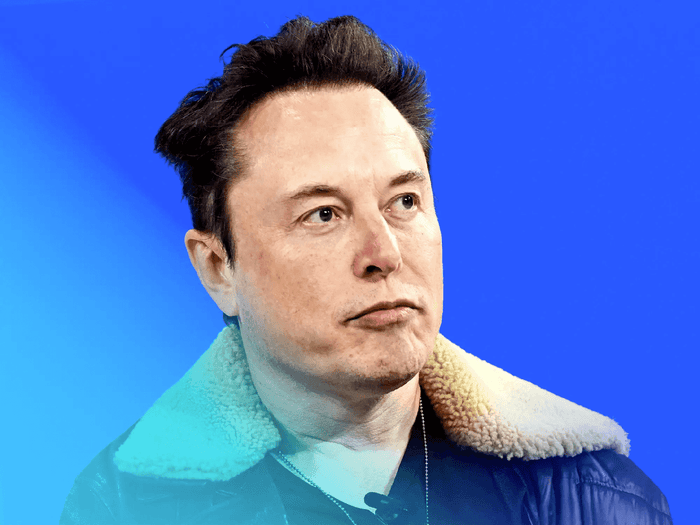

Tesla's Market Volatility And Its Ripple Effect On Cryptocurrency, Including Dogecoin

Table of Contents

Tesla's Stock Price Fluctuations and Their Underlying Causes

Tesla's stock price is notoriously volatile. Several factors contribute to these dramatic fluctuations:

-

Elon Musk's Tweets and Pronouncements: Musk's social media activity frequently impacts Tesla's stock price. A single tweet can send the stock soaring or plummeting, demonstrating the significant influence he holds over investor sentiment. His unpredictable pronouncements on various topics, from cryptocurrency to his company's future plans, keep investors on edge.

-

Overall Market Conditions: Broader economic factors like inflation, recessionary fears, and interest rate hikes significantly influence Tesla's stock performance. Periods of economic uncertainty often lead to increased volatility across the entire market, and Tesla, with its high valuation, is particularly susceptible.

-

Company-Specific News: Production challenges, supply chain disruptions, regulatory hurdles, and any negative news surrounding Tesla's operations can cause immediate and significant dips in its stock price. Any hint of slowing production or increased competition can impact investor confidence.

-

Competition in the Electric Vehicle Market: The electric vehicle market is becoming increasingly competitive. The emergence of new players and advancements in technology create pressure on Tesla, contributing to the uncertainty surrounding its future market share and, consequently, its stock price.

The correlation between Tesla's stock performance and investor sentiment is undeniable. Positive news boosts confidence, driving the price up, while negative news creates fear and uncertainty, leading to sell-offs.

The Correlation Between Tesla Stock and Cryptocurrency Prices

A strong correlation exists between Tesla's stock price and the prices of various cryptocurrencies, especially Dogecoin. This correlation is largely driven by investor sentiment and speculative trading.

-

Specific Examples: Numerous instances showcase how Tesla stock movements have directly impacted crypto prices. When Tesla's stock soars, there's often a corresponding increase in cryptocurrency prices, and vice-versa.

-

Elon Musk's Influence: Musk's impact on both markets is undeniable. His endorsements of specific cryptocurrencies, coupled with his pronouncements on Tesla, create a ripple effect across both realms.

-

Psychological Impact: Investor behavior plays a critical role. The same speculative tendencies and emotional reactions that influence Tesla's stock price often translate directly to the cryptocurrency market, creating a synchronized pattern of price fluctuations.

-

Studies and Analyses: While definitive causal links remain complex to establish, several studies have explored the correlation between Tesla's stock and cryptocurrency prices, pointing to a strong relationship driven by shared investor sentiment and Musk's influence.

This correlation is driven by the intertwined nature of these markets. Investors who are bullish on Tesla often express this sentiment in the cryptocurrency market as well, and vice-versa.

Dogecoin's Unique Sensitivity to Tesla and Elon Musk

Dogecoin, a meme-based cryptocurrency, stands out due to its extreme sensitivity to news related to Tesla and Elon Musk. This heightened sensitivity stems from its origins as a meme coin and its close association with Musk.

-

Historical Examples: Numerous instances illustrate how Musk's tweets and actions have caused dramatic swings in Dogecoin's price, often resulting in both significant gains and losses for investors.

-

Meme-Stock Nature: Dogecoin's volatile nature is partly due to its meme-stock characteristics. Driven more by social media trends and speculation than by underlying fundamentals, its price is incredibly susceptible to sentiment changes.

-

Community's Role: The Dogecoin community actively participates in price fluctuations, amplifying the impact of news related to Tesla and Musk. The community's enthusiasm and speculation further fuel the volatility.

-

Investment Risks: Investing in Dogecoin carries significant risk. Its price is extremely volatile and dependent on external factors like social media trends and the actions of influential individuals, making it a high-risk, high-reward investment.

For Dogecoin investors, understanding this sensitivity is crucial. Investing in Dogecoin requires a high tolerance for risk and a realistic understanding of its speculative nature.

The Broader Impact on the Cryptocurrency Market

Tesla's market volatility doesn't just impact Dogecoin; it creates ripples throughout the broader cryptocurrency market.

-

Spillover Effects: The interconnectedness of the cryptocurrency market means that volatility in one coin often spills over to others. When Tesla-related news causes significant swings in Dogecoin, it can influence the prices of other cryptocurrencies as well.

-

Investor Confidence: Frequent and unpredictable fluctuations fueled by Tesla-related news can erode investor confidence in the entire cryptocurrency market, making investors more hesitant to participate.

-

Potential Regulatory Responses: Extreme volatility can lead to increased regulatory scrutiny, potentially resulting in stricter regulations that could impact the growth and adoption of cryptocurrencies.

-

Long-Term Implications: The continued influence of Tesla's market movements on the crypto world raises concerns about the long-term stability and sustainability of the crypto market.

Tesla's market volatility is a significant factor influencing the adoption and acceptance of cryptocurrencies. Addressing the uncertainty and ensuring market stability are crucial for the future of the crypto market.

Conclusion

The strong correlation between Tesla's market volatility and cryptocurrency fluctuations, particularly the dramatic price swings in Dogecoin influenced by Tesla-related news, is undeniable. This article has highlighted the complexities and risks involved in investing in both Tesla stock and cryptocurrencies, especially those heavily influenced by social media trends and the actions of key individuals. Understanding Tesla's market volatility and its impact on cryptocurrency is crucial for informed investment decisions. By monitoring Tesla's influence on cryptocurrency and analyzing the ripple effect on Dogecoin and other cryptos, investors can make better-informed choices. Remember, informed decision-making is paramount when navigating these volatile markets. Continue to research the correlation between Tesla's stock and various cryptocurrencies to stay ahead and manage your investments effectively.

Featured Posts

-

Japa Navigating The Uks Stricter Visa Policies For Nigerians And Pakistanis

May 10, 2025

Japa Navigating The Uks Stricter Visa Policies For Nigerians And Pakistanis

May 10, 2025 -

Blue Origins New Shepard Launch Cancelled Subsystem Problem

May 10, 2025

Blue Origins New Shepard Launch Cancelled Subsystem Problem

May 10, 2025 -

Understanding Elon Musks Wealth Key Investments And Business Strategies

May 10, 2025

Understanding Elon Musks Wealth Key Investments And Business Strategies

May 10, 2025 -

Ai Driven Podcast Creation Transforming Repetitive Data Into Engaging Content

May 10, 2025

Ai Driven Podcast Creation Transforming Repetitive Data Into Engaging Content

May 10, 2025 -

New Evidence Emerges In Wynne Evans Defence Following Strictly Allegations

May 10, 2025

New Evidence Emerges In Wynne Evans Defence Following Strictly Allegations

May 10, 2025