Tesla Stock Decline And Tariffs Impact Elon Musk's Net Worth

Table of Contents

The Recent Tesla Stock Decline: Causes and Consequences

Tesla's stock price has experienced considerable volatility in recent times. Understanding this decline requires examining several interconnected factors.

Market Volatility and Investor Sentiment

The overall market's health significantly influences individual stock performance. Investor confidence in Tesla, like any publicly traded company, is heavily impacted by news cycles.

- Negative News: Production delays at Gigafactories, concerns about vehicle safety features (e.g., Autopilot incidents), and intensifying competition from established and emerging automakers have all contributed to negative investor sentiment and decreased stock prices.

- Positive News Counteracted: While positive announcements like record deliveries or new product launches might temporarily boost the stock, these gains are often quickly eroded by prevailing negative market trends or persistent concerns about the company's future.

Competition in the EV Market

The electric vehicle (EV) market is rapidly expanding, attracting significant investment and increasing competition.

- Key Competitors: Established automakers like Ford, General Motors, and Volkswagen are aggressively investing in their EV divisions, while new entrants like Rivian and Lucid Motors pose significant challenges. These companies are leveraging their established manufacturing capabilities and brand recognition to compete directly with Tesla.

- Tesla's Competitive Landscape: While Tesla retains a strong brand and early-mover advantage in the EV market, its competitive edge is increasingly being challenged by competitors offering comparable technology and features at potentially lower prices. This competitive pressure affects investor confidence and stock valuations.

Economic Headwinds and Global Uncertainty

Broader economic factors are also impacting Tesla's stock performance.

- Rising Interest Rates: Increased interest rates make borrowing more expensive, impacting consumer spending and potentially reducing demand for luxury goods like Tesla vehicles. This directly affects investor expectations of future profits.

- Supply Chain Disruptions: Global supply chain issues continue to affect many industries, including the automotive sector. These disruptions can lead to production delays, increased costs, and negatively impact investor confidence.

The Role of Tariffs in Impacting Tesla's Profitability and Stock Price

Tariffs imposed by various governments worldwide significantly impact Tesla's profitability and, consequently, its stock price.

Import and Export Tariffs

Tesla's global operations are susceptible to tariffs on both imported raw materials and exported vehicles.

- Supply Chain Impact: Tariffs on raw materials, such as battery components or steel, directly increase Tesla's production costs, squeezing profit margins and impacting overall financial performance.

- Export Market Challenges: Tariffs on exported Tesla vehicles reduce the company's competitiveness in international markets, limiting sales potential and affecting overall revenue generation. For example, tariffs in certain regions could make Tesla vehicles less attractive compared to locally produced alternatives.

Geopolitical Factors and Trade Wars

International trade relations and trade wars further complicate the situation.

- Regional Impacts: Trade disputes between major economies can disrupt supply chains and impact access to key markets for Tesla. For instance, trade tensions between the US and China have created uncertainty for Tesla's operations in both countries.

- Increased Production Costs: Trade wars and related tariffs often result in significantly higher production costs, reducing profit margins and impacting stock valuations. The uncertainty surrounding trade policies adds to the volatility in investor sentiment.

The Correlation Between Tesla Stock and Elon Musk's Net Worth

Elon Musk's substantial ownership stake in Tesla directly links his personal wealth to the company's financial performance.

Elon Musk's Stake in Tesla

Musk's significant ownership percentage in Tesla means that fluctuations in the company's stock price translate directly into substantial changes in his net worth.

- Ownership Percentage: Musk's significant ownership stake in Tesla means that even small percentage changes in the stock price represent enormous dollar amounts in terms of his personal wealth.

- Direct Correlation: Any drop in Tesla's share price directly translates into a decrease in Musk's net worth, while any increase leads to a corresponding surge.

Impact on Musk's Other Ventures

The decline in Tesla's stock price could have ripple effects on Musk's other ventures.

- Funding and Investment: The reduced value of Tesla shares might limit Musk's ability to leverage his equity for funding his other companies, like SpaceX or The Boring Company. This interdependence underscores the interconnectedness of his business empire.

Conclusion

Tesla's recent stock decline is a multifaceted issue, stemming from market volatility, intensifying competition in the EV sector, economic headwinds, and the impact of tariffs on its global operations. This decline has had a significant and directly proportional impact on Elon Musk's net worth, given his massive stake in the company. The interconnectedness of these factors highlights the complexities of evaluating Tesla's future prospects and the challenges faced by the company in navigating a rapidly evolving global market. Stay updated on the latest developments in Tesla stock decline and Elon Musk's net worth to gain a comprehensive understanding of this dynamic situation.

Featured Posts

-

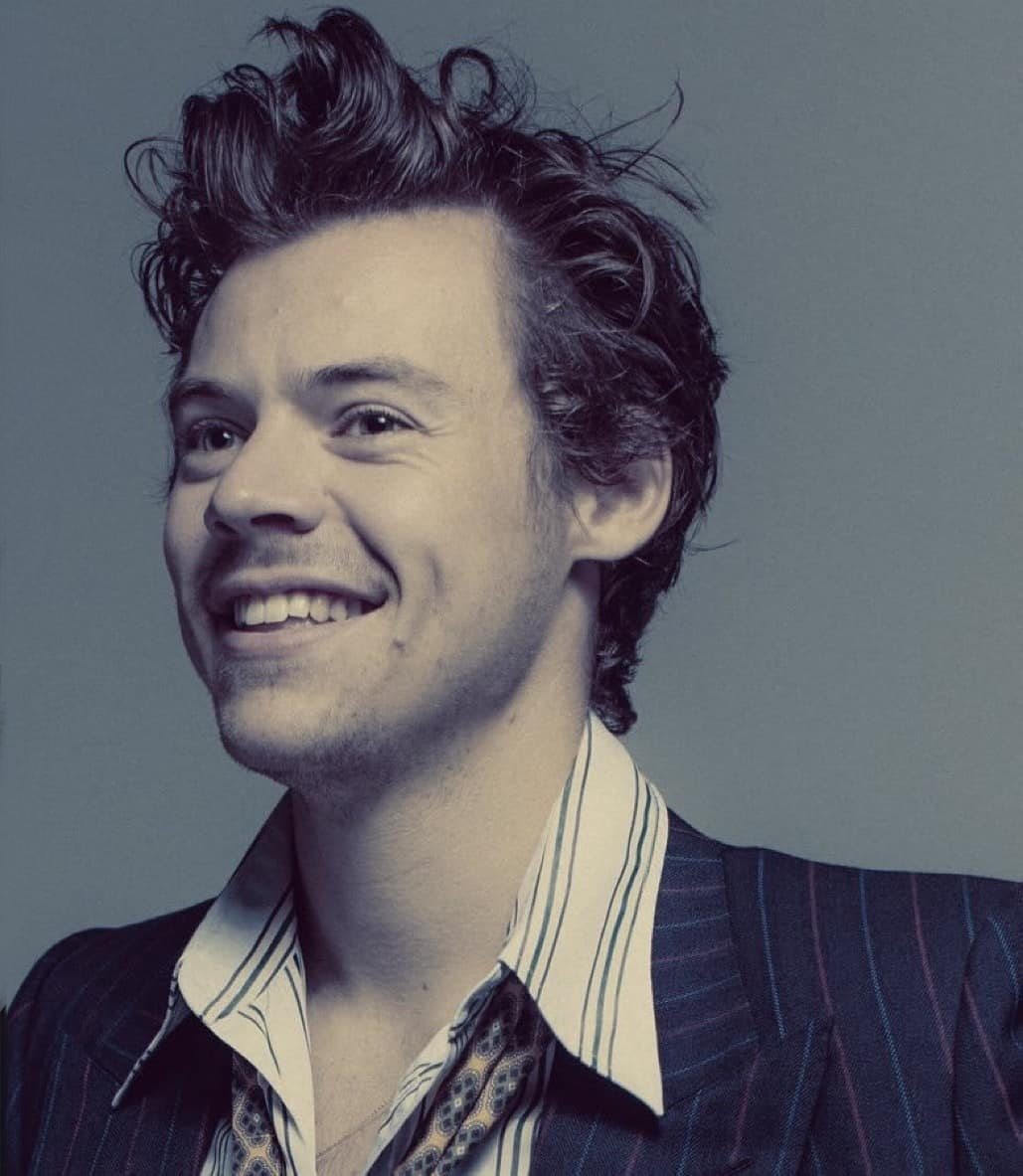

Harry Styles Snl Impression The Reaction That Broke The Internet

May 10, 2025

Harry Styles Snl Impression The Reaction That Broke The Internet

May 10, 2025 -

Alexandria Ocasio Cortez Calls Out Trump And His Fox News Supporters

May 10, 2025

Alexandria Ocasio Cortez Calls Out Trump And His Fox News Supporters

May 10, 2025 -

Universitaria Transgenero Arrestada Uso De Bano Femenino Y Derechos Trans

May 10, 2025

Universitaria Transgenero Arrestada Uso De Bano Femenino Y Derechos Trans

May 10, 2025 -

La Fires Landlord Price Gouging Claims Surface After Devastating Blazes

May 10, 2025

La Fires Landlord Price Gouging Claims Surface After Devastating Blazes

May 10, 2025 -

150 Million The Price Of Silence Broken At Credit Suisse

May 10, 2025

150 Million The Price Of Silence Broken At Credit Suisse

May 10, 2025