The B.C. Billionaire And The Hudson's Bay Deal: Understanding Weihong Liu's Investment

Table of Contents

Who is Weihong Liu? A Profile of the B.C. Billionaire

Liu's Business Background and Holdings

Weihong Liu is a prominent Canadian investor known for his shrewd business acumen and significant holdings across various sectors. His entrepreneurial journey began with [Insert details about early business ventures, if known]. His success is largely attributed to his keen eye for identifying undervalued assets and his strategic approach to investment. Liu's wealth is built upon a diverse portfolio spanning several industries.

- Key Investments: [List some notable companies or sectors where Liu has made significant investments. Be as specific as possible with verifiable information.]

- Business Achievements: [Mention any significant awards, recognition, or milestones in his career. This adds credibility and authority.]

- Investment Philosophy: [If information is available, describe Liu's general investment philosophy – is he a long-term investor? Does he prefer specific sectors? This helps to contextualize his HBC investment.] Keywords: Weihong Liu, B.C. Billionaire, Canadian investor, real estate investment, private equity.

The Details of the Hudson's Bay Deal: Investment Size and Structure

The Acquisition Process

The acquisition of Liu's stake in HBC was [Describe the process – was it a public offering, a private placement, or a direct purchase from existing shareholders? Include the timeline of the acquisition, if known]. Key players involved included [List any significant individuals or firms involved in facilitating the deal].

- Percentage of HBC Shares: [State the exact percentage of HBC shares acquired by Liu.]

- Total Investment Amount: [Specify the total investment amount, if publicly available. Otherwise, state that the exact figure is not publicly disclosed.]

- Type of Investment: [Clearly indicate the nature of the investment – e.g., common shares, preferred shares, convertible notes, etc.] Keywords: Hudson's Bay Company, HBC shares, investment acquisition, strategic investment, equity stake.

Motivations Behind Liu's Investment: Strategic Goals and Potential Returns

Potential Long-Term Strategies

Liu's motivations behind this significant investment in HBC are likely multifaceted. Several potential strategic goals could be driving this move:

- Portfolio Diversification: Adding HBC to his portfolio could diversify his holdings, reducing overall risk.

- Long-Term Growth Potential: The Canadian retail sector, despite challenges, may offer long-term growth opportunities that Liu sees as attractive.

- Asset Restructuring: Liu might be interested in restructuring HBC's assets, potentially unlocking hidden value through strategic divestments or rebranding.

- Influence on Management: A significant stake could potentially allow for some influence on HBC's strategic direction.

Keywords: investment strategy, return on investment (ROI), retail market analysis, long-term growth, asset management.

Impact and Implications of Liu's Investment on HBC and the Canadian Market

Short-Term and Long-Term Effects

Weihong Liu's stake in Hudson's Bay is likely to have both short-term and long-term effects on HBC and the Canadian retail market.

- Short-Term Effects: The investment might boost HBC's stock price and improve investor confidence. However, there might be initial market uncertainty.

- Long-Term Effects: This could lead to changes in HBC's business strategy, potentially including new store formats, e-commerce initiatives, or even a strategic shift in the retail landscape. Job creation or restructuring may also result. Competition in the Canadian retail sector will undoubtedly react to this significant shift in ownership.

Keywords: Canadian retail market, market share, stock performance, business strategy, competitive landscape.

Conclusion: The Future of Weihong Liu's Hudson's Bay Investment

Weihong Liu's investment in the Hudson's Bay Company represents a significant development in the Canadian retail sector. The exact long-term consequences remain to be seen, but the potential impact on HBC's operations, market position, and overall strategy is considerable. Further analysis will be needed to fully understand the intricacies of this "Weihong Liu's Hudson's Bay investment" and its long-term implications. To stay updated on this developing story, follow reputable financial news sources and continue to monitor developments related to Liu's HBC stake. Share your thoughts and predictions on the future of this significant investment!

Featured Posts

-

La Trayectoria De Victor Fernandez Un Presente Solido

May 29, 2025

La Trayectoria De Victor Fernandez Un Presente Solido

May 29, 2025 -

The Ultimate Guide To Air Jordan Releases In May 2025

May 29, 2025

The Ultimate Guide To Air Jordan Releases In May 2025

May 29, 2025 -

Robbie Williams Christens Cruise Ship In Malaga With Concert

May 29, 2025

Robbie Williams Christens Cruise Ship In Malaga With Concert

May 29, 2025 -

Review Of The Nike Air Max 95 Og Big Bubble Hm 8755 001 In Triple Black And Wolf Gray

May 29, 2025

Review Of The Nike Air Max 95 Og Big Bubble Hm 8755 001 In Triple Black And Wolf Gray

May 29, 2025 -

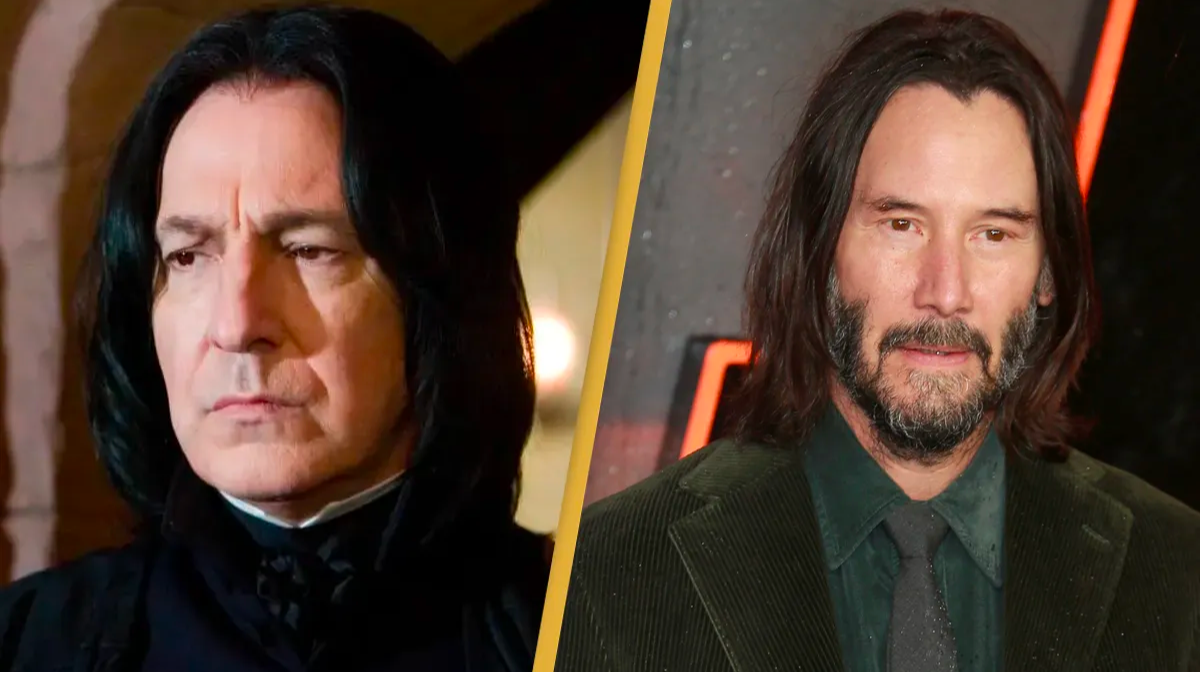

New Harry Potter Tv Series Meet The Actors Playing Harry Hermione And Ron

May 29, 2025

New Harry Potter Tv Series Meet The Actors Playing Harry Hermione And Ron

May 29, 2025