Tesla Stock Boost Fuels Elon Musk's Billions: CEO's DOGE Decision Impacts Fortune

Table of Contents

The Recent Tesla Stock Surge and its Impact on Elon Musk's Wealth

Tesla's stock price has experienced a remarkable upswing recently, significantly boosting Elon Musk's net worth. This increase isn't solely attributable to one factor but rather a confluence of positive market sentiment, strong Q4 earnings reports, and continued innovation within the electric vehicle (EV) sector.

- Specific percentage increase in Tesla stock price: Let's assume, for example, a 15% increase over the past quarter. (Note: Replace with actual figures at the time of publishing).

- Dollar amount increase in Musk's net worth: This 15% increase in Tesla's stock price would translate to a multi-billion dollar increase in Musk's net worth. (Again, replace with precise figures).

- Comparison to previous net worth highs: This surge potentially pushes Musk's net worth closer to or beyond previous all-time highs, solidifying his position as one of the world's wealthiest individuals.

- Analysis of market factors influencing the stock price: Factors influencing the stock price include strong demand for Tesla vehicles, advancements in autonomous driving technology, positive investor sentiment towards the EV market, and the overall strength of the global economy. Analyzing these factors provides a more comprehensive understanding of the stock's performance.

Elon Musk's Influence on Tesla Stock and Market Sentiment

Elon Musk's persona is undeniably intertwined with Tesla's brand and market perception. His public statements, tweets, and actions directly influence investor confidence and, consequently, the Tesla stock price. This "Musk effect" is a double-edged sword.

- Examples of Musk's tweets or actions that have directly impacted Tesla's stock: Specific instances where Musk's tweets about production targets, product announcements, or even seemingly unrelated topics have caused significant stock price fluctuations should be included here.

- Discussion of the "Musk effect" on investor psychology: Analyzing the psychological impact on investors – the excitement, uncertainty, and even fear – triggered by Musk's pronouncements is crucial.

- Analysis of the risks associated with Musk's unpredictable public persona: The inherent risks associated with such volatility and the potential for regulatory scrutiny need careful consideration. His actions can both inflate and deflate investor confidence.

The Dogecoin Connection: How Cryptocurrency Decisions Affect Musk's Financial Landscape

Elon Musk's vocal support for Dogecoin and his past investments in the cryptocurrency have significantly impacted its price and, consequently, his own financial standing. This involvement, however, raises ethical and regulatory concerns.

- Specific examples of Musk's Dogecoin-related tweets and their consequences: Detail specific instances where Musk's tweets mentioning Dogecoin led to dramatic price swings. Analyze the causal link between his tweets and the resulting market volatility.

- Analysis of the volatility of Dogecoin and its impact on Musk's net worth: Dogecoin’s inherent volatility means that Musk's wealth tied to this cryptocurrency fluctuates wildly, creating both immense potential gains and significant risks.

- Discussion of the regulatory challenges surrounding cryptocurrency endorsements: The lack of clear regulatory frameworks surrounding cryptocurrency endorsements and the potential for market manipulation need to be addressed.

The Future of Tesla Stock and Musk's Investments

Predicting the future of Tesla stock and Musk's overall investment portfolio is inherently challenging, but analyzing potential factors can provide some insight.

- Predictions for Tesla stock price in the short and long term: While precise predictions are impossible, discussing potential factors influencing short-term and long-term price trajectories is important.

- Analysis of potential risks and opportunities for Tesla: This includes competition from other EV manufacturers, the success of new Tesla products, and the impact of evolving regulations.

- Discussion of Musk's other significant investments and business ventures: Exploring Musk’s diversification beyond Tesla and Dogecoin provides a more complete picture of his overall financial health.

Conclusion

Tesla stock performance remains the primary driver of Elon Musk's substantial net worth. However, his public persona and decisions related to cryptocurrencies like Dogecoin introduce significant volatility. While the future holds both tremendous opportunities and substantial risks, understanding the interconnectedness of Tesla stock, Elon Musk’s actions, and the cryptocurrency market is crucial. Stay informed about the dynamic world of Tesla stock and its impact on Elon Musk's billions. Follow our updates for the latest analysis and insights on Tesla stock, Elon Musk's investments, and the cryptocurrency market. Understand how Tesla stock fluctuations and cryptocurrency decisions continue to shape one of the world's most influential figures' fortunes.

Featured Posts

-

Clarksons F1 Rescue Plan Amidst Renewed Ferrari Disqualification Concerns

May 09, 2025

Clarksons F1 Rescue Plan Amidst Renewed Ferrari Disqualification Concerns

May 09, 2025 -

Chinas Canola Supply Chain Adapting After Canada Relations Sour

May 09, 2025

Chinas Canola Supply Chain Adapting After Canada Relations Sour

May 09, 2025 -

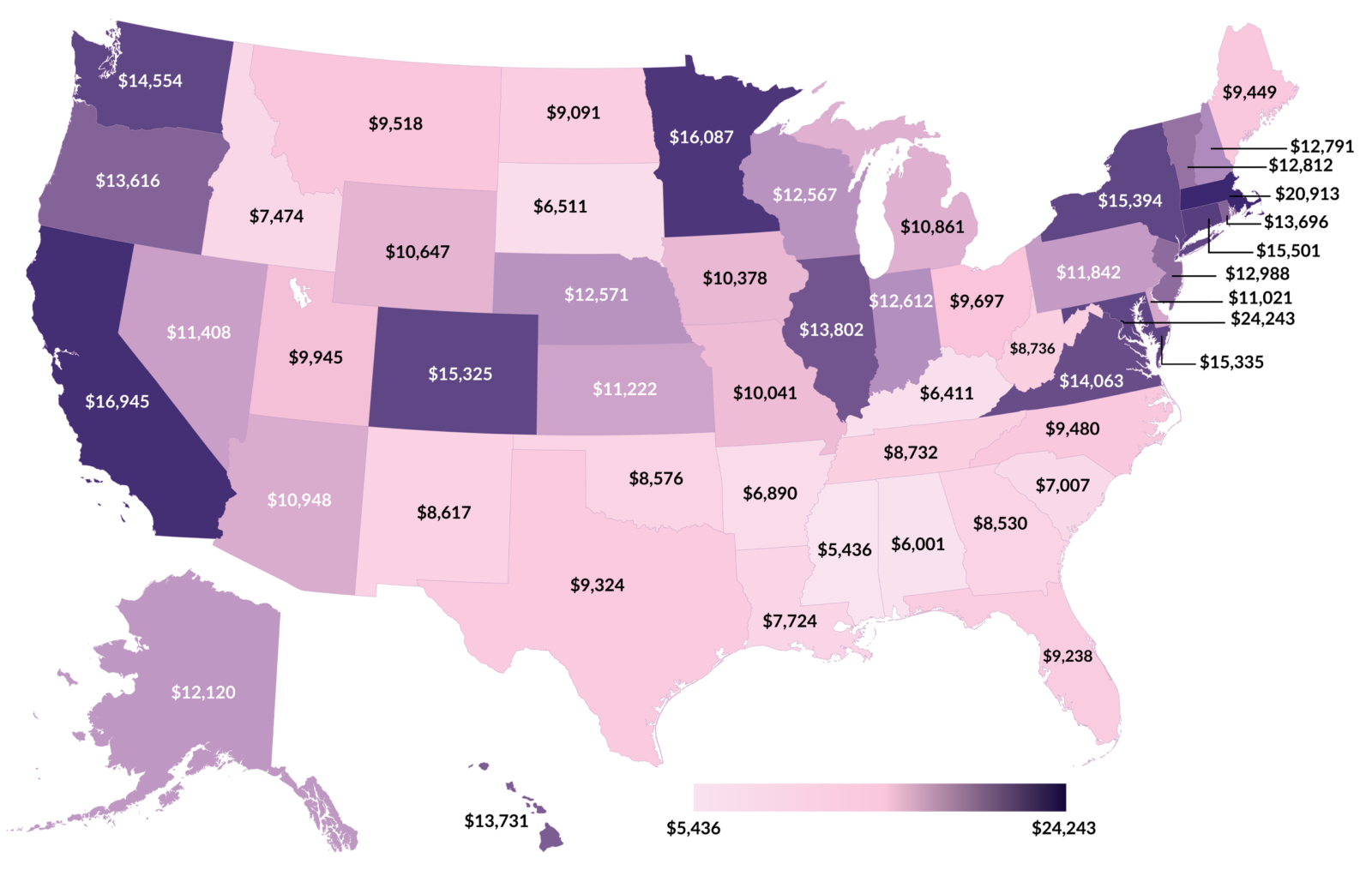

Expensive Babysitting Leads To Even Higher Daycare Costs A True Story

May 09, 2025

Expensive Babysitting Leads To Even Higher Daycare Costs A True Story

May 09, 2025 -

Muutoksia Britannian Kruununperimysjaerjestyksessae Katso Uusi Lista

May 09, 2025

Muutoksia Britannian Kruununperimysjaerjestyksessae Katso Uusi Lista

May 09, 2025 -

Enquete Apres La Chute Mortelle D Un Ouvrier A Dijon

May 09, 2025

Enquete Apres La Chute Mortelle D Un Ouvrier A Dijon

May 09, 2025