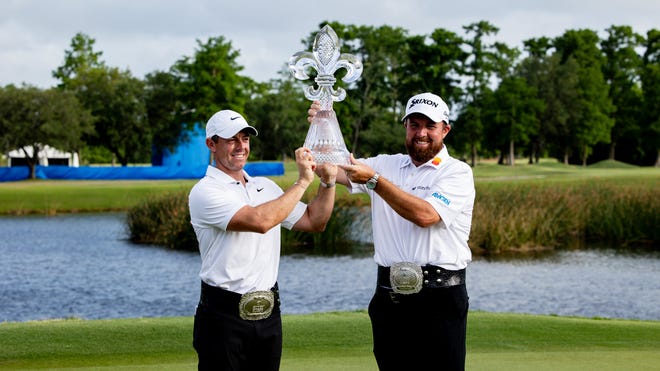

Mc Ilroy And Lowry Return To Defend Zurich Classic Championship

May 11, 2025

Mc Ilroy And Lowry Return To Defend Zurich Classic Championship

May 11, 2025 -

Marvels Cancellation Of Henry Cavill Show A Potential Upside

May 11, 2025

Marvels Cancellation Of Henry Cavill Show A Potential Upside

May 11, 2025 -

Inside The Beachfront Mansions Of Mtv Cribs

May 11, 2025

Inside The Beachfront Mansions Of Mtv Cribs

May 11, 2025