The Bank Of Canada's Dilemma: How To Tackle Persistent Core Inflation

Table of Contents

Understanding Persistent Core Inflation in Canada

Core inflation, a measure of inflation that excludes volatile items like food and energy, is currently a major concern for the Bank of Canada. Unlike headline inflation, which can fluctuate wildly due to temporary shocks, core inflation reflects underlying price pressures within the economy, making it a more reliable indicator of long-term inflationary trends. Its persistence signals deeper, more entrenched inflationary pressures that require a stronger and more sustained response.

Several factors contribute to persistent core inflation in Canada:

- Supply chain disruptions and bottlenecks: The lingering effects of the COVID-19 pandemic and the war in Ukraine have created significant supply chain disruptions, leading to shortages and higher prices for various goods and services. This has particularly impacted the manufacturing and transportation sectors.

- Strong consumer demand and wage growth: Robust consumer spending, fueled by pent-up demand and government support measures, continues to put upward pressure on prices. Simultaneously, rising wages, while beneficial for workers, contribute to increased production costs and further fuel inflation.

- Housing market dynamics and soaring rental costs: The Canadian housing market has experienced significant price increases in recent years, contributing to higher shelter costs. Rental costs, a major component of core inflation, have also soared, impacting a significant portion of the population. This is further exacerbated by limited housing supply.

- Global inflationary pressures: Canada's economy is intertwined with the global economy. Global inflationary pressures, stemming from factors like rising energy prices and supply chain issues, are transmitted to the Canadian economy, making it challenging to control inflation domestically.

The impact of persistent core inflation on the Canadian economy is substantial:

- Erosion of purchasing power: Rising prices reduce the purchasing power of consumers, leading to a decline in their real disposable income.

- Increased uncertainty for businesses and consumers: High and unpredictable inflation creates uncertainty, making it difficult for businesses to plan investments and for consumers to make long-term financial decisions.

- Potential for wage-price spirals: If wages continue to rise in response to inflation, leading to further price increases, a dangerous wage-price spiral can develop, making inflation even harder to control.

The Bank of Canada's Current Monetary Policy Response

The Bank of Canada has responded to persistent core inflation by implementing a series of interest rate hikes. The goal is to cool down the economy by making borrowing more expensive, reducing consumer spending and investment, thereby lowering demand-pull inflation.

However, the effectiveness of these rate hikes in curbing inflation is complex:

- Lag effects of monetary policy: Monetary policy operates with a significant lag. The full impact of interest rate changes is not felt immediately, but rather over several months or even years.

- Potential for unintended consequences: Aggressive interest rate hikes can lead to unintended consequences, such as a significant economic slowdown, increased unemployment, and a potential recession. The Bank must carefully balance the need to control inflation with the risk of harming economic growth.

- Evaluation of the current inflation rate relative to the Bank's target: While interest rate hikes have begun to show some effect, core inflation remains above the Bank of Canada's 2% target, indicating that further measures may be necessary.

The Bank faces the challenging task of balancing inflation control with sustainable economic growth. A premature halt to rate hikes risks reigniting inflation, while overly aggressive tightening could trigger a deep recession.

Alternative Strategies and Policy Options

Beyond interest rate hikes, the Bank of Canada could explore alternative monetary policy tools:

- Quantitative tightening (QT): Reducing the Bank's balance sheet by selling government bonds can help to reduce the money supply and curb inflation.

- Forward guidance and communication strategies: Clearly communicating the Bank's intentions and policy outlook can help to shape inflation expectations and influence market behavior.

- Targeted interventions in specific sectors: The Bank could consider targeted interventions in specific sectors experiencing particularly high inflation, although this approach is less common.

Fiscal policy also plays a crucial role:

- Government spending and taxation policies: The government can use fiscal policy tools, such as reducing government spending or increasing taxes, to help cool down the economy and reduce inflationary pressures.

- Coordination between monetary and fiscal authorities: Effective coordination between the Bank of Canada and the federal government is crucial for a comprehensive approach to managing inflation.

Each strategy has its own set of benefits and drawbacks that need careful consideration in the context of the overall economic situation.

Forecasting the Future and the Implications for Canadians

Predicting the future trajectory of inflation is challenging, but a gradual decline towards the Bank of Canada's target is a reasonable expectation, contingent upon continued monetary policy tightening and cooperation from fiscal authorities. However, the path to 2% inflation is likely to be bumpy and prolonged.

The potential impact on the Canadian economy includes:

- Housing market: Higher interest rates are likely to continue to cool down the housing market, potentially leading to price corrections in some areas.

- Employment: While some job losses are possible due to slower economic growth, the overall labor market is expected to remain relatively robust.

For Canadian consumers, the implications include:

- Cost of living: Inflation will continue to put pressure on the cost of living, particularly for households with lower incomes.

- Borrowing costs: Higher interest rates will increase borrowing costs for mortgages, loans, and credit cards.

Conclusion

The Bank of Canada faces a complex challenge in tackling persistent core inflation. While interest rate hikes have been implemented, their full impact remains to be seen. The central bank must carefully weigh the risks of further tightening against the potential for economic slowdown. Alternative strategies and effective policy coordination between monetary and fiscal authorities are crucial in navigating this dilemma. Understanding the complexities of the Bank of Canada's dilemma regarding persistent core inflation is crucial for individuals and businesses alike to make informed financial decisions. Stay informed about the Bank of Canada's actions and their impact on the Canadian economy, and consider consulting financial experts for personalized advice.

Featured Posts

-

Casper Residents Boat Lift Infested With Thousands Of Zebra Mussels

May 22, 2025

Casper Residents Boat Lift Infested With Thousands Of Zebra Mussels

May 22, 2025 -

United Healths Future The Man Who Built An Empire Faces A Critical Challenge

May 22, 2025

United Healths Future The Man Who Built An Empire Faces A Critical Challenge

May 22, 2025 -

The Evolving Weirdness Of Gumball

May 22, 2025

The Evolving Weirdness Of Gumball

May 22, 2025 -

3 Financial Mistakes Women Should Avoid To Build Wealth

May 22, 2025

3 Financial Mistakes Women Should Avoid To Build Wealth

May 22, 2025 -

Antalya Da Nato Parlamenter Asamblesi Guevenlik Tehditlerine Karsi Ortak Coezuemler

May 22, 2025

Antalya Da Nato Parlamenter Asamblesi Guevenlik Tehditlerine Karsi Ortak Coezuemler

May 22, 2025

Latest Posts

-

Dauphin County Apartment Building Fire Investigation Underway After Overnight Emergency

May 22, 2025

Dauphin County Apartment Building Fire Investigation Underway After Overnight Emergency

May 22, 2025 -

Major Fire At Dauphin County Apartment Complex Residents Evacuated

May 22, 2025

Major Fire At Dauphin County Apartment Complex Residents Evacuated

May 22, 2025 -

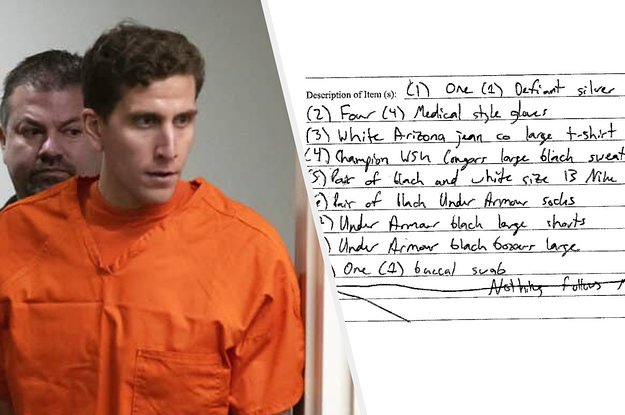

Fbi Raid In Lebanon County Pennsylvania Details Of The Search Warrant

May 22, 2025

Fbi Raid In Lebanon County Pennsylvania Details Of The Search Warrant

May 22, 2025 -

Overnight Fire Engulfs Dauphin County Apartment Building

May 22, 2025

Overnight Fire Engulfs Dauphin County Apartment Building

May 22, 2025 -

Pilots Son Injured In Lancaster County Crash Released From Hospital

May 22, 2025

Pilots Son Injured In Lancaster County Crash Released From Hospital

May 22, 2025