The BofA Perspective: Why High Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Long-Term Growth Outlook Remains Positive

BofA's forecast paints a picture of sustained long-term economic growth, a crucial factor underpinning their belief that high stock market valuations shouldn't dissuade investors. This optimistic market predictions isn't based on blind faith; it's rooted in several key factors:

-

Technological Innovation: BofA points to the relentless pace of technological advancements as a key driver of future economic expansion. Disruptive innovations across various sectors are expected to boost productivity and create new market opportunities, fueling growth.

-

Demographic Shifts: Changes in global demographics, particularly in emerging markets, are anticipated to create significant demand for goods and services. This demographic tailwind is expected to sustain economic activity for years to come.

-

Government Policies: While acknowledging potential risks, BofA notes that supportive government policies in many developed economies, aimed at fostering economic growth and infrastructure development, could contribute positively to the overall economic landscape.

-

Specific Sectors: BofA anticipates robust growth in sectors like technology, healthcare, and renewable energy. These sectors are positioned to benefit significantly from technological progress and evolving consumer preferences.

However, BofA also acknowledges potential risks, such as inflationary pressures and geopolitical uncertainties. Their analysis incorporates these factors, demonstrating a balanced and nuanced approach to market prediction.

Understanding the Nuances of "High" Valuations

The term "high valuations" is often thrown around without sufficient context. Understanding stock valuation metrics is crucial for making informed investment decisions. Simply stating that valuations are high is misleading; a holistic view is essential. Key metrics like the Price-to-Earnings ratio (P/E ratio) and market capitalization provide a snapshot of valuation, but they need to be interpreted within a broader context:

-

Limitations of Valuation Metrics: The P/E ratio, for instance, can be influenced by factors such as accounting practices and industry-specific characteristics. Relying solely on a single metric can lead to inaccurate conclusions.

-

Impact of Macroeconomic Factors: Interest rates, inflation, and economic growth significantly influence stock valuations. High inflation, for example, can compress future earnings expectations, impacting valuation multiples.

-

Comparative Valuation: It's crucial to compare valuations across different asset classes (stocks, bonds, real estate, etc.). High stock valuations might be perfectly reasonable if other asset classes are even more expensive.

Therefore, BofA's perspective emphasizes a nuanced approach to valuation, considering both quantitative and qualitative factors to arrive at a comprehensive assessment.

The Power of Long-Term Investing Despite High Valuations

Despite high stock market valuations, BofA strongly advocates for long-term investing strategies. This approach mitigates the risks associated with market volatility. Key strategies include:

-

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy reduces the risk of investing a lump sum at a market peak.

-

Portfolio Diversification: Diversifying investments across different asset classes, sectors, and geographies helps to reduce overall portfolio risk. If one sector underperforms, others might offset those losses.

-

Long-Term Investment Horizon: The power of compounding returns is maximized over the long term. Market fluctuations are less impactful over extended periods, allowing investors to ride out short-term volatility.

By adopting these strategies, investors can significantly improve their chances of achieving their long-term financial goals, even in a market characterized by high valuations.

BofA's Recommended Investment Strategies (Optional - if BofA provides specific strategies)

(This section would include specific strategies recommended by BofA, if available. For example, it could mention their preferred asset allocation models or specific sector recommendations.)

Conclusion

In conclusion, while high stock market valuations are a legitimate concern, BofA's perspective highlights the importance of taking a long-term view. Their positive long-term growth outlook, coupled with a nuanced understanding of valuation metrics and the power of long-term investment strategies, suggests that high valuations shouldn't necessarily deter investors. Remember, a well-diversified portfolio and a long-term investment horizon remain crucial elements of a successful investment strategy. Don't let high stock market valuations deter you. Consult with a financial advisor to develop a long-term investment plan tailored to your individual needs and risk tolerance. Consider reviewing BofA's market analysis for further insights into their detailed perspectives on the current market climate and future opportunities.

Featured Posts

-

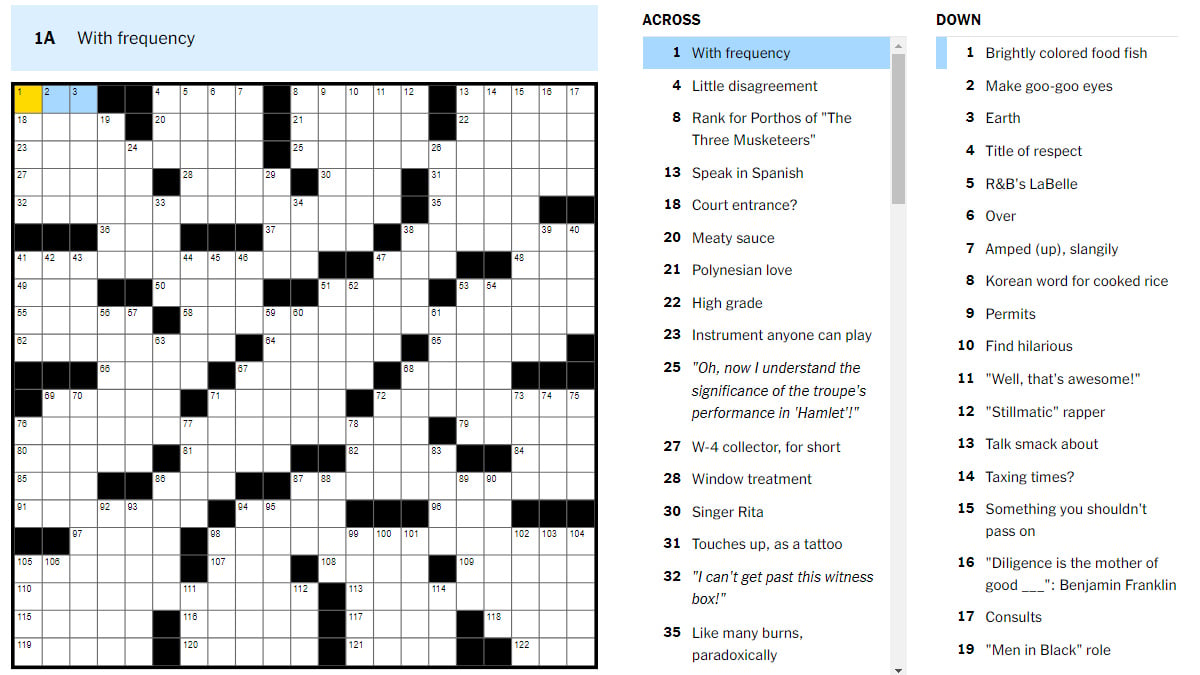

Nyt Mini Crossword Clues And Answers Thursday April 10

May 31, 2025

Nyt Mini Crossword Clues And Answers Thursday April 10

May 31, 2025 -

Receta Aragonesa De 3 Ingredientes Un Viaje Al Pasado

May 31, 2025

Receta Aragonesa De 3 Ingredientes Un Viaje Al Pasado

May 31, 2025 -

Moroccan Childrens Charity Receives Boost From Duncan Bannatyne

May 31, 2025

Moroccan Childrens Charity Receives Boost From Duncan Bannatyne

May 31, 2025 -

Harvards Foreign Student Ban Extension Judge Grants Reprieve

May 31, 2025

Harvards Foreign Student Ban Extension Judge Grants Reprieve

May 31, 2025 -

Nyt Mini Crossword May 7 Answers Complete Clue Breakdown And Solving Tips

May 31, 2025

Nyt Mini Crossword May 7 Answers Complete Clue Breakdown And Solving Tips

May 31, 2025