The BofA Perspective: Why High Stock Market Valuations Are Not A Threat

Table of Contents

BofA's Underlying Economic Assumptions

BofA's assessment of high stock market valuations rests on several key economic assumptions. Their optimistic outlook is fueled by projections of robust corporate earnings growth, a persistent low-interest-rate environment, and a manageable inflation outlook.

Strong Corporate Earnings Growth

BofA projects continued strong corporate earnings growth, a key factor supporting current valuations. This growth isn't evenly distributed across all sectors; however, specific areas are driving significant expansion.

- Technology: The tech sector continues to show impressive revenue growth, driven by cloud computing, AI, and other disruptive technologies.

- Healthcare: Innovation in pharmaceuticals and medical technology is fueling robust earnings in this sector.

- Financials: A recovering economy is boosting financial institutions' performance.

BofA's analysts predict a combined annual earnings growth rate of X% for these key sectors over the next few years (Note: replace X% with actual data from a BofA report). This robust corporate profit outlook, based on strong revenue projections, helps to justify current market valuations. Further research into earnings growth and corporate profits will show the strength of this argument.

Low Interest Rate Environment

The prevailing low-interest-rate environment significantly impacts stock valuations. Low interest rates make borrowing cheaper for corporations, enabling investment and expansion. This also makes bonds less attractive relative to stocks, pushing investors towards equities.

- Discounted Cash Flow Models: Lower discount rates, a consequence of low interest rates, increase the present value of future earnings, thus supporting higher stock prices.

- Quantitative Easing: Continued quantitative easing (QE) programs by central banks inject liquidity into the market, further supporting stock prices.

- BofA Interest Rate Forecasts: BofA's forecasts suggest that interest rates will remain low for the foreseeable future (Note: reference BofA's published forecasts here).

Understanding the interplay between interest rates, monetary policy, and quantitative easing is crucial for grasping BofA's perspective.

Inflation and Its Impact

While inflation is a concern for many investors, BofA's analysis suggests that the current level of inflation is manageable and unlikely to significantly derail corporate earnings growth or dramatically impact stock valuations.

- BofA Inflation Predictions: BofA forecasts inflation to remain within a target range, avoiding runaway price increases (Note: cite BofA's inflation predictions).

- Impact on Corporate Earnings: While some price increases will impact input costs for businesses, BofA's models suggest that these increases will be offset by strong revenue growth.

- Consumer Price Index (CPI): Analyzing the Consumer Price Index (CPI) and other inflation indicators supports BofA’s relatively optimistic view on inflation expectations.

Understanding inflation and its impact on price increases is crucial to a balanced assessment of market valuations.

Rebutting Common Concerns about High Stock Market Valuations

Many investors remain concerned that the market is overvalued. BofA addresses these concerns by highlighting alternative valuation metrics, acknowledging technological disruption, and emphasizing the importance of a long-term investment horizon.

Addressing the "Overvalued" Argument

The common argument that the market is "overvalued" often relies solely on simple metrics like the price-to-earnings ratio (P/E). BofA counters this by pointing to several factors:

- Alternative Valuation Metrics: Using alternative valuation metrics, such as price-to-sales ratios or free cash flow multiples, paints a more nuanced picture and reveals opportunities not readily apparent using P/E alone.

- Long-Term Growth Potential: The focus shouldn't be solely on current valuations but also on the long-term growth potential of underlying companies. High market capitalization doesn’t automatically imply overvaluation.

- Technological Innovation: Technological innovation continues to drive productivity gains and reshape industries, justifying higher valuations for certain sectors. Analysis of growth stocks, especially in the tech sector, demonstrates this point.

The Role of Technological Disruption

Technological advancements are a significant driver of current market valuations. Specific sectors benefit disproportionately from this innovation:

- Artificial Intelligence (AI): AI is transforming industries, leading to increased efficiency and new revenue streams.

- Cloud Computing: The shift to cloud-based infrastructure is creating opportunities for growth and higher valuations.

These disruptive technologies are reshaping the competitive landscape, leading to higher valuations for companies at the forefront of innovation.

Long-Term Investment Horizon

BofA strongly advocates for a long-term investment horizon. Short-term market fluctuations are inevitable, but a long-term perspective mitigates the risk associated with these fluctuations.

- Buy-and-Hold Strategy: A buy-and-hold strategy, historically successful, lessens the impact of short-term market volatility.

- Historical Market Performance: Historical data shows the long-term upward trend of the stock market, despite short-term corrections.

- Risk Management: Proper risk management techniques, including portfolio diversification, are essential to navigating market uncertainty.

Conclusion

In summary, BofA's analysis suggests that current high stock market valuations are not necessarily a cause for alarm. Their perspective rests on robust corporate earnings growth, a low-interest-rate environment, and manageable inflation. Furthermore, BofA addresses common concerns about overvaluation by emphasizing alternative valuation metrics, the role of technological disruption, and the importance of long-term investing. Don't let concerns about high stock market valuations deter you from pursuing a long-term investment strategy. Consider the BofA perspective and explore the opportunities available in today's market. Remember, understanding the nuances of high stock market valuations is key to successful long-term investing.

Featured Posts

-

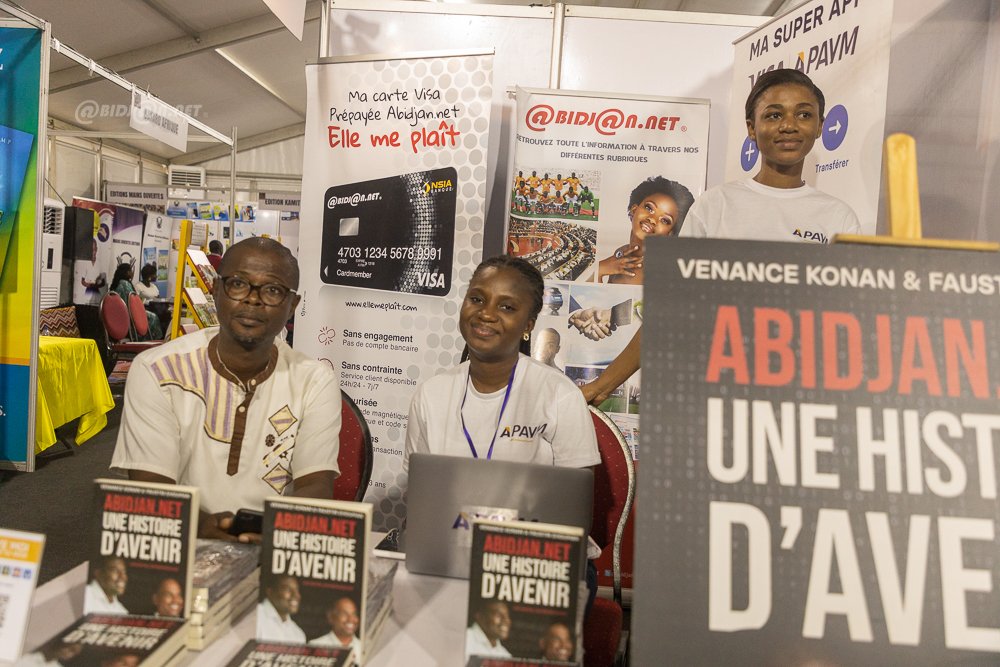

15eme Salon International Du Livre D Abidjan Une Conference De Presse Pour Le Lancement

May 20, 2025

15eme Salon International Du Livre D Abidjan Une Conference De Presse Pour Le Lancement

May 20, 2025 -

Usmc Tomahawk Cruise Missile Drone Truck Armys New Weapon System

May 20, 2025

Usmc Tomahawk Cruise Missile Drone Truck Armys New Weapon System

May 20, 2025 -

Vijesti Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Vijesti Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme 1050 Price Increase

May 20, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme 1050 Price Increase

May 20, 2025 -

Best Wireless Headphones 2024 Improved Models And Innovations

May 20, 2025

Best Wireless Headphones 2024 Improved Models And Innovations

May 20, 2025

Latest Posts

-

Nyt Mini Crossword April 26 2025 Helpful Hints

May 20, 2025

Nyt Mini Crossword April 26 2025 Helpful Hints

May 20, 2025 -

Michael Strahan Soaked By Susan Lucci Video Goes Viral

May 20, 2025

Michael Strahan Soaked By Susan Lucci Video Goes Viral

May 20, 2025 -

Madrid Open Sabalenka And Zverev Progress To Next Round

May 20, 2025

Madrid Open Sabalenka And Zverev Progress To Next Round

May 20, 2025 -

Madrid Open Sabalenka Cruises Past Mertens Into Next Round

May 20, 2025

Madrid Open Sabalenka Cruises Past Mertens Into Next Round

May 20, 2025 -

Sabalenka And Zverevs Triumph Top Seeds Advance In Madrid Open

May 20, 2025

Sabalenka And Zverevs Triumph Top Seeds Advance In Madrid Open

May 20, 2025